View related analysis:

- NZD/USD, AUD/USD Catch Sympathy Bid as RBNZ Play Safe with 25bp Cut

- AUD/USD Analysis: Eyes on China and the yuan Amid Trump’s 104% Tariff

- AUD/JPY, Wall Street: Tentative Signs of Stability Amid Tariff Turbulence

- Traders Placed Bets Against VIX and Swiss Franc Ahead of Tariffs: COT Report

President Trump made an unexpected reversal on Wednesday by temporarily lowering tariffs on many of the countries he had just imposed them on. Most have now been reduced to the baseline 10% for the next 90 days—mirroring the suggestion made earlier this week by billionaire investor Bill Ackman.

China, however, wasn’t let off the hook. Trump instead hiked their tariffs to 125%, seemingly punishing them for not crawling to the negotiation table and begging for a deal.

I’ll admit, I didn’t expect Trump to blink so quickly, especially with world leaders supposedly queuing up to strike a deal with the man himself. But it’s clear he had been under significant pressure - from business leaders, and from mounting negative headlines about the economy, as well as turmoil in the stock and bond markets.

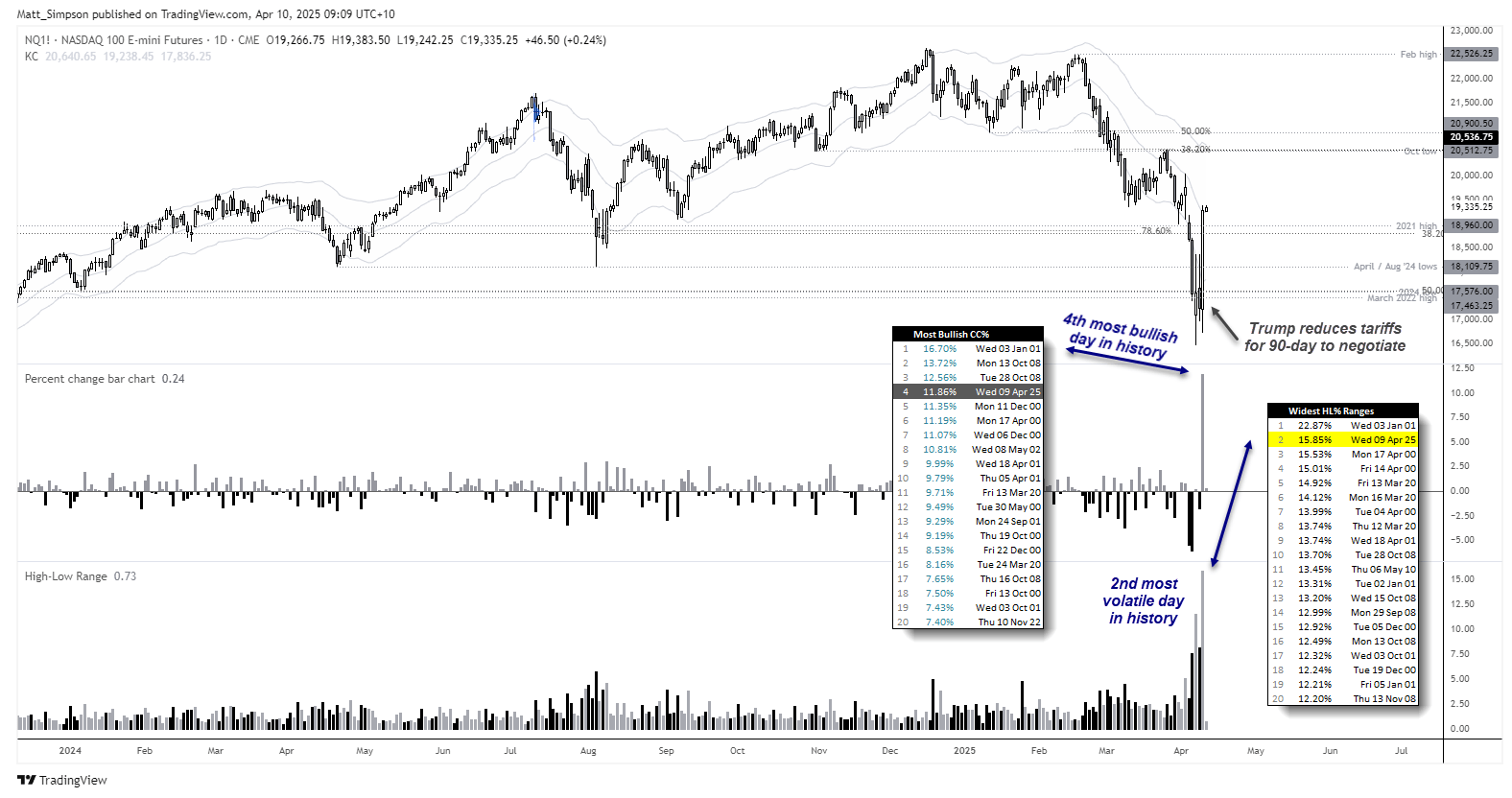

Nasdaq 100 futures led Wall Street’s bullish stampede

To say risk assets took it well would be an understatement. Wall Street notched one of its best days in history, with Nasdaq 100 futures surging an incredible 11.8% (fourth best day on record) - most of which came after lunchtime. It also marked the second most volatile day for the Nasdaq on record, with a daily high to low range of 15.9%. S&P 500 futures soared 9.4%, and the Dow Jones rose 7.9%.

