Australian Dollar Outlook: AUD/USD

AUD/USD pushes above the February high (0.6409) as it extends the V-shaped recovery from earlier this month.

AUD/USD Extends V-Shape Recovery to Clear February High

AUD/USD climbs to a fresh yearly high (0.6438) on the back of US Dollar weakness, and developments coming out of the White House may continue to influence foreign exchange markets as President Donald Trump insists that ‘preemptive cuts in interest rates are being called for by many.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

With that said, speculation for a looming Federal Reserve rate cut may keep AUD/USD afloat, but the V-shape recovery in the exchange rate may unravel should it struggle to test the December high (0.6515).

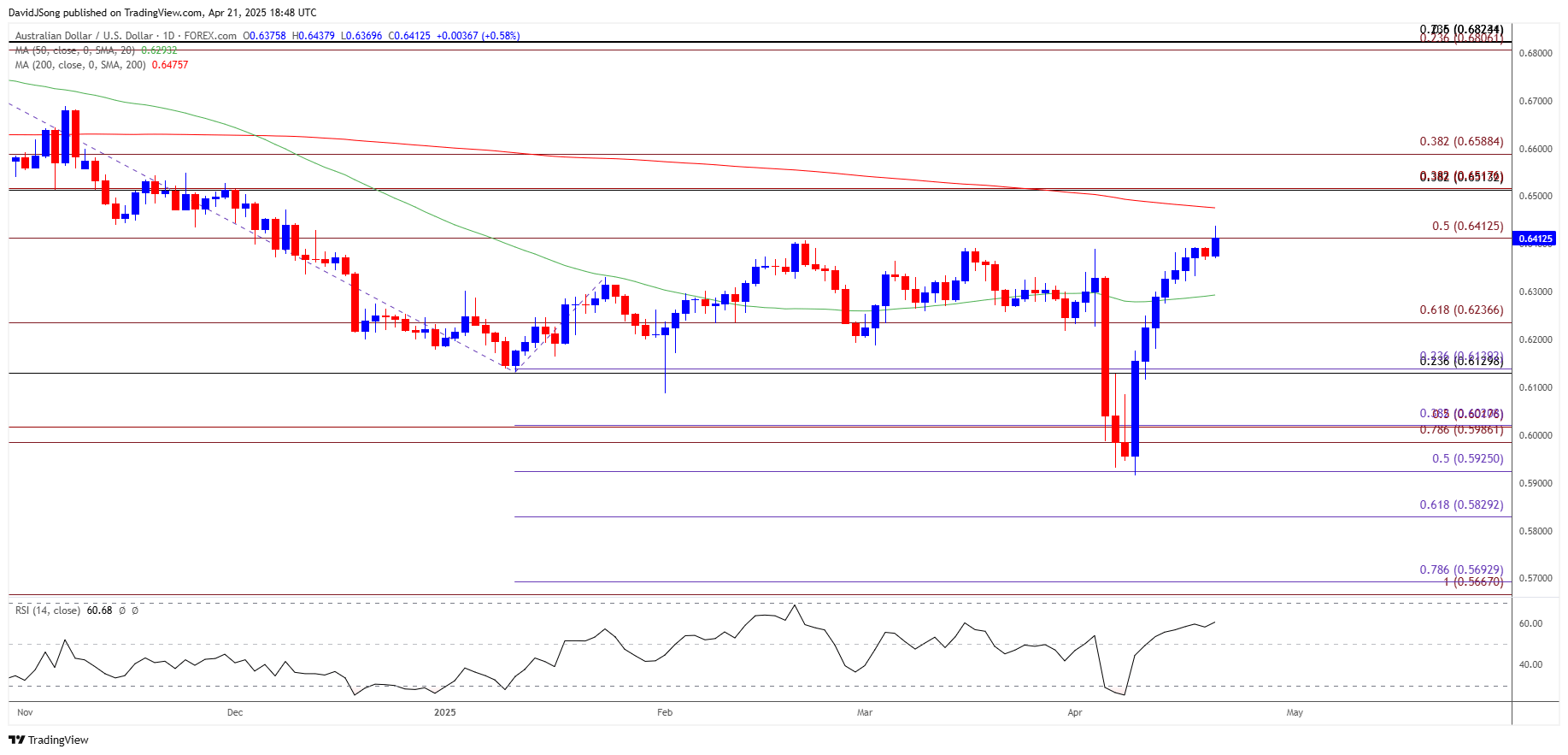

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD may attempt to test the December high (0.6515) as it trades to a fresh yearly high (0.6438), with a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region opening up 0.6590 (38.2% Fibonacci extension).

- Next area of interest comes in around the November high (0.6688), but AUD/USD may struggle to retain the advance from the start of the week should it fail to close above 0.6410 (50% Fibonacci extension).

- Need a move below 0.6240 (61.8% Fibonacci extension) to bring the 0.6130 (23.6% Fibonacci retracement) to 0.6140 (23.6% Fibonacci extension) area on the radar, with the next region of interest coming in around 0.5990 (78.6% Fibonacci extension) to 0.6020 (38.2% Fibonacci extension).

Additional Market Outlooks

USD/JPY Falls Toward 2024 Low to Push RSI into Oversold Zone

Gold Bullish Price Series Keeps RSI in Overbought Territory

Euro Forecast: EUR/USD Vulnerable to RSI Sell-Signal amid ECB Rate Cut

Canadian Dollar Forecast: USD/CAD Drops as BoC Holds Interest Rate

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong