Australian Dollar Outlook: AUD/USD

AUD/USD may consolidate over the remainder of the month as it halts a four-day selloff, but developments coming out of Australia may keep the exchange rate afloat as the Reserve Bank of Australia (RBA) ‘remains cautious on prospects for further policy easing.’

AUD/USD Halts Four-Day Selloff Ahead of Australia CPI

AUD/USD appears to be stuck in a defined range as it failed to test the February high (0.6409) during the previous week, and the exchange rate may continue to track sideways as the ongoing transition in US trade policy clouds the outlook for global growth.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In response, the RBA may continue to unwind its restrictive policy as ‘there are signs that disinflation might be occurring a little more quickly than earlier expected,’ but indications of persistent price growth may encourage the central bank to keep interest rates on hold as the ‘Board remains resolute in its determination to return inflation to target.’

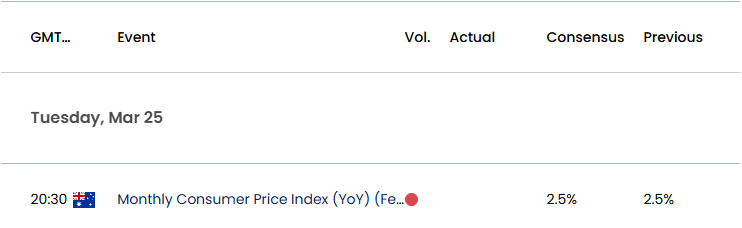

Australia Economic Calendar

In turn, the update to Australia’s Consumer Price Index (CPI) may generate a bullish reaction in the Australia Dollar as the headline reading for inflation is expected to hold steady at 2.5% in February, but signs of slower price growth may drag on AUD/USD as it fuels speculation for another RBA rate-cut.

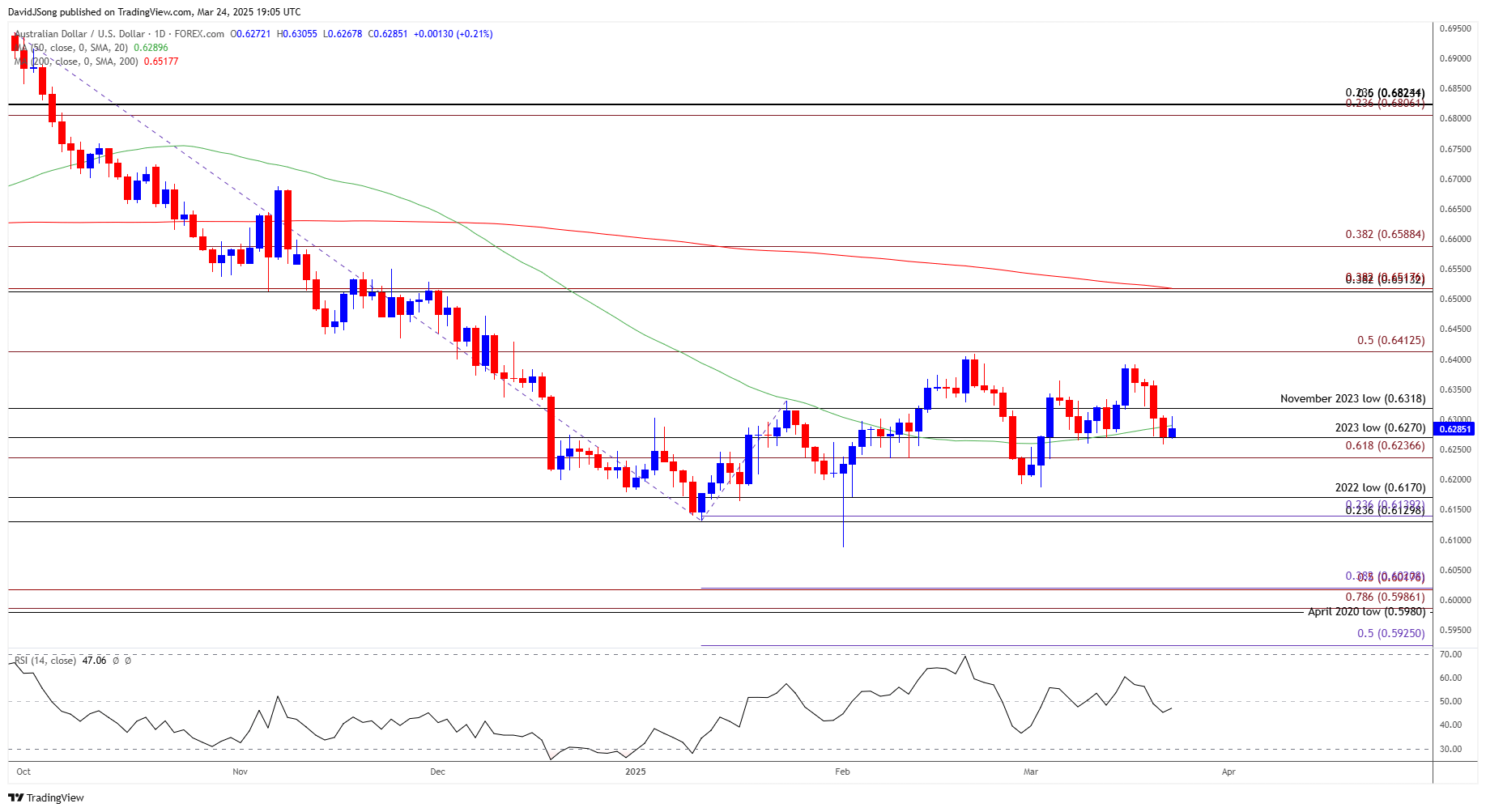

With that said, AUD/USD may continue to give back the advance from the start of the month as it pulls back ahead of the February high (0.6409), but the exchange rate may trade within a defined range amid the flattening slope in the 50-Day SMA (0.6290).

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD may consolidate over the remainder of the month as it no longer carves a series of lower highs and lows, and lack of momentum to break/close below the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) zone may push the exchange rate back towards 0.6318 (November 2023 low).

- Next area of interest comes in around the monthly high (0.6391), but a breach above the February high (0.6409) may lead to a test of the December high (0.6515).

- At the same time, failure to defend the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) zone may lead to a test of the monthly low (0.6187), with a break/close below the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) region bringing the February low (0.6088) on the radar.

Additional Market Outlooks

British Pound Forecast: GBP/USD Vulnerable to Dovish Bank of England (BoE)

Canadian Dollar Forecast: USD/CAD Coils Ahead of Reciprocal Trump Tariffs

EUR/USD Rebounds Ahead of Weekly Low to Keep RSI in Overbought Zone

USD/JPY Rebound in Focus with BoJ Expected to Hold Interest Rate

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong