Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- USD/CAD plunges nearly 6.9% off yearly high- rebounds off trend support at five-month lows

- USD/CAD weekly range-breakout pending- U.S. Core PCE / NFPs on tap

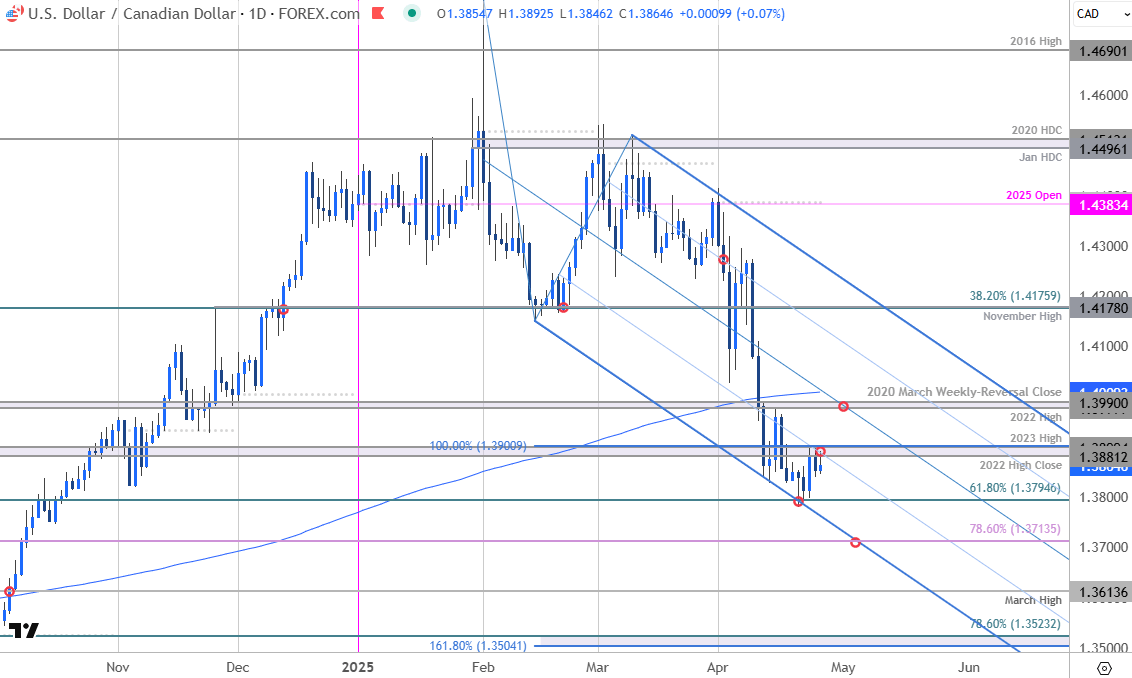

- Resistance 1.3881-1.39, 1.3978-1.4009 (key), 1.4176/78- Support 1.3795 (key), 1.3714, 1.3614

The US Dollar snapped a seven-week losing streak against the Canadian Dollar with USD/CAD rebounding off technical support at five-month lows. The focus now shifts to a breakout of the weekly range with the bears vulnerable into the close of the month. Battle lines drawn on the USD/CAD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: USD/CAD plunged into downtrend support on Monday with prices holding a well-defined range into the close of the week. The immediate focus is on a breakout of this range with daily momentum divergence suggesting the yearly downtrend may be vulnerable while above slope support. Looking for possible price inflection off these lows.

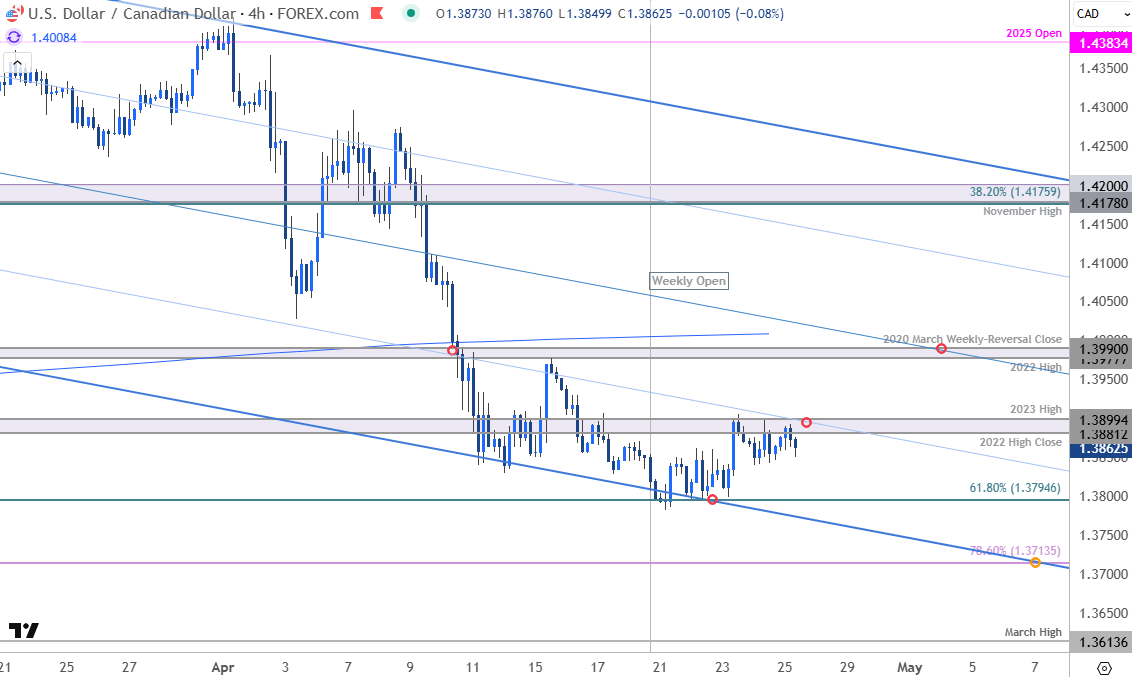

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows USD/CAD trading into the lower parallel of the descending pitchfork extending off the yearly highs. The weekly opening-range remains intact, and the immediate focus is on a breakout here for near-term guidance.

Initial resistance is eyed at the 2022 high-close / 2023 high at 1.3881-1.39 and is backed by a more significant technical confluence near 1.3978-1.4009- a region defined by the 2022 high, the 2020 March weekly reversal close, and the 200-day moving average. Ultimately, a topside breach / close above the median-line would be needed to suggest a more significant low is in place / a larger reversal is underway.

Initial support rests with the 61.8% retracement of the late 2023 advance at 1.3795 – a break / close below this threshold would mark downtrend resumption towards lower parallel / 78.6% retracement of the September advance at 1.3714 and the March 2024 high at 1.3614. The next major technical consideration rests with the 1.618% extension / 78.6% retracement at 1.3504/23.

Bottom line: USD/CAD is in a near-term range just above downtrend support- the immediate focus is on a breakout. From a trading standpoint, rallies would need to be limited to the 200-day moving average IF price is heading lower on this stretch with a close below 1.3795 needed to mark resumption.

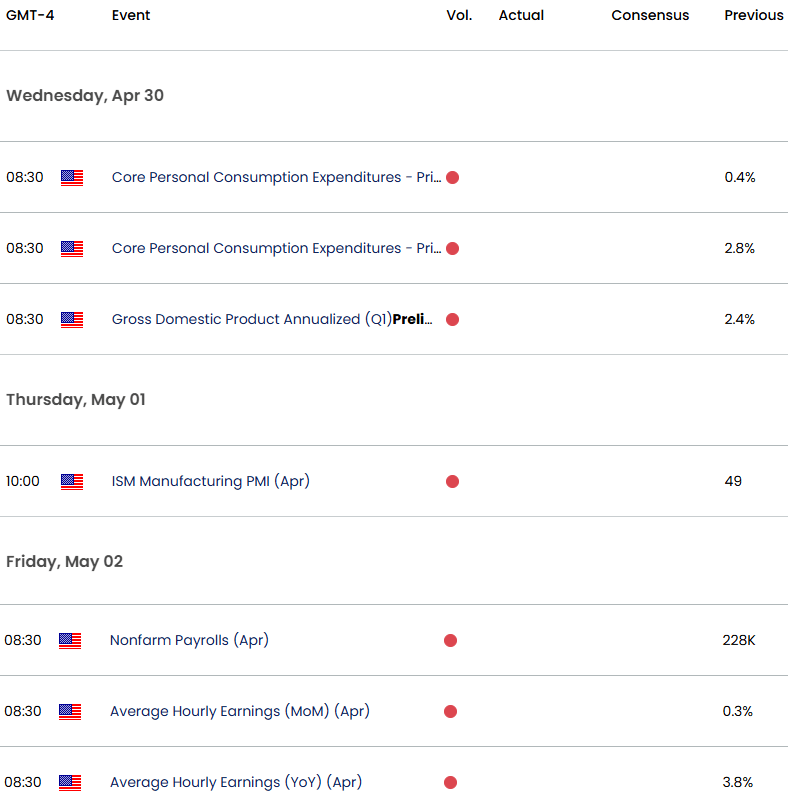

Keep in mind we get the release of key U.S. inflation data (Core PCE) and Non-Farm Payrolls next week into the monthly cross. Stay nimble into the releases and watch the weekly closes here for guidance. Review my latest Canadian Dollar Weekly Technical Forecast for a closer look at the longer-term USD/CAD trade levels.

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex