Australian Dollar (AUD) Pairs Lower Heading into Key Inflation Data

The US dollar caught a bid after President Trump took the seemingly positive step of allowing US car makers more time to move supply chains back home. Trump has agreed to provide car makers with credits of up to 15% of vehicle values assembled domestically. US Commerce Secretary Lutnick also told CNBC that he has closed the first trade deal with a foreign power, though details are yet to surface.

View related analysis:

- EUR/AUD Analysis: April’s Candle is Eerily Similar to 2008, 2020 Highs

- ASX 200 Falters at Resistance, Pullback Pending?

- AUD/USD Weekly Outlook: Trimmed Mean Inflation in Focus

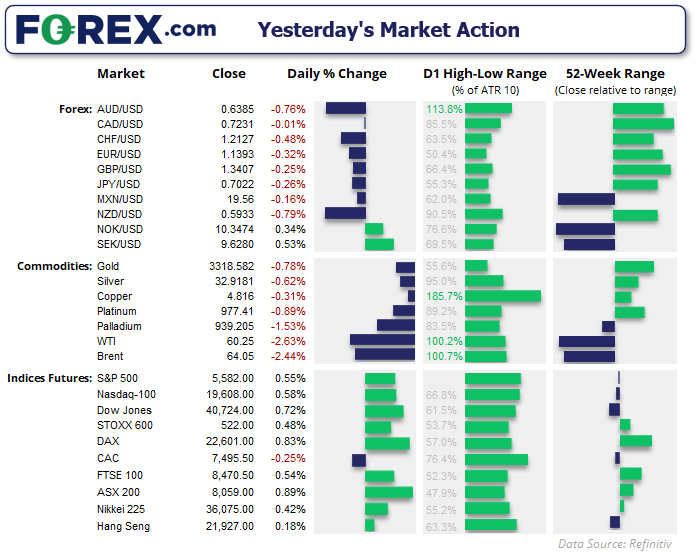

With commodities lower and the US dollar higher, the Australian dollar came under pressure ahead of today’s inflation data. Momentum for the Aussie now appears to be turning notably lower against the US dollar (USD), British pound (GBP), Japanese yen (JPY), and Canadian dollar (CAD). Bets on a slower pace of cuts from the Bank of England (BOE) compared to the Federal Reserve (Fed) have helped GBP/USD outperform in April, and renewed expectations of cuts from the Reserve Bank of Australia (RBA) have now sent GBP/AUD to a 12-day high. AUD/JPY also declined for a second day, with the Japanese yen gaining traction ahead of this week’s Bank of Japan (BOJ) meeting.

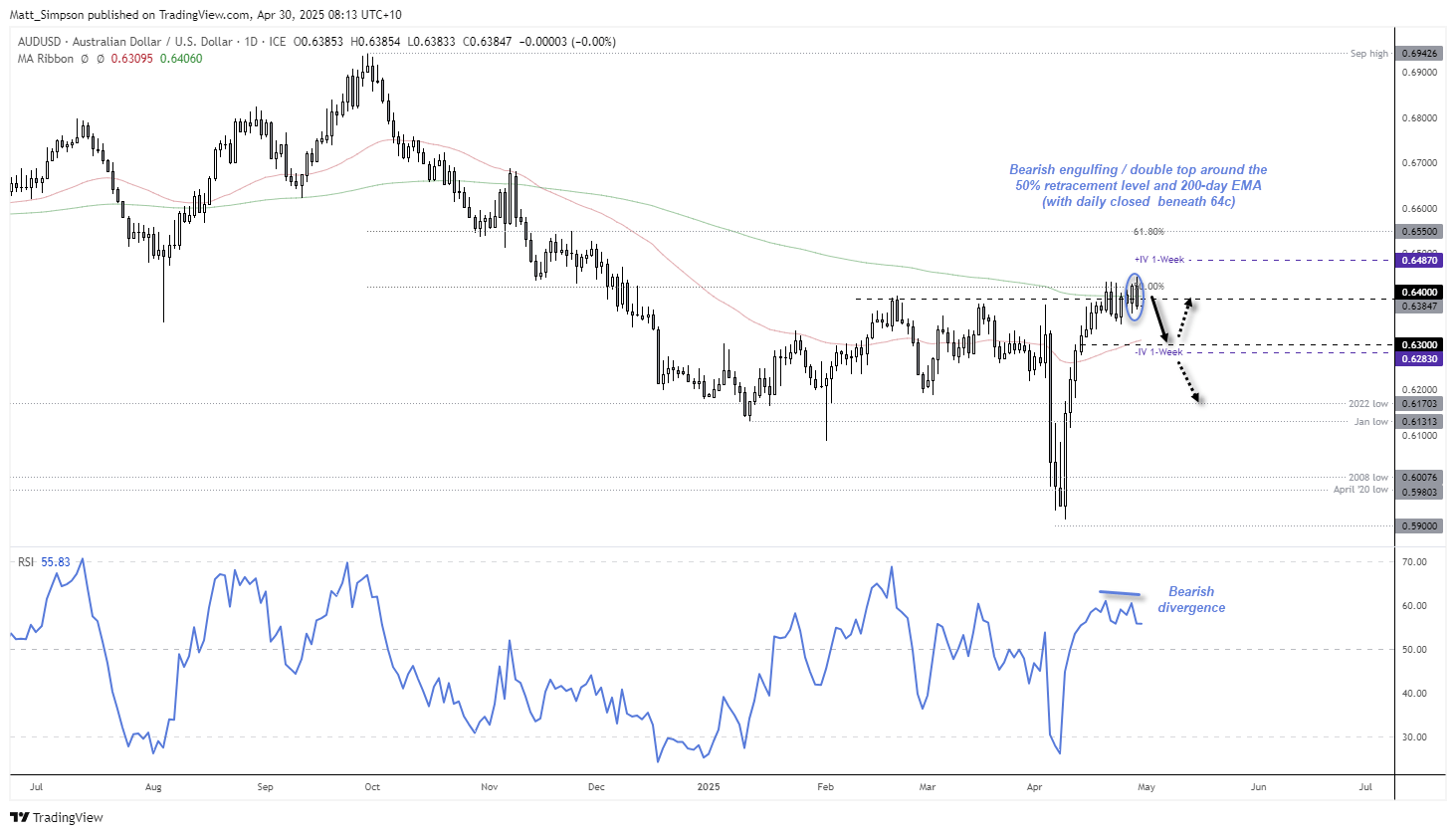

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

The tussle with the 200-day EMA continues for AUD/USD, though I suspect we are now one important step closer towards the next leg lower for the Australian dollar. A bearish engulfing candle formed on Tuesday, which saw a false break of the 50% retracement level, a close back beneath the 200-day EMA and 64c handle, and the formation of a double top around 0.6440.

Given my hunch that the US dollar remains oversold and thus due a bounce, my bias is for AUD/USD to head towards 63c and the 50-day EMA. A soft set of CPI figures could give Australian dollar bears a decent hand, in anticipation of an RBA cut in May.

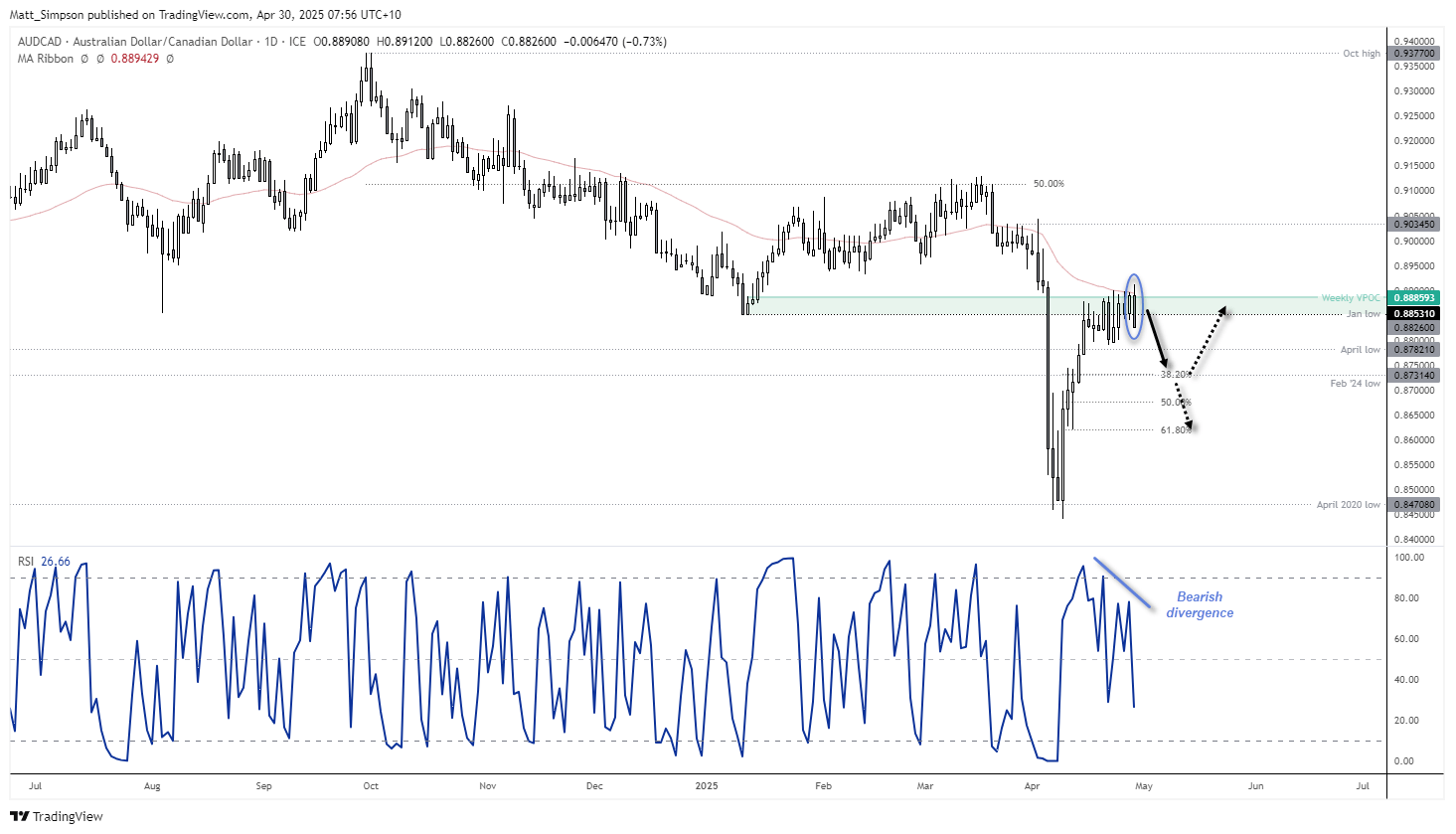

AUD/CAD Technical Analysis: Australian vs Canadian Dollar

Bullish momentum is slowing on AUD/CAD after its three-week rebound from the April 2020 low. Price action has remained quite choppy over the past week and a half around the January low, 10-week EMA, and resistance at the 50-day EMA and historical weekly VPOC (volume point of control).

Given the bearish engulfing candle on the daily chart, I suspect a swing high has been seen just above the 0.89 handle, leaving AUD/CAD vulnerable to a retest — and potential break beneath — the April low.

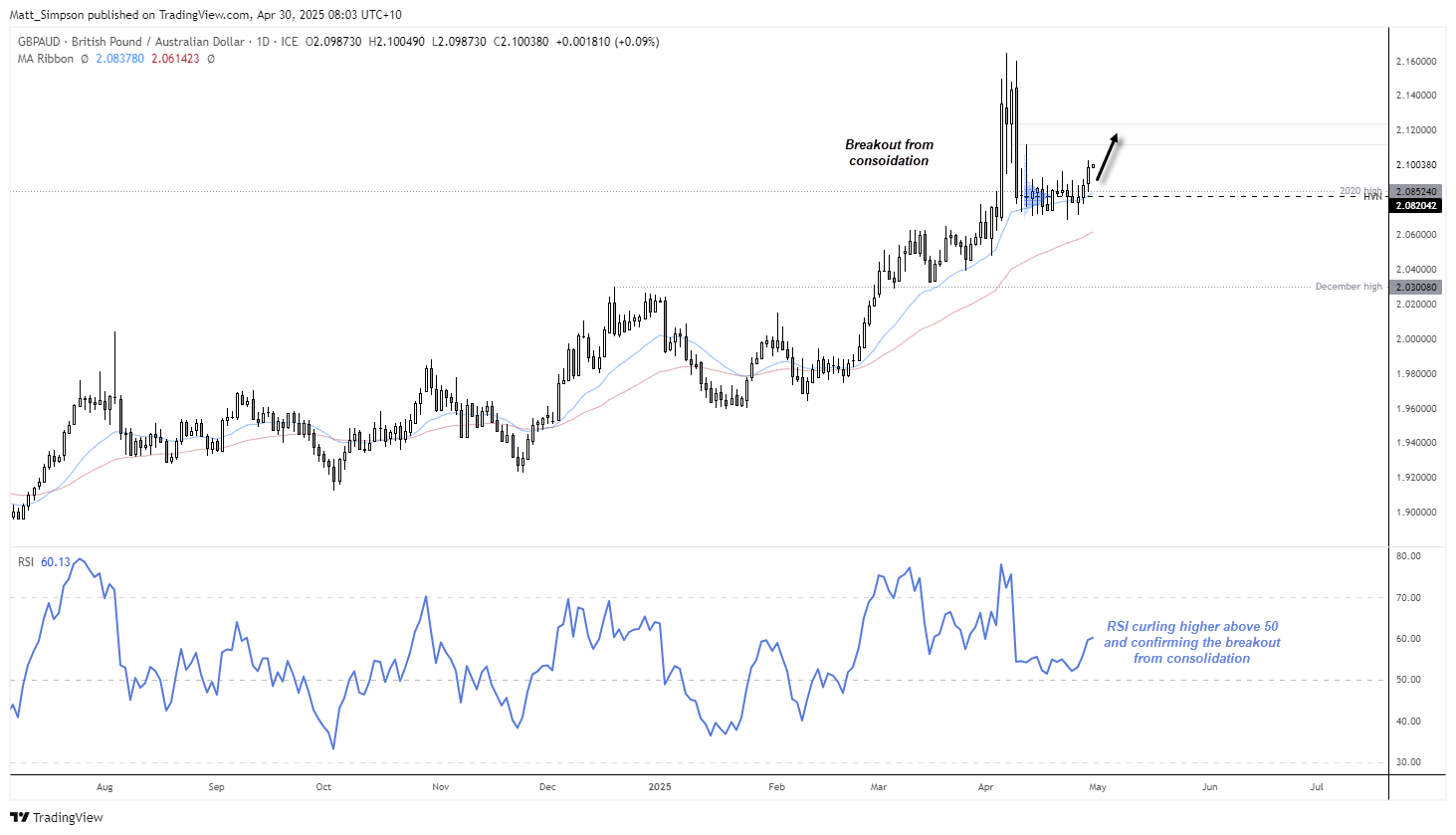

GBP/AUD Technical Analysis: British Pound vs Australian Dollar

GBP/AUD rose for a second day to a 12-day high, using the 20-day EMA as a springboard to clear the highs of its near three-week consolidation. The daily RSI (14) is curling higher from its 50 level and confirming the move, with no immediate threat of an overbought reading or bearish divergence.

The bias is now for GBP/AUD to rise and break above 2.1, and enter the 2.113–2.1245 zone, while prices remain above the 2020 high.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge