Australian Dollar Outlook: AUD/USD

AUD/USD seems to be coiling within a narrow range after climbing to a fresh yearly high (0.6552) at the start of the week, but the Federal Reserve rate decision may sway the exchange rate as the central bank is slated to update its Summary of Economic Projections (SEP).

AUD/USD Coils After Trading to Fresh 2025 High

Keep in mind, AUD/USD defended the advance from the start of the month to push above the May range, and the Australian Dollar may continue to appreciate against the Greenback as the US Retail Sales report shows a 0.9% contraction in May versus forecasts for a 0.7% decline.

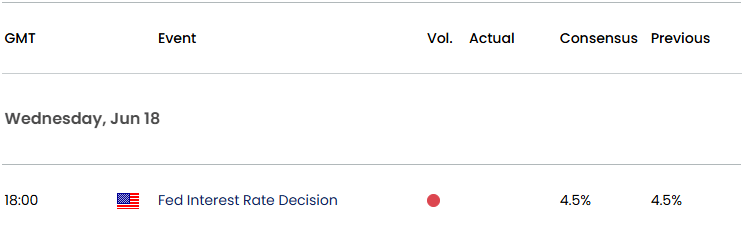

US Economic Calendar

In turn, the fresh forecasts from Fed officials may influence AUD/USD as the central bank is expected to keep US interest rates on hold, and more of the same from Chairman Jerome Powell and Co. may produce headwinds for the US Dollar as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent at the end of this year.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

As a result, speculation for a looming Fed rate-cut may fuel the recent advance in AUD/USD, but a shift in the forward guidance for monetary policy may generate a bullish reaction in the US Dollar should the Federal Open Market Committee (FOMC) show a greater willingness to keep US interest rates higher for longer.

With that said, AUD/USD may threaten the V-shape recovery from earlier this year if it fails to defend the advance from the monthly low (0.6432), but the exchange rate may attempt to further retrace the decline from the November high (0.6688) as it continues to trade to fresh yearly highs in June.

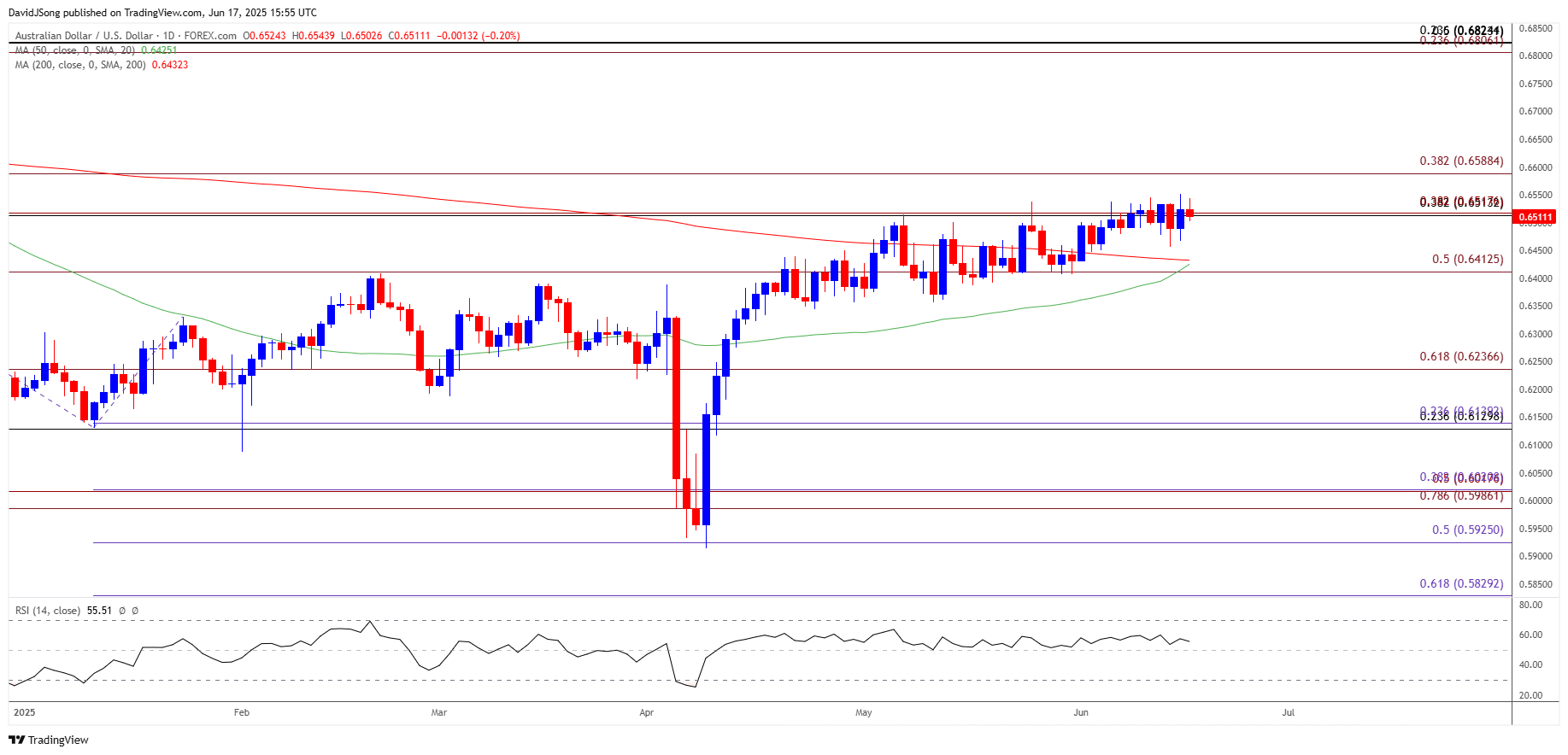

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- The consolidation in AUD/USD may turn out to be temporary as it seems to be coiling above the monthly low (0.6432), with a move/close above 0.6590 (38.2% Fibonacci extension) opening up the November high (0.6688).

- Next area of interest comes in around 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement), but AUD/USD may give back the V-shape recovery from earlier this year if it fails to defend the advance from the monthly low (0.6432).

- A move/close below 0.6410 (50% Fibonacci extension) brings the May low (0.6357) on the radar, with the next region of interest coming in around 0.6240 (61.8% Fibonacci extension).

Additional Market Outlooks

GBP/USD Susceptible to Slowing UK CPI Ahead of BoE Meeting

EUR/USD Outlook Hinges on Federal Reserve Forward Guidance

Canadian Dollar Forecast: USD/CAD Slump Pushes RSI into Oversold Zone

USD/JPY Weakness Persists with US PPI Unfazed by Higher Tariffs

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong