Canadian Dollar Outlook: USD/CAD

USD/CAD falls from a fresh weekly high (1.3862) as the US Court of International Trade blocks the tariffs imposed by the Trump administration, and the exchange rate may track the negative slope in the 50-Day SMA (1.3978) as it holds below the moving average.

Canadian Dollar Forecast: USD/CAD Snaps Rebound from May Low

Keep in mind, the recent recovery in USD/CAD kept the Relative Strength Index (RSI) out of oversold territory, but the exchange rate may continue to give back the rebound from the monthly low (1.3686) as it snaps the series of higher highs and lows from the start of the week.

Canada Economic Calendar

Looking ahead, the Bank of Canada (BoC) interest rate decision may sway USD/CAD should the central bank stick to the sidelines, and central bank may retain a wait-and-see approach as the ‘Governing Council will proceed carefully, with particular attention to the risks and uncertainties facing the Canadian economy.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, more of the same from Governor Tiff Macklem and Co. may fuel the recent weakness in USD/CAD as the BoC appears to be at or nearing the end of its rate-cutting cycle, but the Canadian Dollar may face headwinds should the central bank prepare households and businesses for lower interest rates.

With that said, the BoC rate decision may influence the near-term outlook for USD/CAD as it struggles to extend the rebound from the monthly low (1.3686), with the opening range for June in focus as the exchange rate snaps the bullish price action from earlier this week.

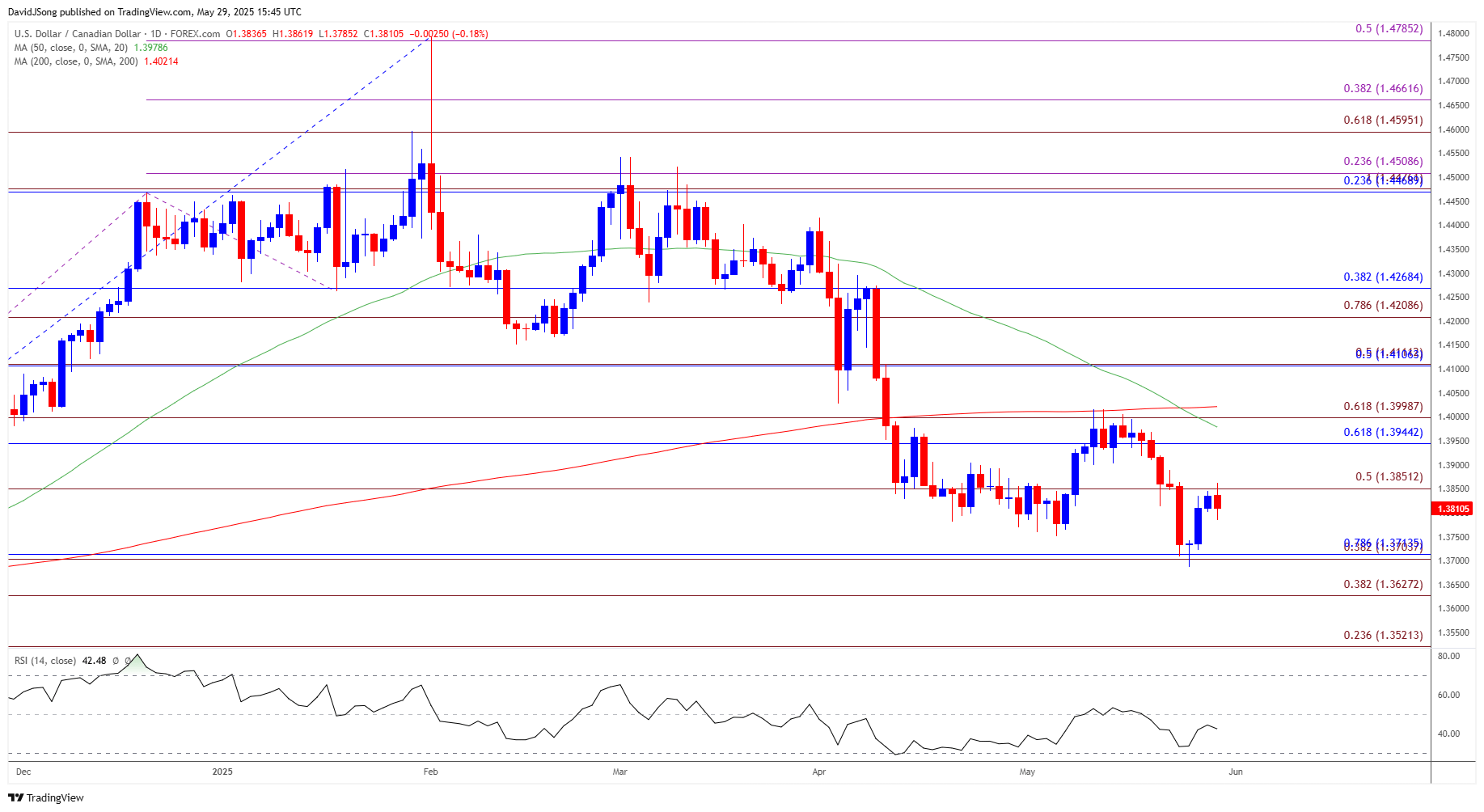

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD falls from fresh weekly high (1.3862) to snap the recent series of higher highs and lows, and lack of momentum to hold above the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region may lead to a test of the monthly low (1.3686).

- Need a break/close below 1.3630 (38.2% Fibonacci extension) to bring 1.3520 (23.6% Fibonacci extension) on the radar, but USD/CAD hold within the May range should it continue to close above the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region.

- Need a move/close above 1.3850 (50% Fibonacci extension) to bring the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone on the radar, with the next area of interest coming in around the monthly high (1.4017).

Additional Market Outlooks

GBP/USD Holds Below February 2022 High for Now

Gold Price Falls as Trump Delays EU Tariff

USD/JPY Approaches Monthly Low as Trump Plans 50% Tariff for Europe

Australian Dollar Forecast: AUD/USD Struggles Following RBA Rate Cut

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong