Over the past five trading sessions, USD/CAD has depreciated by nearly 1.5% in favor of the Canadian dollar, mainly due to growing market expectations surrounding the upcoming Bank of Canada (BoC) rate decision, along with the recent weakness of the U.S. dollar, which has supported the pair’s ongoing bearish trend. As these factors persist, downward pressure on USD/CAD may become even more pronounced in the short term.

Is Confidence Returning to the Canadian Dollar?

Last week, Canada released its year-over-year trimmed CPI data, which measures April inflation compared to the same month a year earlier. The market expected a 2.8% print, but the actual figure came in at 3.1%, signaling a steady increase in inflation levels.

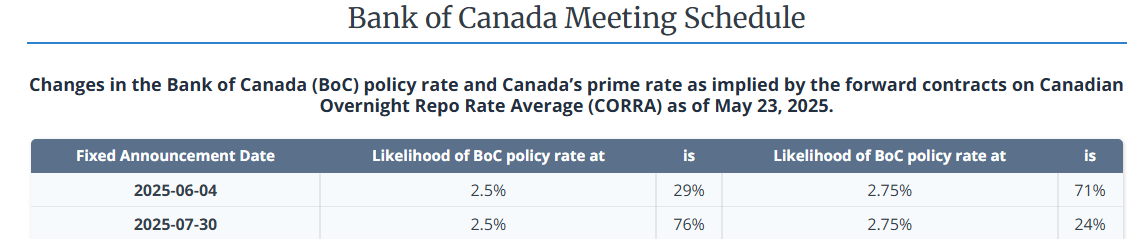

This new data is shifting monetary policy expectations at the BoC, as the inflation rebound leads markets to anticipate a more neutral stance from the central bank. The interest rate probability chart for the upcoming June 4 meeting now shows a 71% chance that the BoC will hold rates at 2.75%, and only a 29% chance of a cut to 2.5%.

Source: Wowa

This more neutral stance appears to be supporting the Canadian dollar, as previous decisions leaned heavily toward rate cuts. In the current inflationary context, the BoC is leaning toward holding the rate steady, which could help sustain returns on CAD-denominated bonds and fixed-income assets. This, in turn, may attract investment into the Canadian dollar, reinforcing selling pressure on USD/CAD.

However, it's important to note that U.S. interest rates remain higher, with the Federal Reserve currently holding rates at 4.5%. If this rate divergence persists, it could make U.S. assets more attractive and drive demand for the dollar in the long term. While current risk factors—particularly the ongoing trade war—have held back demand for U.S. assets, any shift in these conditions could trigger renewed buying pressure on USD/CAD.

What’s Happening with the U.S. Dollar?

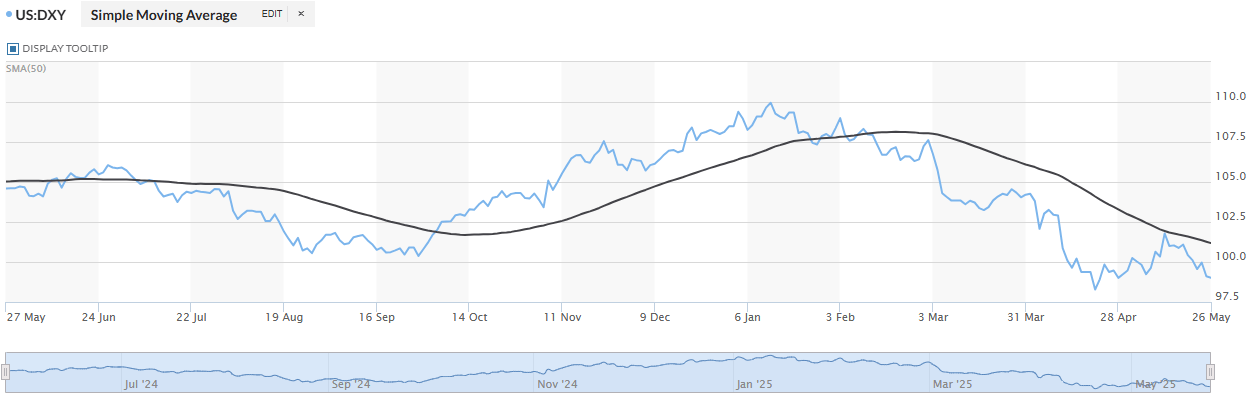

The U.S. dollar continues to weaken in the short term, primarily due to new threats from Trump toward Europe, including a potential 50% tariff hike if ongoing negotiations fail. This has reduced demand for the dollar, and the DXY index, which tracks its strength against a basket of currencies, has declined and now remains below the 100-point level, reflecting a persistent bearish trend.

Source: Marketwatch

This ongoing weakness in the U.S. dollar is currently benefiting the Canadian dollar, as capital flows appear to be moving out of the USD toward other currencies such as the CAD. If this trend continues, selling pressure on USD/CAD could intensify, especially as investors view the Canadian dollar as a temporary safe haven amid U.S. economic and geopolitical uncertainty.

USD/CAD Technical Outlook

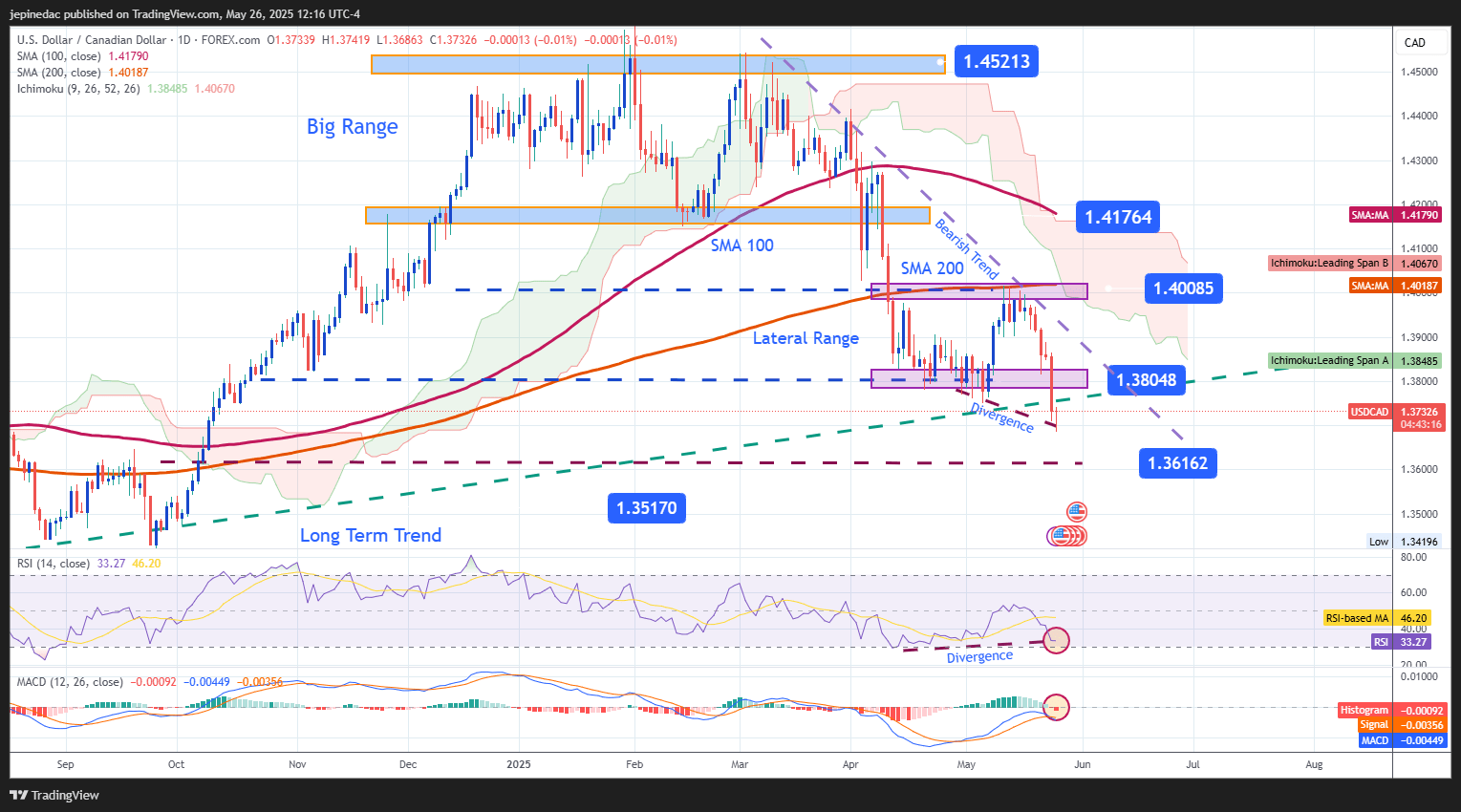

Source: StoneX, Tradingview

- Firm Downtrend: Since March 11, USD/CAD has established a strong bearish trend, with no significant bullish corrections to challenge the structure. However, the recent strength of selling momentum could open the door to short-term technical pullbacks.

- RSI: A bullish divergence is currently forming, as the RSI has posted higher lows while the price has recorded lower lows. This suggests a potential imbalance in market pressure, and that the dominant bearish bias may be overextended, leaving room for technical rebounds.

- MACD: The MACD histogram has returned to negative territory below zero, indicating renewed bearish momentum. However, its current proximity to the zero line also points to a neutral or consolidating scenario, particularly given the support levels currently being tested by USD/CAD.

Key Levels:

- 1.40085 – Distant Resistance: This level aligns with the 200-period simple moving average. A move back to this zone could challenge the prevailing bearish trend and signal a stronger bullish reversal.

- 1.38048 – Near-Term Resistance: Represents a recent zone of indecision, which could act as a technical barrier to upward corrections.

- 1.36162 – Key Support: A level observed in September 2024. A break below this area could pave the way for a more sustained bearish trend in upcoming sessions.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25