View related analysis:

- Nasdaq 100 Futures Eye ATH as Wall Street Awaits Trade Headlines

- AUD/USD, NZD/USD Outlook: US Dollar Slides as Tariff Risks Resurface

- AUD/USD Weekly Outlook: GDP, NFP On Tap

- USD, EUR, GBP, JPY Outlook: Weekly COT Report Highlights

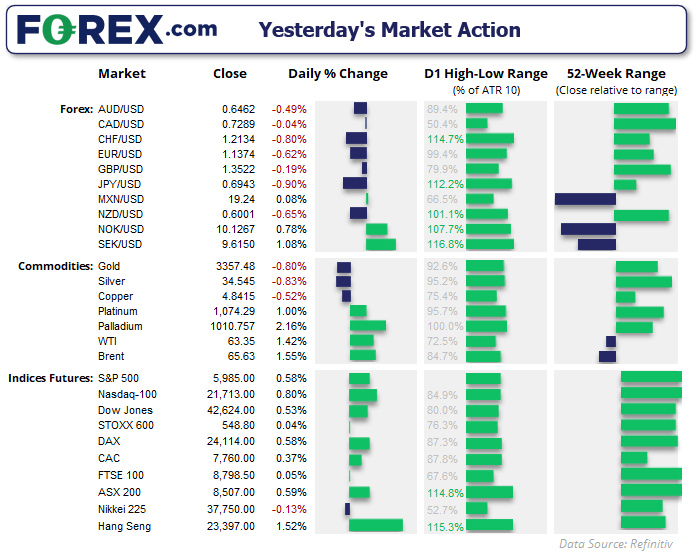

Risk appetite returned on Tuesday as Wall Street indices extended gains and traders pinned hopes on progress in US-China trade talks. With President Trump set to speak with President Xi “this week,” markets remain sensitive to headline risk, especially in the absence of confirmed timing or substance. Still, investors embraced cautious optimism, pressuring safe havens like the Japanese yen (JPY) and Swiss franc (CHF) while lifting risk-sensitive currencies and Wall Street indices.

- The Japanese yen (JPY) and Swiss franc (CHF) were broadly weaker on Tuesday amid a slight risk-on session.

- The US dollar (USD) was the strongest major on trade deal hopes.

- USD/JPY was the strongest FX major, rising 0.9% and paring most of Monday’s losses

- The Canadian dollar (CAD) also performed well, helping CAD/JPY rise 0.88% and form a bullish engulfing candle

- GBP/JPY hints at a swing low at 192.80 with its own bullish engulfing candle

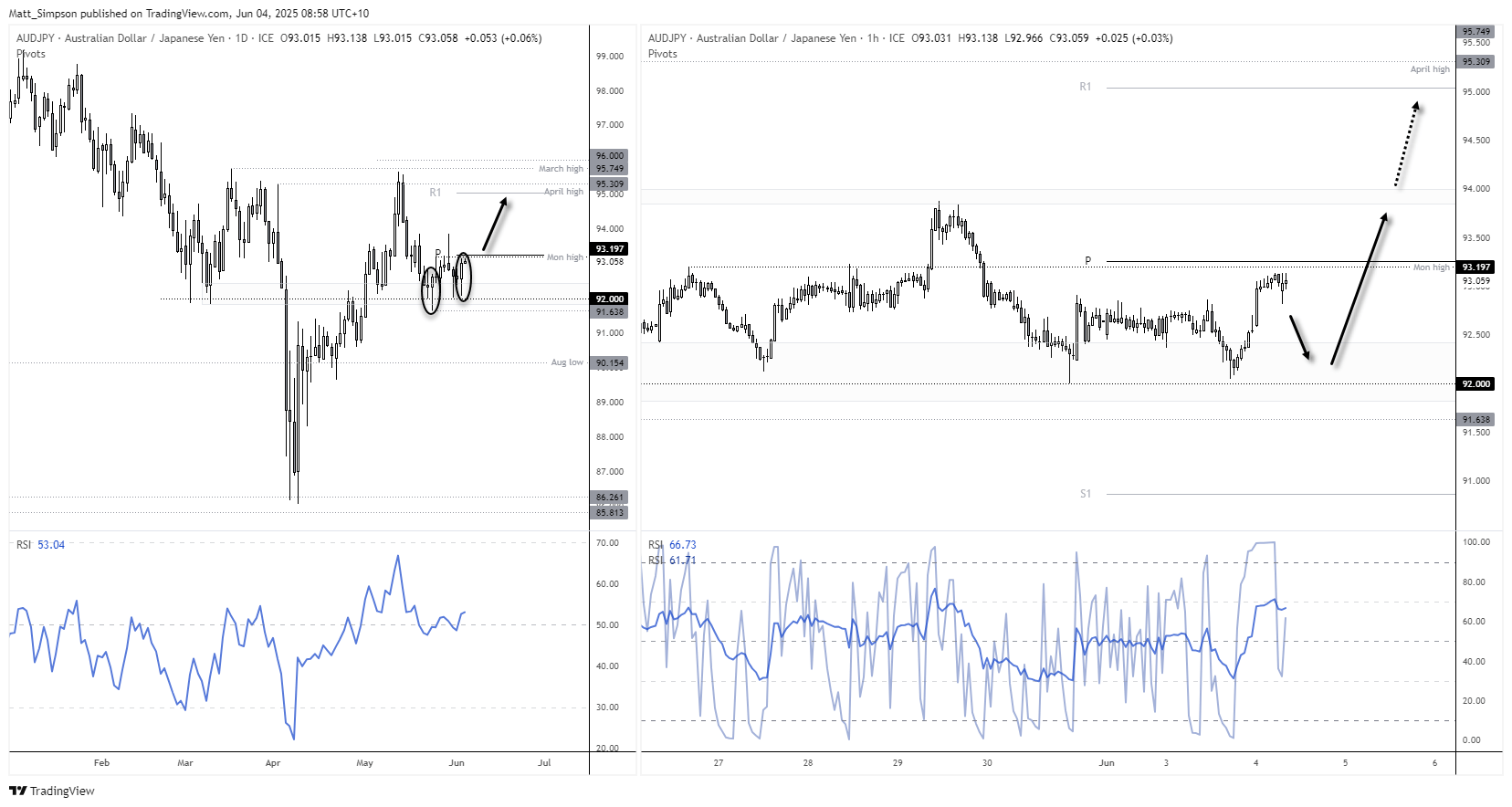

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

92 has been a pivotal level on the Aussie yen (AUD/JPY) since March, acting as both support and resistance during this time. I noted its importance in a recent video and expressed my hesitancy to favour shorts until we saw a clear break of that key level. I’m glad I did, as it’s once again providing a decent level of support.

A bullish hammer marked a false break of 92 and an important swing low on March 23. While price action has been mostly choppy, the daily close line has drifted higher, and a bullish outside candle formed on Tuesday — its low holding above 92 to form a higher low.

The daily RSI (14) is curling higher from 50, suggesting bullish momentum is building.

- A break above the monthly pivot point (93.20) also clears last Monday’s high and brings the 94 handle into view over the near term.

- A break above that puts the 95 handle and monthly R1 pivot into focus.

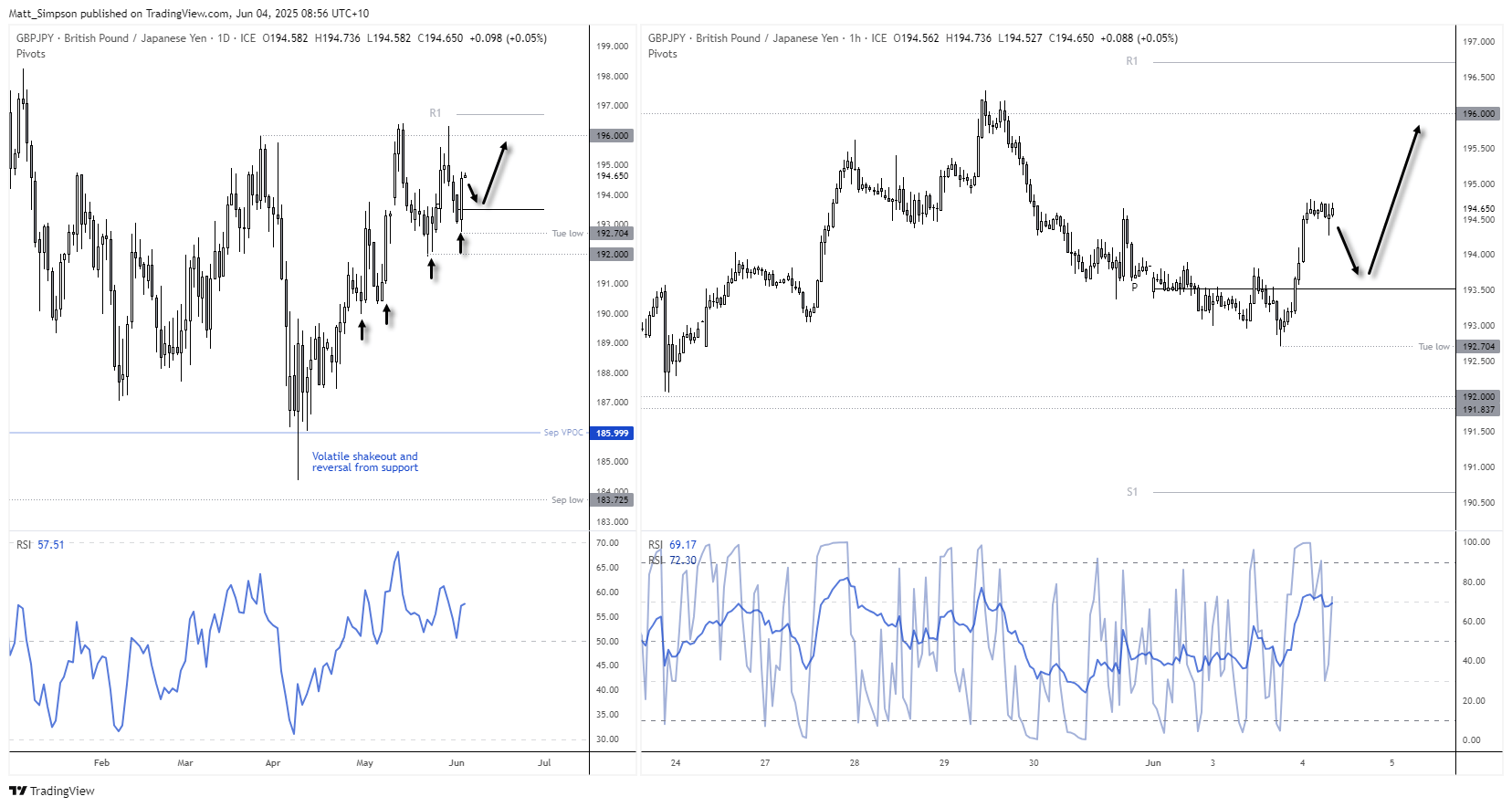

GBP/JPY Technical Analysis: British Pound vs Japanese Yen

The swing trade long idea on May 23 worked out well. GBP/JPY has since snapped a 3-day pullback with a bullish engulfing candle, which leaves the potential for another crack at 196. While we have seen 3 false breaks above it already, GBP/JPY displays a series of higher lows into this key resistance level to suggest bullish pressure is building.

Bulls could seek dips down to the monthly pivot point (193.52) or the 193 handle and maintain a bullish bias while prices remain above Tuesday’s low (192.78).

Economic Events in Focus (AEST / GMT+10)

- 09:00: AUD AIG PMIs (May) (AUD/USD, ASX 200)

- 10:30: JPY Services PMI (May) (USD/JPY, EUR/JPY, Nikkei 225)

11:30: AUD GDP (QoQ, YoY) (AUD/USD, ASX 200, AUD/JPY) - 18:30: GBP S&P Global Composite Services PMI (May) (GBP/USD, GBP/JPY, EUR/GBP, FTSE 100)

21:00: USD MBA Mortgage Data (USD, S&P 500, Nasdaq 100, Dow Jones) - 22:15: USD ADP Nonfarm Employment Change (May) (USD, Gold, S&P 500, Nasdaq 100, Dow Jones)

- 22:30: USD Fed Governor Cook, FOMC Member Bostic Speaks (USD, Gold, S&P 500, Nasdaq 100, Dow Jones)

- 22:30: CAD Labor Productivity (Q1) (USD/CAD, CAD/JPY, TSX)

- 23:45: USD S&P Global Services PMI (May) (USD, S&P 500, Nasdaq 100, Dow Jones)

- 23:45: CAD BoC Rate Statement, Interest Rate Decision (USD/CAD, CAD/JPY, TSX)

- 00:00: USD ISM Non-Manufacturing ISM (May) (USD, Gold, S&P 500, Nasdaq 100, Dow Jones)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge