In the last four trading sessions, Bitcoin has dropped more than 15%, reaching a low of $76,600. The strong bearish trend remains driven by disappointment over the new strategic BTC reserve announced by the White House, as well as a decline in confidence in risk markets due to growing global tensions.

Factors Sustaining the Bearish Pressure

Despite the Trump administration’s support for the digital asset market, the announcement of a strategic BTC reserve in the U.S. has disappointed the market in the short term.

On March 7, the president signed an executive order allowing the use of BTC and other cryptocurrencies to establish a strategic reserve. However, the announcement clarified that the cryptocurrencies used would come from assets seized in criminal cases, meaning the government will not be purchasing Bitcoin directly from the market for now. Shortly after the announcement, BTC fell more than 6%, fueling growing distrust among investors.

Another key factor is the market's concern over the new trade war. This week, the U.S. government is expected to impose a 25% tariff on steel and aluminum. The possibility of a global economic slowdown has led investors to move away from high-risk assets.

In this context, cryptocurrencies are still considered high-risk assets due to their high volatility and lack of official regulation, which, in some cases, can compromise their security.

Given this scenario, investors have begun shifting toward safer assets to hedge against short-term volatility. If economic uncertainty persists and there are no signs that the U.S. government intends to buy Bitcoin directly in the near future, BTC’s bearish pressure may continue.

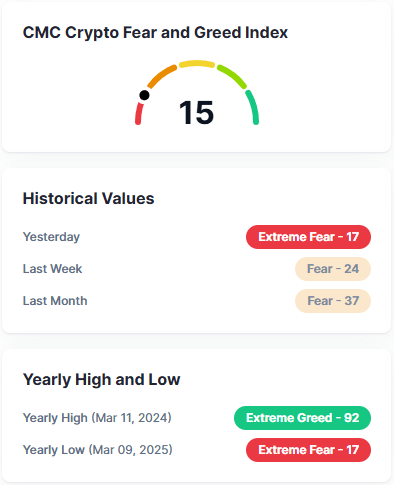

Market Sentiment: Fear & Greed Index

The Crypto Fear & Greed Index is currently at 15, placing it within "extreme fear" territory. This marks a significant drop, considering the index registered 24 last week and 37 last month.

Source: Coinmarketcap

The recent drop in the index reflects widespread loss of confidence and an increase in selling pressure. For now, such low levels suggest that investors are avoiding crypto purchases in the short term.

If the index continues to decline, reaching 10 or lower in the coming sessions, the bearish bias in BTC price movements could intensify further.

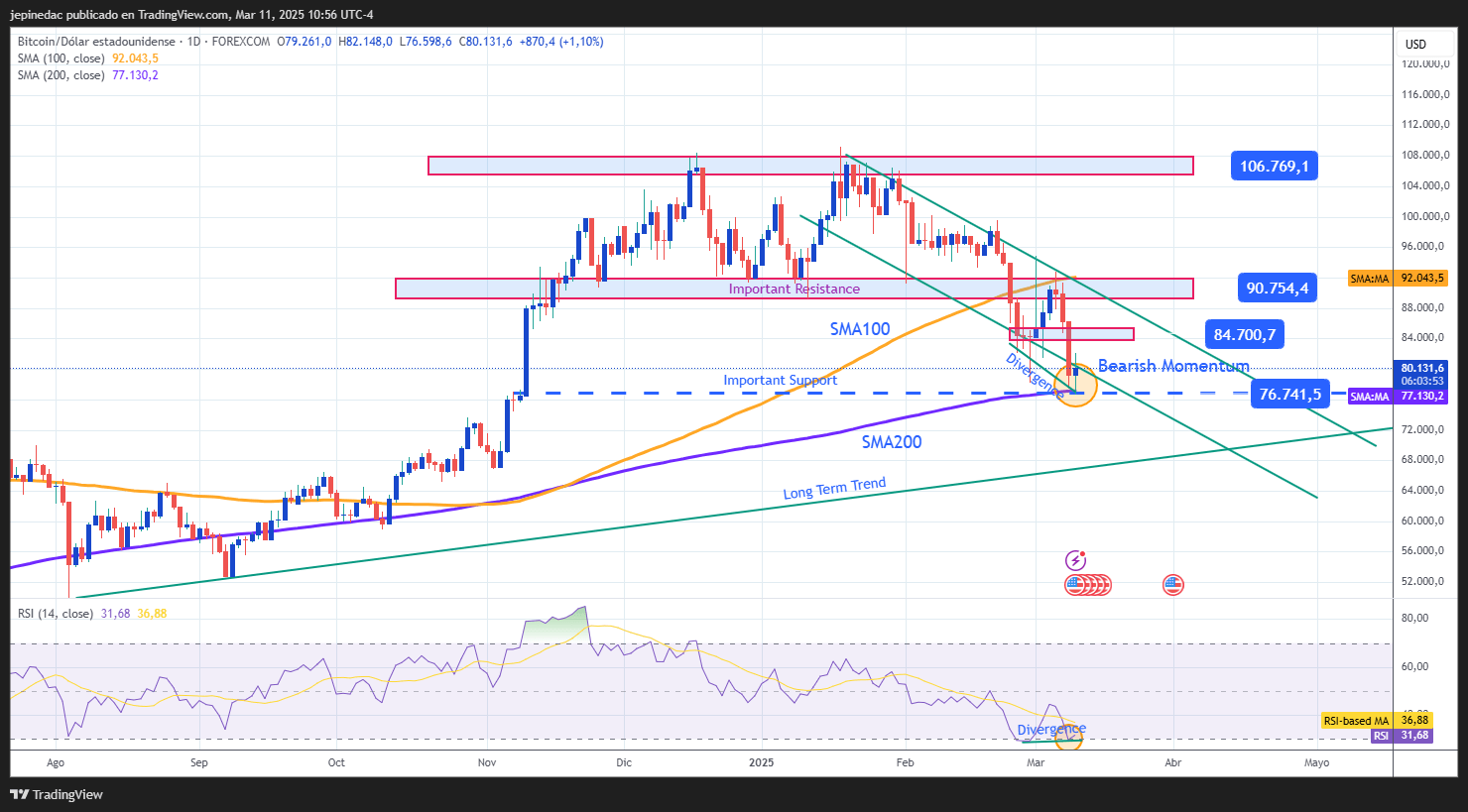

Bitcoin Technical Outlook

Source: StoneX, Tradingview

- Bearish Channel Formation: Since January 20, BTC has been forming a bearish channel, bringing its price down to $76,600. Currently, BTC is testing the lower boundary of the channel and facing a key support level, which could trigger a short-term bullish correction as selling positions take a breather after the steep drop in recent weeks.

- RSI: The RSI is hovering near the 30 level, indicating oversold conditions due to the rapid acceleration of recent declines. Additionally, lower price lows and a stable RSI line suggest a divergence, which could signal a potential short-term rebound.

Key Levels:

- $90,000 – Main Resistance: This level, which previously acted as a major support, now serves as a key resistance and coincides with the 100-period simple moving average. A break above this level could reignite buying interest and trigger a more sustained recovery.

- $84,000 – Immediate Barrier: This is currently the closest resistance level and represents a neutral zone in recent sessions. It could serve as a key level for potential short-term price corrections.

- $76,000 – Key Support: This level aligns with the 200-period simple moving average and serves as a crucial reference point for determining the continuation of the bearish trend. If BTC breaks below this support, the bearish channel could accelerate further in the short term.

Written by Julian Pineda, CFA – Market Analyst