View related analysis:

- Japanese Yen Bulls Still Pushing Their Luck: COT Report

- USD/JPY, GBP/JPY Technical Outlook: BOJ Inaction Weighs on Japanese Yen

- WTI Crude Oil Analysis: Bears Eye Another Assault on $60

- Japanese Yen (JPY) Sentiment Could Be at an Extreme: COT Report

The Australian dollar (AUD/USD) is set for another potentially bullish week, buoyed by rising correlations with the Chinese yuan (USD/CNH) and shifting expectations around both the Federal Reserve (Fed) and the Reserve Bank of Australia (RBA). With limited domestic data ahead, the Aussie is likely to take its cues from US economic releases and Chinese yuan direction.

The Federal Reserve (Fed) is Expected to Hold Interest Rates Steady

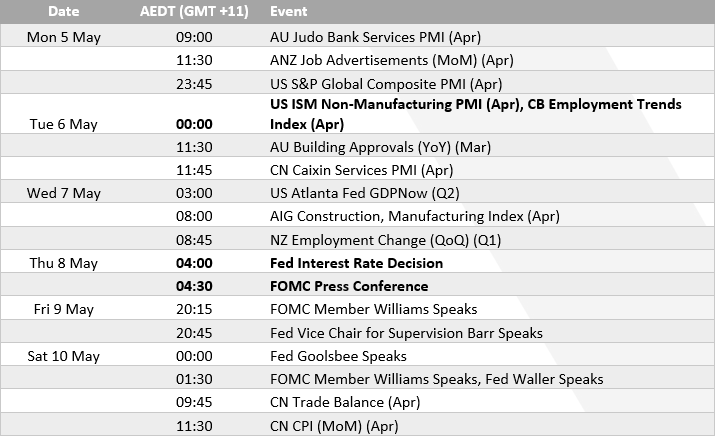

It is extremely unlikely that the Fed will change their policy this week, and is not anticipated to lay the groundwork for a cut either. While job growth slowed marginally in April, the latest nonfarm payrolls figure of 177k still reflects a robust labour market. Meanwhile, although ISM manufacturing contracted at its fastest pace in five months, the prices paid component rose to its highest level since July 2022—signalling that inflationary pressures remain alive and well.

Fed funds futures imply a 96.8% chance of a hold this week and a 63.3% chance of a hold in June, making it unlikely the Fed will set the stage for a cut at this week’s meeting. The odds of a July cut currently stand at 54.8%.

The RBA are poised to cut rates in May

Australia’s Q1 inflation data should give the Reserve Bank of Australia (RBA) room to cut the cash rate by 25 basis points to 3.85%, with core inflation at a three-year low and the trimmed mean now within the RBA’s 2–3% target band. RBA cash rate futures also imply a 56% chance of a 50bp cut to 3.6%. But knowing the RBA’s reserved nature, my money is on a 25bp cut.

There are no top-tier economic events for Australia this week, which means AUD/USD will likely be driven by US data and the direction of the Chinese yuan (CNH). While a weak ISM services report could bolster calls for a Federal Reserve (Fed) rate cut, we’re also likely to see higher ‘prices paid’—which could tie the Fed’s hands regarding any imminent easing.

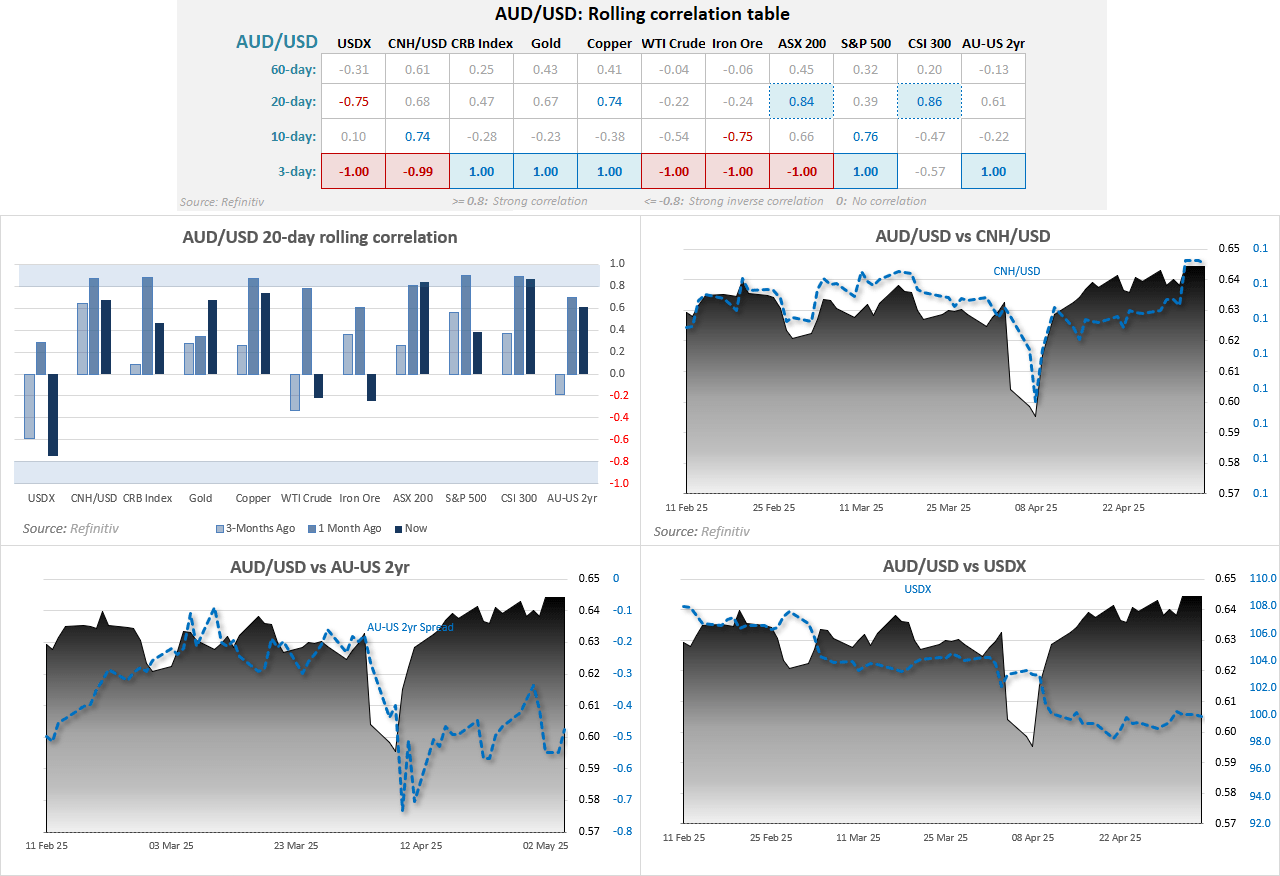

AUD/USD Correlations:

The correlation between the Australian dollar and Chinese yuan has regained traction, with AUD/USD closing above 0.64 for the first time since December, and USD/CNH falling to a six-month low. USD/CNH appears to have further downside potential, which should support continued upside momentum for AUD/USD bulls.

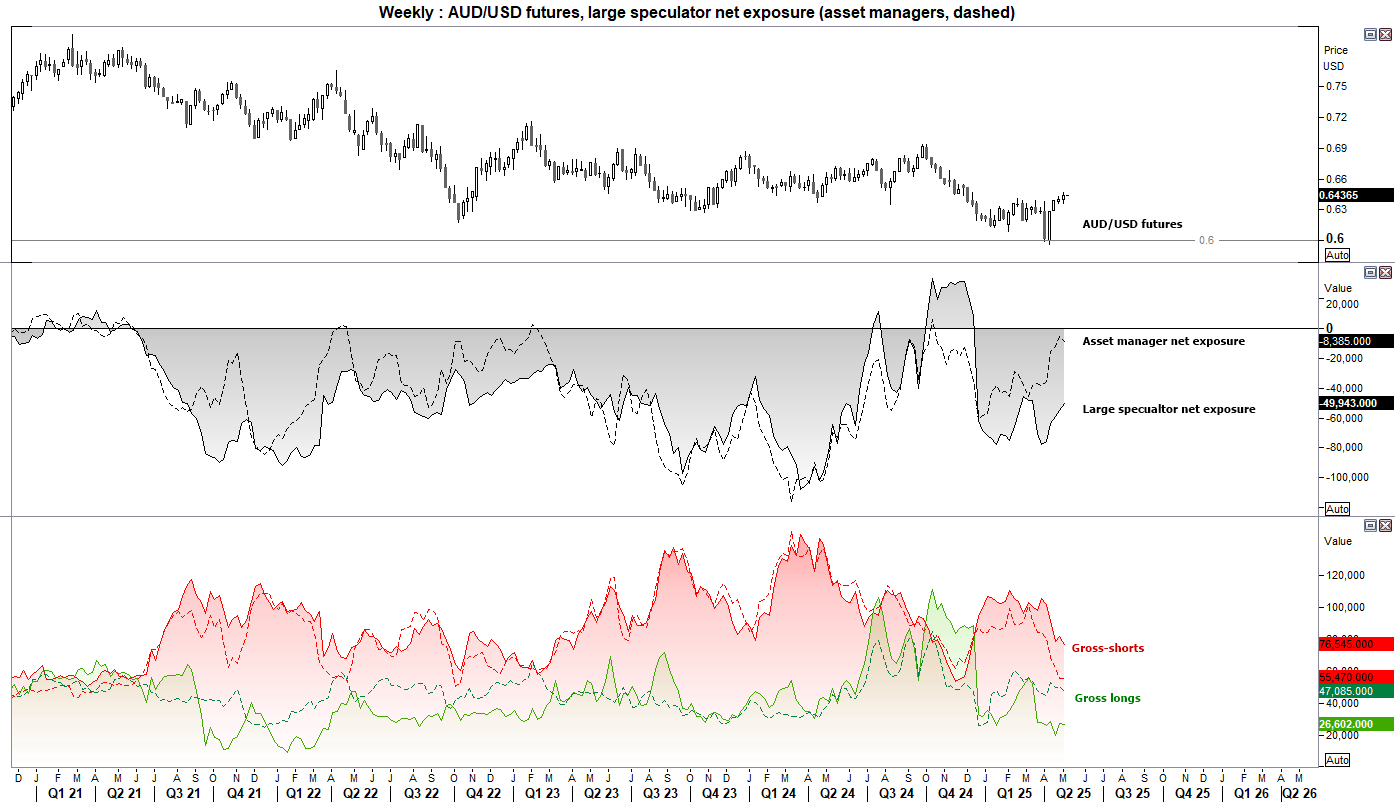

AUD/USD Futures – COT Report Positioning

The Aussie rose for a fourth consecutive week, and early trade suggests it’s aiming for a fifth. Perhaps this can coax some bulls off the sidelines. Asset managers remained net-short AUD/USD futures last week and actually increased their net-short exposure by 3.4k contracts. However, they also reduced both gross-long and gross-short positions. Large speculators trimmed their net-short exposure by 4.7k contracts to -49.9k, although they also pared back longs by 573 contracts and cut shorts by 5.2k. Traders appear hesitant to commit to longs, but are clearly more committed to closing short positions.

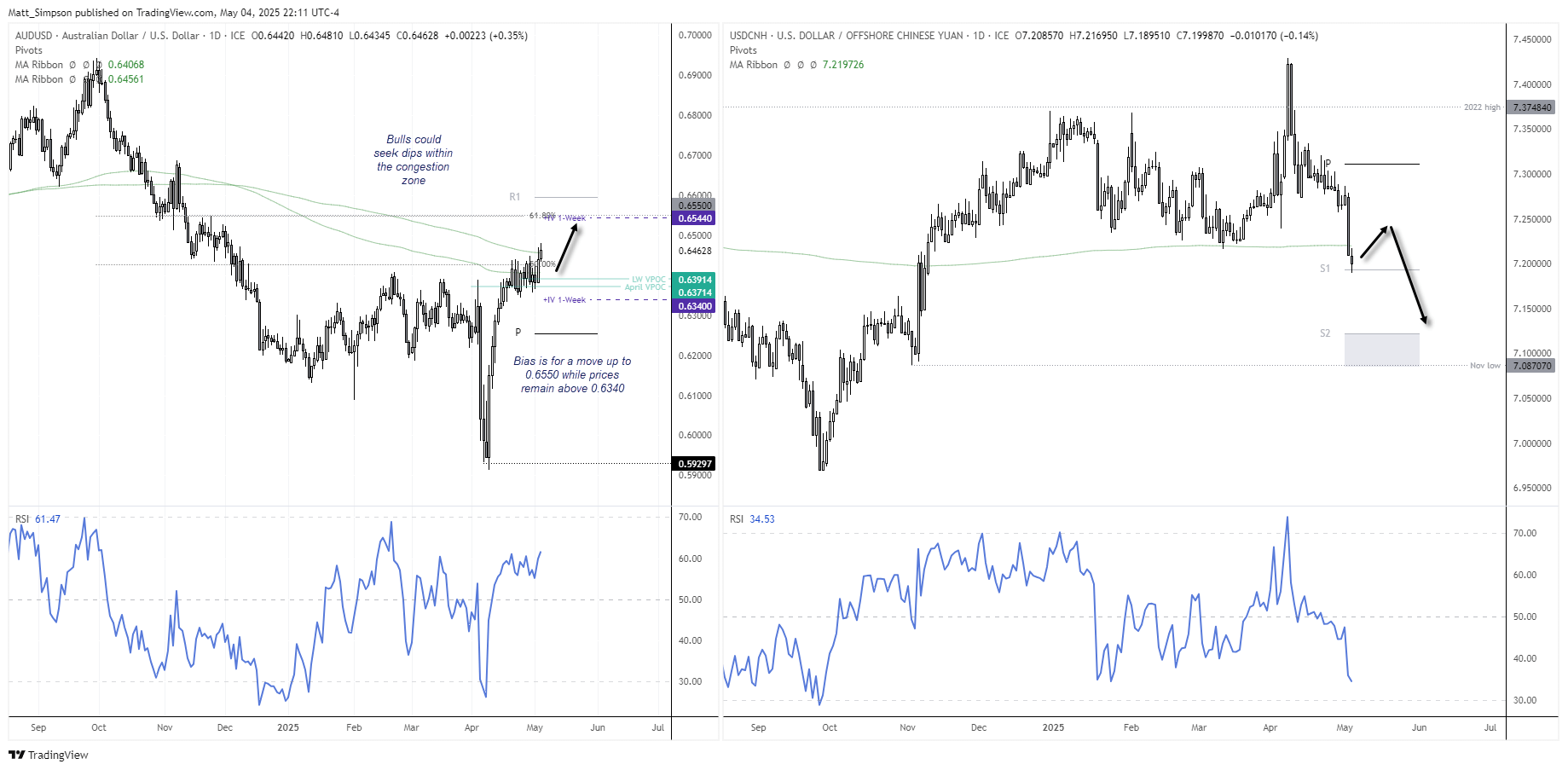

AUD/USD (Australian Dollar) Technical Analysis

With USD/CNH having fallen 100 pips at Monday’s open, AUD/USD has extended its gains and now sits above the 200-day SMA (simple moving average). However, it appears the bulk of USD/CNH’s move may be behind us for the day, leaving it vulnerable to a bounce—which could, in turn, weigh on AUD/USD. Should AUD/USD offer bulls a retracement, they may look to seek dips within the consolidation zone of the past two weeks. Note the potential VPOC (volume point of control) support levels at 0.6371 and 0.6391, which could offer areas for bulls to consider fresh longs. The bias remains for a move up to 0.6550 while prices hold above 0.6340.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge