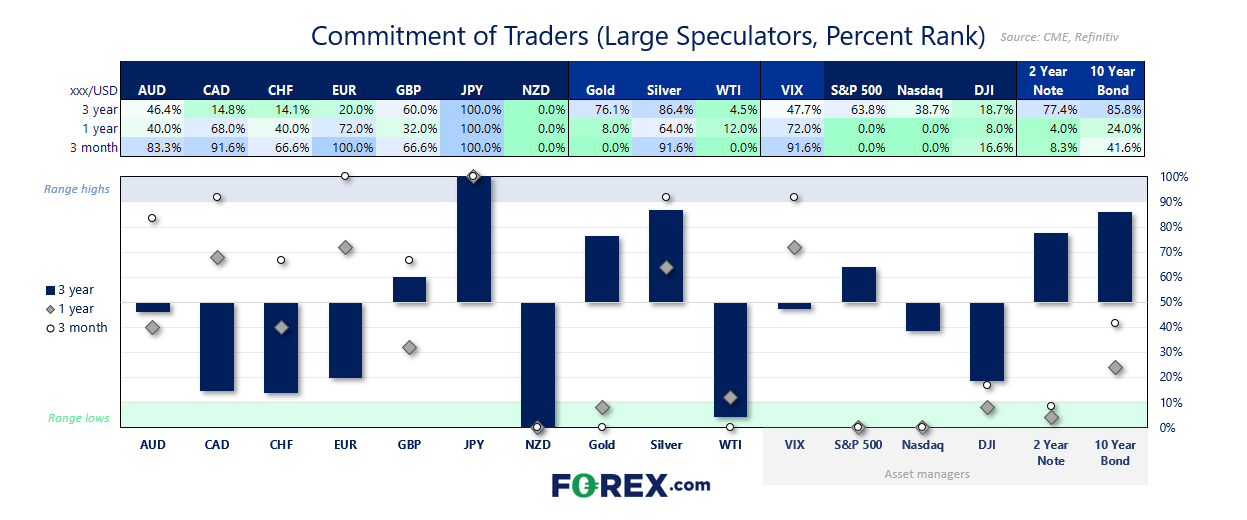

Market positioning from the COT report – 4 March 2025:

- Net-long exposure to Japanese yen futures rose to another record high last week among large speculators

- They increased net-long exposure by 37.6k contracts, their fastest weekly pace in over six months

- Their net-short exposure to EUR/USD futures fell to a 16-week low of -10k contracts

- Large speculators reduced longs to gold by 4.4% (-13.8k contracts) and increased shorts by 8.2% (6.2k contracts)

- They also trimmed exposure to silver by reducing longs by 6.6% (-5.1k contracts) and reducing shorts by -22% (-5.6k contracts)

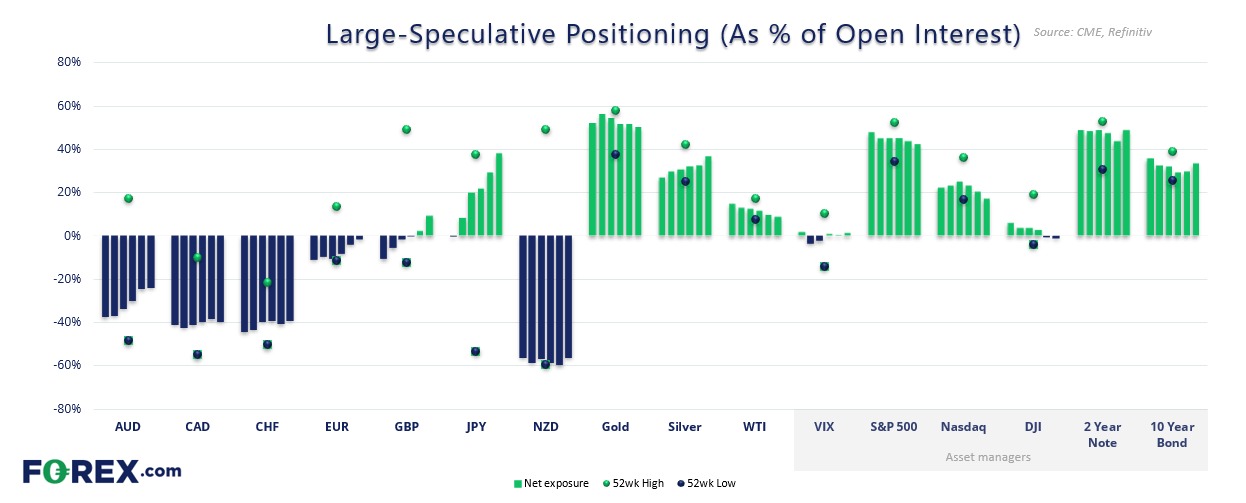

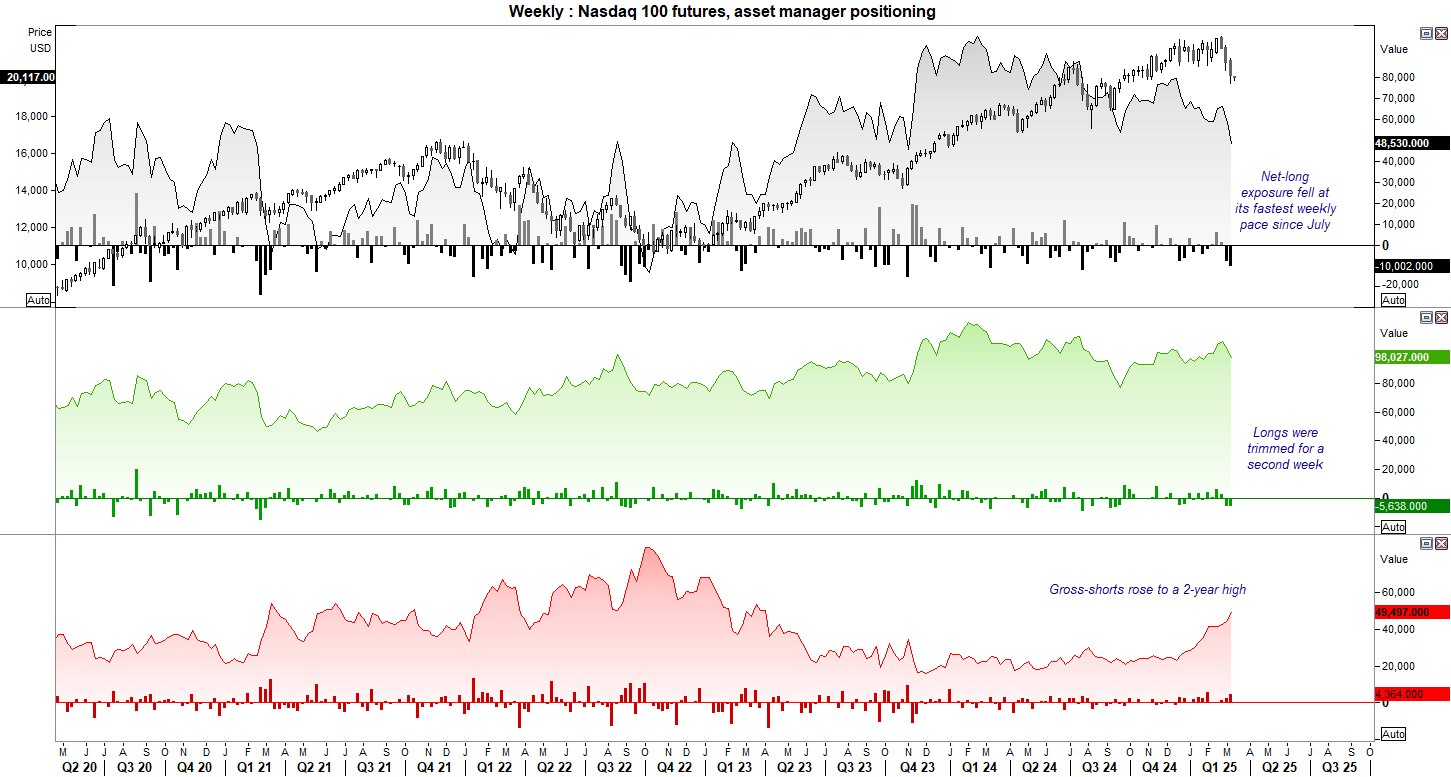

- Asset managers increased their gross-short exposure to Nasdaq 100 futures to a2-year high

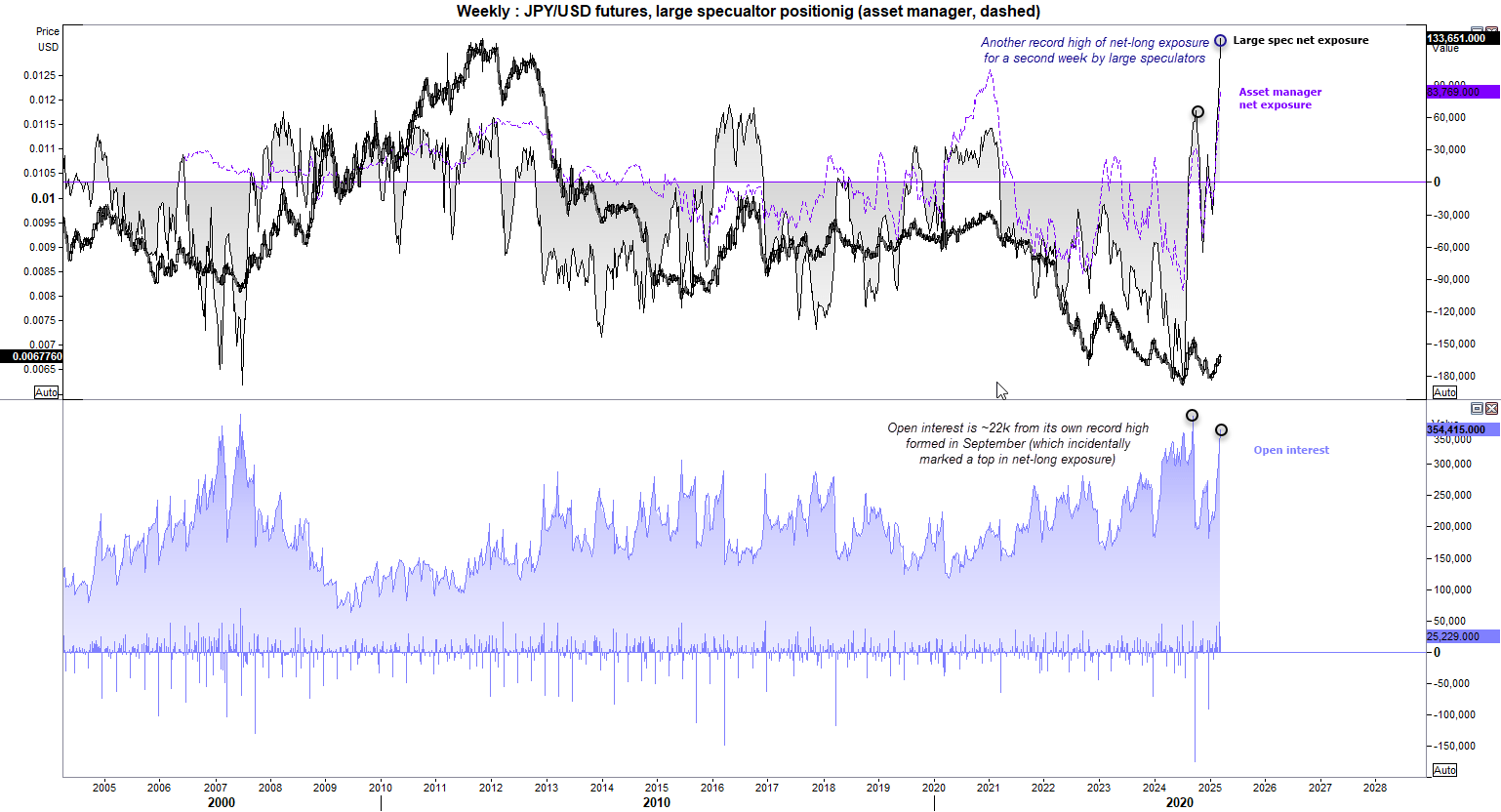

JPY/USD (Japanese yen futures) positioning – COT report:

A combination of fresh longs alongside declining shorts saw net-long exposure to Japanese yen futures rise to a fresh record high, and at their fastest weekly pace in 32 weeks. 12.2k longs were added, taking the seven-week total to 92.5k new longs added. Moreover, the 25.4k short contracts reduced last week was the fastest weekly pace of short covering in seven months.

Open interest also increased by 25k contracts to take it to within 22k contracts of the record high set back in September. Incidentally, this is also when net-long exposure peaked. Perhaps we should be on guard for a sentiment extreme on the Japanese yen.

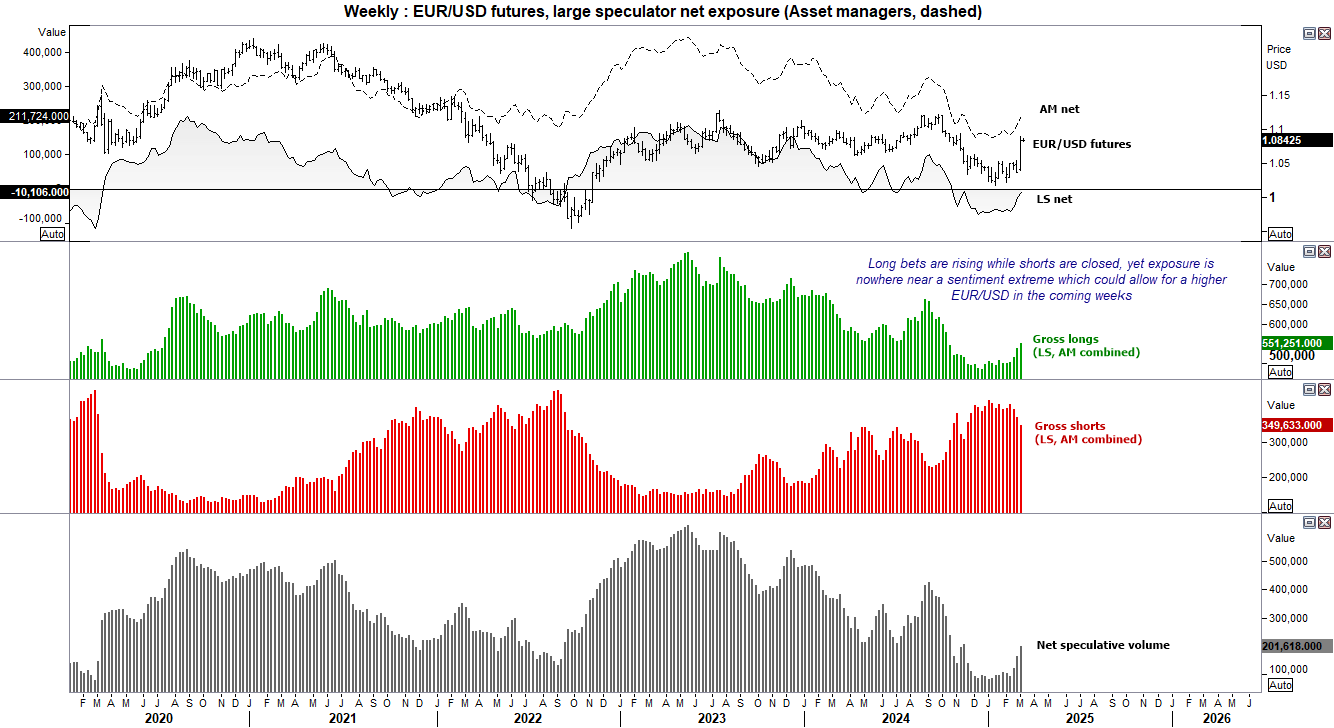

EUR/USD (Euro dollar futures) positioning – COT report:

Large speculators were close to flipping back to net-long exposure to EUR/USD futures, with an increase of longs and reduction of shorts seeing net-short exposure fall to a 16-week low of 10.k contracts. Asset managers increased their net-log exposure to a 17-week high.

And with prices continuing to rise into the back end of the week, we have to assume bullish exposure will be the more bullish in this week’s figures. And as we’re nowhere near a sentiment extreme then it’s possible we could be looking at a higher EUR/USD and lower US dollar index in the coming weeks.

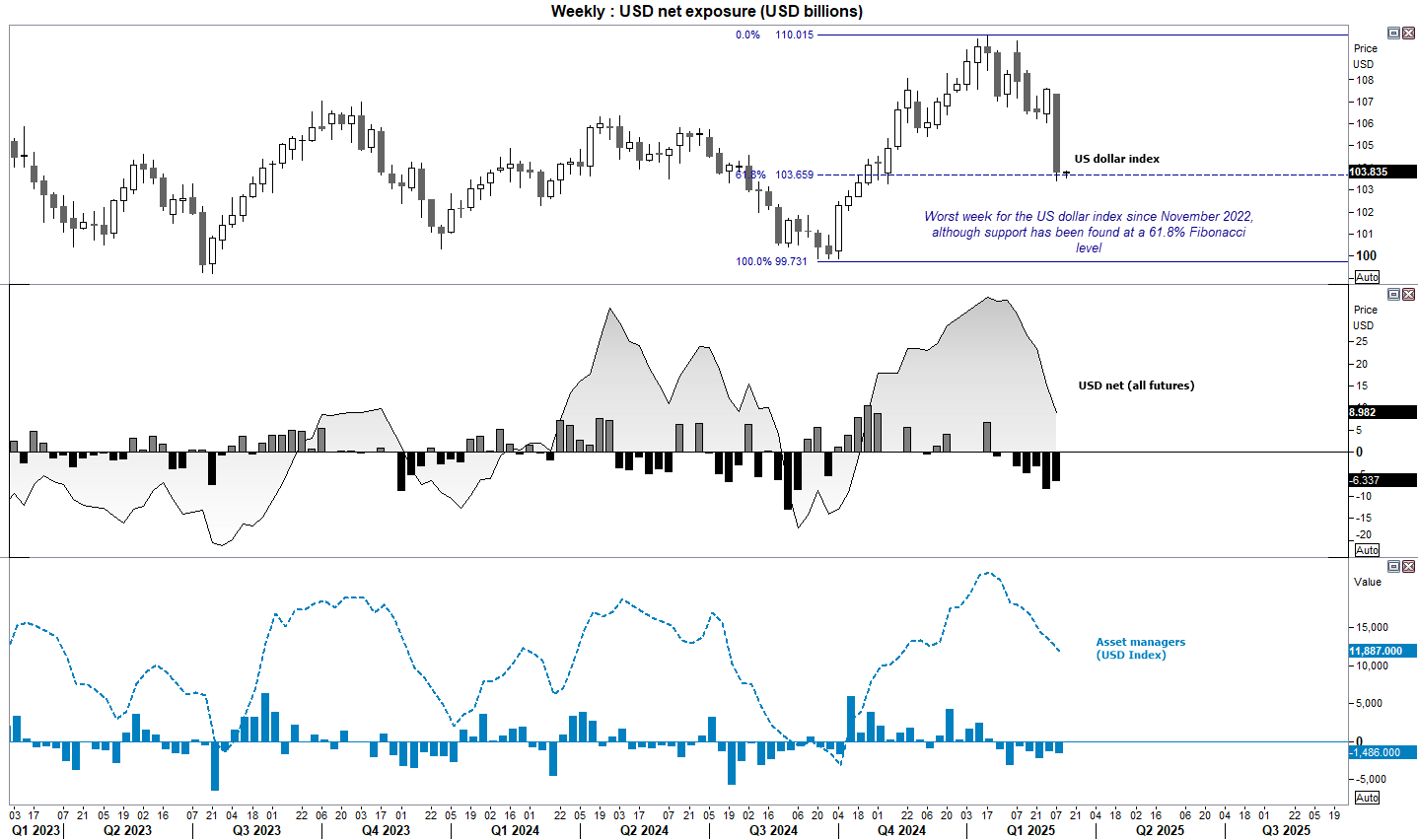

US dollar positioning (IMM data) – COT report:

Last week was the worst performance for the US dollar index since November 2022, and takes its decline from the January high to around -6%. Incidentally, this is similar to the decline in 2023 of 6% and the drop in 2024 was 5%.

But the way momentum has accelerated lower suggests to me that the cycle low is not yet in. Still, it has found support at the 61.8% Fibonacci ratio, and it is not uncommon to see prices retrace against a strong move, which could see the US dollar recoup some losses for at least part of this week.

Net-long exposure to the US dollar dell by -$6.4 billion last week to $8.9 billion, its least bullish level since October. Asset managers also reduced their net-long exposure to the US dollar index by -1.4k contracts, although they lack the appetite to be bearish as they actually reduced their shorts by -156 contracts. This is noteworthy as asset managers have been better at calling the US dollar than large speculators, who increased gross shorts by 2.9k contracts.

Nasdaq 100 futures (NQ) positioning – COT report:

Asset managers continued to shy away from the tech sector by reducing gross longs by -5.6k contracts for a second week. But they’re also actively betting against it, with gross-longs rising to a 2-year high. It is also the third consecutive week of increased shorts. Net-long exposure has now fallen to its least bullish level since November 2023.

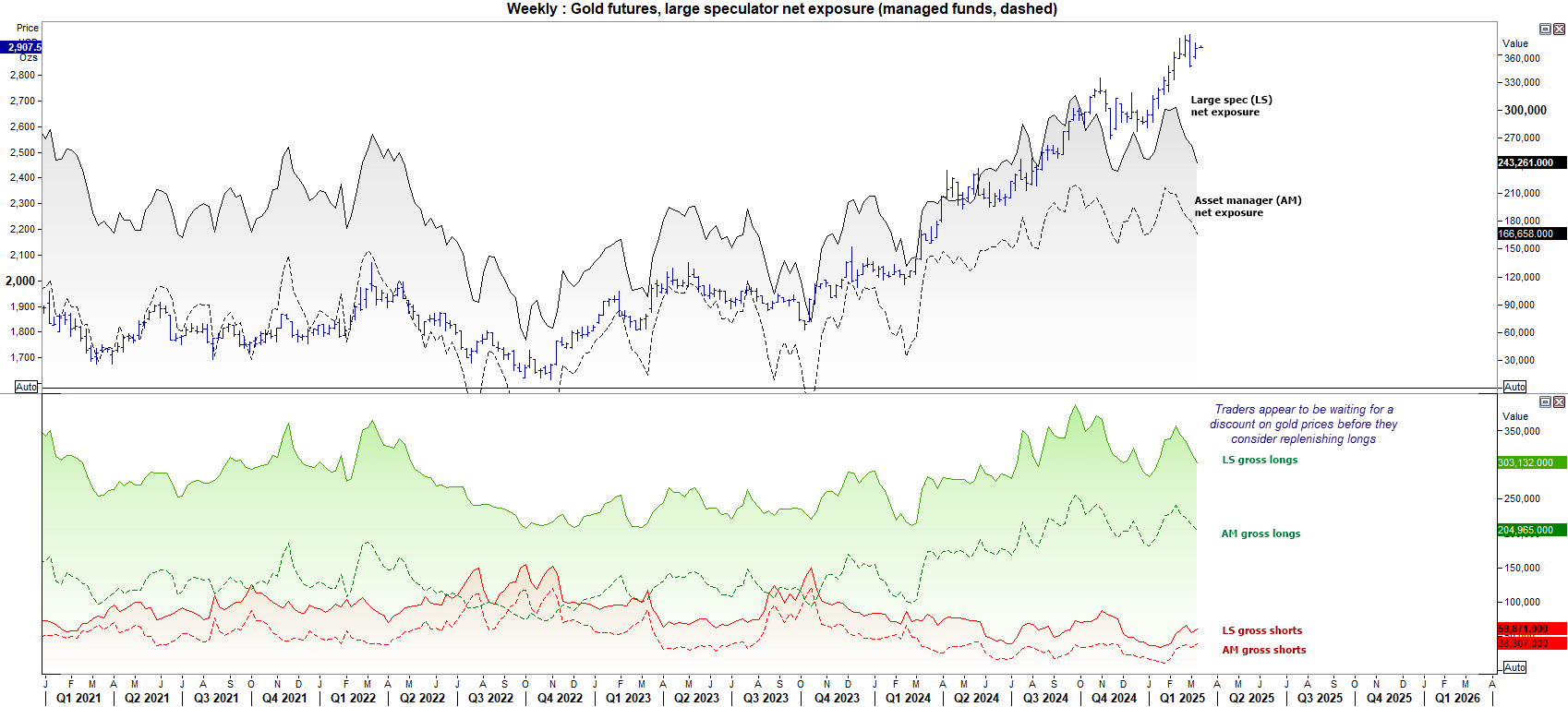

Gold futures (GC) positioning – COT report:

Both sets of traders are reducing longs to gold futures while shorts are trending higher. Yet prices remain elevated relative to their record high. This suggests that they want to see more of a pullback before recommitting to the long side, because while shorts are trending higher they dop remain low. The move lower on net-long exposure has been fuelled mostly by a reduction of longs, which I suspect will be more than happy to return to the table