British Pound Outlook: GBP/USD

GBP/USD grinds towards channel support following the failed attempt to test the November high (1.3048), and the exchange rate may consolidate over the coming days as the UK Office for Budget Responsibility (OBR) projects ‘real GDP growth of 1.0 per cent this year, half the rate in our October forecast.’

British Pound Forecast: GBP/USD Grinds Toward Channel Support

Fears of a slowing economy may drag on the British Pound as it puts pressure on the Bank of England (BoE) to switch gears at a faster pace, but the central bank may stick to its current approach as ‘monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the Monetary Policy Committee (MPC) may gradually unwind its restrictive policy after keeping UK interest rates on hold in March, and the rebound bound price action in GBP/USD may turn out to be temporary as the BoE still combats inflation.

With that said, GBP/USD may continue to trade within the ascending channel from earlier this year should it track the positive slope in the 50-Day SMA (1.2679), but the British Pound may face headwinds ahead of the next BoE meeting on May 8 as the transition in US trade policy clouds the outlook for global growth.

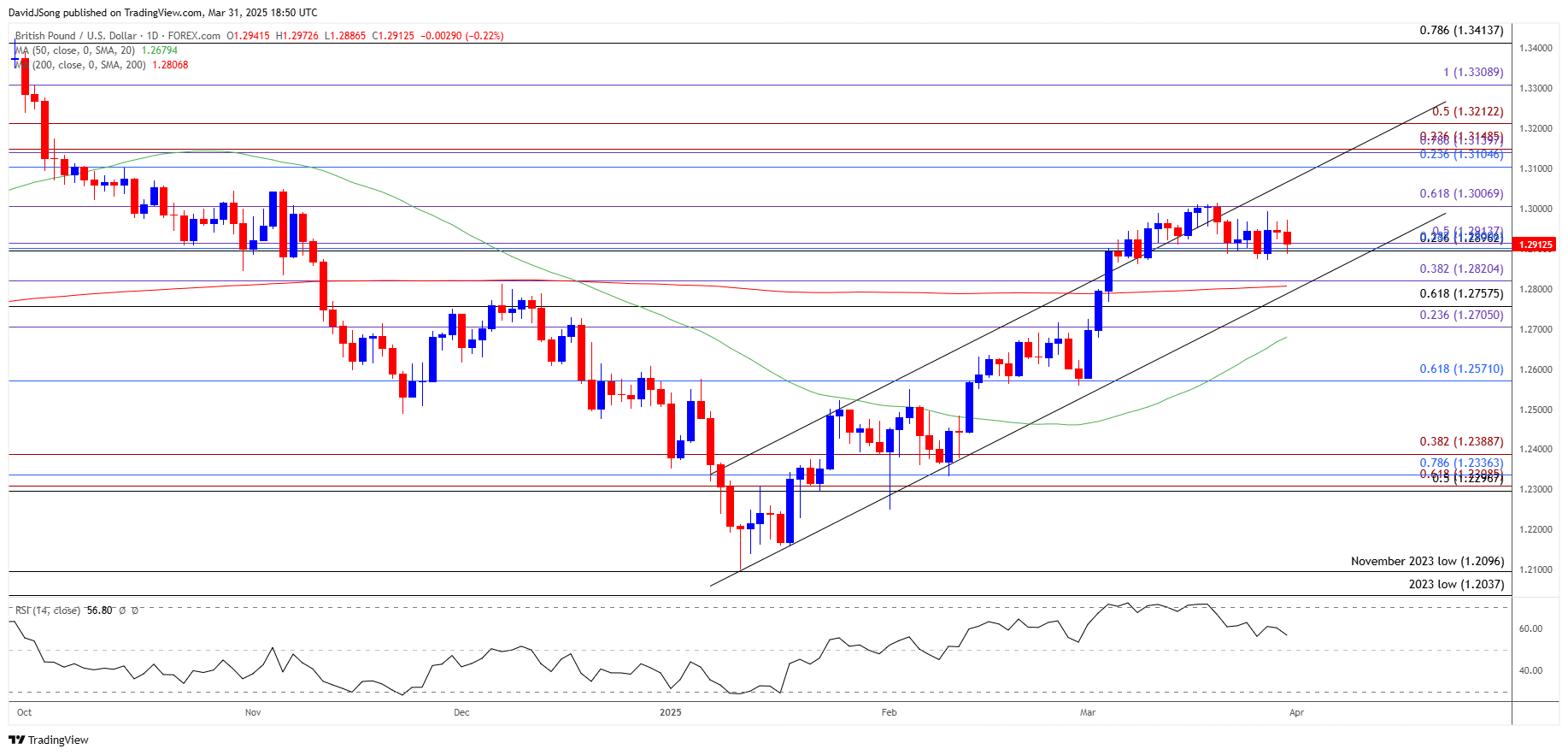

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD may consolidate over the coming days as it appears to be stuck in a narrow range, but the exchange rate may negate the ascending channel from earlier this year if it struggles to hold above 1.2820 (38.2% Fibonacci extension).

- A break/close below the 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement) region may push GBP/USD towards the monthly low (1.2579), with the next area of interest coming in around 1.2390 (38.2% Fibonacci extension).

- At the same time, a break/close above 1.3010 (61.8% Fibonacci extension) brings the November high (1.3048) on the radar, with the next area of interest coming in around 1.3110 (23.6% Fibonacci retracement) to 1.3150 (23.6% Fibonacci extension).

Additional Market Outlooks

Euro Forecast: EUR/USD Cup-and-Handle Formation Takes Shape

Gold Price Halts Decline from Record High Ahead of Trump Tariffs

Australian Dollar Forecast: AUD/USD Coils Ahead of RBA Rate Decision

Canadian Dollar Forecast: USD/CAD Continues to Coil with More Trump Tariffs on Tap

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong