US Dollar Outlook: AUD/USD

AUD/USD may consolidate ahead of the Federal Reserve interest rate decision as it fails to test the February high (0.6409).

AUD/USD Fails to Test February High Ahead of Fed Rate Decision

Keep in mind, AUD/USD pushed above the opening range for March as China, Australia’s largest trading partner, plans to boost private-sector lending to shore up household consumption, and Asia/Pacific currencies may benefit from the ongoing change in fiscal policy as the region targets a 5% rate of growth for 2025.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, AUD/USD may defend the advance from the start of the week even as the ongoing shift in US trade policy clouds the outlook for global growth, and it remains to be seen if the Fed will adjust the forward guidance for monetary policy as the central bank is slated to update the Summary of Economic Projections (SEP).

US Economic Calendar

The fresh forecasts from Fed officials may sway AUD/USD as the central bank pursues a neutral policy, and more of the same from Chairman Jerome Powell and Co. may drag on the Greenback as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent’ at the end of this year.

With that said, AUD/USD may stage further attempts to test the February high (0.6409) should the Federal Open Market Committee (FOMC) stay on track to further unwind its restrictive policy, but the exchange rate may struggle to retain the advance from the start of the week if the Fed prepares to keep US interest rates on hold for longer.

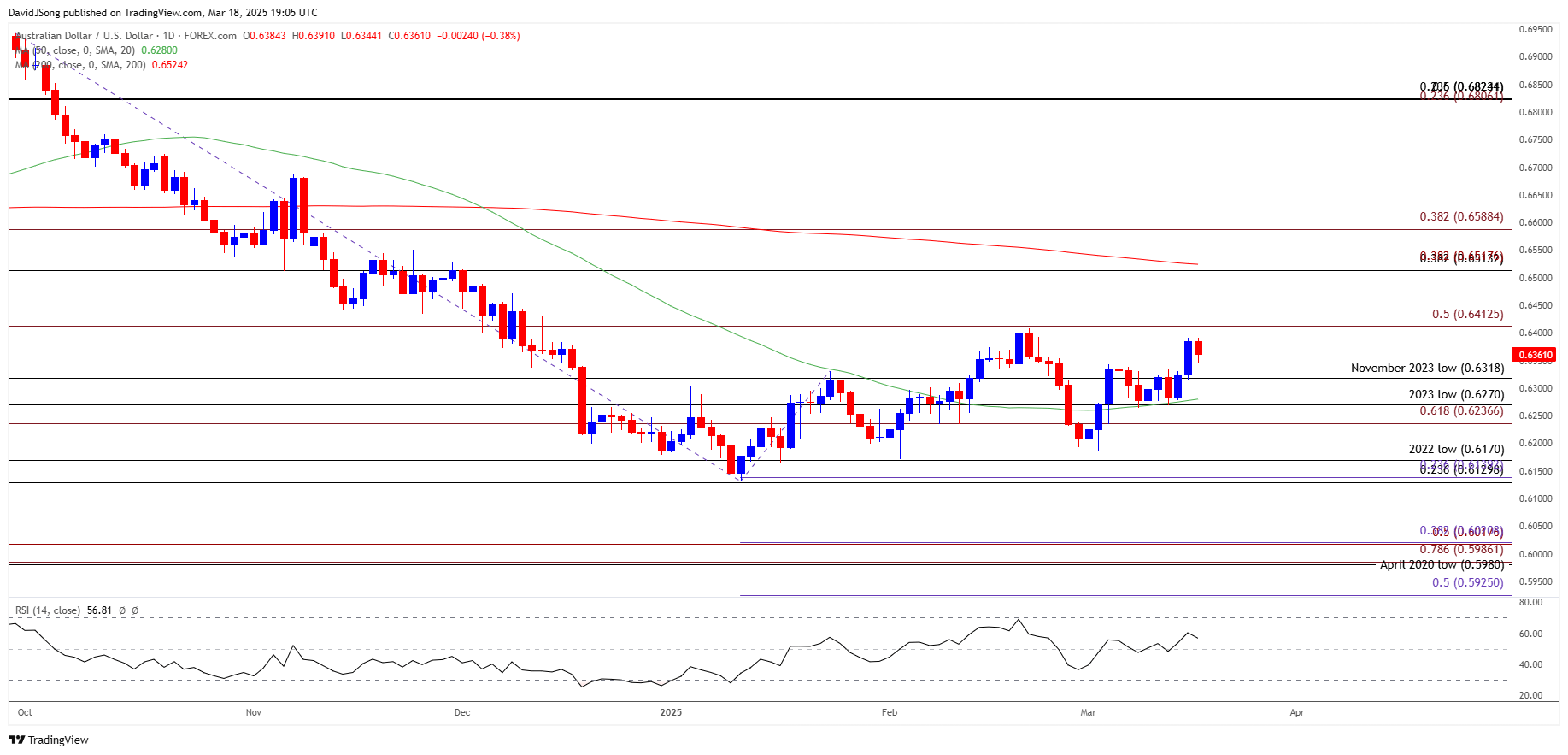

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD holds below the February high (0.6409) as it struggles to extend the recent series of higher highs and lows, and lack of momentum to hold above the weekly low (0.6316) may push the exchange rate back towards the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) zone.

- A breach below the monthly low (0.6187) brings the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) region on the radar, but AUD/USD may stage further attempts to test the February high (0.6409) as it pushes above the opening range for March.

- A break/close above 0.6410 (50% Fibonacci extension) may push AUD/USD towards the December high (0.6515), with a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) area opening up 0.6590 (38.2% Fibonacci extension).

Additional Market Outlooks

British Pound Forecast: GBP/USD Vulnerable to Dovish Bank of England (BoE)

Canadian Dollar Forecast: USD/CAD Coils Ahead of Reciprocal Trump Tariffs

EUR/USD Rebounds Ahead of Weekly Low to Keep RSI in Overbought Zone

USD/JPY Rebound in Focus with BoJ Expected to Hold Interest Rate

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong