Canadian Dollar, Bank of Canada Key Points

- The Bank of Canada left interest rates unchanged at 2.75% as expected in a “clear consensus” decision.

- The Toronto Sun reported earlier today that a trade deal between the US and Canada could be done before the G7 summit starting on June 15

- USD/CAD is threatening a breakdown below key support in the 1.3700-15 area – the next support level for bears to watch is near 1.3625, the minor highs from last September

Earlier this morning, the Bank of Canada (BoC) announced its decision to maintain its benchmark interest rate at 2.75% for the second consecutive meeting, as generally – but not unanimously – expected.

In his accompanying press conference, BOC Governor Tiff Macklem highlighted the significant risks posed by escalating U.S. trade policies, including this week’s doubling of tariffs on Canadian steel and aluminum to 50%. These developments have introduced considerable unpredictability into Canada's economic outlook. While the Canadian economy saw a 2.2% annualized GDP growth in the first quarter, driven largely by pre-tariff export activities, underlying indicators such as rising unemployment and subdued domestic consumption warn of potential weaknesses ahead.

Canada’s inflation dynamics muddy the outlook further. Although the headline inflation rate declined to 1.7% in April, core inflation measures have risen above the BoC's target range to 3.15%, the fastest pace in nearly a year. This uptick is attributed to higher goods prices, including food, and may reflect the early effects of trade disruptions.

Given these mixed signals, the BoC has adopted a "wait-and-see" approach for now. Governor Macklem indicated that while the economy is "softer but not sharply weaker," there is a consensus to hold the policy rate steady as the bank gathers more information on US trade policies and their impacts.

On that front, the Toronto Sun reported earlier today that a trade deal between the US and Canada could be done before the G7 summit starting on June 15. While it is just one report (with conditional phrases galore), progress on a trade deal between the two allies could benefit both economies and clarify the outlook for Macklem and company.

Looking ahead, the BOC’s next interest rate decision is scheduled for July 30, accompanied by an updated monetary policy report. After today’s “dovish hold”, markets are assigning about a 50/50 probability to another rate hold at that meeting.

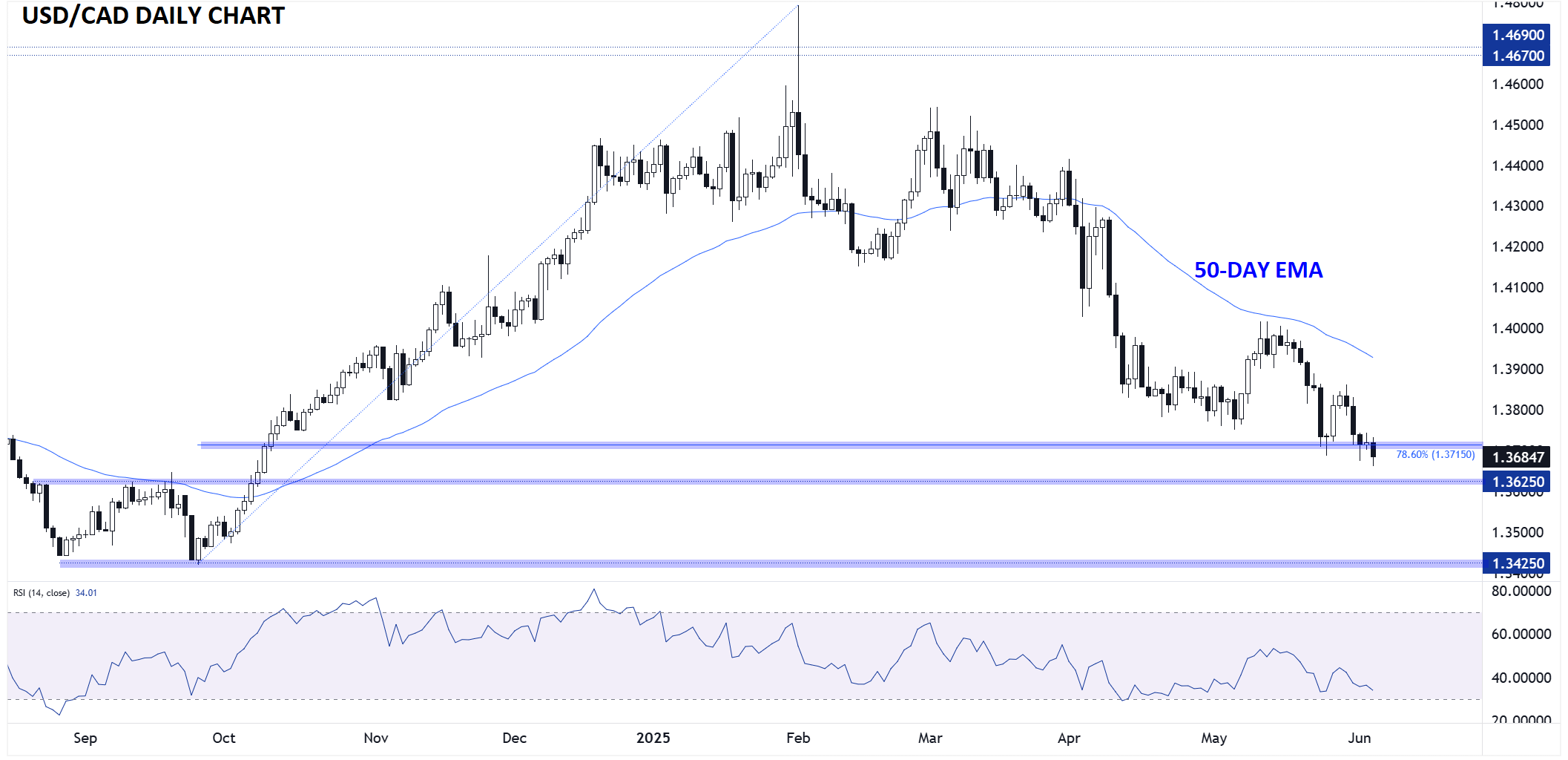

Canadian Dollar Technical Analysis: USD/CAD Daily Chart

Source: TradingView, StoneX

Turning our attention to the chart, USD/CAD is threatening a breakdown below key support in the 1.3700-15 area, where the 2025 low and 78.6% Fibonacci retracement of the September-February rally converge. Beyond the BOC hold, stronger-than-expected Services PMI figures out of Canada and weaker-than-expected Services PMI figures from the US are contributing to USD/CAD’s weakness.

Moving forward, the next support level for bears to watch is near 1.3625, the minor highs from last September, and if that level gives way, a continuation toward the 16-month lows near 1.3425 could eventually play out. Meanwhile, a reversal back above the 1.3700 level could shift the near-term bias back to neutral, though from a longer-term perspective, the bears will maintain the upper hand as long as rates stay below the 50-day EMA near 1.3900.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX