- Australian monthly CPI is the major domestic risk event; softer inflation could increase the probability of another RBA rate cut in July.

- Governor Bullock confirmed a 50bp cut was discussed, reinforcing the RBA’s dovish stance as inflation returns to the target band.

- Retail sales data will also be watched, with sluggish consumer spending further supporting the RBA's easing bias.

- President Trump’s fiscal policies and a weak bond auction drove US bond yields higher, capping AUD/USD upside despite the dovish RBA.

- US core and ‘super core’ PCE inflation prints could determine the Fed’s next move and heavily influence USD direction.

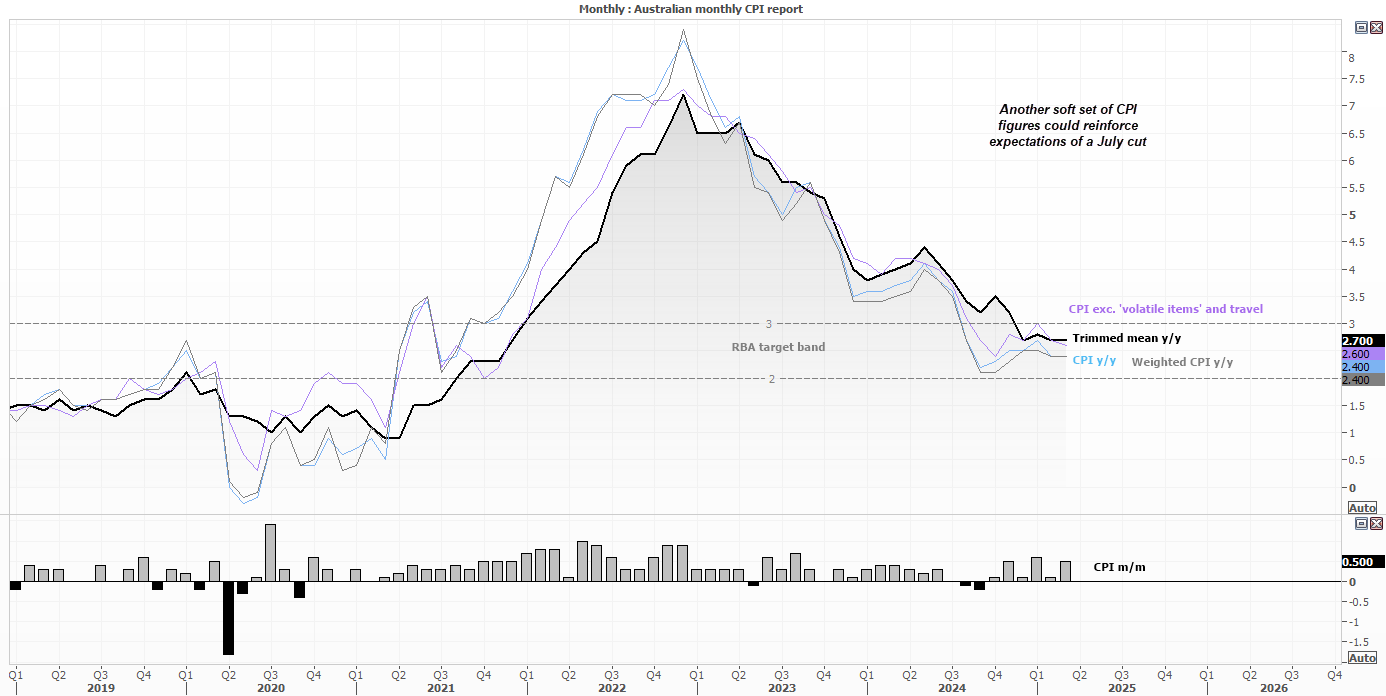

Australian Economic Data: Monthly CPI Data on Wednesday

The Reserve Bank of Australia (RBA) delivered a dovish 25 basis point rate cut last week, and a softer monthly CPI inflation report this week could further strengthen expectations of another cut in July. The Board acknowledged that “inflation has fallen substantially” from its peak and is now comfortably within the 2–3% target band. Crucially, the RBA also noted that upside risks to inflation have diminished.

The fact that Governor Michele Bullock confirmed a 50bp cut was discussed sends a clear signal that the RBA is open to front-loading its easing cycle if incoming data supports such a move.

RBA cash rate futures currently imply around a 70% chance of a July cut, with 50bp of cuts fully priced in by November. These odds might be even higher had the RBA not flagged a tight labour market — an assessment that was validated by another strong employment report. Still, expectations for a July rate cut could be bolstered if trimmed mean CPI inflation softens further this week.

Also worth watching is the retail sales data. While not a direct catalyst for rate decisions, retail spending continues to contribute very little to economic growth. Given the RBA’s repeated references to soft household demand, another weak retail report would likely bolster the case for continued monetary easing.

View related analysis:

- USD/JPY and GBP/JPY Snap Losing Streaks, US Dollar Selling Eases

- WTI Crude Oil Outlook: Bearish Risks Build as Traders Trim Longs

- Japanese Yen and VIX Rise as Wall Street Slips on Weak Bond Auction

- Gold Rally Stalls Below Monthly High: Is a Deeper Pullback Brewing?

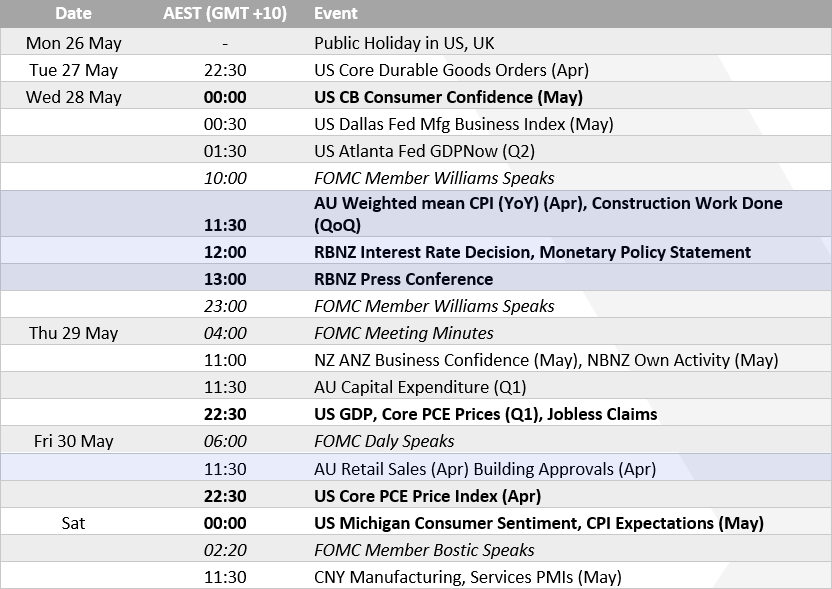

US Economic Data: Consumer Sentiment, GDP, PCE Inflation – and Trump

President Donald Trump remains a key influence on global markets through his policy announcements and fiscal plans. Bond yields surged last week following a weak 20-year bond auction, as investors showed concern over the higher fiscal deficit his agenda is expected to bring. This has weighed on the US dollar and kept AUD/USD rangebound — despite the RBA’s dovish bias.

This week, traders will assess whether US consumer sentiment has picked up in the Conference Board and University of Michigan surveys — particularly in light of an improved tone around tariffs. That said, any meaningful rise in sentiment seems unlikely. Softer inflation expectations would be welcomed, especially given the one-year outlook recently surged to 6.5%.

Q1 GDP data will be released but is considered stale, while Federal Reserve commentary is unlikely to shift materially until trade and inflation risks become clearer.

Keep A Close Eye On ‘Super Core’ PCE Inflation

The most important release from the US will be the PCE price index — the Fed’s preferred inflation gauge. While headline CPI and year-on-year core PCE figures have eased, the month-over-month readings — particularly the ‘super core’ PCE, which excludes food, energy, and housing — are causing concern.

In April, super core PCE rose by 0.6% — its highest monthly gain since January 2024. If this metric remains elevated or accelerates, it could delay potential Fed rate cuts and revive fears of stagflation. That scenario could strengthen the US dollar and weigh on AUD/USD, especially if Australian data underwhelms.

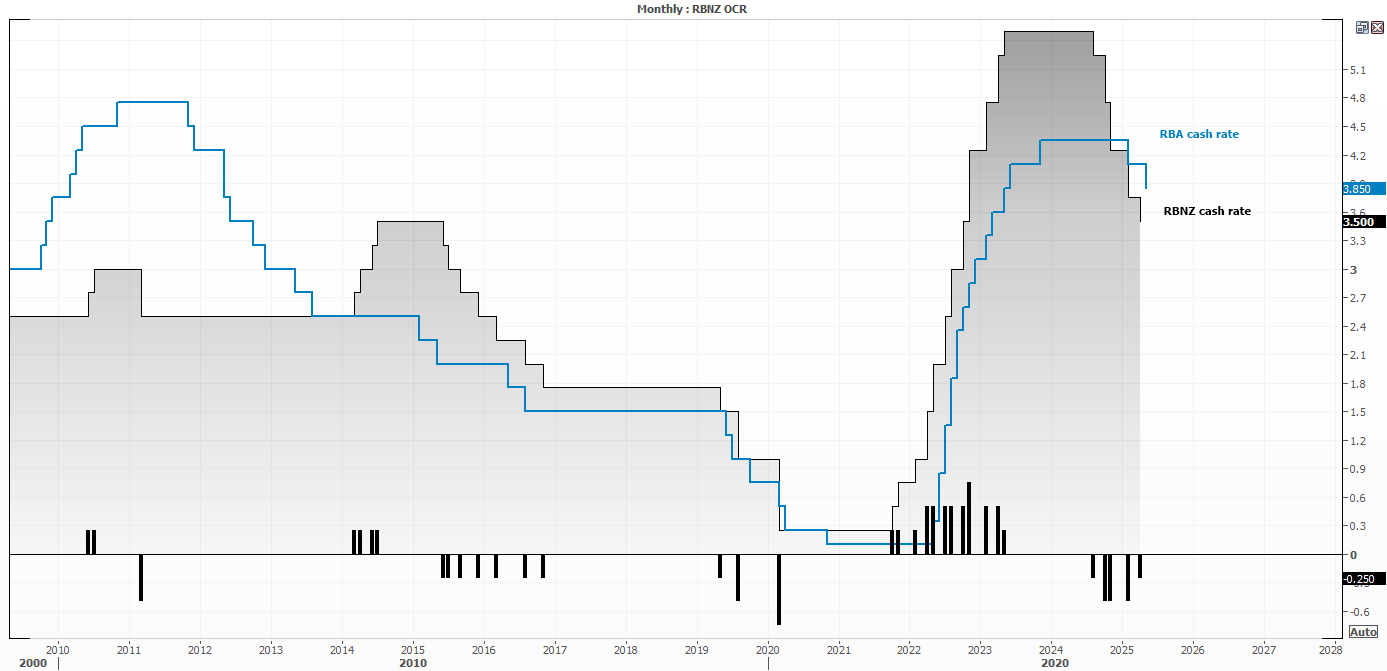

Reserve Bank of New Zealand (RBNZ): 25bp Cut expected

It is widely expected that the RBNZ will cut their overnight cash rate (OCR) by 25bp to 3.25% on Wednesday. It would mark their sixth cut of the easing cycle, and widen the RBA-RBNZ cash rate spread to 60bp.

CPI y/y is at 2.2% (within the 1–3% target band), and although two-year inflation expectations have ticked up to 2.29%, they remain anchored and not high enough to derail the easing bias. Job growth has slowed and underemployment has crept higher, suggesting spare capacity remains in the economy.

The focus is therefore on whether they will signal any further cuts. If they do, AUD/NZD should weaken as it suggests that the RBNZ cash rate will end beneath the RBA’s at the end of the year.

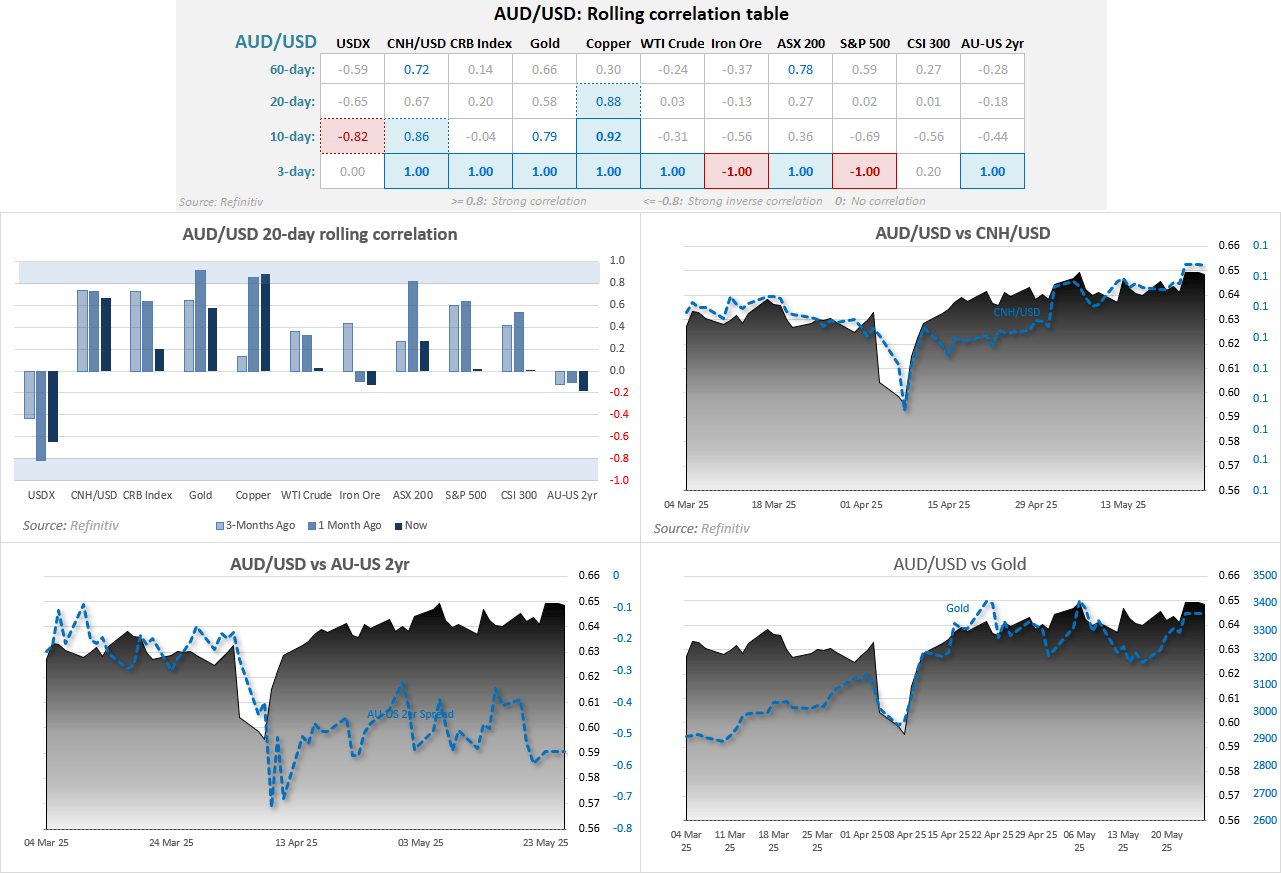

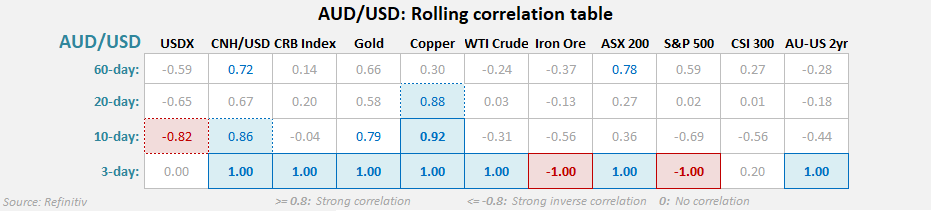

AUD/USD correlations

The Australian dollar retains a strong correlation with the Chinese yuan over the 3- and 10-day timeframes, although this link weakens slightly over the 20- and 60-day periods.

Additionally, copper and gold prices maintain a positive correlation with AUD/USD over the shorter 3- and 10-day horizons, reinforcing the Aussie’s commodity-linked nature.

AUD/USD Futures: COT Report

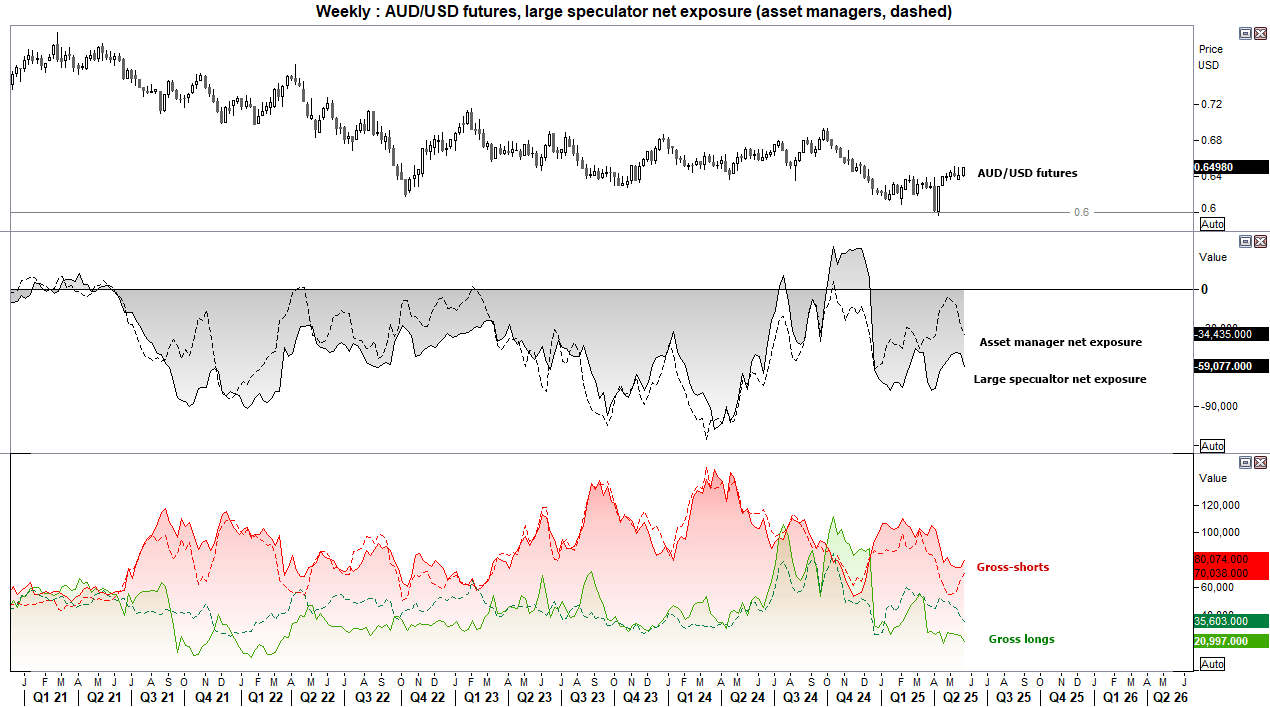

Traders increased their net-short exposure to AUD/USD futures last week, yet Aussie bulls scored a 1.5% weekly gain, marking the best performance in eight weeks.

The US dollar remains under heavy selling pressure, driven by worries over US fiscal stability following the sovereign credit downgrade and President Trump’s tariff threats on the European Union.

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

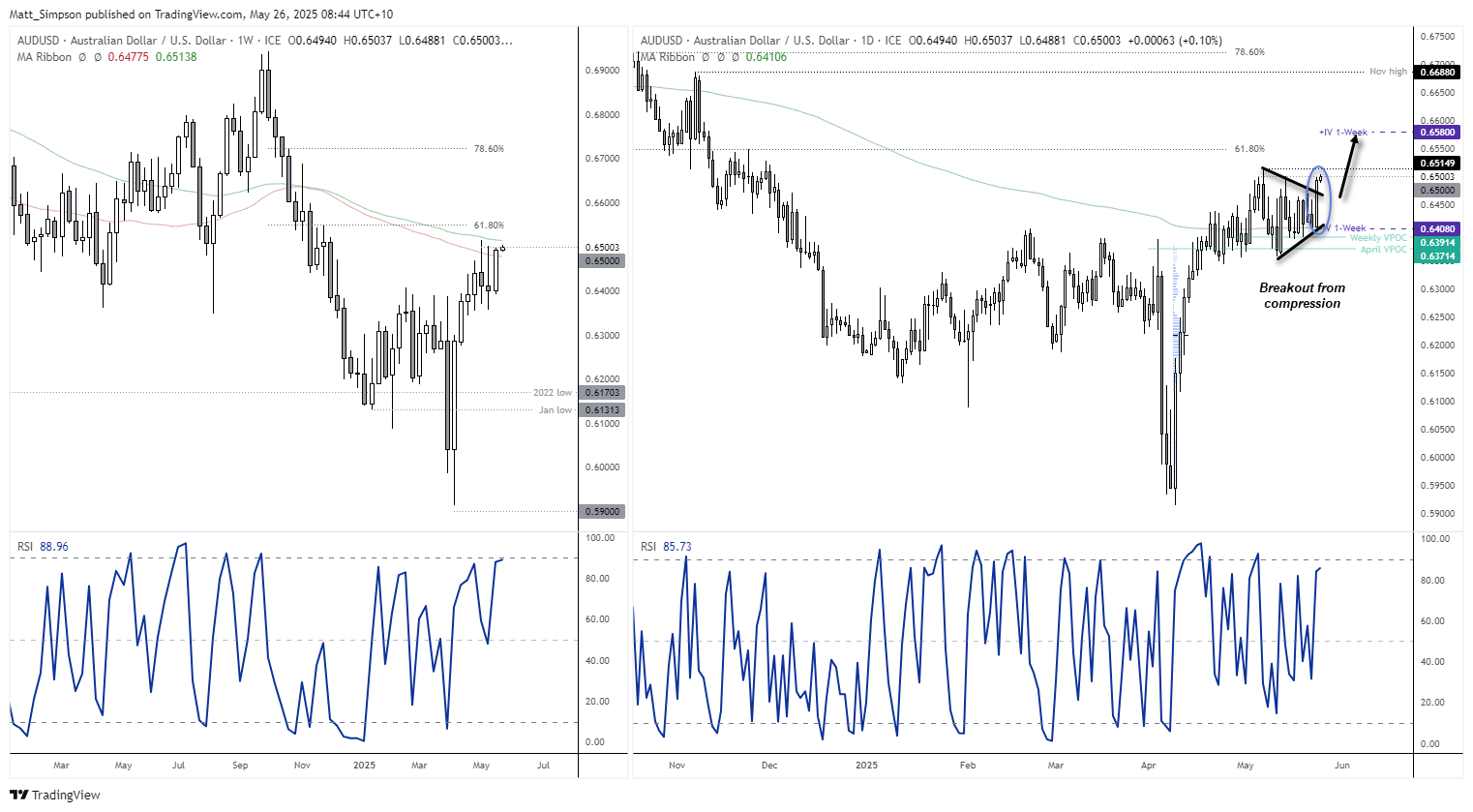

The US Dollar Index snapped a four-week winning streak with its most bearish week in six, opening near the high and closing at the low — fuelling an Aussie dollar rally.

On Friday, AUD/USD printed a bullish engulfing candle and is now flirting with a breakout above the 65-cent handle. However, a confirmed breakout would require a move above the 200-week SMA and May high at 0.6515.

The 61.8% Fibonacci level at 0.6550 marks the next resistance target, with the 66-cent handle and November high near 0.67 in play if USD weakness accelerates.

One-week implied volatility bands suggest a potential range between 0.6408 and 0.6580. A 66c test is possible this week if Aussie CPI surprises and the greenback remains under pressure.

The bias stays bullish while AUD/USD trades above 0.64.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge