- USD/CAD tracks G7 FX, not commodity currencies

- Yield differentials gaining influence on the pair

- BoC seen holding rates at 2.75%, cut risk low due to inflation risk

- USD/CAD supports: 1.3820, 1.3750, 1.3700. Resistance 1.3947, 200DMA

Summary

With both an inflation report and Bank of Canada decision looming, this week won’t just be about U.S. tariff policy for USD/CAD traders. Still, let’s be realistic—Donald Trump’s erratic policy pivots remain the dominant force behind Loonie moves, keeping headline risk front and centre for anyone dabbling in the pair.

What’s also notable is USD/CAD’s divergence from other commodity-linked currencies like AUD, instead tracking alongside G7 peers such as the euro and yen. That suggests the pair has been a recipient of capital flows away from U.S. dollar assets rather than benefiting from a broader risk or commodity narrative. Technically, the bias remains to the downside, with a string of minor support levels now in play.

Capital Flight Boosts Loonie

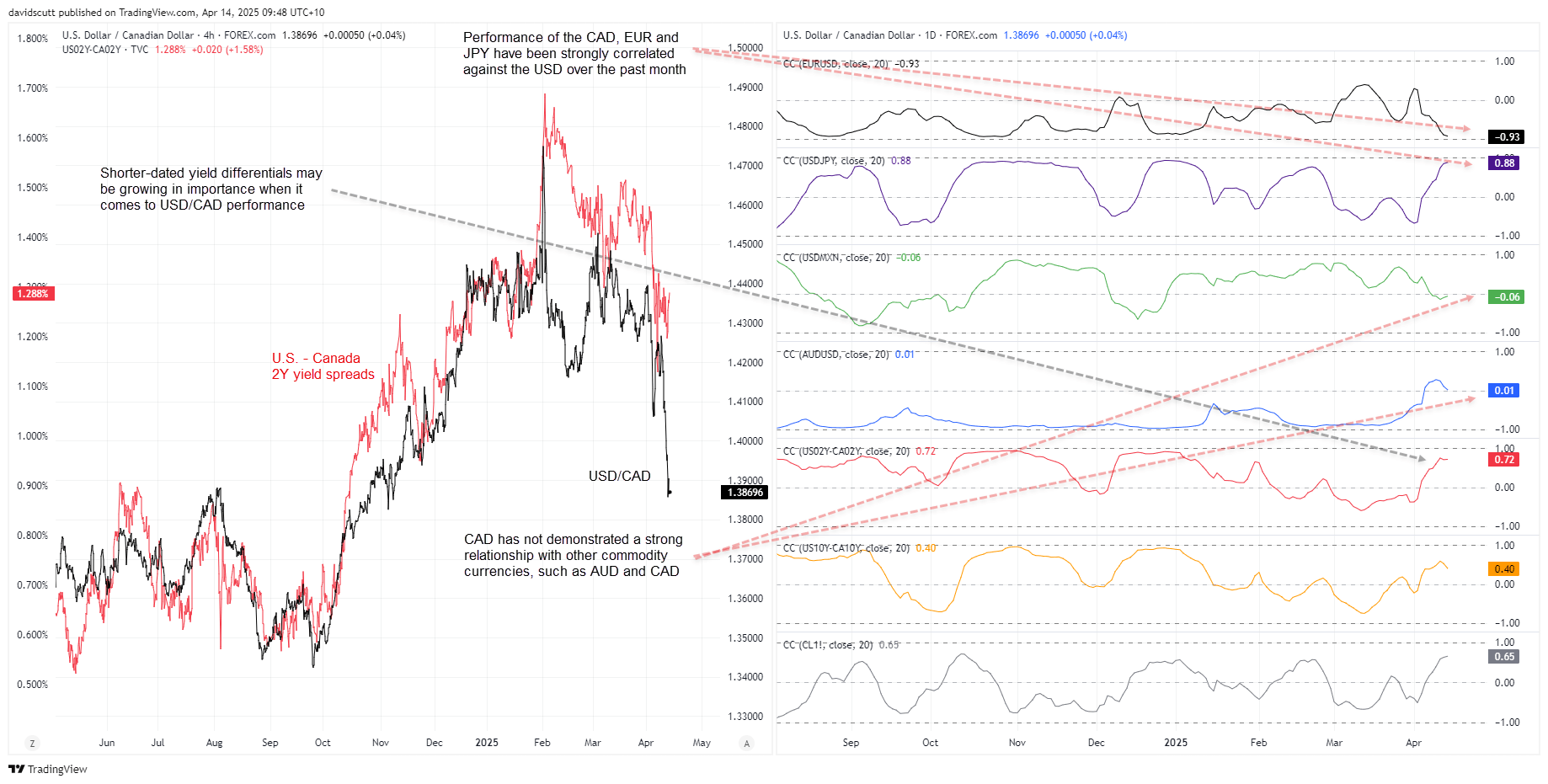

While headlines relating to U.S. tariff policy continue to generate significant volatility across FX, bond and equity markets, meaning it remains highly relevant to USD/CAD traders, one look at the correlation analysis below suggests ongoing policy uncertainty continues to fuel a shift away from the U.S. dollar into other major developed nation currencies.

Over the past month, the correlation coefficient between USD/CAD with EUR/USD and USD/JPY sits at -0.93 and 0.88 respectively, indicating the Loonie, euro and yen have been close to perfectly correlated against the U.S. dollar. What is interesting is the lack of a similarly strong relationship with the likes of the Australian dollar or Mexican peso, suggesting the Loonie is less a risk-on, risk-off play when it comes to broader financial market sentiment.

Source: TradingView

Rather than sentiment, what is noticeable is the strengthening relationship USD/CAD has seen with shorter-dated yield differentials between the United States and Canada over the past month, sitting with a correlation coefficient of 0.72 with two-year spreads. That’s not a strong relationship by any measure, but it does suggest that economic data and central bank commentary cannot be totally overlooked this week.

BoC, Canada Inflation, U.S. Retail Sales Top Event Risk

In normal circumstances, the calendar this week would be a blockbuster for USD/CAD traders with an inflation report and interest rate decision in Canada and key read on the health of U.S. retail spending topping event risk.

Source: TradingView

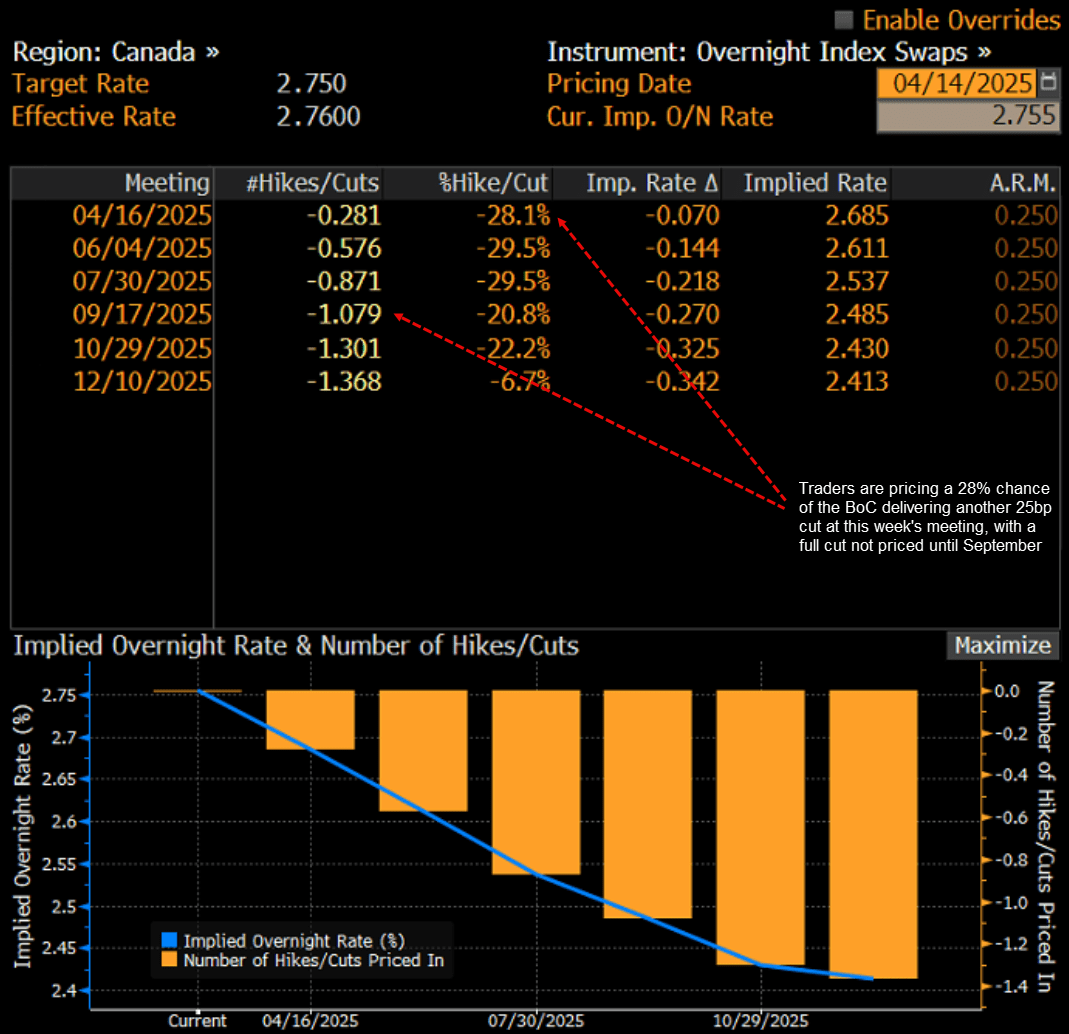

Regarding the interest rate decision from the BoC on Wednesday, the risk of a further 25bp rate cut—taking the key policy rate to 2.5%—is deemed a long-shot by traders, sitting at just 28%. Another full 25bp cut is not priced until September, although a move at the June 4 meeting is deemed a toss-up at this point.

After implementing seven consecutive rate cuts, bringing the policy rate down to 2.75%, the BoC has adopted a far more neutral policy stance given concerns about tariff-induced inflation. That goes some way to explaining the limited amount of rate cuts priced into the Canadian dollar overnight index swap curve this year.

Source: Bloomberg

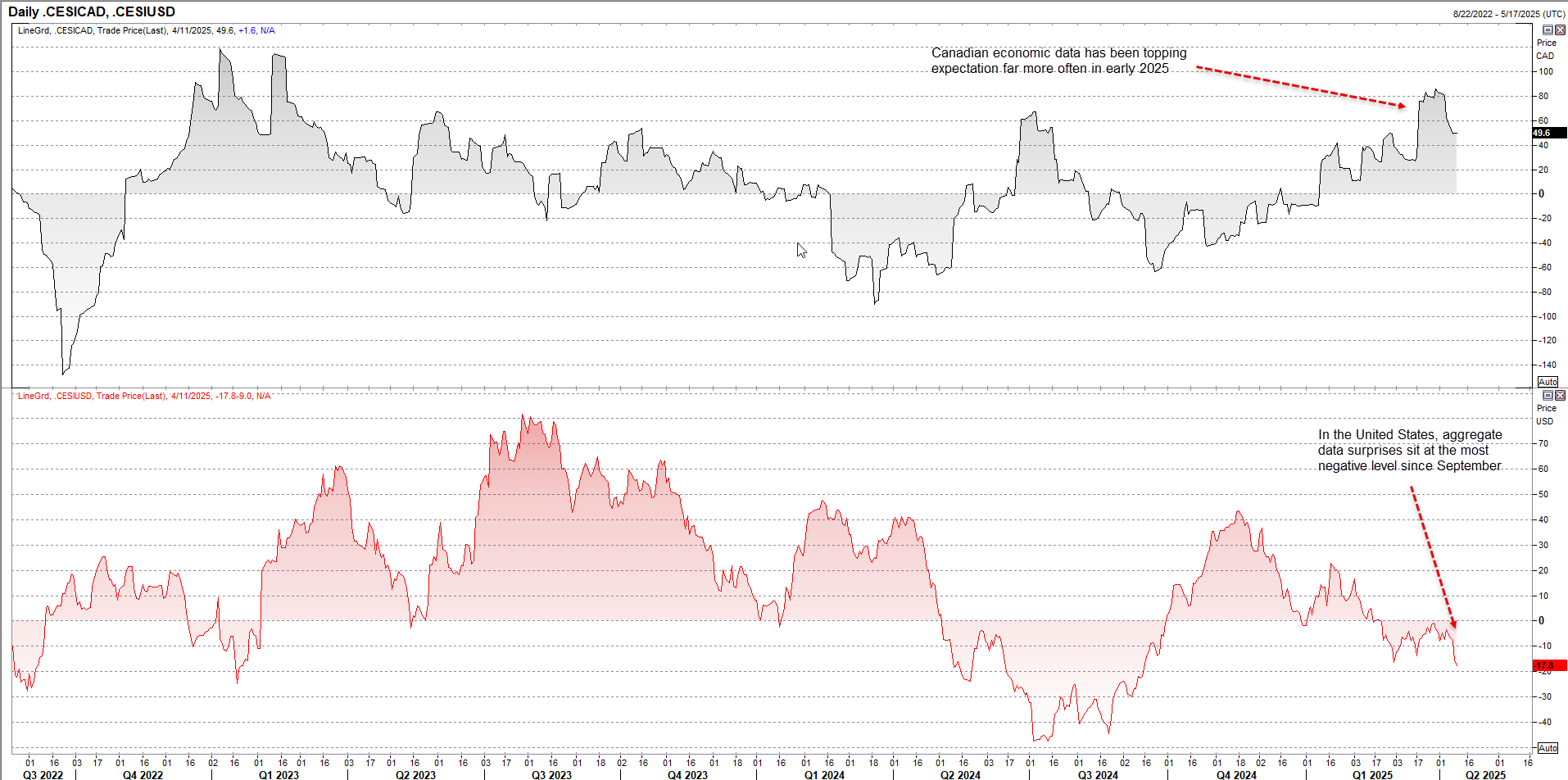

So too does the relative resilience of the Canadian economy despite greater trade barriers being adopted by its neighbour to the south, as demonstrated by Citi’s economic surprise index below. Sitting at 49.6, the reading suggests Canadian economic data has topped expectations more often than not in recent months, a vastly different story to the United States where aggregate data surprises are now the most negative since September 2024.

Source: Refinitiv

Despite the highly uncertain outlook, the Canadian economy looks in relatively good shape. And with underlying inflationary pressures stabilising at levels well above the BoC’s 2% target, there is simply no need for the BoC to rush decisions with prior monetary policy easing still working its way through the economy. Within Canada’s March inflation report, the core reading—which is the average of the trimmed mean and median series—is expected to remain elevated at 2.9%.

In the United States, retail sales are expected to surge in March as consumers front-loaded purchases ahead of Trump Administration’s “Liberation Day” tariff announcement in early April. If there is no evidence of a major pull-forward of purchases, it will only act to fuel concern that the U.S. economy may be entering a recession. It will be an important figure to watch this week, standing above all else on the U.S. calendar.

USD/CAD: Downside Remains Favoured

Source: TradingView

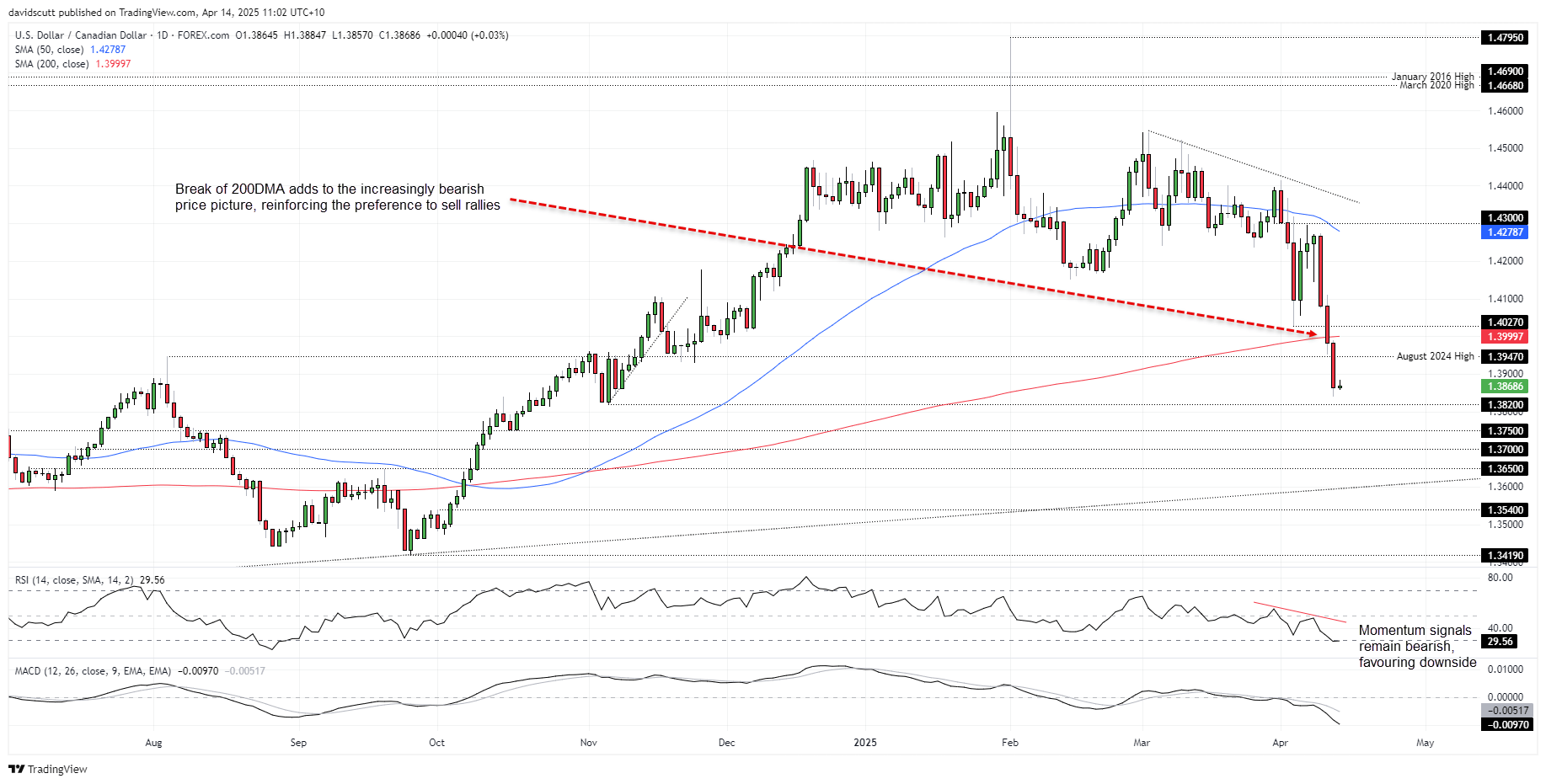

The downside risk flagged in a separate analysis note late last week materialised on Friday, seeing USD/CAD break below the August 2024 high of 1.3947, an important level the pair did plenty of work either side of around the time of the U.S. Presidential election last year.

With momentum indicators like RSI (14) and MACD deeply negative and trending lower, the overall bias remains to sell rallies and bearish downside breaks, putting minor levels such as 1.3820, 1.3750, 1.3700 and 1.3650 on the radar for bears. On the topside, 1.3947 may now act as resistance, putting it and the 200-day moving average in focus should the pair manage some form of countertrend bounce.

-- Written by David Scutt

Follow David on Twitter @scutty