Over the past four trading sessions, USD/CAD has depreciated by nearly 1.5% in favor of the Canadian dollar, as the market anticipates the upcoming Bank of Canada (BoC) rate decision. This scenario has created a momentary sense of indecision, while the Canadian dollar remains firm against the weakness of the U.S. dollar. If these conditions persist, downward pressure on USD/CAD could intensify in the short term.

The Role of the BoC

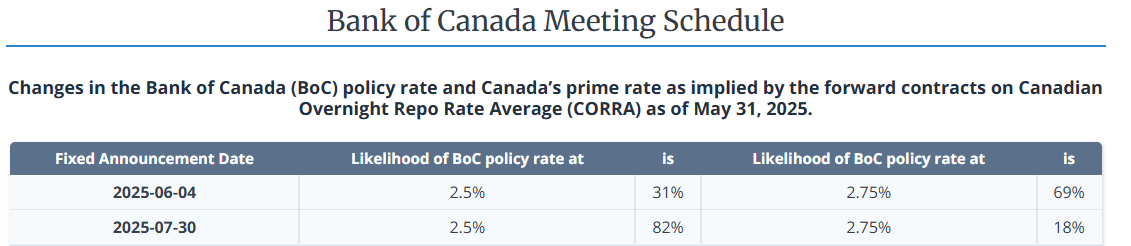

On June 4, the BoC is expected to announce its latest interest rate decision. Market consensus currently anticipates that the central bank will maintain a neutral stance, keeping the rate at its current level of 2.75%, which would mark the end of a prolonged streak of rate cuts.

Source: ForexFactory

According to current estimates, there is a 69% probability that the rate will remain unchanged, as reflected by the BoC’s own forecasting tool. This outlook is based on recent inflation data, which have shown a steady rise in Canada. For now, the central bank appears focused on maintaining its 2% inflation target, thus holding its policy steady.

Source: WOWA

This neutral rate stance is supporting the Canadian dollar in the short term, as it ensures stable yields on fixed-income instruments, helping maintain investor interest in CAD-denominated assets. However, the U.S. interest rate remains at 4.5%, which over time could redirect capital flows toward the U.S. dollar. For now, the shift in BoC expectations has revived demand for the Canadian dollar, and this may act as a key driver of selling pressure on USD/CAD, unless the central bank surprises the market with an unexpected policy shift.

Is the Canadian Dollar Affected by the Trade War?

A 25% general tariff remains in place on Canadian exports to the U.S., and ongoing trade negotiations have yet to provide a clear resolution in the short term.

Recently, Trump renewed threats to double tariffs on steel and aluminum (from 25% to 50%) and accused China of violating trade agreements. It is speculated that the U.S. may have countermeasures ready if no concrete progress is made to support American interests.

Although Canada has not been directly targeted in this latest round of tensions, it is well known that the Trump administration could reignite trade conflict with other countries, as seen recently with China and the European Union. The Canadian dollar has proven to be highly sensitive to trade-related headlines, and a new wave of tariff threats from the White House could trigger a loss of confidence in the CAD, supporting buying pressure on USD/CAD.

In this context, while negotiations between the U.S. and Canada continue, reaching a concrete agreement is crucial before the July 8 deadline, which marks the expiration of the 90-day extension previously announced by the White House. Avoiding new threats will be essential to prevent a potential re-escalation of trade tensions with Canada in the near term.

USD/CAD Technical Outlook

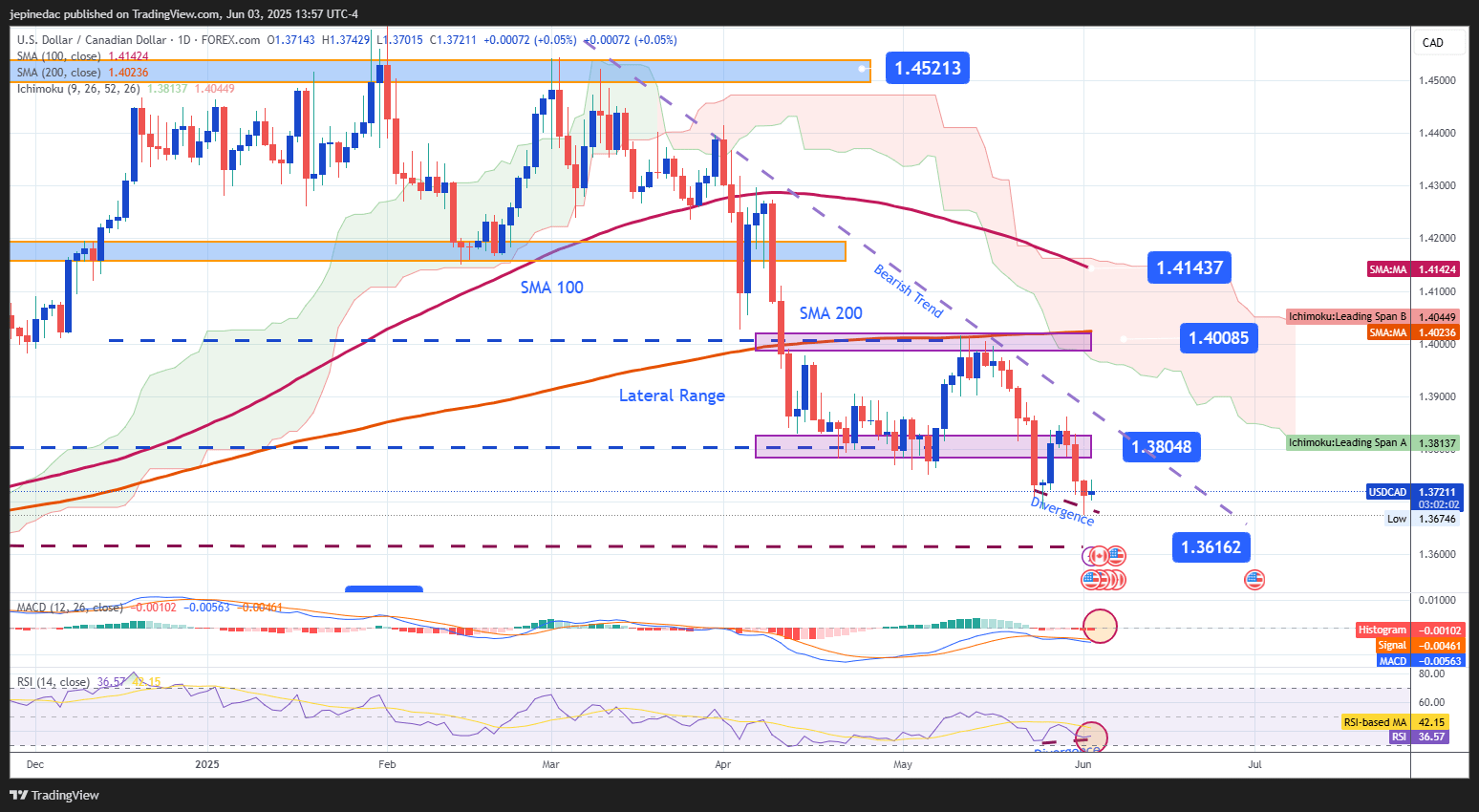

Source: StoneX, Tradingview

- Firm Downtrend: Since March 11, USD/CAD has maintained a clear bearish trend, with no significant bullish corrections challenging the overall structure. However, recent price action suggests growing neutrality, and if this condition persists, it could open the door for short-term bullish corrections.

- RSI: A bullish divergence is currently observed, with the RSI forming higher lows while price action registers lower lows. This indicates waning bearish momentum and may lead to technical rebounds in favor of the U.S. dollar.

- MACD: The MACD histogram continues to fluctuate around the zero line, showing balanced strength between buyers and sellers. If this persists, the market may enter a more clearly defined sideways range in upcoming sessions.

Key Levels:

- 1.40085 – Distant Resistance: Aligns with the 200-period simple moving average. A return to this area would challenge the prevailing downtrend.

- 1.38048 – Near-Term Resistance: A recent indecision zone, which may act as short-term resistance to potential rebounds.

- 1.36162 – Key Support: A level not seen since September 2024. A sustained break below this level could restore bearish momentum and strengthen the current downward trend.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25