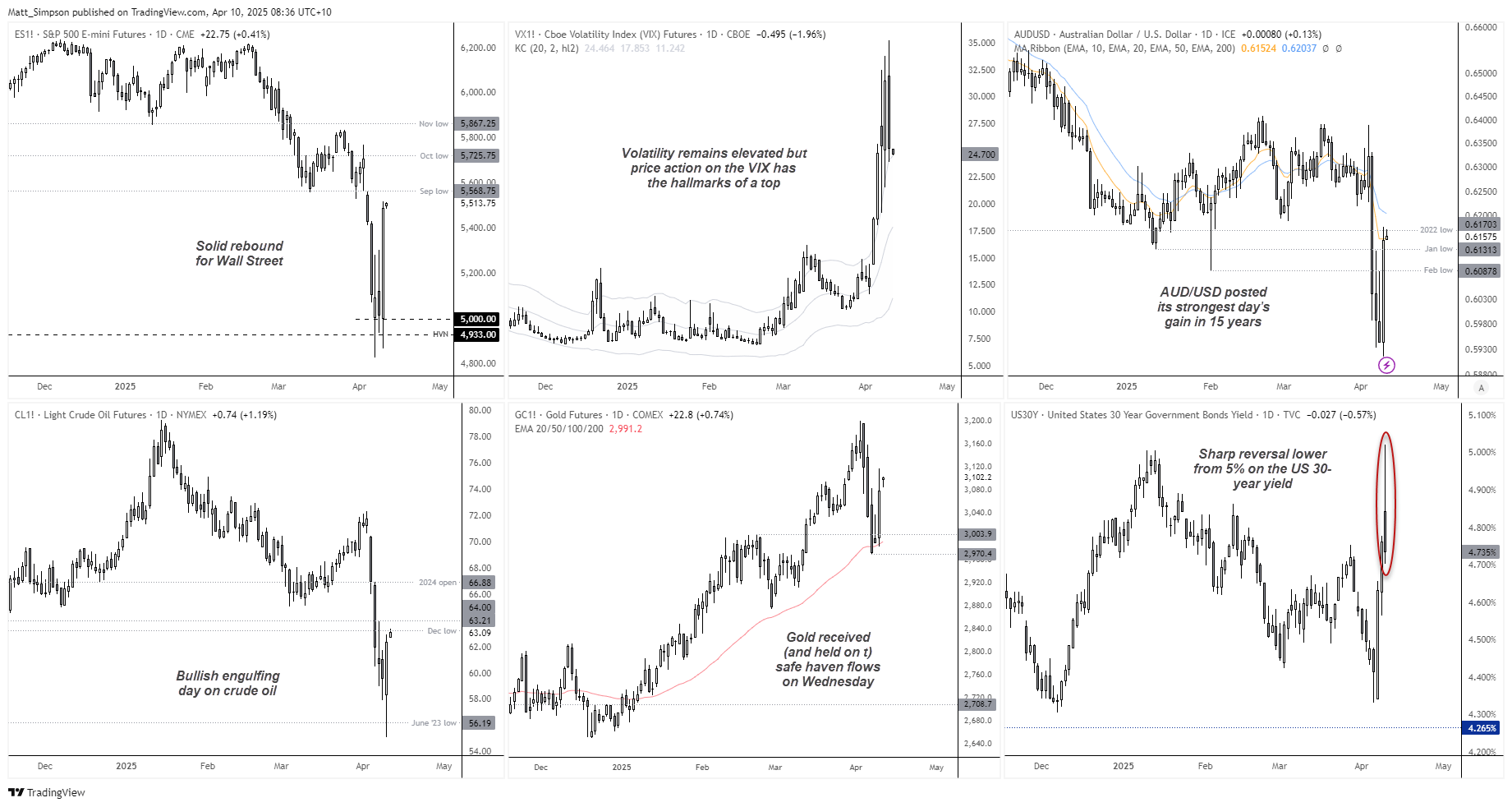

- The volatility index (VIX) was down -6.24 points to 25.2, its fastest single-day decline since August 2024. Volatility remains elevated of course, but this is how tops begin.

- The US dollar index closed flat, though a bullish pinbar formed which also could be part of a higher low

- WTI crude oil formed rallied 4.7% to mark its best day of the year, forming bullish engulfing day, following a false break of the June 2023 low

- Gold held onto its safe-haven gains achieved earlier on Wednesday, after the 30-year bond surged to 5% in the Asian session (note the solid rebound from the 50-day EMA)

- Bond traders returned to support prices, which saw the 30-year yield perform a sharp reversal lower from the 5% level set in Asia

- Commodity FX led the way for FX majors, with AUD/USD, NZD/USD and CAD being the strongest majors while the Swiss franc (CHF) and Japanese yen (JPY) were the weakest amid a clear risk-on session

- Interestingly, China’s futures markets were also a touch higher overnight despite the rise of Trump’s tariffs

AUD/USD technical analysis

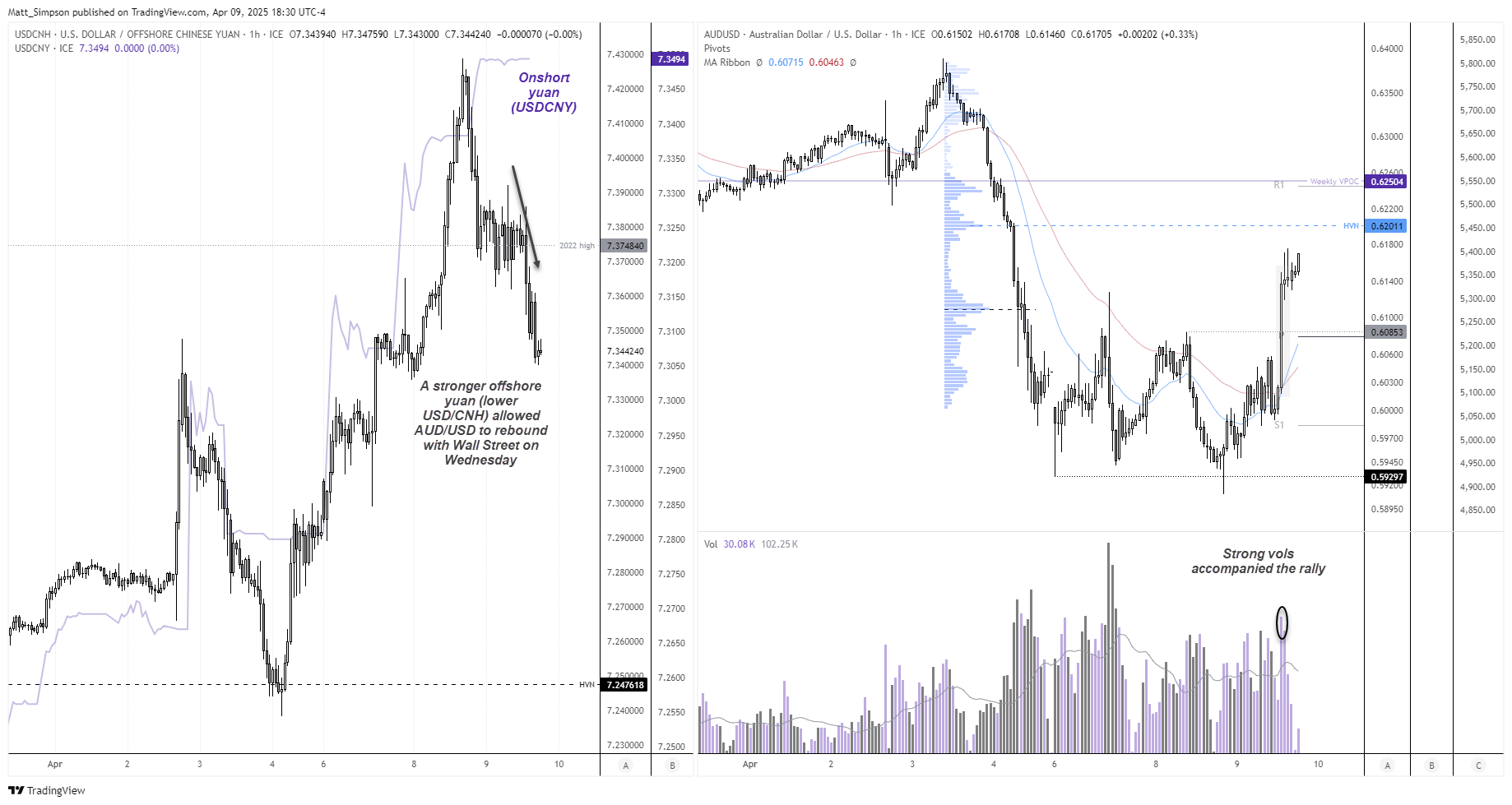

The Australian dollar rebounded alongside risk assets—a welcome surprise, given it had been teetering on the edge of breaking below 59 cents on Wednesday. Its 3.4% jump marked the strongest one-day rally in 15 years, and the 14th best day on record. Prices have now climbed back above the January and February lows, although resistance has been found around the 2022 low and the 10-day moving average.

AUD/USD appeared to gain breathing room as traders bet that Beijing would refrain from aggressively weakening its currency. The offshore yuan rallied, with USD/CNH erasing all of Tuesday’s gains to finish the session effectively flat. That move gave AUD/USD the green light to rally alongside broader risk sentiment when Trump announced a rollback in tariffs.

The 1-hour chart on AUD/USD shows strong volumes accompanied the rebound from ~60c to 0.6140. A couple of bearish pinbars and small-ranged candles alongside lower volumes suggest near-term exhaustion to the move, but if AUD/USD provides any dips then bulls may seek to have another crack at 62c near a high-volume node (HVN).

I doubt we’ll see Wednesday’s level of volatility repeated today, but if Wall Street futures can hold on to gains and USD/CNH avoid a rally (keep an eye on China’s fix at 11:15) then a move to 0.6200 and 0.6250 could be on the cards.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge