Canadian Dollar Outlook: USD/CAD

USD/CAD pulls back from a fresh weekly high (1.4415) with US President Donald Trump on track to impose reciprocal tariffs, and the exchange rate may face increased volatility over the coming days as the shift in US trade policy puts pressure on the Bank of Canada (BoC) to support the economy.

Canadian Dollar Forecast: USD/CAD Rebound Fizzles Ahead of Trump Tariffs

Keep in mind, USD/CAD still trades within the February range as the Trump tariffs cloud the outlook for global growth, and the exchange rate may continue to trade sideways as it appears to be tracking the flattening slope in the 50-Day SMA (1.4338).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Nevertheless, the Canadian Dollar may face headwinds ahead of the BoC meeting on April 16 as the central bank acknowledges that ‘the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest.’

In turn, the BoC may continue to implement lower interest rates in an effort to prevent a recession, but Governor Tiff Macklem and Co. may move to the sidelines as the ‘Governing Council will be carefully assessing the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.’

With that said, developments coming out of the Trump administration may sway USD/CAD as the BoC warns that ‘monetary policy cannot offset the impacts of a trade war,’ but the exchange rate may defend the rebound from the March low (1.4235) as it carves a series of higher highs and lows.

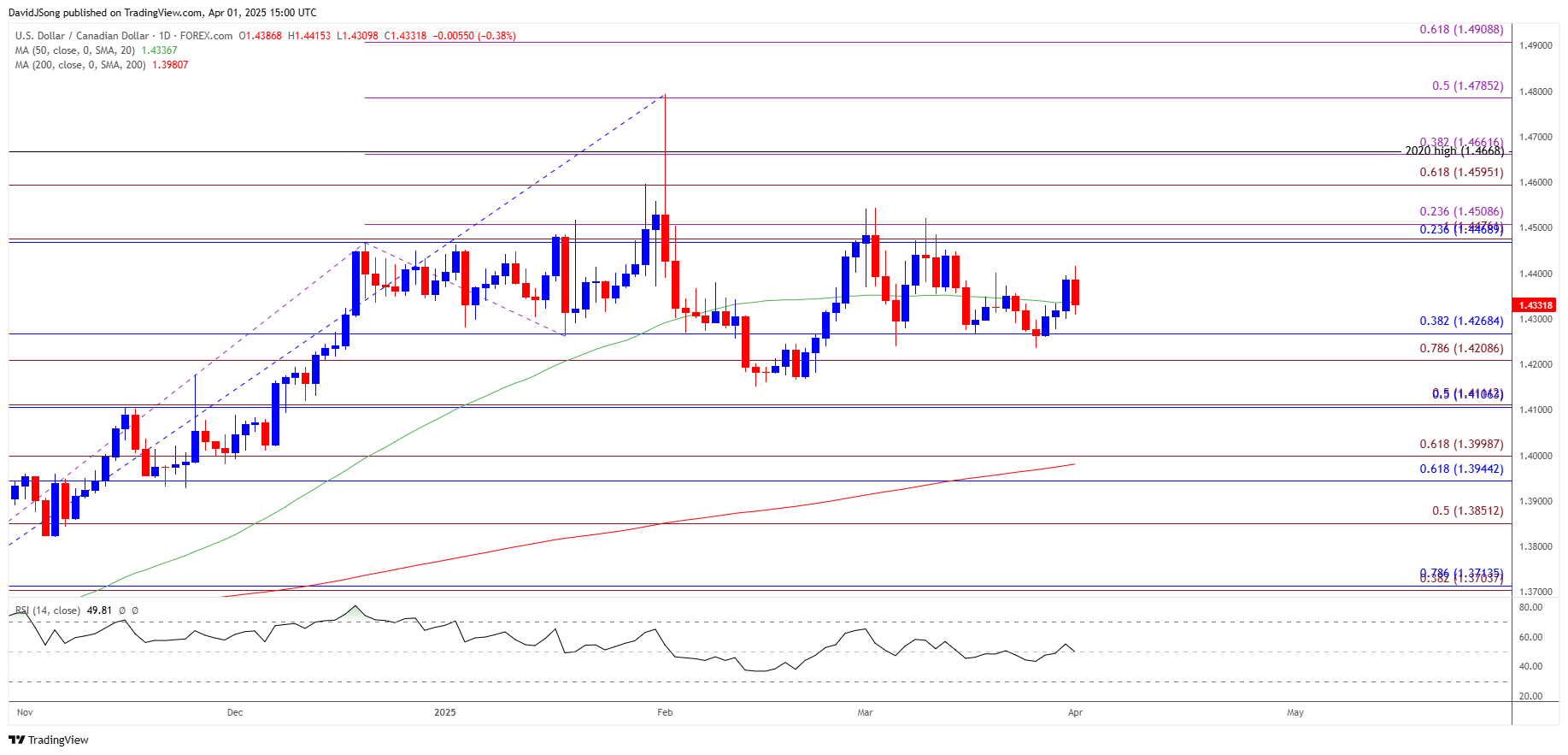

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD extends the rebound from the March low (1.4235) after defending the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement) zone, and a move above the 1.4470 (23.6% Fibonacci retracement) to 1.4510 (23.6% Fibonacci extension) region may lead to a test of the March high (1.4543).

- A break/close above the 1.4600 (61.8% Fibonacci extension) to 1.4660 (38.2% Fibonacci extension) zone opens up 1.4790 (50% Fibonacci extension), but USD/CAD may hold within the February range should it track the flattening slope in the 50-Day SMA (1.4338).

- At the same time, break/close below the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement) zone may push USD/CAD towards the February low (1.4151), with the next area of interest coming in around 1.4110 (50% Fibonacci retracement).

Additional Market Outlooks

British Pound Forecast: GBP/USD Grinds Toward Channel Support

Euro Forecast: EUR/USD Cup-and-Handle Formation Takes Shape

Gold Price Halts Decline from Record High Ahead of Trump Tariffs

Australian Dollar Forecast: AUD/USD Coils Ahead of RBA Rate Decision

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong