View related analysis:

- Gold forecast: Another solid run, though a 3k shakeout seems likely

- Crude Oil Forecast: Short Covering and WTI Spread Hint at Bounce

- AUD/USD rises, EUR/USD, USD/CAD dip, US dollar selloff loses steam

- Nasdaq 100 Forecast: Asset Managers Ramp Up Bearish Tech Bets

The Federal Reserve are almost certain to hold their interest rate at the 4.25% - 4.5% target range this week. But odds of a 25bp cut in June have risen to ~70% according to Fed Fund futures, up from 20% from just a few weeks ago. Cracks in the US economy have emerged alongside rising inflationary pressures in the data, and Trump’s aggressive approach to tariffs has exacerbated fears of a global slowdown.

Traders will therefore pay very close attention to the Fed’s economic outlook, as it will be their first since Trump took office back in January.

Fed doves may in for disappointment

But I cannot help but wonder if traders hoping for a dovish meeting may be left disappointed. The Fed already shaved 50bp of potential cuts in 2025 in their December meeting, increased core PCE by 0.4 percentage points, (PCE up by 0.3) while adding 0.1 to GDP and shaving 0.1 off of unemployment for next year. Furthermore, Jerome Powell said as recently as March 8th that the “the cost of the Fed being too cautious is low, the economy does not need the central bank to do anything now”.

It seems unlikely that the Fed will be lowering their median Federal Funds rate (FFR) projection below December’s 3.9%, despite recent weakness in some data. If anything, it seems more likely they will increase their 2025 FFR to match the market pricing of one cut. And this could be a savvy move, as tariffs have not yet been implemented and there is still room for negotiation.

Note that Powell is also waiting for the final outcome on tariffs, as he also said it remains “uncertain about what will be tariffed and for how long”, but if tariffs are larger than expected that it would “influence how the Fed reacts”. And with headlines and forecasts at the whim of an occasionally erratic Trump, do the Fed really want to take a punt with forecasts before tariffs have been fully concluded? My guess is not, so this may be quite a reserved FOMC meeting, all things considered.

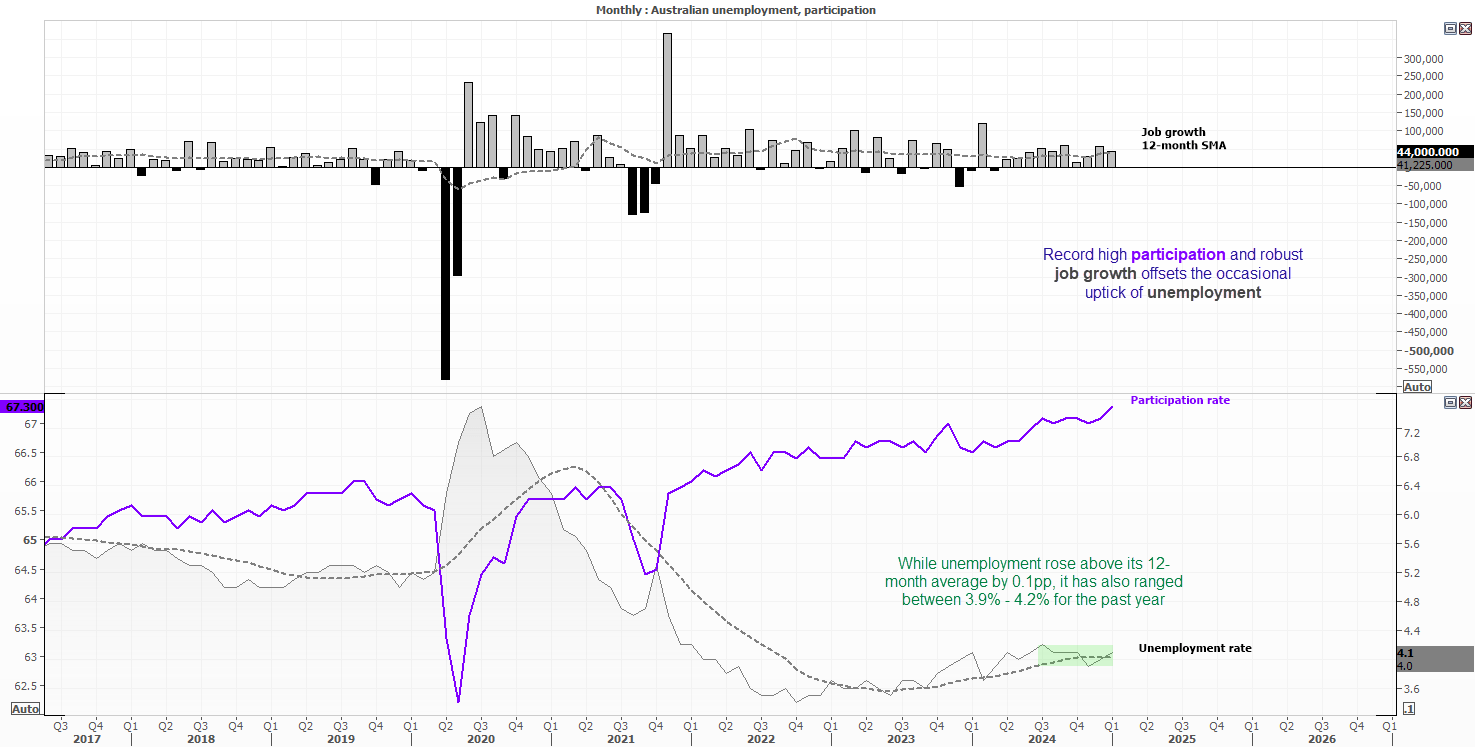

Australian employment likely to remain robust

I wheel this chart out regularly, because it’s a good one. Australia’s participation rate continues to trend higher and sit at a record high, which tends to offset any negativity from a marginally higher unemployment rate. And while unemployment rose to 4.1% and above its 12-month average, I will take it within stride because unemployment has ranged between 3.9% - 4.2% for the past year.

The time to really take notice of the Australian employment report is when we see participation lower, alongside a higher unemployment rate and particularly weak job growth figure (especially if loses with full-time layoffs). For now, job growth remains robust, and I continue to suspect that if another hike is to arrive at all it would be July at the earliest.

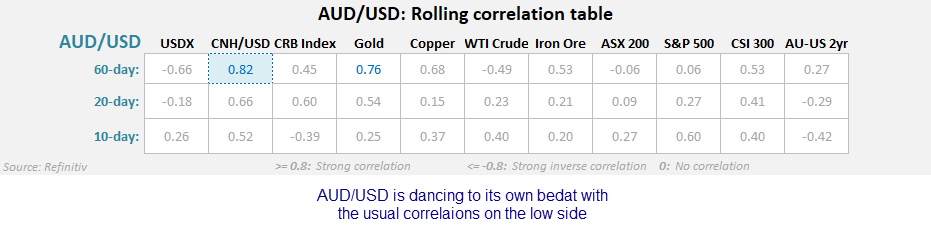

AUD/USD correlations

The Australian dollar really is dancing to its own beat at present, as I do not recall a time where the usual correlations with AUD/USD were so weak. Ideally, we’re looking for correlations to score 0.8 or higher, or -0.8 or lower, to deem it a strong correlation. Only the 60-day CNH/USD (Chinese yuan) ticks that box AT 0.82, and the 20-day at 0.66 or 10-day at 0.52 doe at least show some sort of a relationship, albeit lower than usual.

I think we really need a new set of catalyst, as investors have become fatigued over Fed and RBA policy, Trump’s tariffs and the Russia-Ukraine wall. And until one arrives, we may find that AUD/USD remains rangebound. And such conditions tend to favour range-trading strategies (selling into highs, seeking dip at lows). Otherwise much lower timeframes and to take each day at a time.

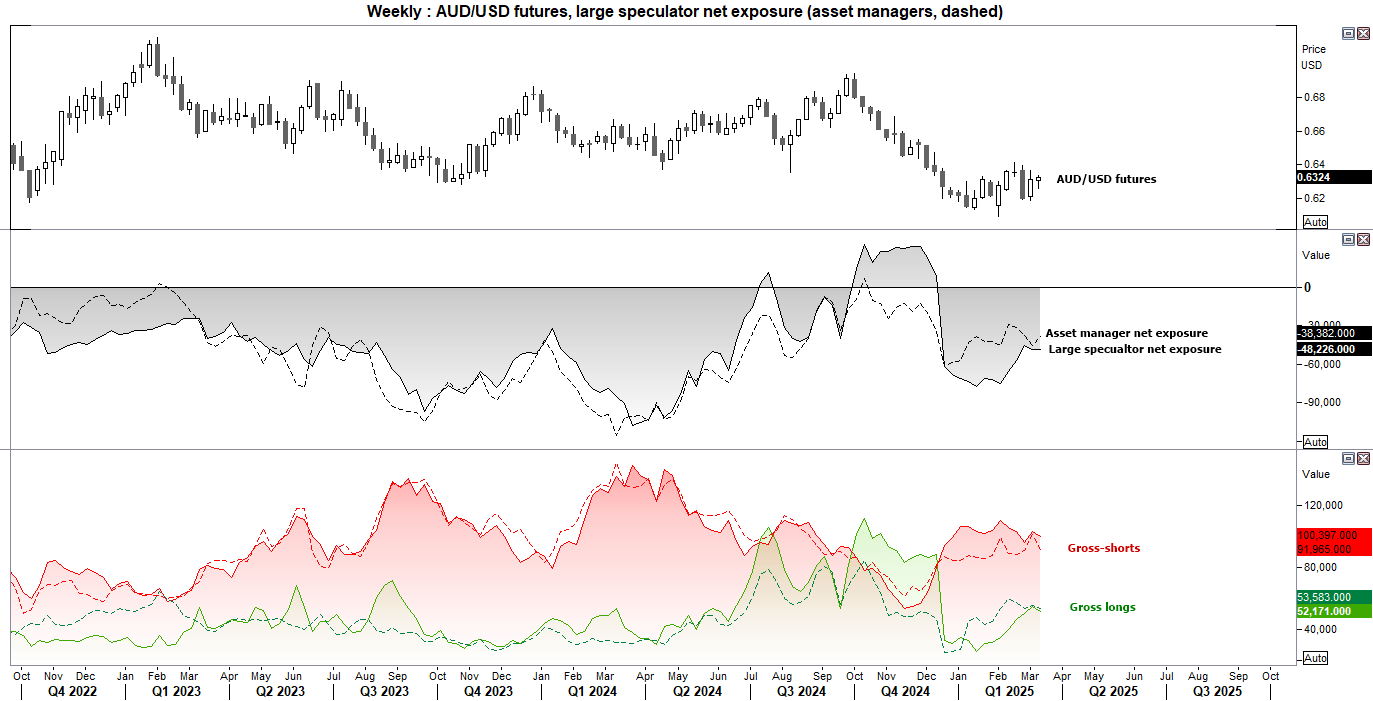

AUD/USD futures – market positioning from the COT report

Nothing truly compelling stands out on the change of market positioning for AUD/USD futures from last week. Asset managers and large speculators derisked from AUD/USD slightly be trimming longs and shorts, and the inside week was its smallest weekly range in 10 weeks. A bit of a ‘meh’ week overall.

AUD/USD technical analysis

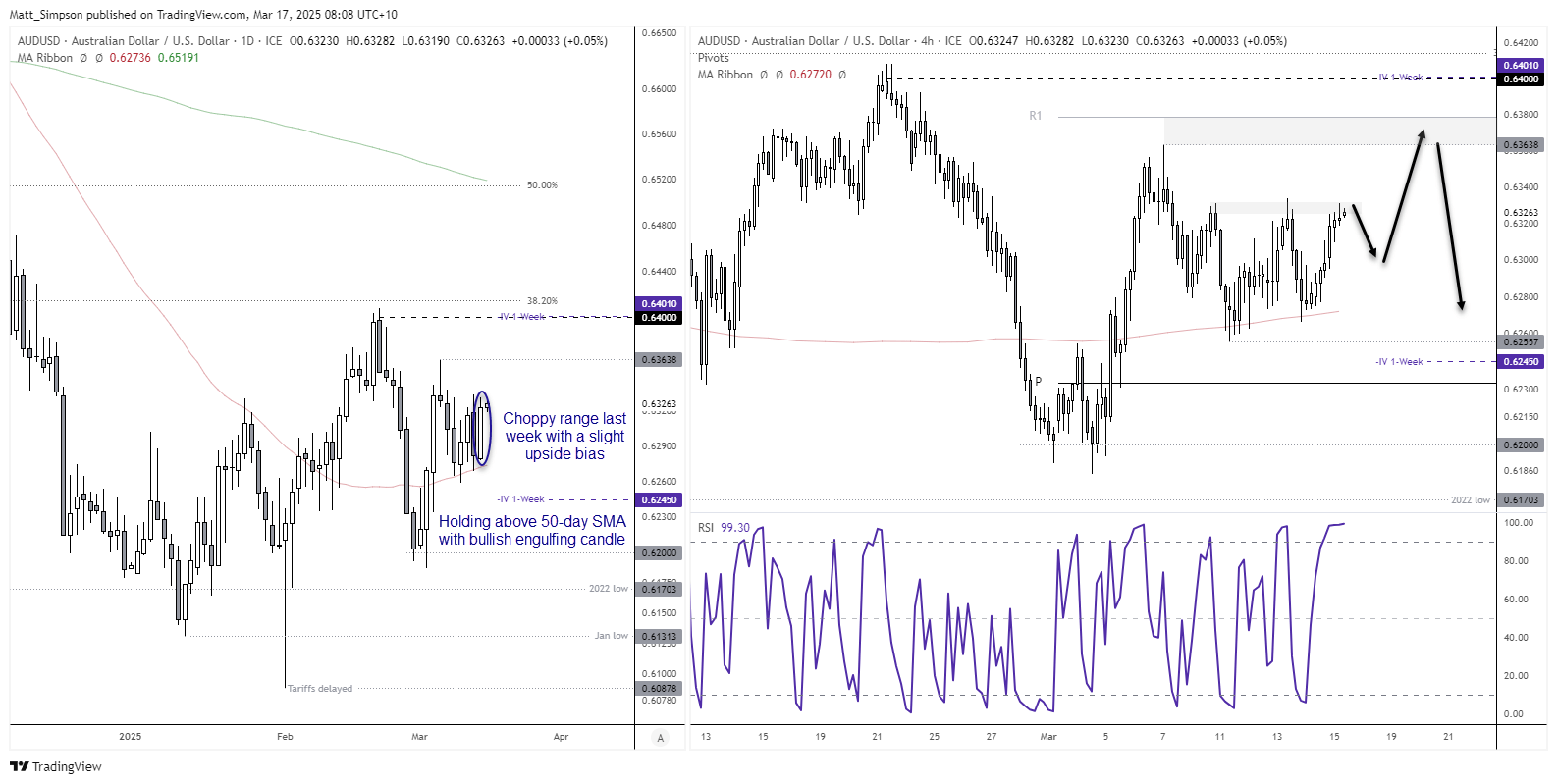

With the US dollar index finding support at the November low, we should be on guard for a potential bounce for the dollar – which could cap gains on AUD/USD (if not, send it lower). Though we’ve already seen the correlation between the two are lower than usual.

I don’t usually go down to the 4-hour chart for the weekly outlook, but the ranges apparent on AUD/USD warrant it. AUD/USD has found support at the 50-day SMA, formed a bullish engulfing candle on Friday and formed a higher low on the 4-hour chart. This could favour bulls who seek dips within Friday’s range for a move up to the March 6 ‘shooting star’ high’, but with the monthly R1 pivot and 64c resistance area nearby, maybe shouldn’t expect too much of a rally without a catalyst.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge