- AUD and NZD hit new 2024 highs vs USD

- Trade talk headlines and PBOC stimulus bets support

- Weak NZ labour data, flat Aussie spending weigh locally

- Price and momentum signals favour more upside for AUD/USD, NZD/USD

Summary

The Australian and New Zealand dollars rocketed to fresh year-to-date closing highs against the U.S. dollar on Tuesday, powered initially by further weakness in the greenback amidst ongoing trade deal uncertainty and speculation Chinese policymakers may unleash fresh stimulus measures on Wednesday to counter trade tensions with the United States.

Those gains took another leg higher after the U.S. close as headlines confirmed both sides will meet for the first time in person later this week in an attempt to resolve their differences on trade. While nobody should expect a rapid resolution, for the likes of the Aussie and Kiwi—often used as China proxies by traders—the news is unambiguously good, pointing to the near-term risk of further upside for AUD/USD and NZD/USD despite the release of spotty domestic economic data back home.

Ahead of the Federal Reserve FOMC interest rate decision, movements in Chinese stocks and USD/CNH may be highly influential on Wednesday.

China-U.S. Trade Tensions Thaw

U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will meet with their Chinese counterpart in Geneva this week, marking the first tentative step towards potential trade talks as tensions escalate under President Trump’s trade war. The U.S. delegation is expected to meet China’s top economic policymaker—Vice Premier He Lifeng—in an attempt to reopen diplomatic channels following months of tit-for-tat trade measures.

While the meeting does not mark the start of formal negotiations, markets welcomed the thawing of tensions with U.S. equity futures and China-linked plays jumping on the news, including the Aussie and Kiwi. Previously, China had stated the United States needed to show "sincerity" in order to begin negotiations, including the demand that tariffs introduced by the Trump administration be dropped.

The talks come amid growing concern over the impact of Trump’s 145% tariffs on Chinese goods and Beijing’s 125% retaliation, which Bessent has warned risk becoming a de facto trade embargo. Any signs of compromise or further talks will be closely watched.

At the margin, the talks lessen the need for the Federal Reserve to resume lowering interest rates in the near term, pointing to the likelihood that Jerome Powell will remain non-committal on guidance when he addresses the media following the May FOMC meeting later Wednesday.

News of the talks arrives just before a potentially important policy announcement from Chinese regulators on Wednesday, including the People's Bank of China (PBOC).

China Stimulus Incoming?

The PBOC will be joined by the National Financial Regulatory Administration and China Securities Regulatory Commission, making a rare joint appearance that suggests authorities are preparing to deliver a coordinated policy response, potentially including new monetary tools and targeted support for priority sectors.

The last-minute nature of the announcement has drawn comparisons to September’s surprise briefing, which triggered a massive surge in Chinese stocks and bonds. Given the threat to economic activity posed by trade tensions, pressure is building on Beijing to move to protect its 5% growth target for the year.

Australian, New Zealand Data Whiffs

While the external environment has improved noticeably for the Aussie and Kiwi, back home, news on the state of their respective domestic economies has been anything but stellar, including the release of disappointing New Zealand unemployment data early Wednesday.

The labour market softened further in the March quarter, with a sizeable 0.2 percentage point drop in labour force participation to 70.8% helping to keep the unemployment rate steady at 5.1%, below the 5.3% rate expected. The number of unemployed remained unchanged at 156,000, although that figure was up by 22,000 over the year. Underutilisation—a broader measure of slack including underemployment and unemployed workers—rose to 12.3%, driven primarily by the lift in unemployment over the past 12 months.

Employment fell over the year, with the shift from full-time to part-time work continuing. Full-time employment dropped by 45,000 while part-time rose by 25,000. Wage growth also softened with the private sector Labour Cost Index easing to 2.5%, below the 2.7% level expected.

The soft Kiwi labour market report followed a 0.3% decline in Australian household spending in March, leaving volumes over the quarter flat and creating immediate downside risks to the RBA’s Q1 GDP growth forecasts.

At the margin, both releases increase the probability of the RBA and RBNZ having to ease policy rates more than would otherwise have been the case, creating headwinds for both AUD/USD and NZD/USD from the domestic side of the ledger.

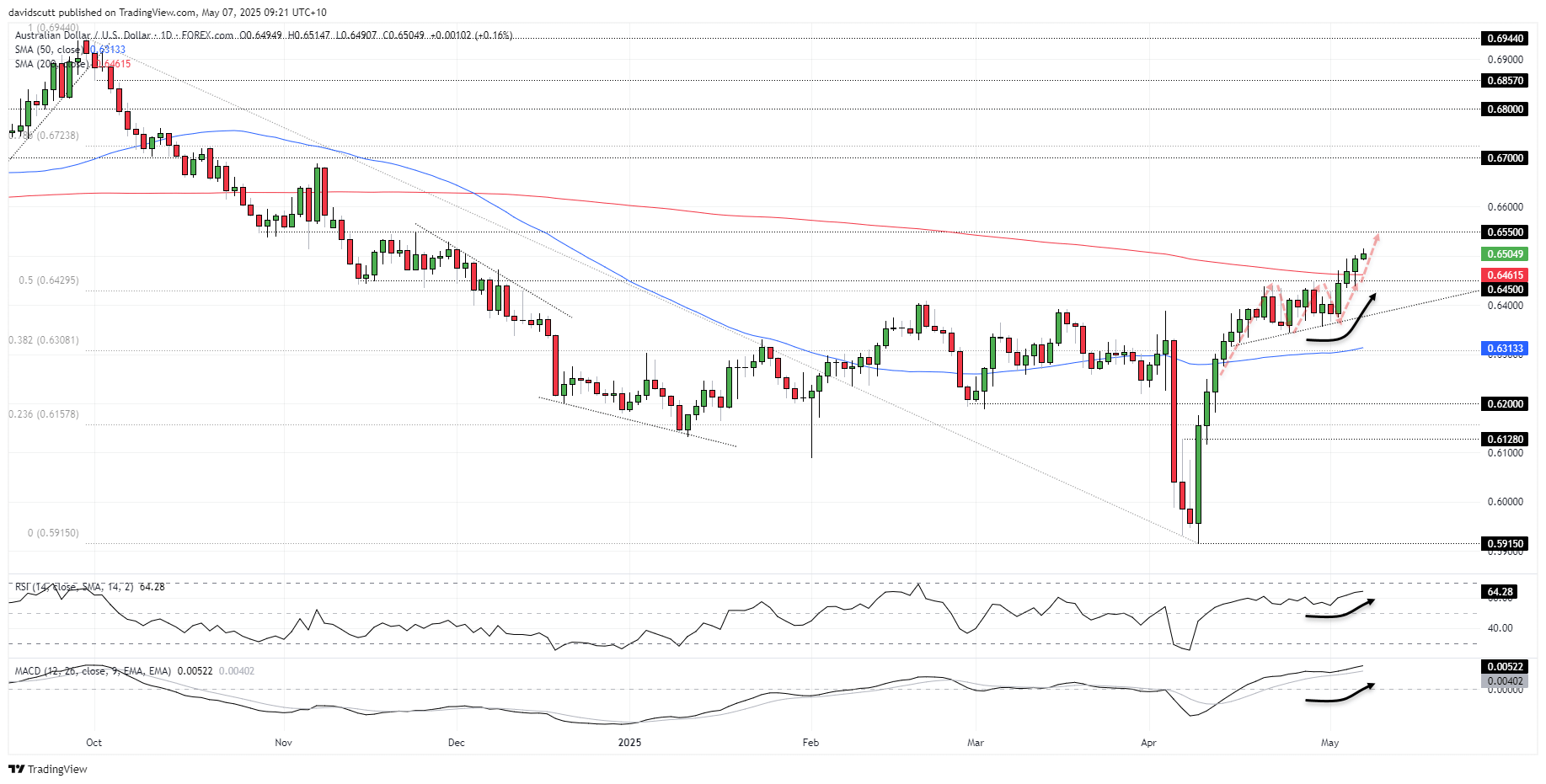

AUD/USD Bounces Strongly from Support Zone

Source: TradingView

AUD/USD closed at the highest level since late November on Tuesday, testing and bouncing strongly from a former resistance zone comprising the 200-day moving average, 50% Fib retracement of the Sept–April high-low and horizontal support at .6450.

With both RSI (14) and MACD pushing higher once again, bullish momentum is building, favouring buying dips in the current environment.

.6550 is the first topside level of note, with a break of that putting AUD/USD on a potential collision course with a far sterner test at .6700. On the downside, having now cleared the 200DMA, it may now revert to offering support.

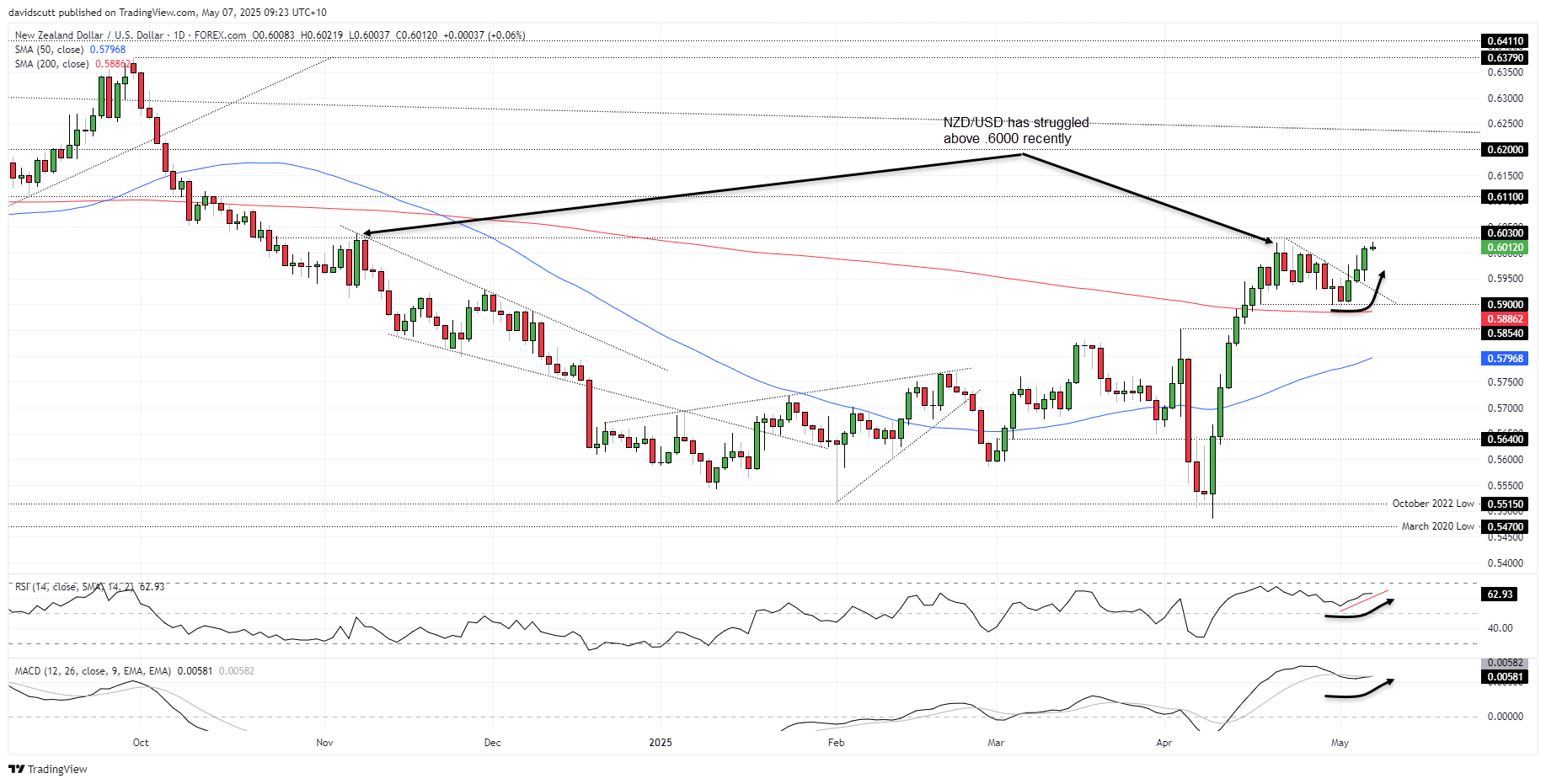

NZD/USD Bulls Resume Battle with Bears above .6000

Source: TradingView

NZD/USD extended the break of downtrend resistance on Tuesday, pushing back above .6000—a level it struggled to overcome in April. If the pair can clear resistance at .6030, it would open the door for a potential run towards .6110 or even .6200 near term. Support is located at .5950 and again at .5900.

Like the Aussie, RSI (14) and MACD are providing clear bullish signals, favouring upside over downside. MACD is on the cusp of crossing the signal line above zero—a move that would further solidify this view.

-- Written by David Scutt

Follow David on Twitter @scutty