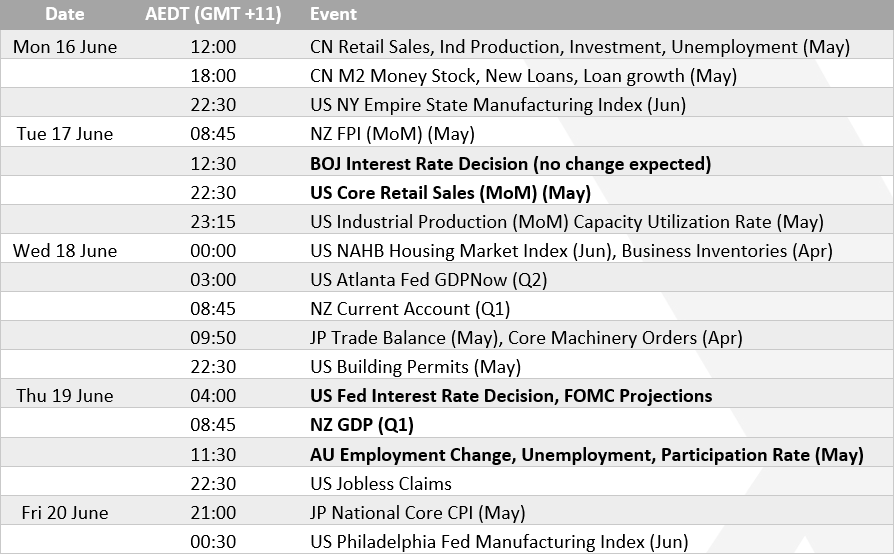

The Australian dollar opens the week in a holding pattern, with traders looking ahead to a packed schedule of high-impact events. The Federal Reserve is widely expected to leave rates unchanged, but its updated projections and Powell’s guidance may shape the USD’s next move. Meanwhile, Australian labour data could offer crucial clues for the Reserve Bank of Australia’s next policy step. With AUD/USD stuck below 0.65, both macro drivers and technical signals suggest pivotal moves lie ahead.

View related analysis:

- WTI Crude Oil Surges, AUD/JPY Slides After Israel’s “Pre-Emptive Strike” on Iran

- ASX 200 Bulls Eye Fresh Record Highs, But Pullback Risks Linger

- AUD/USD, AUD/JPY: Reversal Risks Emerge Near Key Resistance

- AUD/USD Outlook: Headwinds from China Data and RBA Policy

Federal Reserve (Fed) Expected to Hold Rates, Focus on Projections and Powell

The Federal Reserve looks set to leave interest rates unchanged this week, despite softer inflation figures and renewed pressure from Donald Trump for aggressive easing. While the Trump trade war has lost some of its potency, the Fed isn’t in a position to adjust policy until there’s clarity on what deals—particularly with China—have actually been struck. The Fed can also point to the Isreal-Iran conflict to warrant a cautious approach.

Fed funds futures currently imply a ~97% chance of no change this week, even as Trump calls for a full 100bp of rate cuts on the back of core CPI slowing to 0.1% m/m and 2.7% y/y. But the market’s real attention will be on the Summary of Economic Projections (SEP) and Jerome Powell’s press conference. Fed fund futures imply an 87% chance of a September cut,

There’s a mixed bag of data for the Fed to weigh up. While May’s 139k NFP print beat expectations, jobless claims have climbed to an eight-month high, retail sales stalled at 0.0%, and manufacturing remains under pressure. It’s enough to warrant caution, but not signal an imminent cut.

US building permits are also worth watching, having contracted by 70k in April (-4%) — the sharpest decline since September 2023. Attention now turns to May retail sales, due Tuesday, where a downside surprise could reignite hopes of a more dovish tone from the Fed.

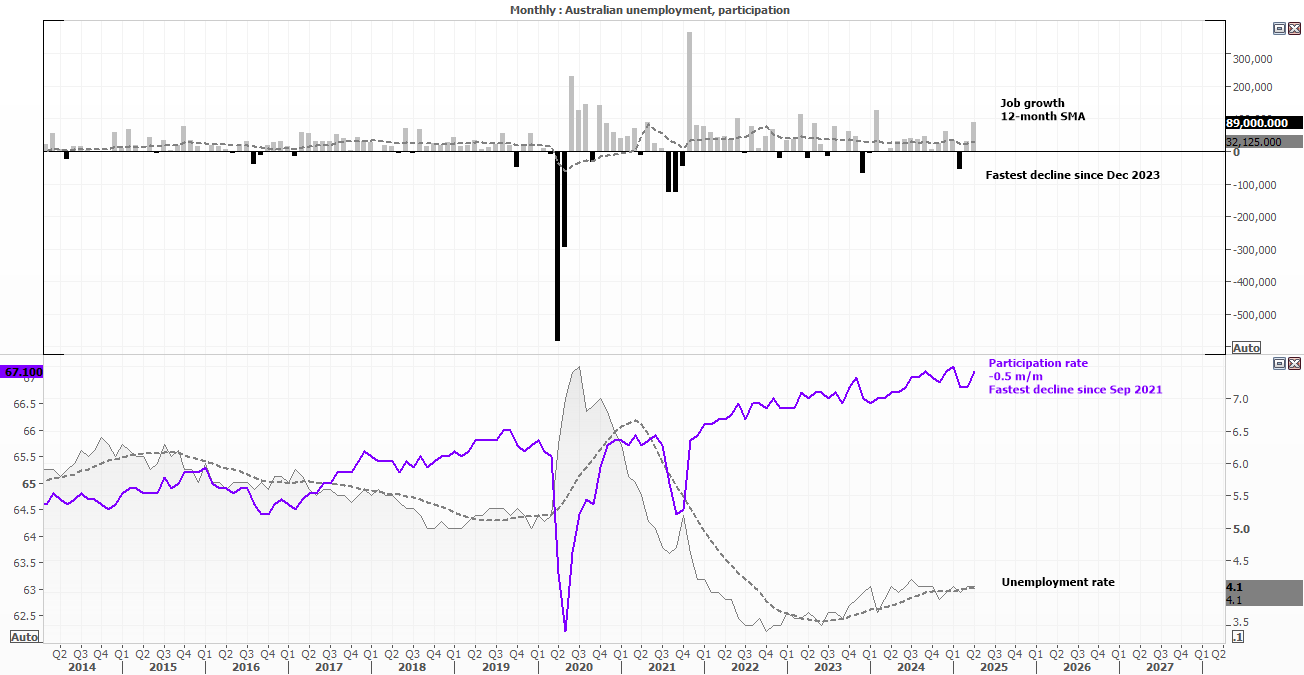

Australian Jobs Report Could Lock in RBA July Rate Cut

Australia has continued to post robust employment figures, which remain a key reason the Reserve Bank of Australia (RBA) has held off on cutting rates. Jobs surged by 89k in April, while the unemployment rate held steady at a healthy 4.1%, with the participation rate at 67%. But as resilient as the labour market has been, we may be approaching a turning point. With weak GDP growth and softening business conditions, it's only a matter of time before the labour data begins to reflect broader economic strain. Whether that shows up in the May report or later remains to be seen — but once it does, the case for an RBA rate cut will only grow stronger.

My bias remains for the RBA to cut their cash rate by 25bp in July to 3.6%, which is in line the RBA cash rate futures pricing of 89%. A softer set of employment figures could lock that in and increase odds of another cut in August or September.

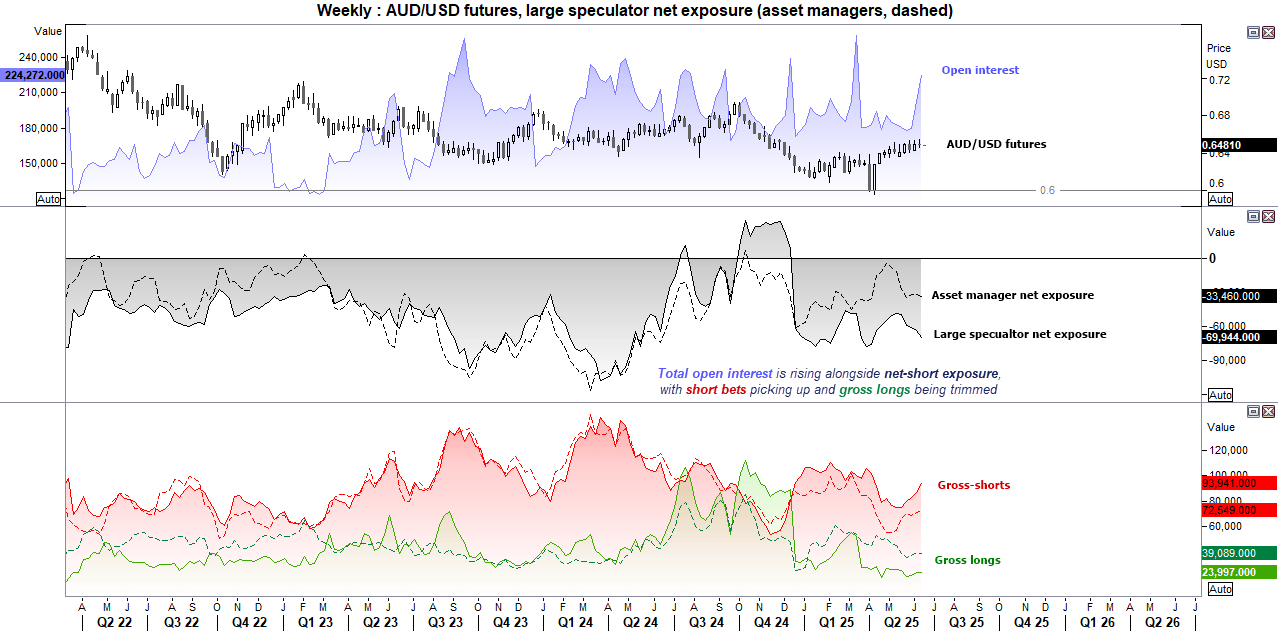

AUD/USD Futures Positioning: Bearish Shift in COT Data

Market positioning is hinting at a move lower for AUD/USD, with total open interest rising alongside net-short exposure for large speculators and asset managers. The fact the move is driven by a rise in gross shorts and reduction of gross long while prices continue to falter with each false break above 65c makes the case for a pullback the more compelling.

- Net-short exposure rose 8.3k contracts between both sets of traders last week

- Gross-short exposure to AUD/USD increased by 7.9k contracts

- Gross-longs trimmed by 374 contracts combined

- Total open interest for AUD/USD futures increased by 21.7k contracts (45k over the past two weeks)

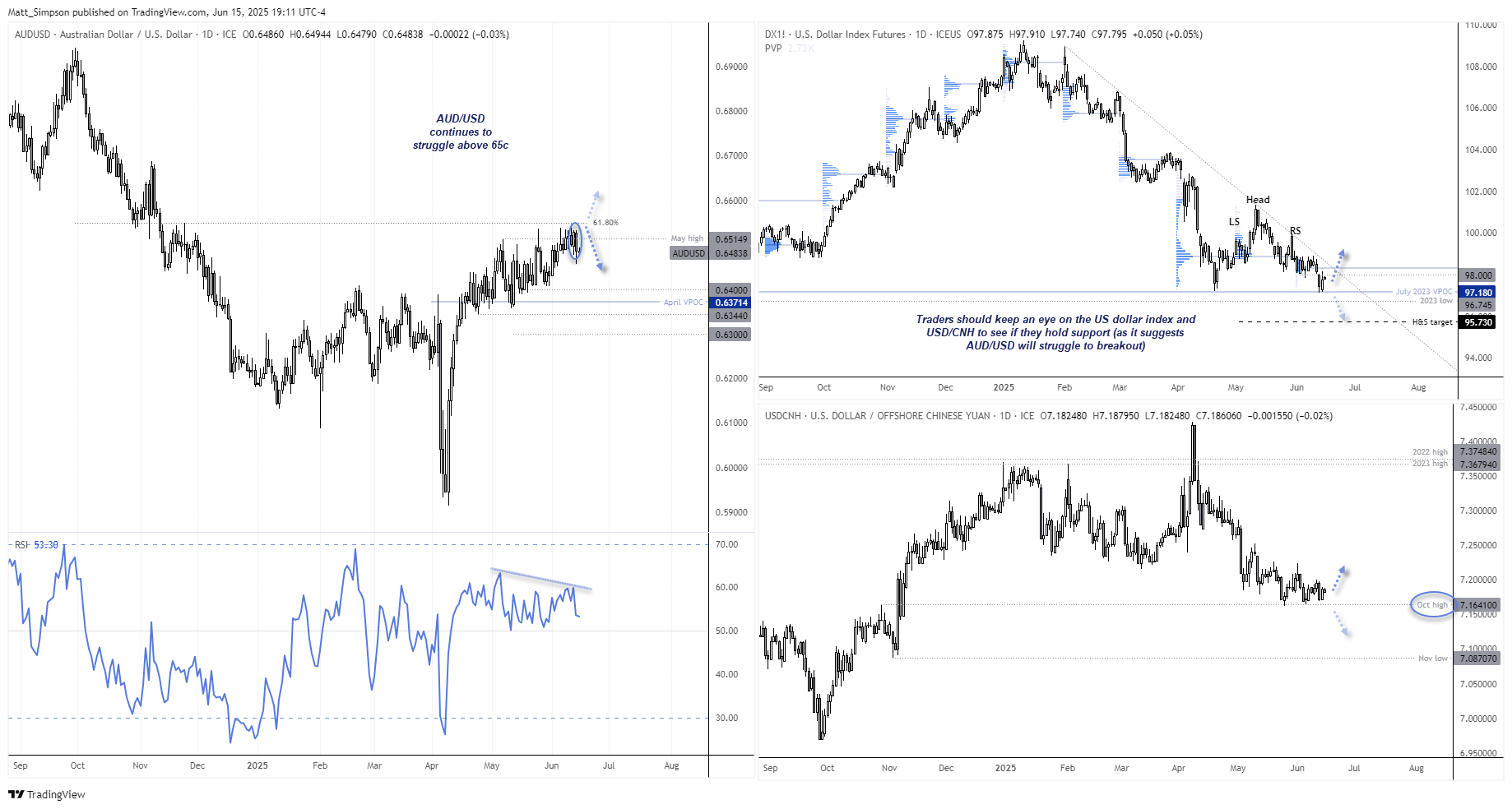

AUD/USD Technical Analysis: Bearish Engulfing Resets Breakout Attempt

The Australian dollar showed signs of breaking higher last week, but once again fell short. AUD/USD posted its narrowest weekly open-to-close range of the year at just 30 pips, and its 80-pip high-to-low range was the tightest in 11 weeks. Thursday hinted at a potential breakout, but escalating Middle East tensions triggered a sharp risk-off move on Friday — sending AUD/USD -0.65% lower and printing a bearish engulfing candle.

This continues the familiar pattern of AUD/USD drifting into the 0.65 zone before facing heavy selling pressure. Until we see a decisive breakout from this range, the technical bias remains for bears to fade rallies above 65c. This view is further supported while the US dollar index (DXY) holds above its April low and USD/CNH remains supported above its May low.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge