View related analysis:

- Nasdaq 100, S&P 500 Forecast: Bring Your Quarter to the Slaughter?

- If Consumers Don’t Consume, a Recession Could be Presumed

- EUR/USD, GBP/USD Diverge, Wall Street Whacked on Trump Tariffs

To say markets were volatile on Thursday following the confirmation of Trump’s tariffs on Liberation Day would be quite an understatement.

The Dow Jones, Nasdaq 100 and S&P 500 had their most bearish day since the pandemic at around -5% on the day. The fact that the Dow was hit has hard as the Nasdaq, an index arguably more in line with Trump’s ‘America First’ policies, shows what traders think the level of tariffs and their expected impact on the US economy.

I had noted earlier this week that Q1 was the worst quarter for Wall Street in 11 quarters. And just four days into Q2, it looks like Wall Street wants to exceed that record, particularly via the Nasdaq.

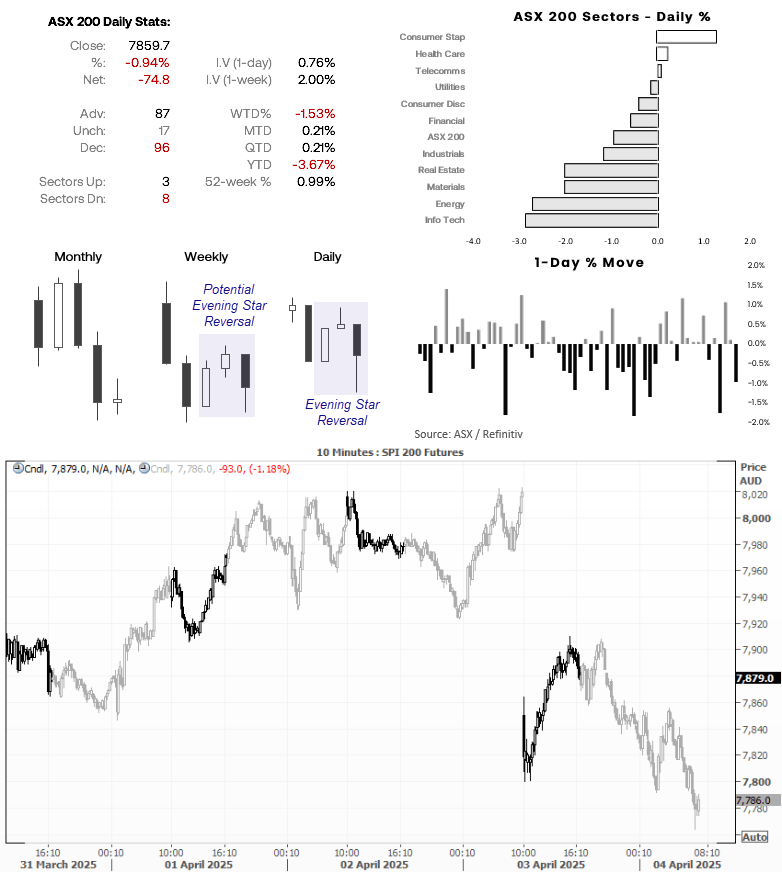

APAC indices weren't spared the fallout either, with the Nikkei 225 down -5.5% and on track for its worst week since September. ASX 200 futures (SPI 200) were only down -1.1% overnight, but there's a reasonable chance we could see a bearish follow-through today and it reach a 7-month low.

Gold Fingers Got Burned

Gold futures finally saw the volatile shakeout I had been expecting around 3,000, with losses in the stock market likely forcing portfolio managers to liquidate gold bets to cover costs. Its -1.4% loss may not seem like much, but its high to low range spanned 4% to mark its most volatile day's trade since June. And given it occurred at a record high, it is likely a sufficient amount of volatility to make traders question their appetite for future gains and cap gains for the foreseeable future.

CHF and JPY Volatility Rudely Awoken From Its Lull

Forex traders were tagging the slew of tariff headlines with stride, with even commodity pairs such as AUD/USD, NZD/USD, and USD/CAD mostly looking past the headlines. Right up until yesterday.

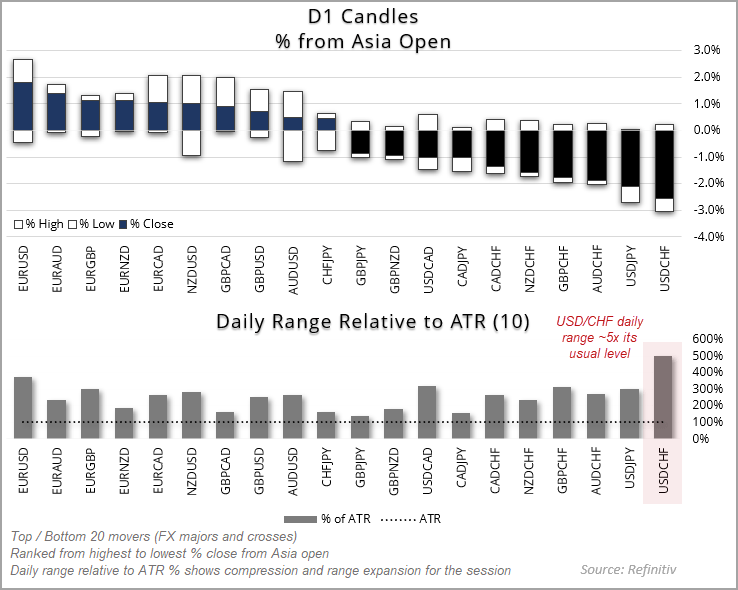

- The USD suffered its most volatile and bearish day since November and now sits at its lowest point since October.

- EUR/USD rallied 2% and briefly traded above 1.11, GBP/USD closed above 1.31 and, like EUR/USD, also sits at its highest level since October.

- The Australian dollar looked past its relatively small 10% tariff and rose 1%

- As did the Canadian dollar, which saw USD/CAD fall to its lowest level since December during its worst day since January

- NZD/USD also rallied despite expectations for the RBNZ to cut in April and continue easing beyond it

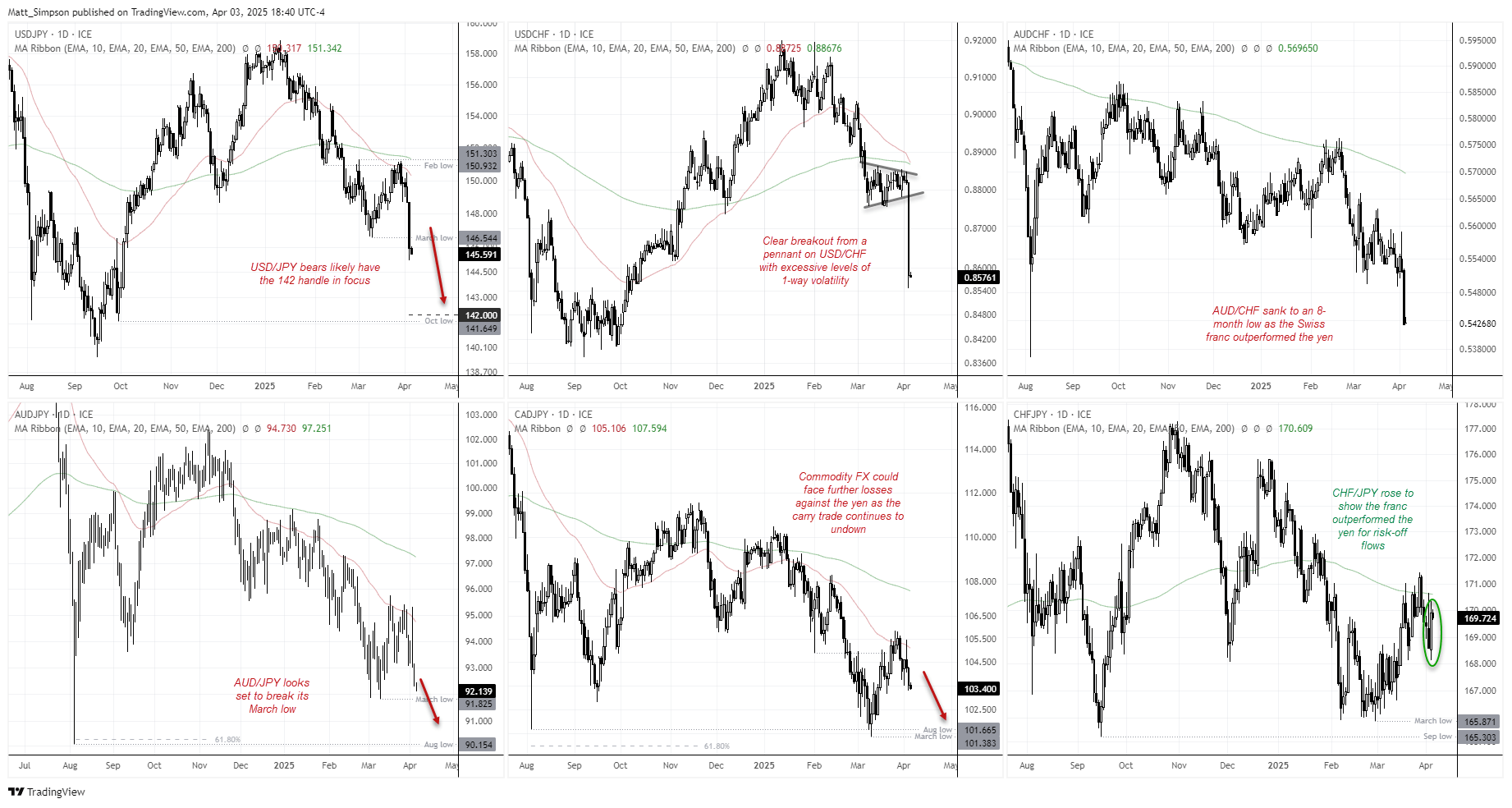

Naturally, the Swiss franc and Japanese yen were the strongest FX majors on Thursday as they benefited from safe haven slows. But the fact that CHF/JPY was up 0.8% on the day and rose against all other peers shows that the Swiss franc is the preferred vehicle for the safety play over the yen under current conditions. We know that the BOJ are not fans of a volatile currency, and such turbulence across global markets is another reason to be wary of imminent BOJ hikes.

USD/CHF won the price for most volatile FX major pair, chalking up a daily range of nearly 5 times its usual level, falling as much as 3% on the day. For perspective, this is the worst day for USD/CHF since June 2022, and nearly its most bearish day since January 2015 when the SNB removed their currency peg to the euro.

Economic events in focus (AEDT)

- 10:30 – Japanese household spending

- 19:30 – UK Construction PMI (Final)

- 23:30 – US Nonfarm Payrolls, Unemployment, Hourly Earnings (March)

- 23:30 – Canadian Employment, Unemployment, Hourly Earnings

- 02:25 – Fed Chair Powell Speaks

- 03:45 – Fed Waller Speaks

ASX 200 at a glance

- One could argue the ASX 200 held up well on Thursday by closing the day only 1% lower.

- However, ASX 200 futures (SPI 200) were down another 1.2% overnight as the bloodbath on Wall Street took hold.

- The ASX 200 cash market had already closed the day with an evening star pattern (3-bar bearish reversal), and prices are expected to open beneath Thursday’s low today.

- Unless Trump does a complete reversal on tariffs (extremely unlikely), the ASX 200 weekly chart appears poised to also close with an evening star reversal.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge