British Pound Talking Points:

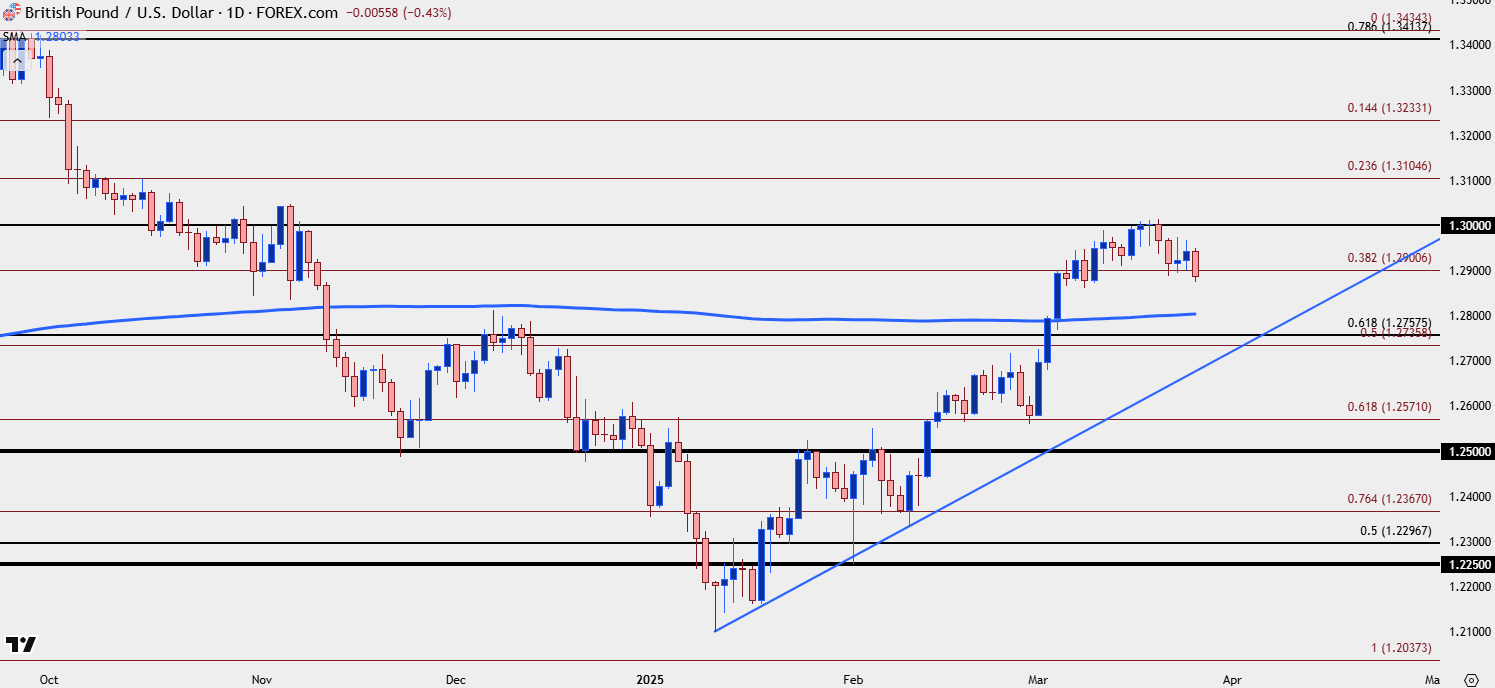

- GBP/USD put in some effort to break-above the 1.3000 handle, but bulls haven’t yet been able to leave the big figure behind.

- This morning’s UK CPI helped to extend a pullback and that’s allowed for a fresh weekly low; but as of this writing the 1.2900 support level is putting up a fight.

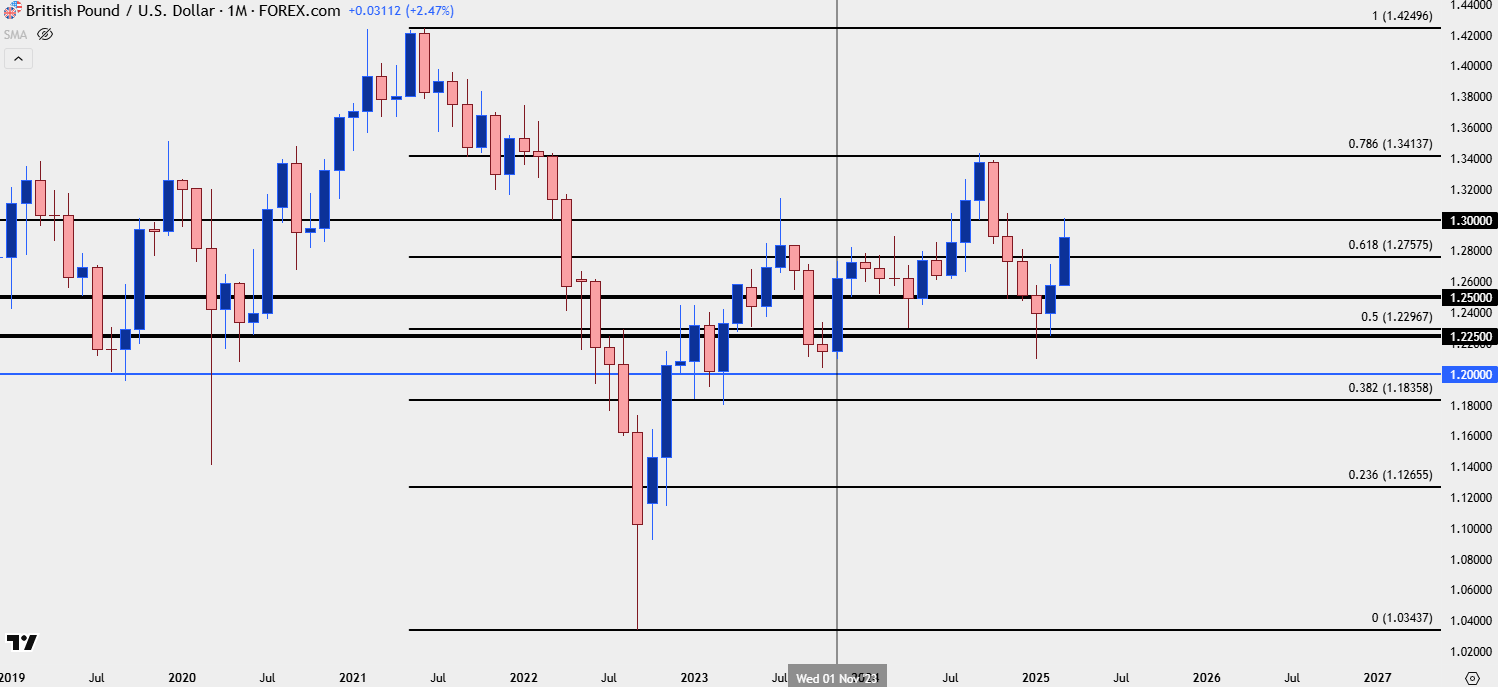

It’s been a strong year so far for GBP/USD, and that probably catches many by surprise given how weak the pair looked into last year’s close. But that sell-off only drove for a couple of weeks into the New Year and since setting a low on January 13th, bulls have been in charge.

So far for this month GBP/USD is up by a little more than 2.5%, which would be the largest monthly gain for the pair since November of 2023; and the third largest since the open of that year.

More recently it’s the 1.3000 psychological level that’s held bulls back from a stronger breakout and as we wind into the end of the month, that’s helped to push a pullback in the pair.

GBP/USD Monthly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

GBP/USD Engaging with 1.3000

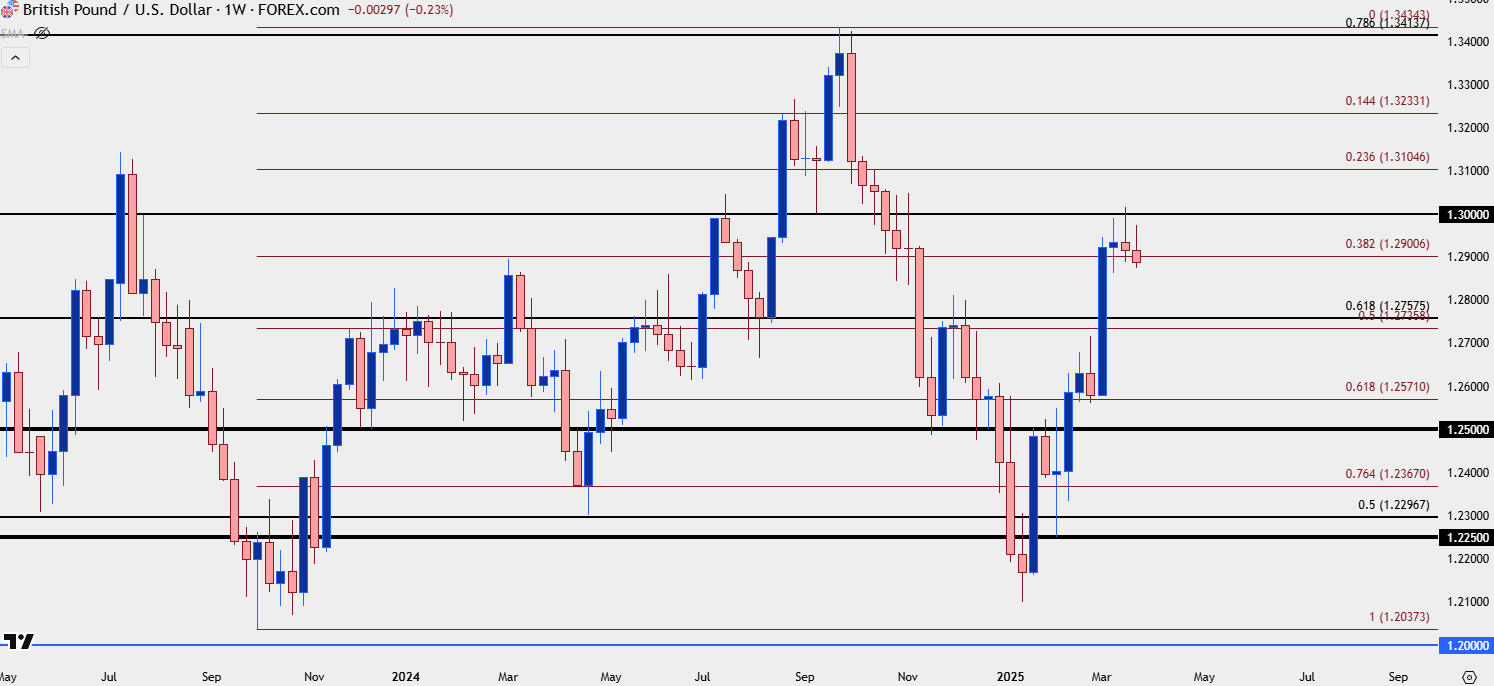

From the weekly chart we can get a better view of just how aggressively that 1.3000 level has stalled bulls. A doji two weeks ago showed as a lower-high, with buyers unable to get all the way up to the 1.3000 level; but the week after they were able to test above and similarly couldn’t find the drive to continue the bullish trend. Last week’s candle also closed as indecisive, although the wider body makes it look more like a spinning top than a doji.

And, so far this week, that stalling at resistance has followed through with another red weekly candle as the pullback has continued thus far.

GBP/USD Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

GBP/USD Shorter-Term

Interestingly if we look at the US Dollar as the mirror image of this move, the bounce in USD has been a larger pullback in the 2025 sell-off in DXY than the pullback has been in GBP/USD. As such, this can keep GBP/USD as attractive for USD-weakness scenarios, as the GBP-strength that’s helped the pair to hold up a bit better than the Euro is something that could make another run of USD-weakness show more prominently. But, as of right now, we have to call this what it is as this morning has produced a fresh lower-low and that goes along with the earlier-week stall inside of the 1.3000 level, which could end up as a lower-high.

For today’s daily bar I think that the 1.2900 level is key: This is the 38.2% Fibonacci retracement of the 2023-2024 major move in the pair, and this is what had helped to set support until this morning’s push to a fresh low. As of this writing it appears as though bulls are responding to that pullback with price attempting to pull back above the 1.2900 level, and if the daily closes like this, it could look attractive as a defense of support.

GBP/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist