Over the last two trading sessions, USD/CAD has posted a gain of nearly 0.8% as markets anticipate today's decision from the U.S. Federal Reserve. The Canadian dollar has begun to show a bearish bias in the short term, driven by growing demand for the U.S. dollar—both from the dollar’s recent rebound and expectations surrounding the Fed. If this dynamic continues, it could lead to stronger buying pressure on USD/CAD in the near term.

FOMC Decision Day Arrives

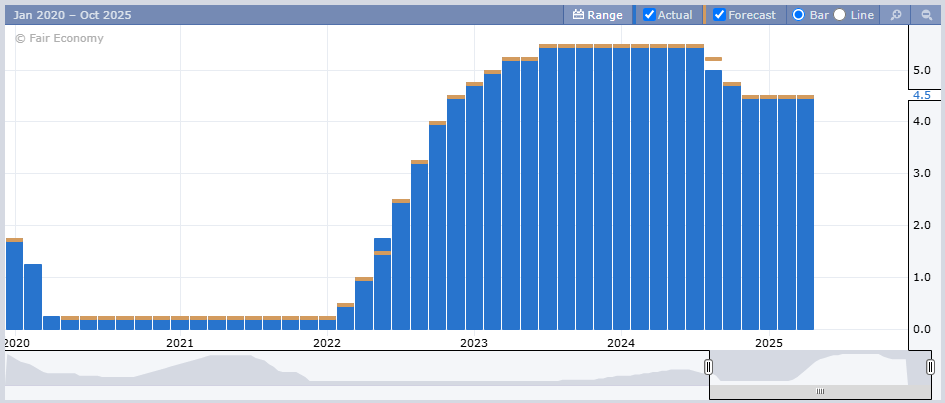

Today, June 18, 2025, markets await the Federal Reserve's rate decision at 2:00 p.m. EST. According to the CME Group, there is a 99.9% probability that the interest rate will be held at 4.5%. If confirmed, it would be the fifth consecutive decision in which the Fed has opted to leave rates unchanged this year.

Source: ForexFactory

The Fed has maintained this stance because inflation remains well above the 2% target, and economic outlooks are still too uncertain to justify cutting rates. Beyond today’s decision, markets will focus on Fed Chair Jerome Powell’s comments, especially regarding the timing of future rate cuts. For now, the expectation of higher rates for longer continues to support the dollar’s strength.

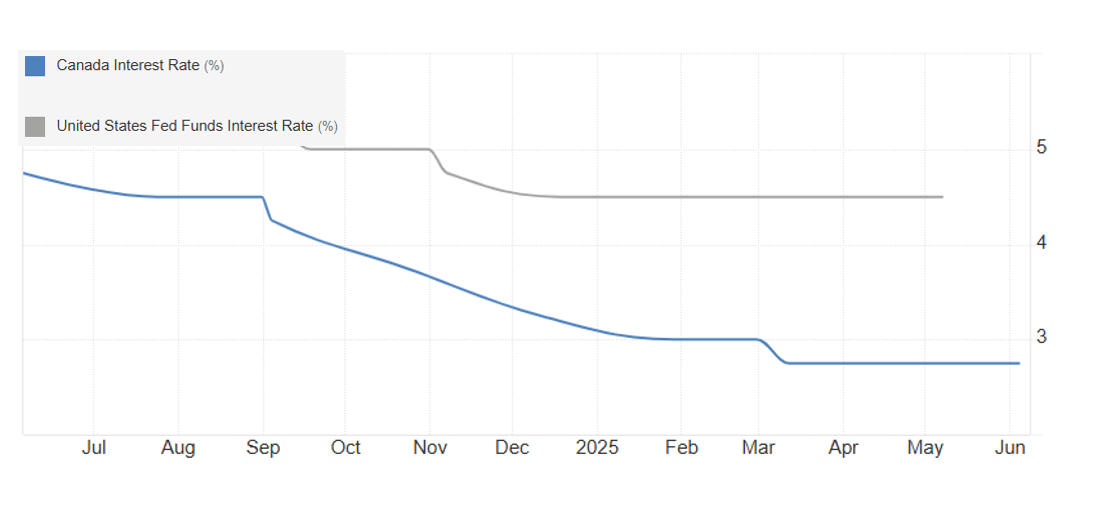

Currently, the U.S. benchmark interest rate stands at 4.5%, while the Bank of Canada (BoC) holds its rate at 2.75%. This 175 basis point gap represents a significant divergence in monetary policy, with no signs of convergence in the short or medium term.

Source: TradingEconomics

While the Fed has maintained a hawkish tone, insisting on keeping rates elevated until inflation moves decisively toward the 2% goal, the BoC has taken a more cautious approach, reflecting structural weaknesses in the Canadian economy.

This rate disparity has direct implications for capital flows. Higher rates in the U.S. tend to attract global investment into dollar-denominated fixed income assets, boosting demand for the greenback. In contrast, lower Canadian rates reduce the appeal of CAD-denominated instruments, limiting capital inflows.

As long as this interest rate gap remains and the Fed stays hawkish, the bullish bias in USD/CAD is likely to strengthen further in the coming weeks.

What’s Going On With the U.S. Dollar?

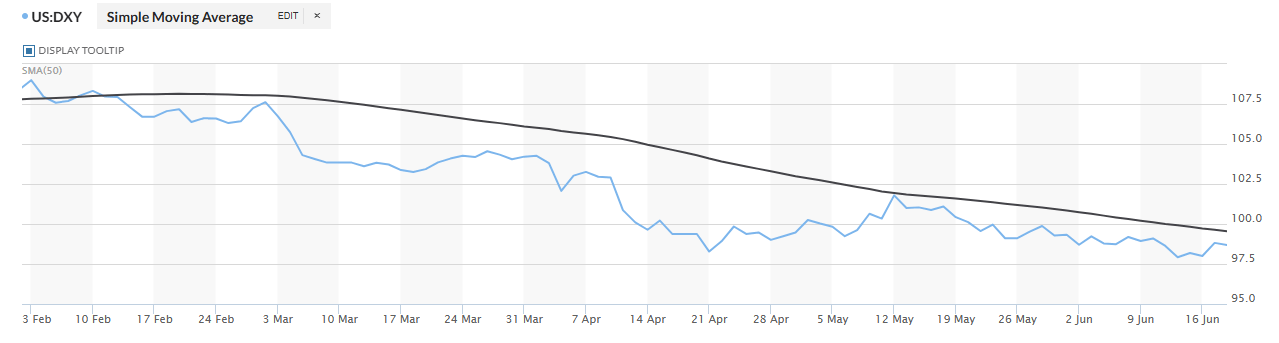

In recent sessions, the DXY index has posted a notable rebound, approaching the 100-point level, after weeks of sustained weakness. This bounce is mainly driven by a shift in market expectations, which now price in higher interest rates for a longer period, amid persistent inflation and the relative resilience of the U.S. economy.

Source: Marketwatch

The dollar has regained some strength, particularly against more sensitive currencies like the Canadian dollar. If the DXY consolidates above the 100-point level, the bullish momentum in USD/CAD could accelerate in the short term.

USD/CAD Technical Outlook

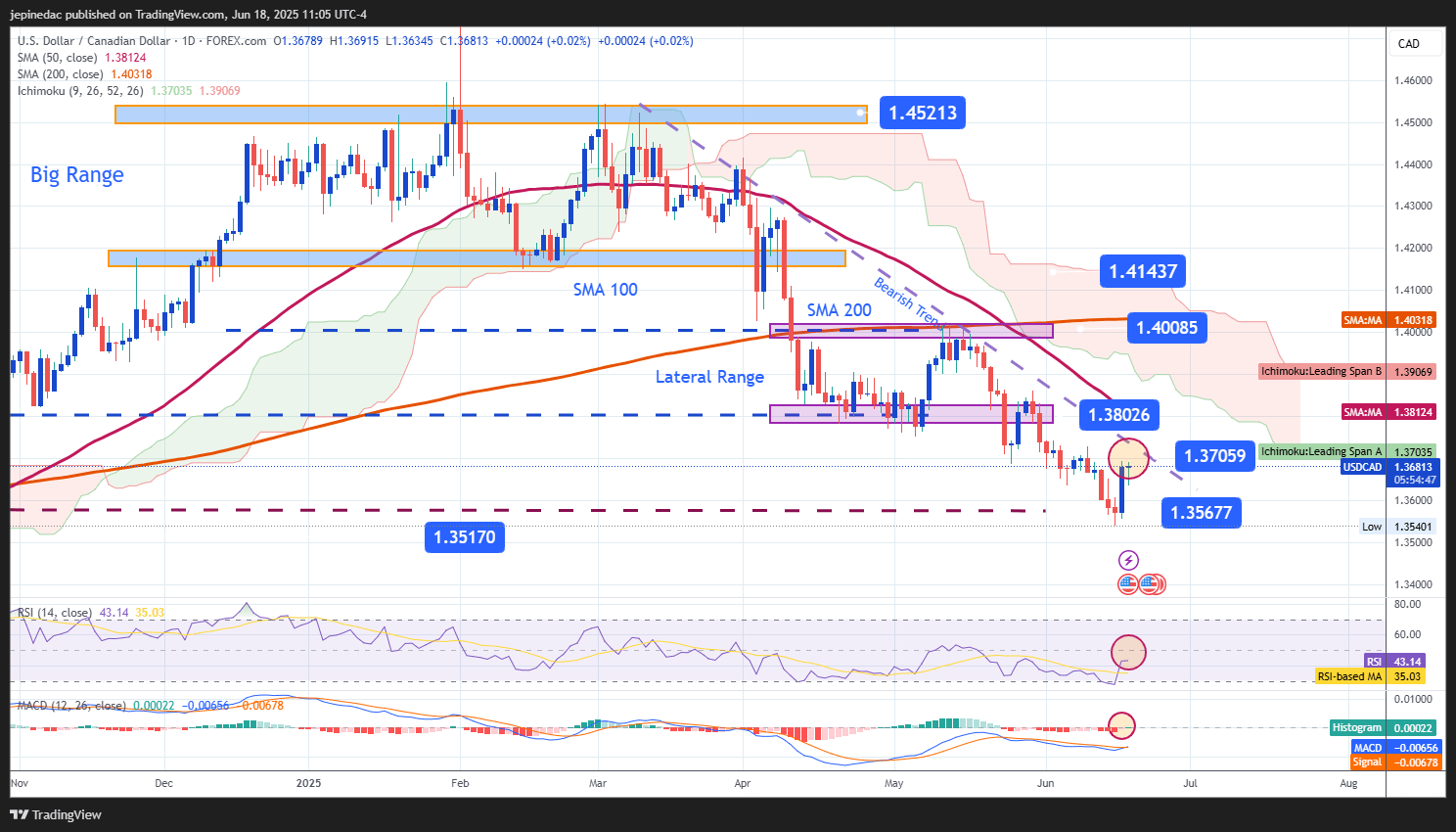

Source: StoneX, Tradingview

- Firm Downtrend: Since March 11, USD/CAD has followed a clear bearish trend. Recent upward corrections have been insufficient to reverse this structure, and price has once again tested the downtrend line. If neutral momentum persists, fresh selling pressure may reemerge in the short term.

- RSI: The Relative Strength Index remains near the neutral 50 level, signaling market equilibrium. This neutral reading suggests that neither side is dominant, and the pair may continue to trade sideways.

- MACD: The MACD histogram is also hovering around the zero line, reinforcing the scenario of technical indecision. Without a clear directional signal, price action could remain range-bound until momentum picks up.

Key Levels to Watch:

- 1.37059 – Current Resistance: Aligns with the downtrend line, which has served as a recurring technical barrier. A failure to break above this level could trigger short-term bearish corrections and reaffirm the broader downward structure.

- 1.38026 – Nearby Resistance: Marks the lower boundary of a previous short-term range and aligns with the 50-period moving average. A confirmed breakout here could shift the momentum bullish and challenge the ongoing downtrend.

- 1.35677 – Key Support: Represents the lowest level in recent weeks, acting as a critical floor. A drop below this point would likely revive bearish momentum, potentially triggering a more extended downward movement.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25