View related analysis:

- Japanese yen broadly lower, USD, risk bounces amid Trump-tariff relief

- EUR/USD bears short-covered at fastest pace in 5 years - COT Report

- AUD/USD Weekly Outlook: AU inflation, US Core PCE on Tap

- ASX 200 Set to Snap 4-Week Losing Streak With 8k Now in Bullish Sights

The Australian government has slightly complicated the Reserve Bank of Australia's decision to cut interest rates with their latest budget, vowing to introduce “new tax cuts for every Australian taxpayer” and an additional $150 energy rebate for every household and small business to address the cost-of-living crisis.

AUD/USD traders and the RBA will be closely watching today’s inflation figures, hoping key measures stay within the RBA’s 2-3% target range. Recent months have seen annual CPI readings drift higher. This could be partly due to basing effects and natural inflation deceleration over the past two years. However, with rising global inflationary pressures in Q4 and the risk of Trump’s tariffs, traders may now be more sensitive to any upticks in inflation prints. With trimmed mean inflation drifting up to 2.8% y/y, a move to 3% or higher could trigger Australian dollar strength as it pushes back prospects of an RBA cut further into Q2.

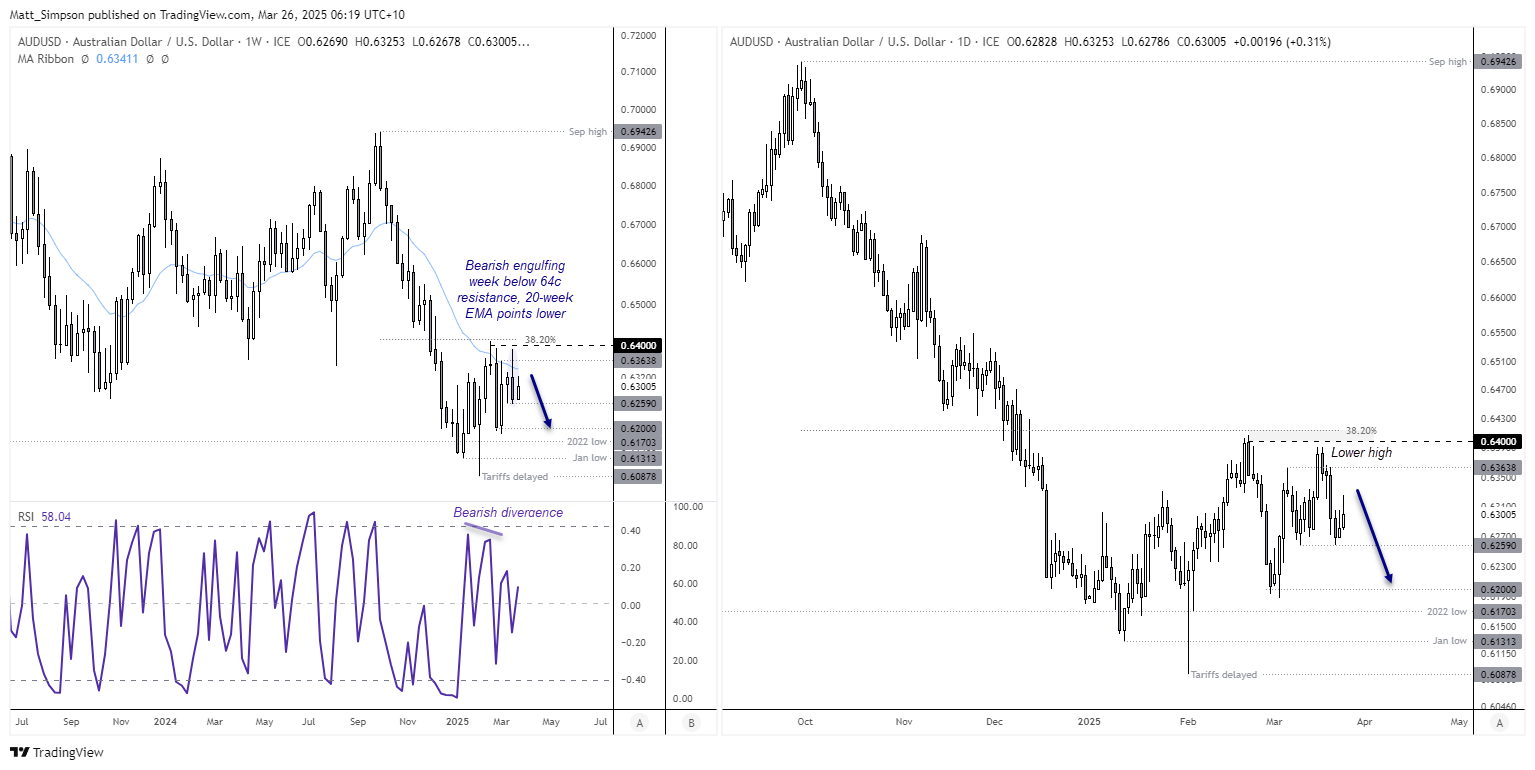

AUD/USD technical analysis:

Still, as outlined in my AUD/USD outlook report, the bias remains to fade into moves while prices stay rangebound on the daily chart. A bearish engulfing week formed after another failed attempt to crack 64c, with the 20-week EMA capping as resistance and a potential bear flag forming on the daily chart. A move higher on USD/CNH also seems feasible, which would be bearish for AUD/USD.

Economic events in focus (AEDT)

- 10:50 – Japanese Corporate Services Price Index

- 11:30 – Australian Monthly Trimmed Mean Inflation (Feb)

- 16:00 – Japanese Leading, Coincident Index

- 18:00 – UK Core CPI, Core PPI

- 21:00 – UK Spring Forecast Statement

- 23:30 – US Core Durable Goods

- 01:00 – FOMC Member Kashkari Speaks

- 01:00 – SNB Quarterly Bulletin

UK inflation brings GBP/AUD into the mix for AUD/USD traders

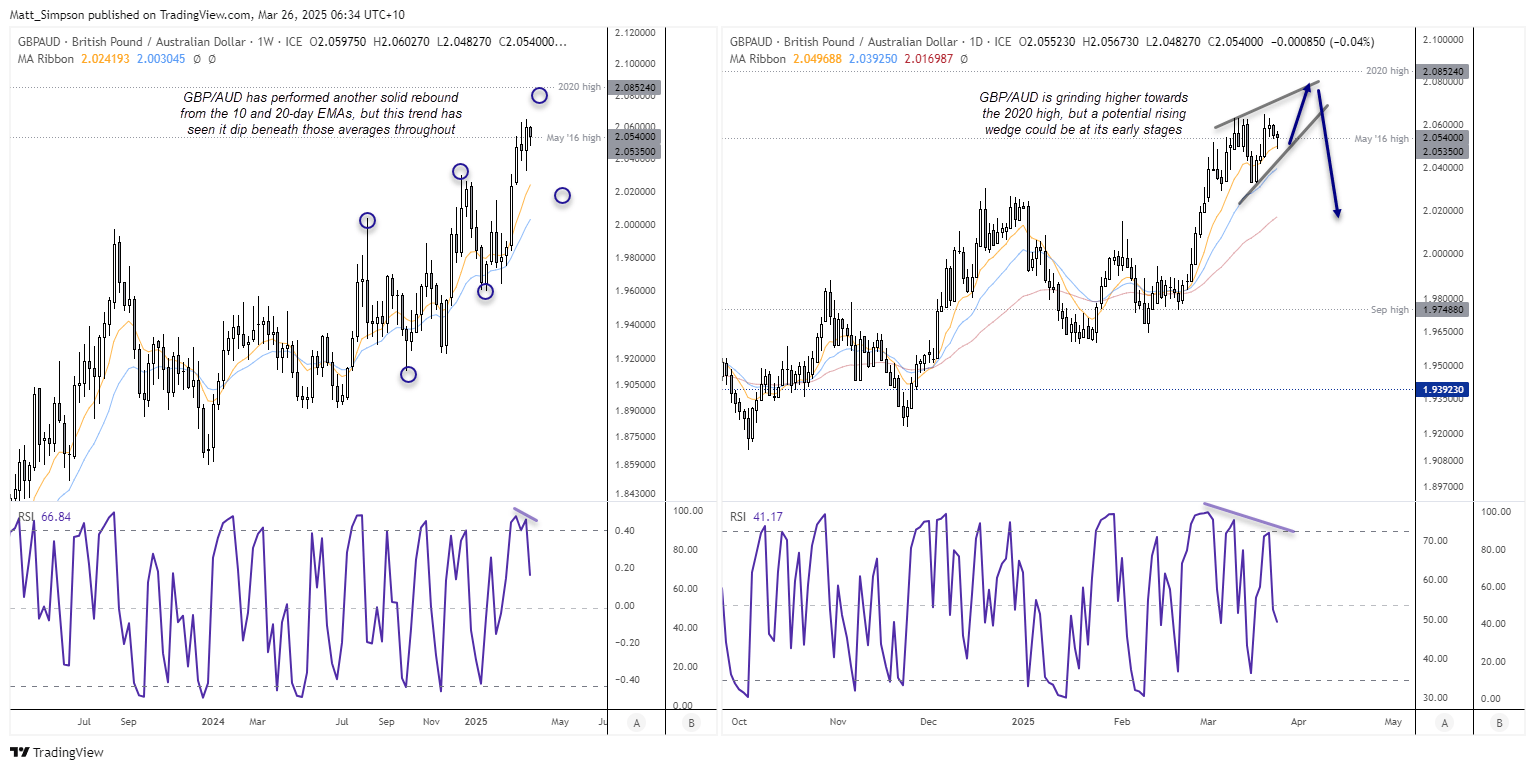

While UK inflation surprised to the downside on a monthly basis, with core CPI at -0.4% m/m and CPI at -0.1% m/m, the annual figures exceeded expectations. They are expected to remain elevated in today’s data. Given the uncertainty surrounding Trump’s tariffs, it seems unlikely that the Bank of England will be in a position to cut rates soon, particularly with only one MPC member voting for a cut compared to the eight who wanted to hold at their recent meeting. And that could keep the British pound bid over the near-term, even if GBP/AUD looks like it is reaching a natural resistance level on the daily chart.

GBP/AUD technical analysis

Last week's bullish engulfing candle saw GBP/AUD reach its highest level since March 2020. The 10-day EMA is providing support, and the cross could reach new highs if UK inflation comes in higher than expected, alongside softer CPI figures from Australia over the next 12 hours. Bulls are clearly eyeing a retest of the 2020 high, just above the 2.08 handle.

However, the weekly chart suggests the current upswing might be closer to the end of its cycle. A small bearish divergence also formed on the weekly RSI (2) in the overbought zone by last week's close.

While the cross reached a fresh 5-year high last week, the daily chart shows it struggled around 2.06 between March 11th to 14th, resulting in a bearish engulfing day and a two-day pullback. Momentum has since turned lower for a second time despite a marginal new high during the interim.

I am on the lookout for some bearish mean reversion towards the 10 or 20-week EMAs, as they have been retested multiple times during this rally, and prices have also fallen beneath them. Patience may be required, but I feel compelled to seek a top on this pair, perhaps some time this week.

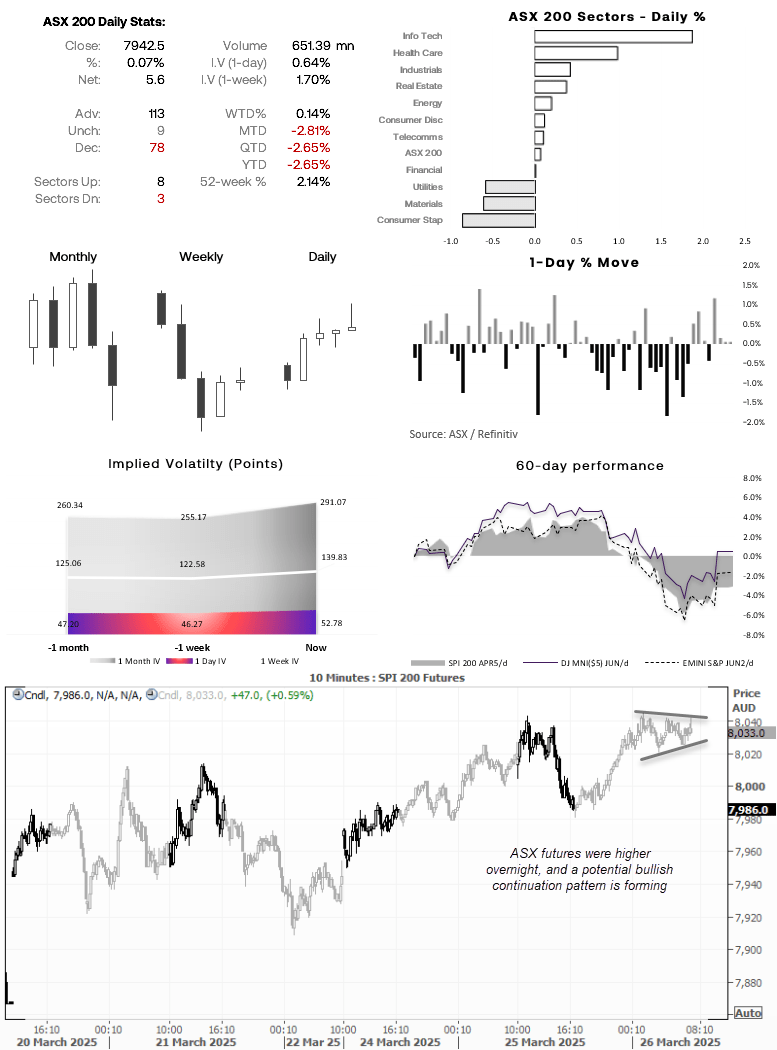

ASX 200 at a glance

- The ASX 200 etched out a fourth day higher, though its second 0.07% daily gain in a row and shooting star candle on Tuesday show a hesitancy for the cash market to break 8,000 for now

- 8 of the 11 ASX 200 sectors advanced (led by Info Tech and Healthcare), 3 ASX sectors declined (led by Consumer Staples and Materials)

- Yet ASX 200 futures were up 0.55% overnight, alongside All Street indices

- A bullish continuation pattern is also forming on ASX 200 futures near the overnight highs

- A soft inflation report could be bullish for the ASX today, though bulls should also see if Wall Street indices can break above their respective resistance levels (200-day averages September and November lows) before getting too excited

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge