Australian Dollar Outlook: AUD/USD

AUD/USD halts the recent series of lower highs and lows as it rebounds from a fresh weekly low (0.6408).

Australian Dollar Forecast: AUD/USD Halts Bearish Price Series

Keep in mind, AUD/USD cleared the December high (0.6515) earlier this week as it registered a fresh yearly high (0.6537), and the exchange rate may attempt to retrace the decline from the November high (0.6688) should it continue to defend the V-shape recovery from last month.

Australia Economic Calendar

Looking ahead, the update to Australia’s Retail Sales report may sway AUD/USD as household spending is expected to increase another 0.3% in April, and a positive development may push the Reserve Bank of Australia (RBA) to the sidelines following the decision to lower the cash rate by 25bp earlier this month.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, signs of a robust economy may fuel the recent rebound in AUD/USD as it curbs speculation for another RBA rate-cut, but a weaker-than-expected Retail Sales report may drag on the Australian Dollar as it puts pressure on Governor Michele Bullock and Co. to further unwind its restrictive policy.

With that said, AUD/USD may consolidate going into the end of May should it fail to defend the advance from the weekly low (0.6408), but the exchange rate may continue to defend the V-shape recovery from April as it bounces back ahead of the monthly low (0.6357).

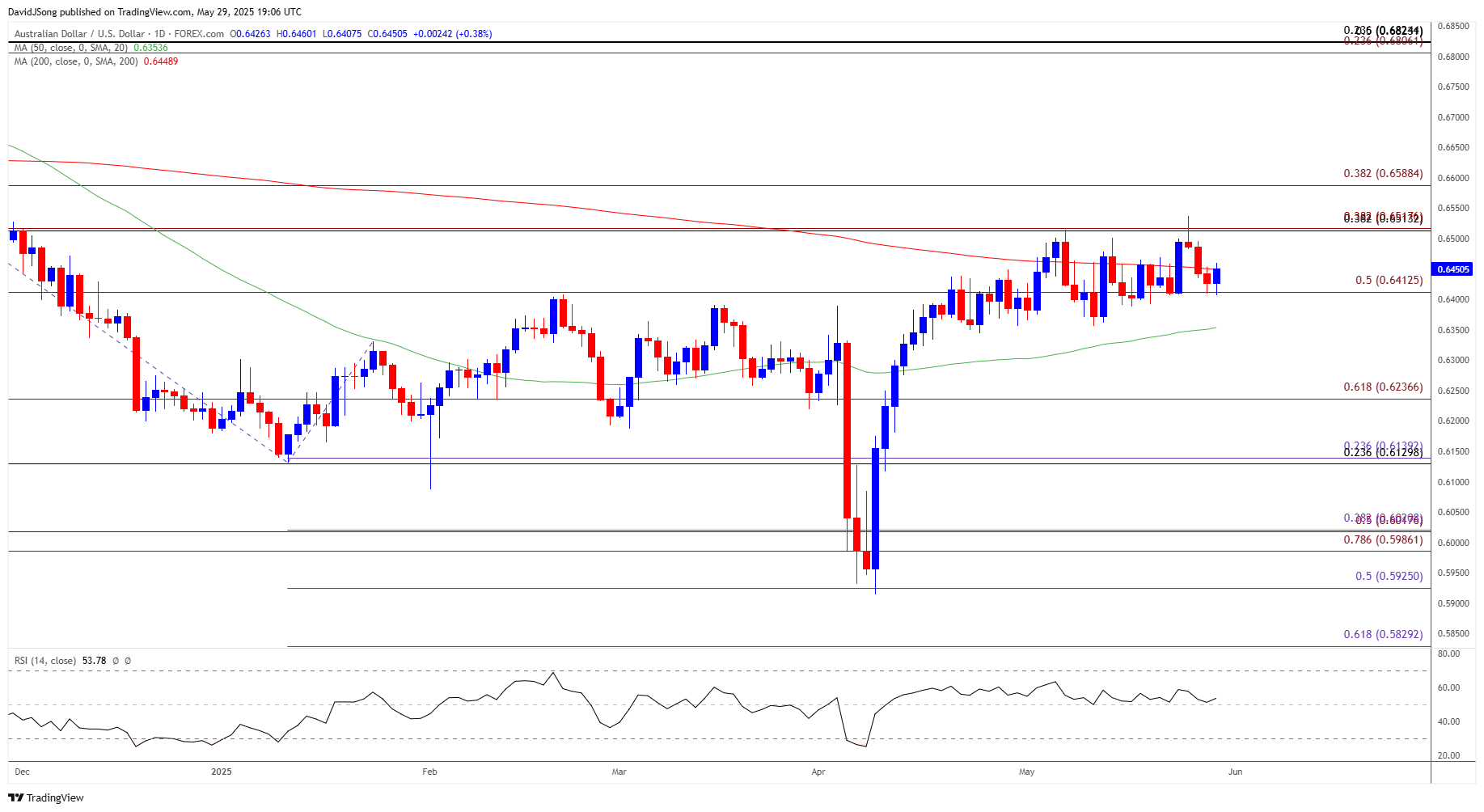

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD bounces back ahead of the monthly low (0.6357) to snap the bearish price series from earlier this week, and the exchange rate may stage a larger rebound amid the failed attempt to close below 0.6410 (50% Fibonacci extension).

- Need a close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region to bring 0.6590 (38.2% Fibonacci extension) on the radar, with the next area of interest coming in around November high (0.6688).

- At the same time, a close below 0.6410 (50% Fibonacci extension) may lead to a test of the monthly low (0.6357), with the next area of interest coming in around 0.6240 (61.8% Fibonacci extension).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Snaps Rebound from May Low

GBP/USD Holds Below February 2022 High for Now

Gold Price Falls as Trump Delays EU Tariff

USD/JPY Approaches Monthly Low as Trump Plans 50% Tariff for Europe

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong