Canadian Dollar Outlook: USD/CAD

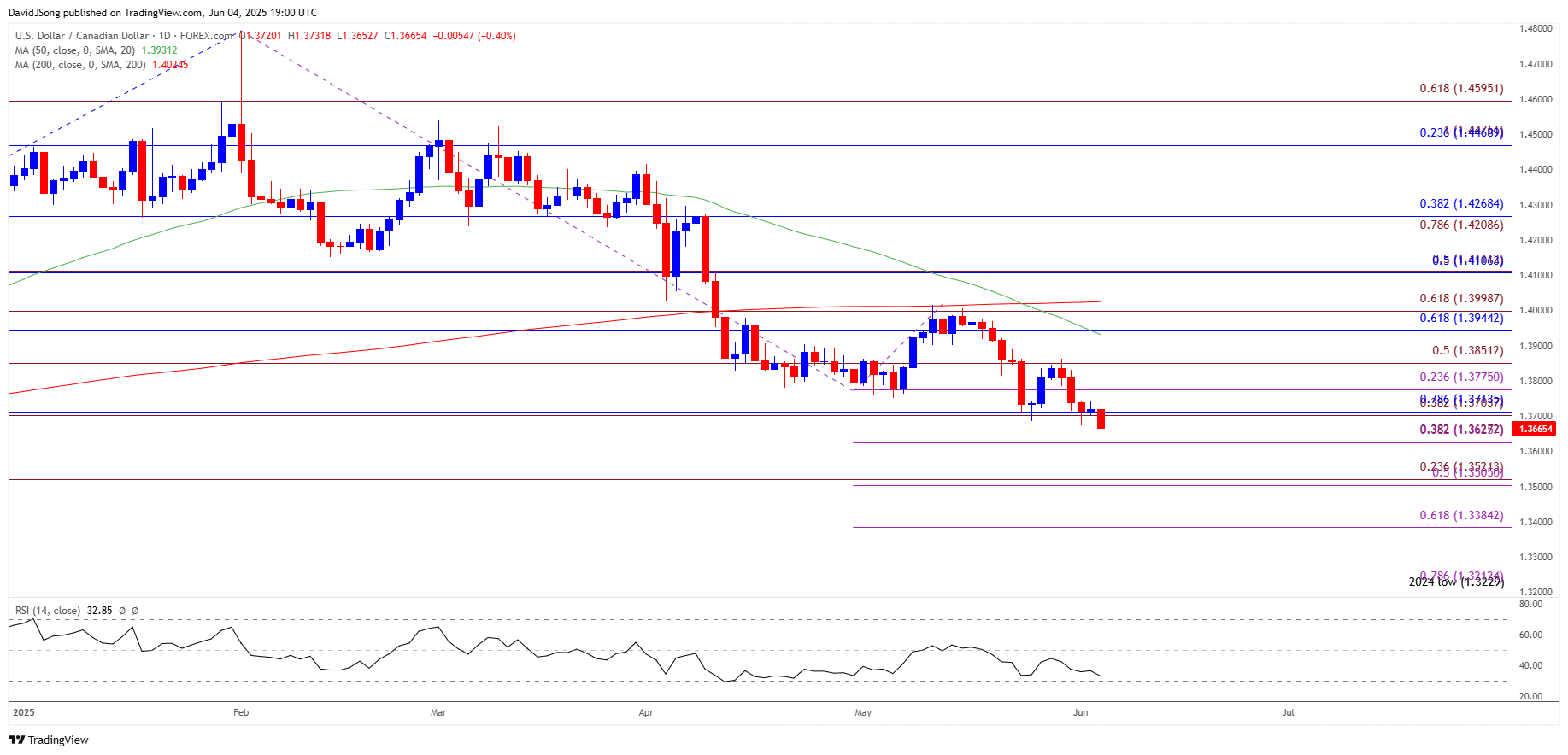

USD/CAD drops to a fresh yearly low (1.3653) as the Bank of Canada (BoC) keeps the benchmark interest rate at 2.75%, and the Relative Strength Index (RSI) may show the bearish momentum gathering pace as it falls toward oversold territory.

Canadian Dollar Forecast: USD/CAD Drops as BoC Stays on Hold

USD/CAD extends the decline from the start of the week as the BoC warns that ‘the Bank’s preferred measures of core inflation, as well as other measures of underlying inflation, moved up,’ and the central bank may stick to the sidelines as Governor Tiff Macklem and Co. pledge to ‘assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, USD may continue to give back the advance from the October low (1.3473) as the BoC appears to be at or nearing the end of its rate-cutting cycle, and a move below 30 in the RSI is likely to be accompanied by a further decline in the exchange rate like the price action from last year.

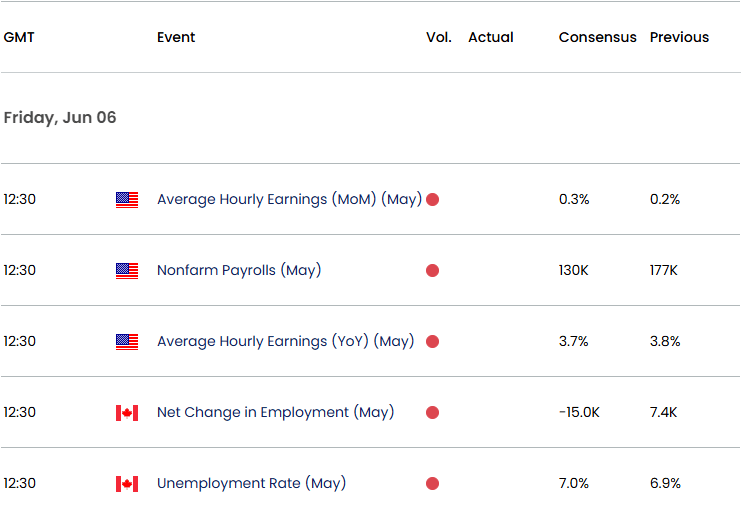

North America Economic Calendar

However, the data prints on tap for later this week may sway USD/CAD as Canada is expected to shed 15.0K jobs in May while the US is anticipated to add 130K jobs during the same period, and indications of a weakening labor market may produce headwinds for the Canadian Dollar as it puts pressure on the BoC to pursue lower interest rates.

With that said, USD/CAD may face increased volatility later this week amid the employment reports coming out of the US and Canada, but the weakness in the exchange rate may persist as it appears to be tracking the negative slope in the 50-Day SMA (1.3931).

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD extends the decline from the start of the week to register a fresh yearly low (1.3653), with a break/close below 1.3630 (38.2% Fibonacci extension) opening up the 1.3510 (50% Fibonacci extension) to 1.3520 (23.6% Fibonacci extension) region.

- Next area of interest comes in around the October low (1.3473), but lack of momentum to break/close below 1.3630 (38.2% Fibonacci extension) may curb the recent decline in USD/CAD.

- Need a move/close above the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) zone to bring 1.3770 (23.6% Fibonacci extension) on the radar, with the next area of interest coming in around 1.3850 (50% Fibonacci extension).

Additional Market Outlooks

US Non-Farm Payrolls (NFP) Report Preview (MAY 2025)

GBP/USD Stuck in Narrow Range amid Failure to Test February 2022 High

US Dollar Forecast: USD/CHF Clears May Low

EUR/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong