Canadian Dollar, USD/CAD Talking Points:

- USD/CAD sank quickly along with the US Dollar in early-April, but for the past three weeks has largely held around a key support level of 1.3846.

- The bigger picture range remains of interest in the pair, but the big question now is whether sellers can re-take control after a few weeks of stalling. USD/CAD has been a touch weaker than the USD (via DXY) over this period so the pair could remain as an attractive venue for USD-weakness scenarios. From the daily chart, there’s a case of RSI divergence which denotes pullback potential, but also a descending triangle which illustrates the possibility of bearish breakdowns.

- I look into USD/CAD at the weekly price action webinar and you’re welcome to join the next one. Click here for registration information.

As we wind towards the close of what’s been a brutal April for both the U.S. Dollar and USD/CAD, it’s important to delineate how that pain priced in. It was largely relegated to the first week and a half of the month as both the pair and the USD dropped precipitously, driven by recession fears that accompanied a heavy sell-off in U.S. equities.

For the past few weeks, however, a different tone has emerged although it hasn’t been a stark contrast in the currency market. Trump backing off tariffs for everyone but China has certainly helped to prod an equity recovery, but still, there’s fear of a recession in the U.S. and we’re coming into some data now that could push the focus back on to that theme. In the U.S. Dollar, the sell-off has largely stalled-out as price continues to test the same support from earlier in the month.

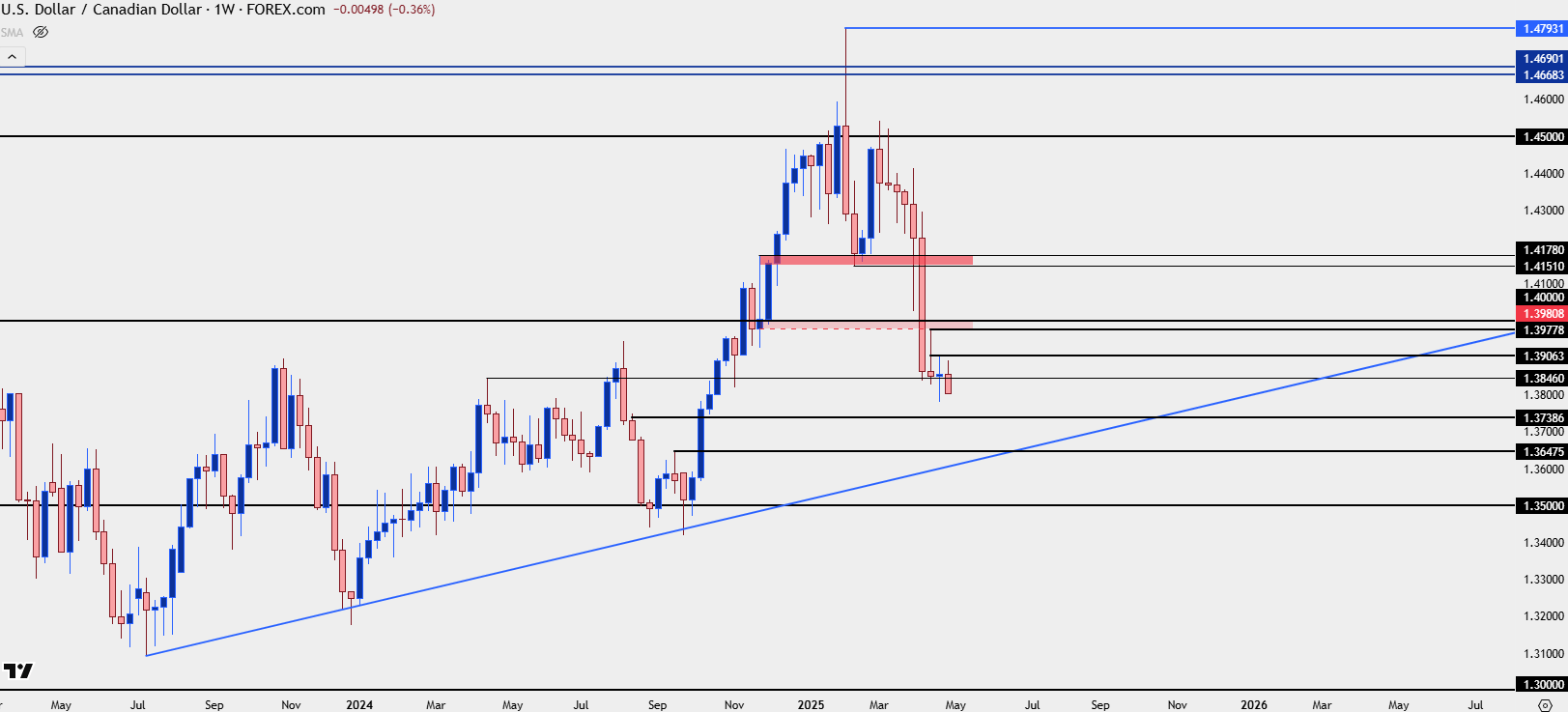

In USD/CAD, there’s been a similar sense of stall although sellers have pushed a bit more, which can be seen in this week’s weekly bar which also shows a fourth consecutive lower-high.

USD/CAD Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

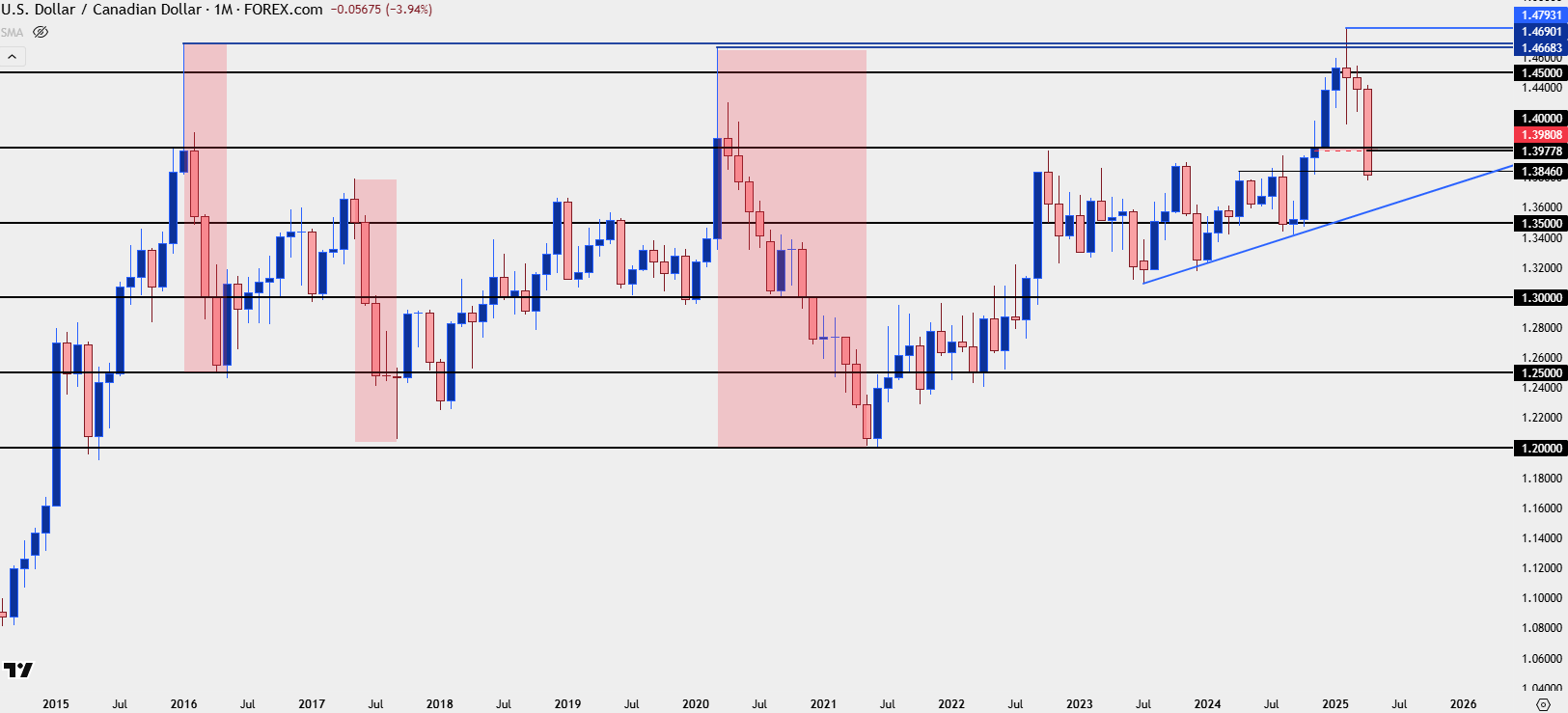

USD/CAD Bigger Picture: The Attraction

The attraction to short-side themes in USD/CAD can be dialed back to the longer-term look in the pair, which has been range-bound for more than the past nine years. There’s also a lot of distance in that range, as support has tended to show around the 1.2000 handle in the pair with the 1.3000 level acting as a form of mid-line to go along with the 1.4000 resistance.

I’ve been talking about this theme even before the USD/CAD top printed in early-February, and then after bulls failed to hold the move, it looked more and more like a top was possibly in-place for the pair.

But it was the breach of the 1.4000 handle earlier in April that gave the look that sellers were taking over; and so far, that price has even remained defended as sellers haven’t allowed for a show of resistance at the big figure.

USD/CAD Monthly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

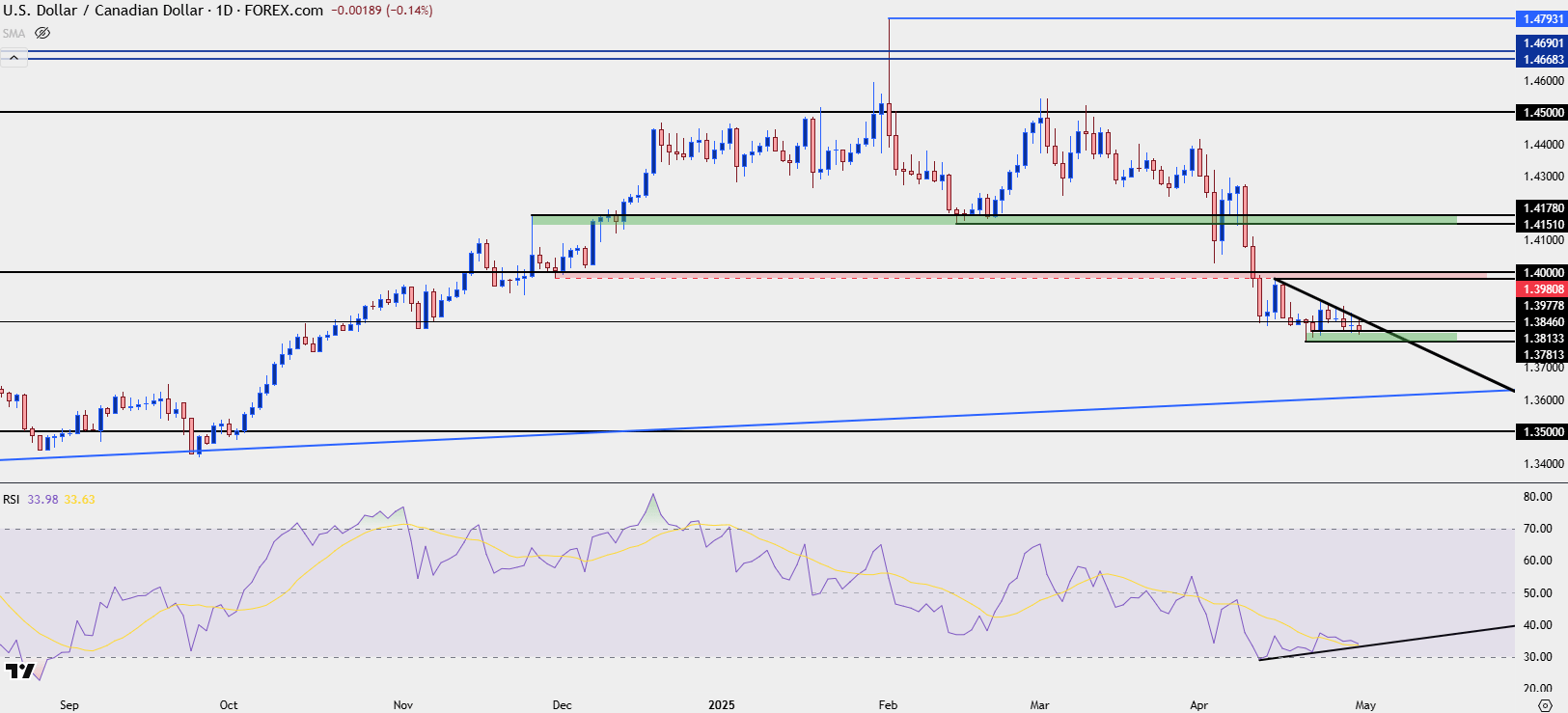

USD/CAD Shorter-Term

At this point USD/CAD weakness remains an attractive theme and given the comparison between DXY and USD/CAD charts, the pair would remain as one of the more attractive major pairs to work with continued USD-weakness.

The challenge, however, is that the USD move is already oversold on the weekly chart and USD/CAD bears, despite the open door to run to fresh lows, haven’t yet been able to do so. From the daily chart, we can even see a case of RSI divergence showing which indicates pullback potential. It’s not a clear-cut bullish case, however, as there’s a descending triangle formation which is often approached with aim of bearish breakdown potential, as lower-highs meet horizontal support.

The bigger question here is whether a breakdown would be able to hold and the answer to that will likely derive from whether the USD can continue to sell-off on its own, and given the Friday NFP report and next week’s FOMC rate decision, that potential is there.

For USD bears the backdrop in USD/CAD remains attractive; and that can span from short, intermediate and longer terms. As discussed in the webinar yesterday, a larger USD pullback scenario, to around 102.00 in DXY, could still be viable for bearish continuation. In that backdrop, resistance in USD/CAD around prior support at 1.4151-1.4178 would be an area of note for sellers to respond to.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist