View recent analysis:

- Japanese Yen Weaker Amid Tariffs, Reduced Hawkish-BOJ Bets, CPI Reports in Focus

- Nasdaq 100, S&P 500 Feel the Force of Trump’s Tariffs, ASX to Open Lower

- If Consumers Don’t Consume, a Recession Could be Presumed

RBA to hold the cash rate at 4.1% this week

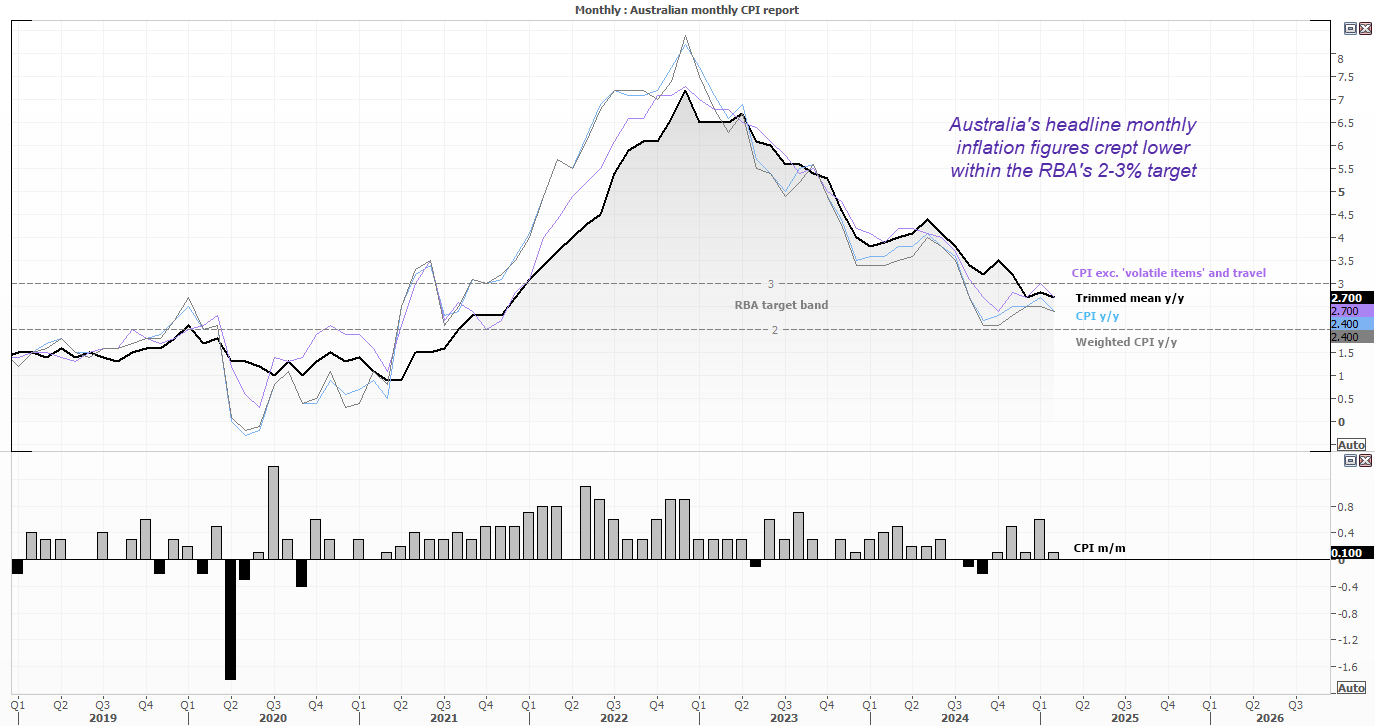

Headline inflation from Australia’s monthly report drifted further within the RBA’s 2-3% target range, which promoted calls for an immediate cut from the usual suspects. I still see it as far more likely the RBA will hold off at least until May, after the quarterly CPI report has been released and the Federal election is out of the way.

I am still veering towards a July cut, which RBA cash futures have nearly fully priced in anyway. But then does it really matter whether a cut lands in May or July? I doubt so, because a cut in May almost certainly kills the odds of a July cut. A second cut is fully priced for October, which places it in line with the RBA’s forecast of ~50bp of cuts in H2. And unless anything significant changes to the Australian or global economy, 50bp of cuts this year seems about right.

While the bias is for a hold, I will look to the statement and Governor Bullock’s press conference to see if the RBA have a greater appetite for easing in future.

Australia’s monthly retail sales for February are released in the hours ahead of Tuesday’s RBA meeting. While it is unlikely to move the needle for the RBA, it will be interesting to see if the ‘household goods and retailing’ takes another hit, having fallen in -4.4% in January.

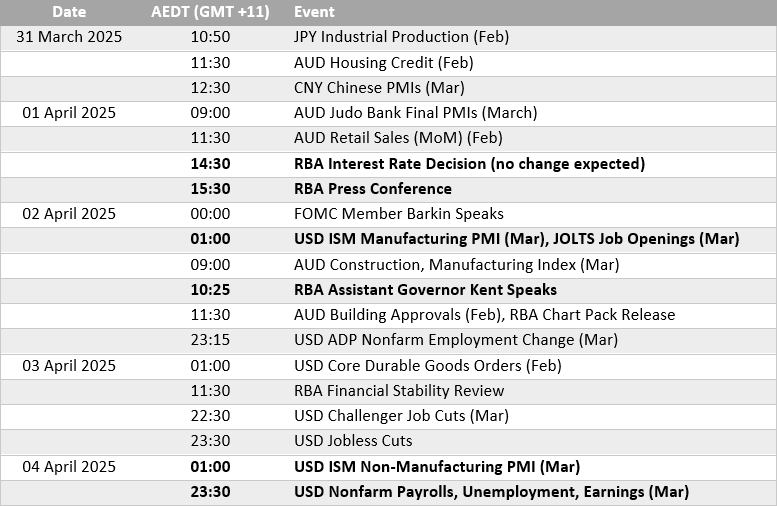

The manufacturing and services ISM reports and NFP are the main calendar events from the US. Tariffs remain a headline risk, though the lack of volatility on AUD/USD suggests traders have reached tariff fatigue. This could potentially bring a bout of risk-on and support AUD/USD should tariffs be watered down or delayed once again.

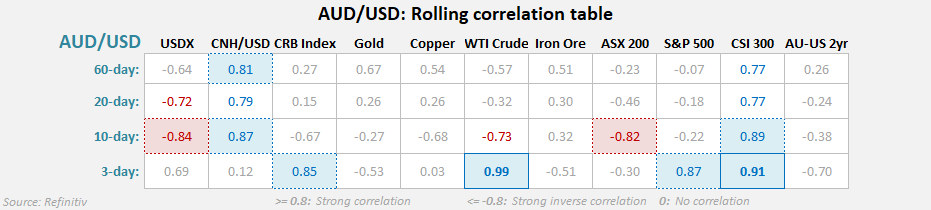

AUD/USD correlations:

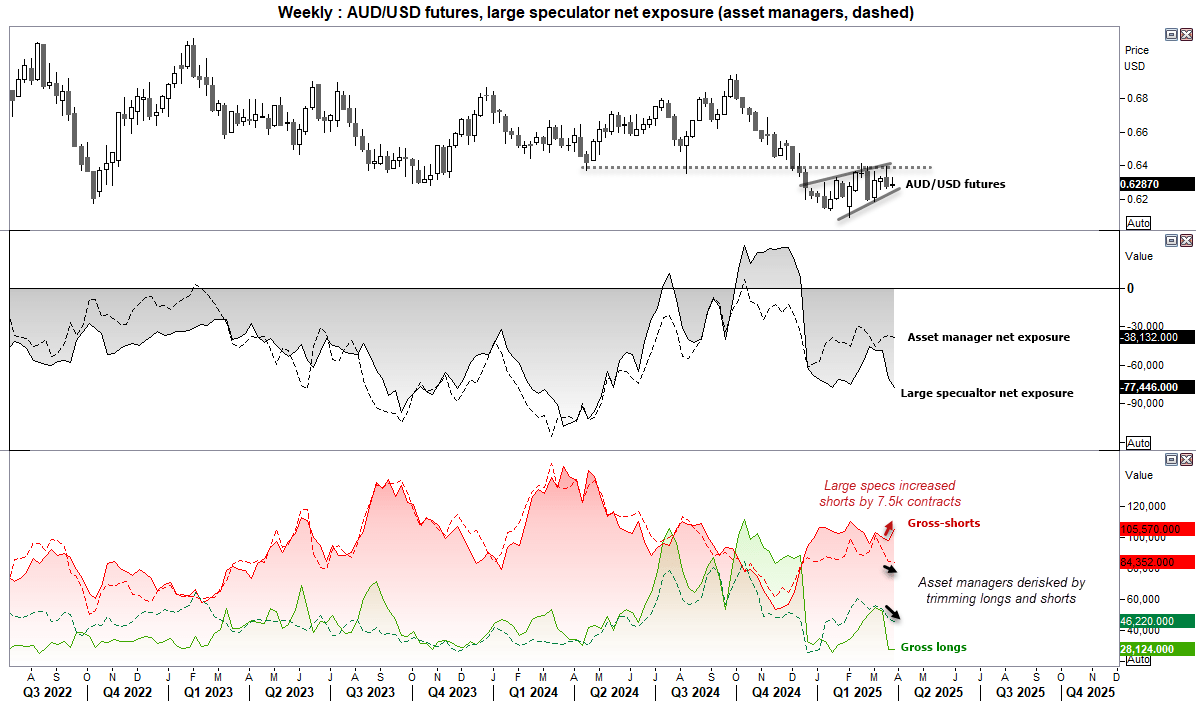

AUD/USD futures – market positioning from the COT report:

- Large speculators increased their gross-short exposure to AUD/USD futures by 7.5k contracts while longs remained flat

- Asset manages derisked for another week by trimming longs and shorts

- The net result overall was to see a slight increase in net-short exposure to AUD/USD futures among both sets of traders

- A potential bear flag is forming on the AUD/USD weekly chart (which likely needs a significantly stronger USD/CNH to stand any chance of breaking down in style)

- A small bearish inside week formed last week to show a general lack of direction and volatility for now, but 64c is clearly a line in the sand for bulls and bears on this timeframe

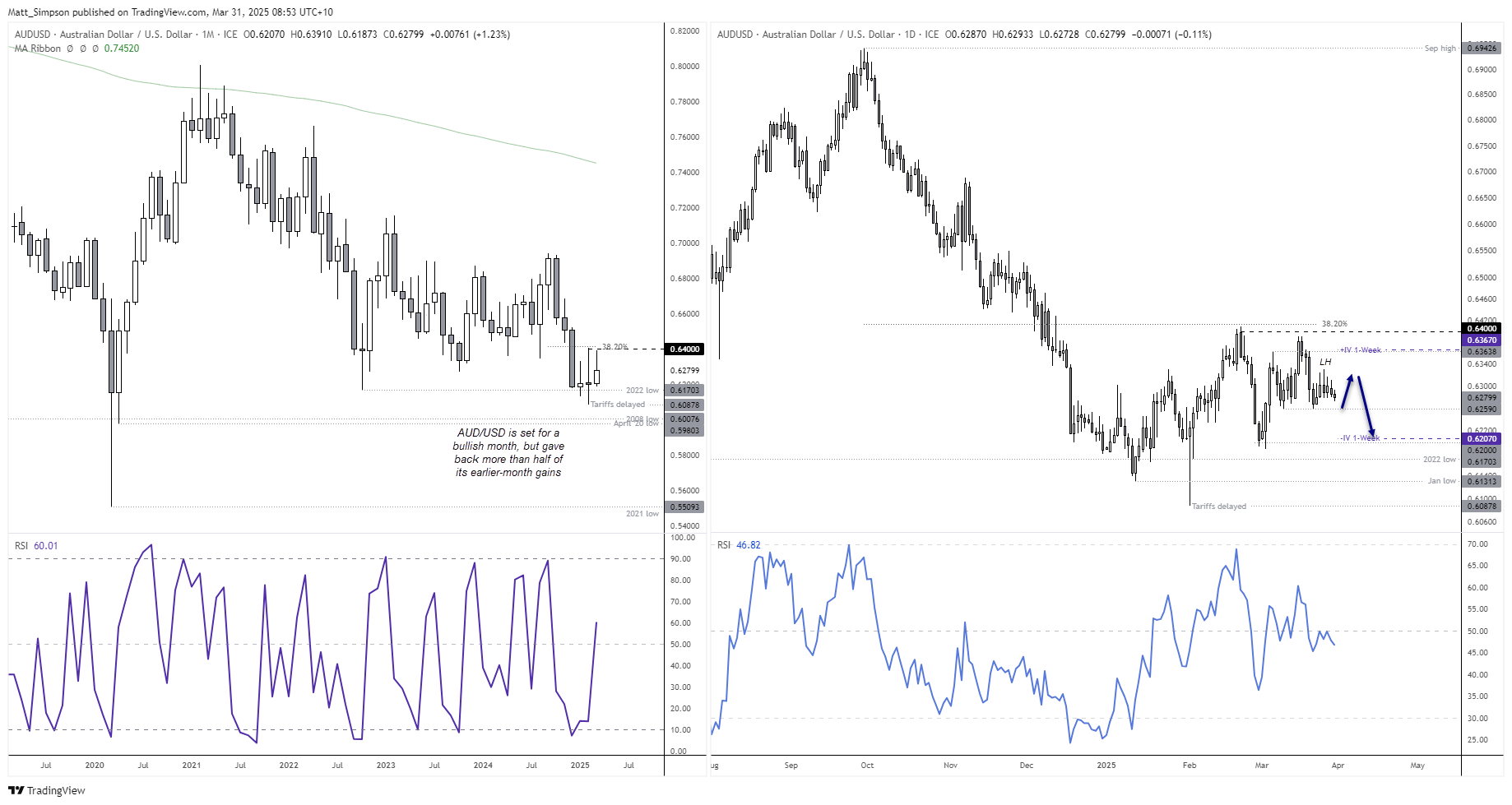

AUD/USD technical analysis

The Australian dollar is on track for a slightly bullish month of around 1.1%, having given back more than half of its early month gains. A failed attempt to hold above 64c in February was accompanied with a failure to even retest that level in March.

The daily chart shows there is a lot of overlap between the candles, as AUD/USD is lacking sustained momentum. A lower high formed on Wednesday, and prices have since drifted below 63c with a lack of conviction. Perhaps AUD/USD can hold above 0.6259 support for now and treat bulls to a minor bounce.

However, a break beneath 0.6259 support takes prices back into the lower range from the start of March, potentially opening up a run for 62c.

But for now, we’re lacking an adequate catalyst to see AUD/USD break out of the 62c – 64c range.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge