View related analysis:

- CHF Beats Yen for Safety as Tariffs Take Second Quarter to the Slaughter

- If Consumers Don’t Consume, a Recession Could be Presumed

- AUD/USD weekly outlook: RBA, ISMs and NFP in Focus

Liberation Day arrived, and the tariffs delivered were more severe as expected, sparking concerns of a global recession. Markets were in turmoil as we closed out the week, with Wall Street indices plunging at their fastest rate since the pandemic. And they have gapped lower today with Treasury Secretary Scott Bessent over the weekend showing that the Trump administration have no appetite to back away from the tariffs. The Japanese yen, Swiss franc and bons assumed their usual role of safe havens.

Even gold was lower last week, with portfolio managers likely being forced to liquidate gold bets to nurse stock market losses. While down just -2.5%, the bearish engulfing week at the record high spanned 5.5% to mark its most volatile week since November.

Naturally, the Australian dollar did not go unscathed.

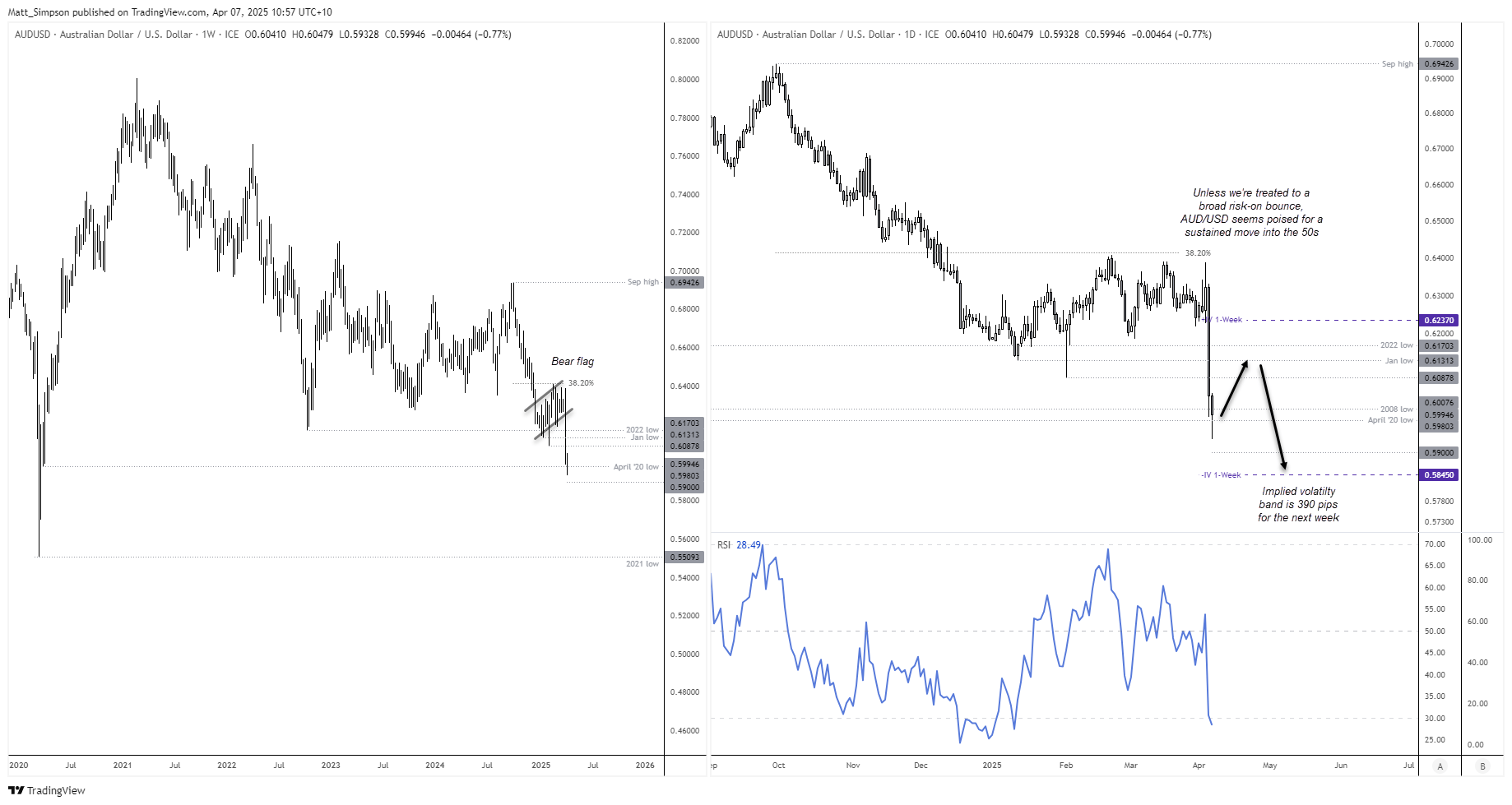

- The near -4% decline marked the worst week for AUD/USD since March 2024, and saw the last of its Q1 gains evaporate to sit -3% year-to-date.

- AUD/USD briefly traded below 60c on Friday but has since gapped beneath it today – marking its first venture into the 50s since March 2020.

- The Australian dollar lost notable ground to the Swiss franc (AUD/CHF -6.1%) and euro (AUD/EUR -5.1%) and remains under pressure today.

- The Australian dollar only managed to hold its ground against the weaker Canadian dollar and Chinese yuan

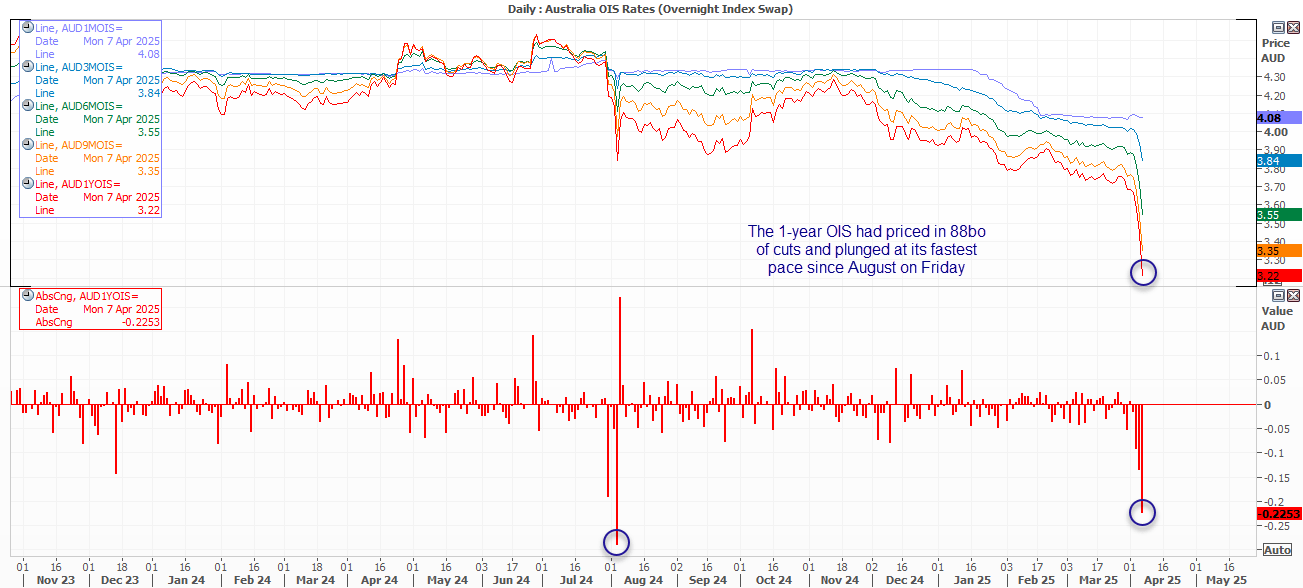

RBA rate cut bets on the rise

Concerns of a global recession are of course increasing the odds of an RBA cut. The 1-year OIS (overnight index swap) has now priced in 88bp, 20bp of which arrived on Friday. And this puts the RBA in a tight spot, because expectations of cuts drives the currency lower and effectively imports the inflation they are trying to fight. While this could be a deterrent for cuts to a degree, the RBA could still be forced to cut rates sooner and more aggressively if they think a recession is coming.

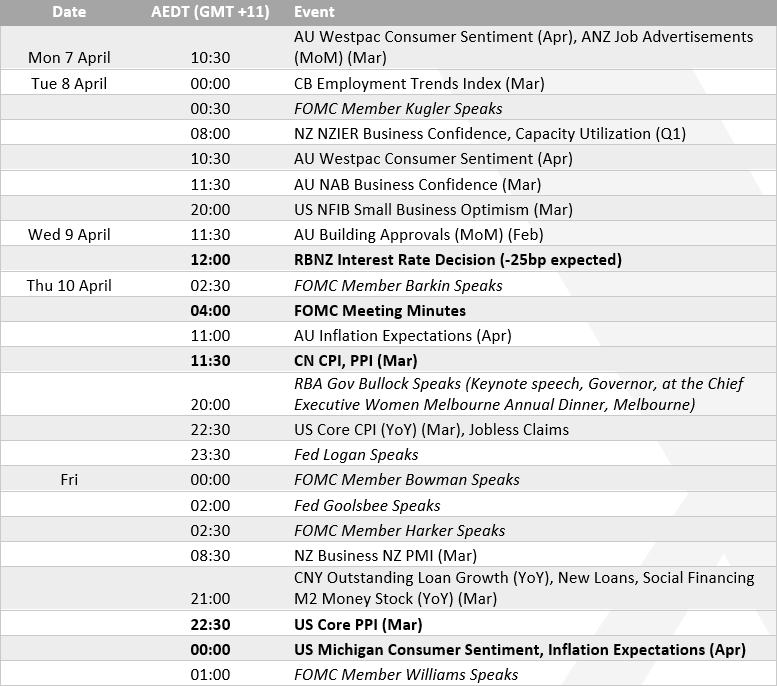

Given the current backdrop, the domestic economic calendar almost seems like a moot point this week. I doubt the consumer and business sentiment reports will capture the immediate aftermath of tariffs in this week’s reports from Westpac and NAB. And the same can be said for pretty much all data releases this week.

And that means the Australian dollar (and sentiment in general) remains at the whim of tariff headlines. I doubt we will be treated to a risk rally unless Trump significantly reduces the level of tariffs suggested. But as Bessent has already suggested, that is not likely to happen. The Australian dollar therefore seems likely to be kept on the ropes, with the bigger question being whether it will break sustainable into the 50s – a level which it only seems to venture when facing a financial or economic crisis, much like the one we could now be facing.

RBA Governor Bullocks delivers a keynote speech at the Executive Women Melbourne Annual Dinner. It seems unlikely policy will be discussed, but in the current climate it might be a waste not too. But given the circumstances, perhaps we should be on guard for policy clues delivered in interviews, a practice that seems to have been forgotten since Lowe’s departure. But one that might make a comeback amid the market turmoil.

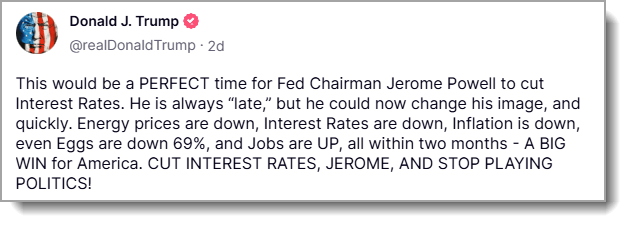

Several FOMC members are set to hit the wires, but will they blink? Donald Trump has already taken aim at the Fed and is trying to strongarm them into cutting rates, to help put out the economic fire he arguably started. Traders should therefore keep a close eye on what FOMC members say this week. I feel they will keep a stiff upper lip regarding policy, and they still have time to see how this plays out before hinting at cuts. But with Wall Street pricing in a deep recession, traders may be right to expect a cut sooner than later.

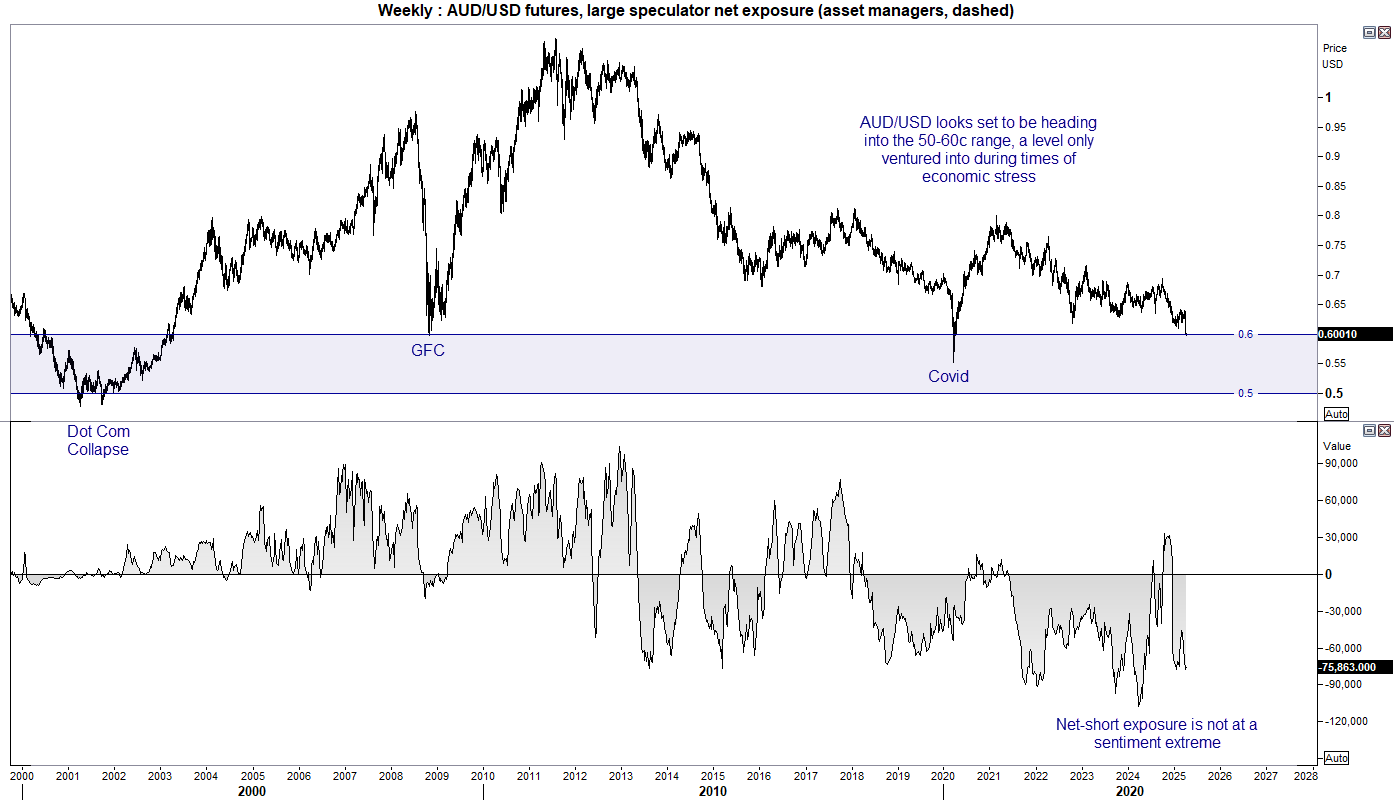

AUD/USD futures – market positioning from the COT report:

- Only minor adjustments were made to AUD/USD futures last week

- Large speculators decreased net-short exposure by -1.5k contracts, and asset decreased their by -2.7k contracts

- AUD/USD is on the brink of a sustained move within the 50-60c range, a zone usually reserved for times of great economic stress (and market reactions suggest we’re heading towards one)

- By Tuesday’s close, net-short exposure was not at a sentiment extreme

- Even if a sentiment extreme presents itself in the next set of data, remember that it can remain in that state for weeks at a time without a price reversal (and one is not expected unless Trump concedes the current tariffs are a step too far)

AUD/USD technical analysis

Ultimately the Australian dollar and global sentiment is to be guided by Trump and any change to his tariffs, if any are to come at all. The 1-week implied volatility band has blown out to 390 pips, which suggests a 200-pip move in either direction.

Prices are trying to hold above the 60c handle and April 2020 low for now. But even if prices recoup some of last week’s losses, I have to assume bears are lurking above and waiting for fresh entries to drive AUD/USD into the 50s without a broad risk-on catalyst.

As Friday’s price action shows, current conditions do not play nicely with technical levels. And for now, lower levels of volatility could be seen as a win for investors or those impacted by currency moves.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge