View related analysis:

- AUD/USD, Nasdaq Soar as Trump Blinks First, Sparking Epic Market U-Turn

- Tentative Signs of a US Dollar Rebound Ahead of Powell speech

- AUD/USD weekly outlook: The Battler Stages a V-Bottom Recovery

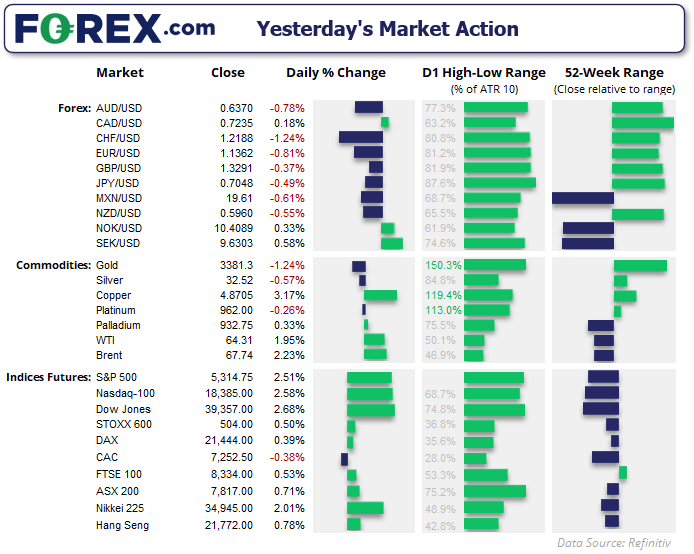

It was a mild risk-on tone on Tuesday, on hopes that US–China trade tensions could recede following comments from US Treasury Secretary Scott Bessent. Speaking at a private investor summit hosted by JP Morgan (JPM), CNC reported that Bessent expects a de-escalation in the trade war with China “very soon”, and that the current status quo of high tariffs is not sustainable.

Wall Street indices were around 2.5% higher, with the S&P 500 and Nasdaq futures forming bullish engulfing days, along with the Dow Jones — the latter of which also snapped a four-day losing streak.

The US Dollar Index rose 0.6% to recoup around three-quarters of Monday’s losses, closing the day back above its December low. This sent EUR/USD back below 1.14 and formed a bearish engulfing day, while helping USD/CAD hold above the November low. However, volatility on the Canadian dollar remains low with Canada’s federal election looming. A weaker Chinese yuan (higher USD/CNH) also helped AUD/USD form a prominent bearish outside day around a cluster of key levels, including the 200-day EMA, 50% retracement level and the 64c handle.

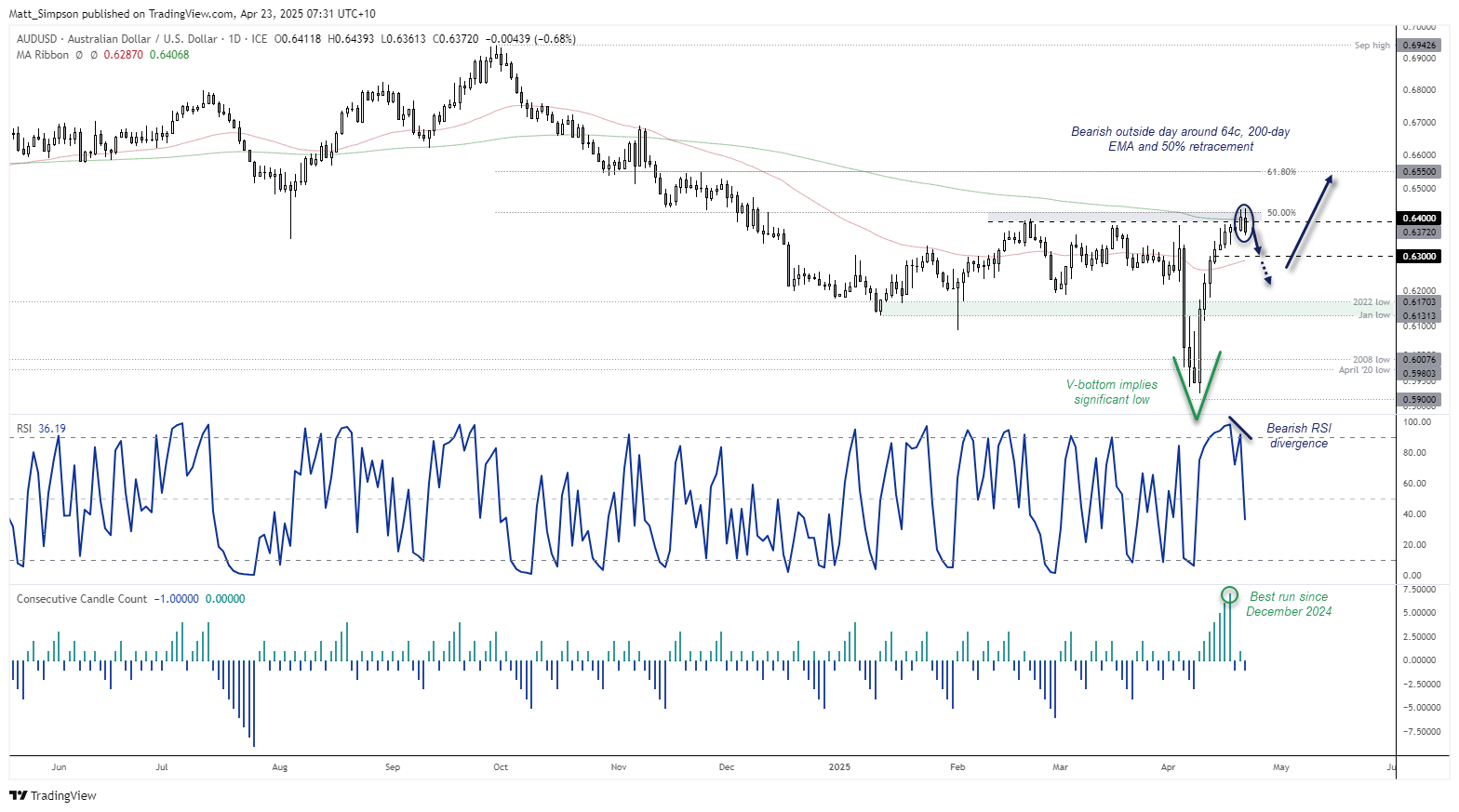

Australian Dollar (AUD/USD) technical analysis

AUD/USD has managed to rebound an impressive 9% in less than two weeks, half of which was achieved on the first day amid its spectacular rebound from 59c. The 4.5% rally on 9 April was thanks to President Trump seemingly blinking first in his own trade war, which marked the Australian dollar’s fourth-best daily return on record and second most volatile.

However, with bearish momentum waning and the rally once again stuttering around 64c, I am on guard for a retracement before an eventual move up to 0.6550.

A bearish outside day formed on AUD/USD on Tuesday, which saw it close back beneath the 200-day EMA and the 64c level. A double top (or tweezer top) also formed around a 50% retracement level, with a bearish RSI divergence already established on the daily chart.

A move to 63c seems feasible, at which point we can reassess its potential for a deeper pullback over a resumption of a rally towards the 0.6550 target.

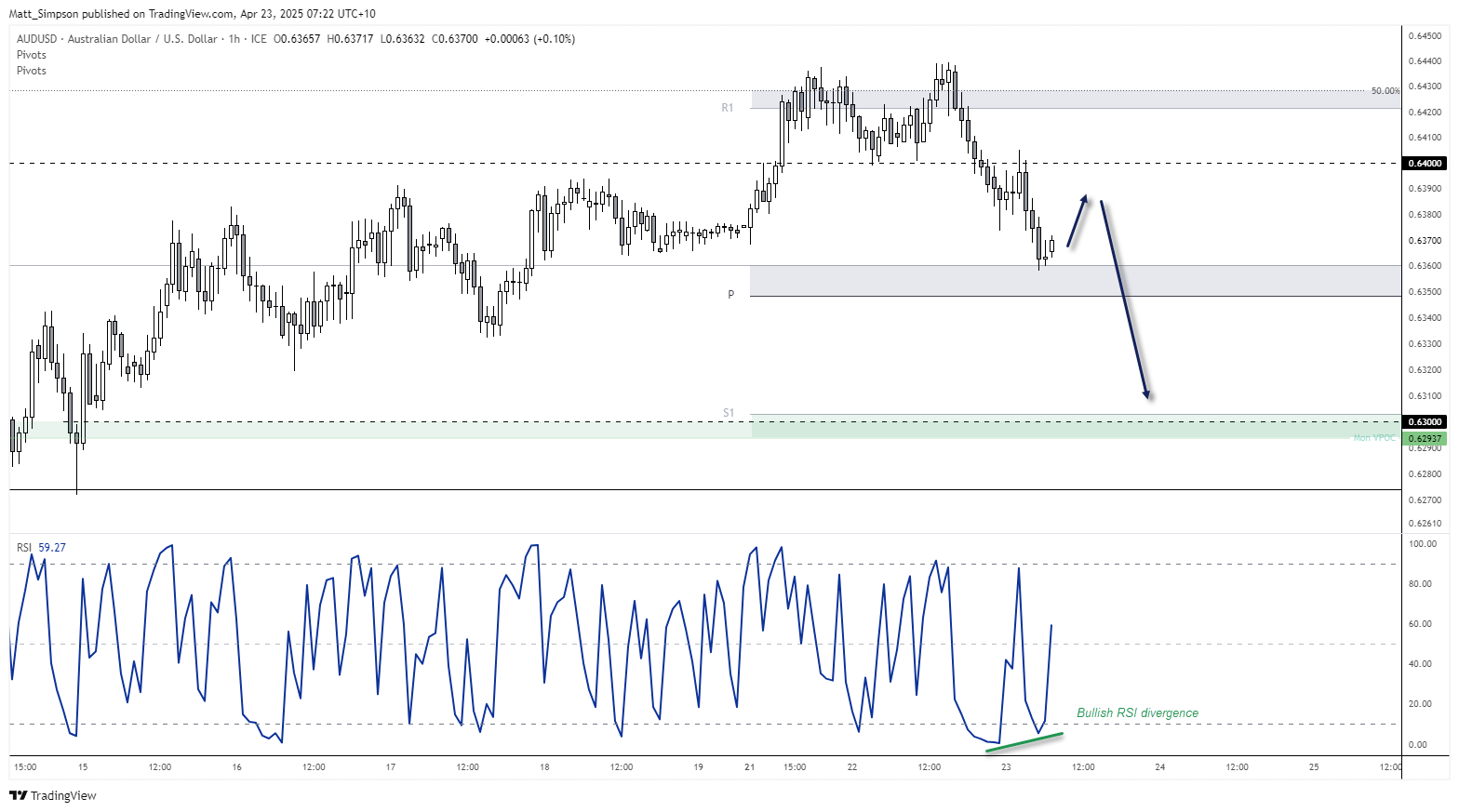

AUD/USD 1-hour chart

The Australian dollar has found support at the monthly S1 pivot point (0.6360), just above the weekly pivot point (0.6348). Given the bullish divergence on the hourly RSI (2), bears could consider fading into moves towards 0.6380 and retain a bearish bias while prices remain beneath the 0.6406 swing high, in anticipation of a break lower and a move towards 63c, near the weekly S1 pivot (0.6303) and historical weekly VPOC (0.6293).

Of course, traders should continue to keep a close eye on USD/CNH as it shares a strong, inverted correlation with AUD/USD. Therefore, we’d want to see USD/CNH rise over the near term to retain confidence of a weaker AUD/USD.

Economic events in focus (AEDT)

- 09:00 – Australian flash PMIs

- 10:30 – Japanese flash PMIs

- 13:00 – New Zealand credit card spending

- 14:30 – Japanese Tertiary Activity Index

- 15:00 – Singaporean CPI

- 17:30 – Franch flash PMIs

- 17:30 – German flash PMIs

- 18:00 – EU flash PMIs

- 18:30 – UK flash PMIs

- 23:45 – US flash PMIs

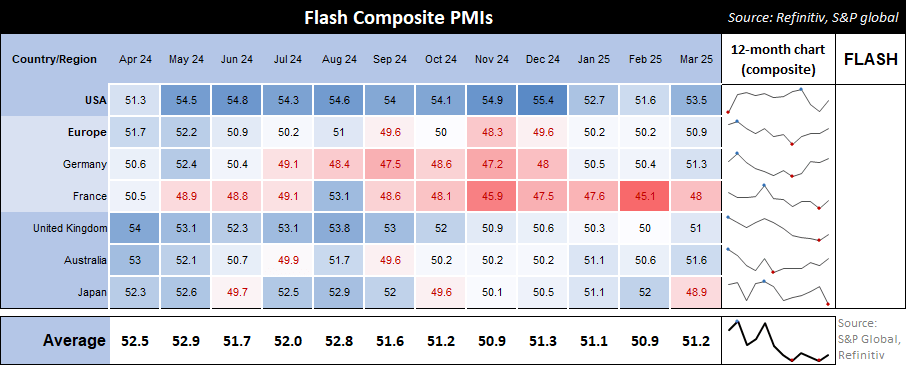

Flash PMIs are the main economic data points over the next 24 hours. Traders will keep a close eye on how inflationary measures such as ‘prices paid’ lands, as any rise here shows that inflationary pressures are building in the midst of Trump’s trade war. Should higher prices be coupled with lower headline PMIs, new orders and employment, calls for stagflation will surely mount.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge