Canadian Dollar Forecast: USD/CAD Rally on Fed, BoC Rate Cuts

USD/CAD has rallied through rate cuts from the Fed and BoC, and the pair remains one of the more attractive major FX markets for USD-strength scenarios.

For the best browsing experience, please rotate your phone to portrait mode

USD/CAD has rallied through rate cuts from the Fed and BoC, and the pair remains one of the more attractive major FX markets for USD-strength scenarios.

It’s been a bullish reaction in the USD to yesterday’s rate cut from the Fed, and this bears some resemblance to last year, when the currency initially pressed into a fresh yearly low on news of the cut, only to rally during the press conference. For last year’s scenario, however, the currency remained near those lows for about two weeks before ultimately reversing and that USD rally ran through Q4 trade and into the 2025 open.

For the current instance, USD-strength has shown a bit more prominently with another push-higher this morning after the release of jobless claims data. And this has helped to further the recovery in USD/CAD following the pullback that ran into the start of this week.

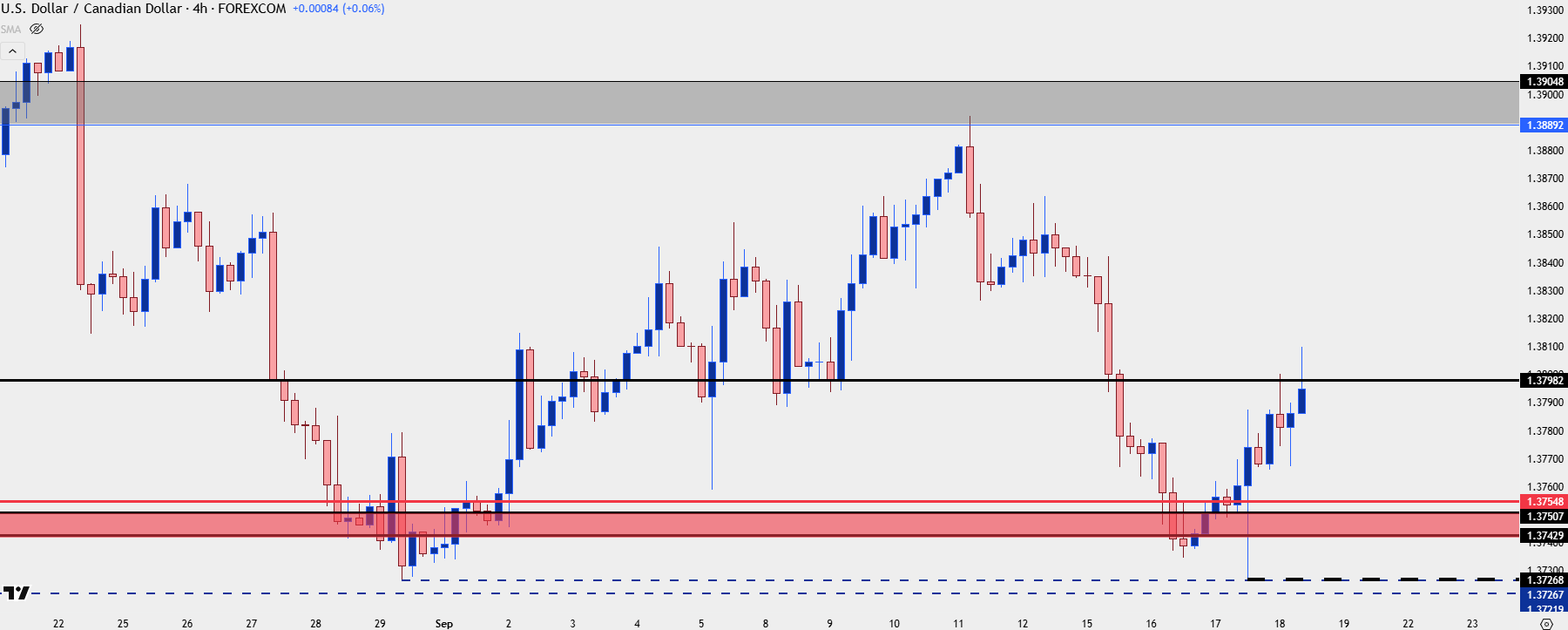

I looked into the pair in the Tuesday webinar, highlighting that support test as it was taking place at a key zone. The 1.3750 area was resistance in June and July after showing as support in May; and more recently, it’s been in as support following the break of an ascending triangle formation. The item focused on was where exactly bulls would show up to hold the lows, and whether that took place above the prior higher-low that had printed in late-August of 1.3626(7). Well, so far that higher low has held at 1.3626(8), or one-tenth of a pip above the prior higher-low, which shows some element of bullish anticipation remaining in the pair that has, so far, led to a rally back above the bigger picture support zone.

USD/CAD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Despite the fresh three-year-low that printed in the USD briefly after the announcement of yesterday’s rate cut, USD/CAD continues to hold bullish structure as shown from the support zone taken from prior resistance, along with the shorter-term observation above of a higher-low holding above the prior test of that support zone.

This sets USD/CAD up as one of the more attractive major pairs for traders looking for USD-strength, and conversely, for those trying to avoid the USD, the Canadian Dollar weakness shown over the past couple of months could potentially be used elsewhere, in a pair with a relatively strong currency such as EUR/CAD or GBP/CAD.

In USD/CAD, the spot that bulls need to take out to illustrate greater control than simply a stall in the broader sell-off is the 1.3900 zone, which has held resistance twice over the past month, most recently last Thursday. Above that is a contentious zone, the same that was setting resistance back in May at the 1.4000 handle.

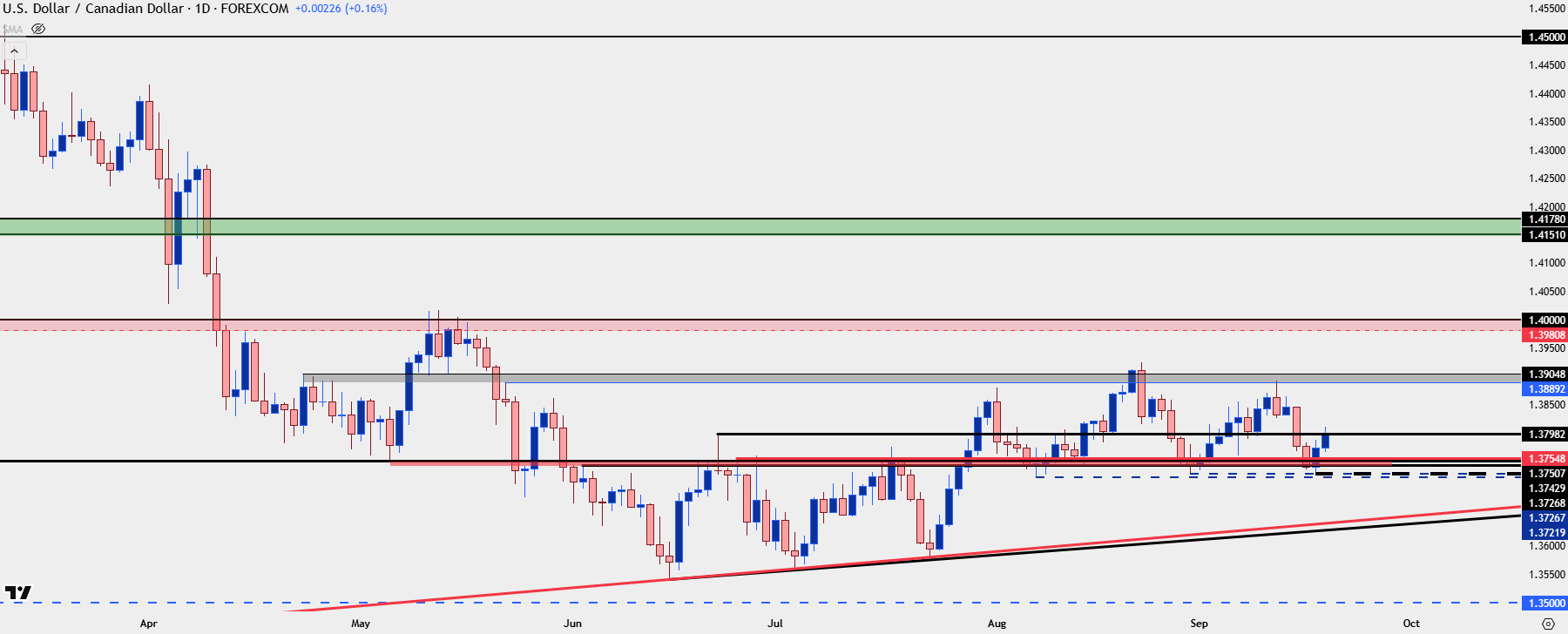

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

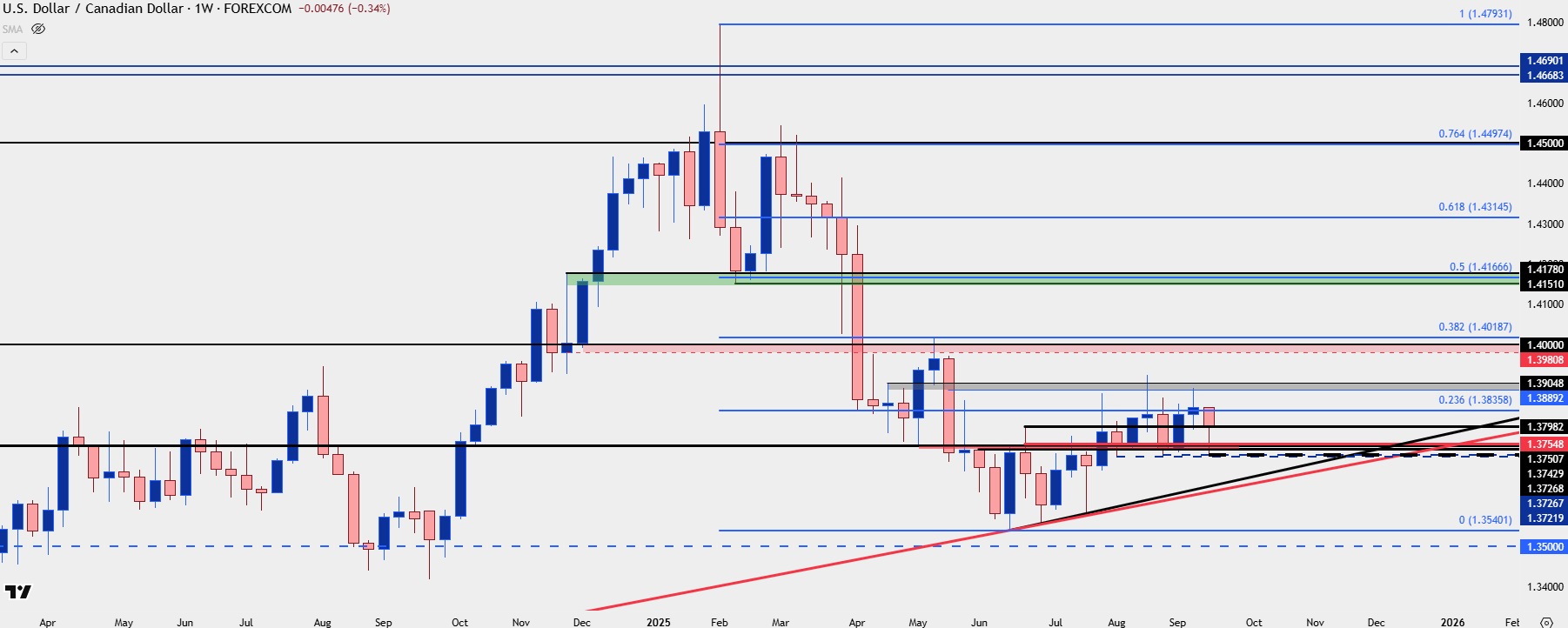

I think the bigger picture look in USD/CAD is worth of mention here, as it helps to highlight where exactly the pair is in terms of the broader sell-off that took over in the first half of this year. At this point, the 23.% retracement of that move has continued to show as short-term resistance, and this highlights how a larger move of USD-strength could carry significant potential should the recovery in the pair continue.

The 38.2% retracement of that move aligns with the swing-high from May, which is also around that 1.4000 spot that saw ardent defense from sellers. And then above that, the 50% mark of this year’s sell-off is right within the zone of prior resistance-turned-support, spanning from 1.4151-1.4178.

If that zone comes into play in Q4, it becomes a significant decision point for the pair; but for now, bulls have to show strength around highs to exhibit greater control of the trend. Because to this point, that bullish lean has been largely deductive with holds of support at prior resistance.

USD/CAD Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist