- AUD/USD and NZD/USD broke higher, but sustained gains may hinge on USD/CNH weakness.

- USD/CNH is coiling within a falling wedge, testing key support near 7.2130.

- A clean break lower could fuel further upside in the Aussie and Kiwi.

- Momentum signals remain mixed, keeping the FX stalemate intact—for now.

Summary

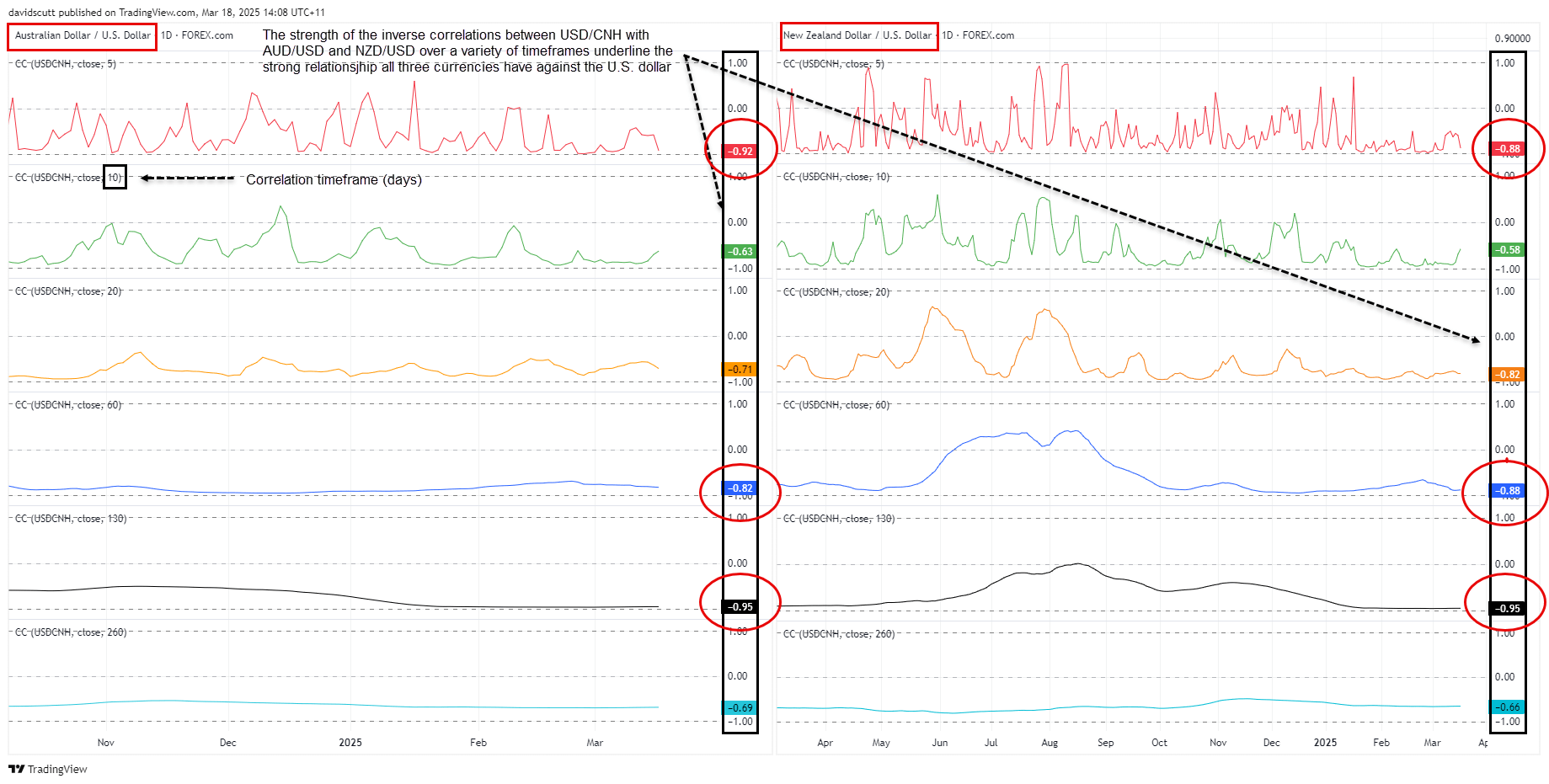

AUD/USD and NZD/USD delivered strong bullish breaks on Monday, adding to a solid session for cyclical assets across FX, equities, and some commodities. While this could mark the start of a broader bullish trend, a more convincing case for the Aussie and Kiwi would come with downside in USD/CNH.

USD/CNH Holds the Key

Source: TradingView

As the chart above shows, the inverse correlation between USD/CNH and AUD/USD, NZD/USD is consistently strong—ranging from relatively high to nearly perfect across various timeframes from one week to one year. This suggests that for the bullish breakout in AUD and NZD to extend, the renminbi may need to rip.

USD/CNH Teeters on Support Zone

Source: TradingView

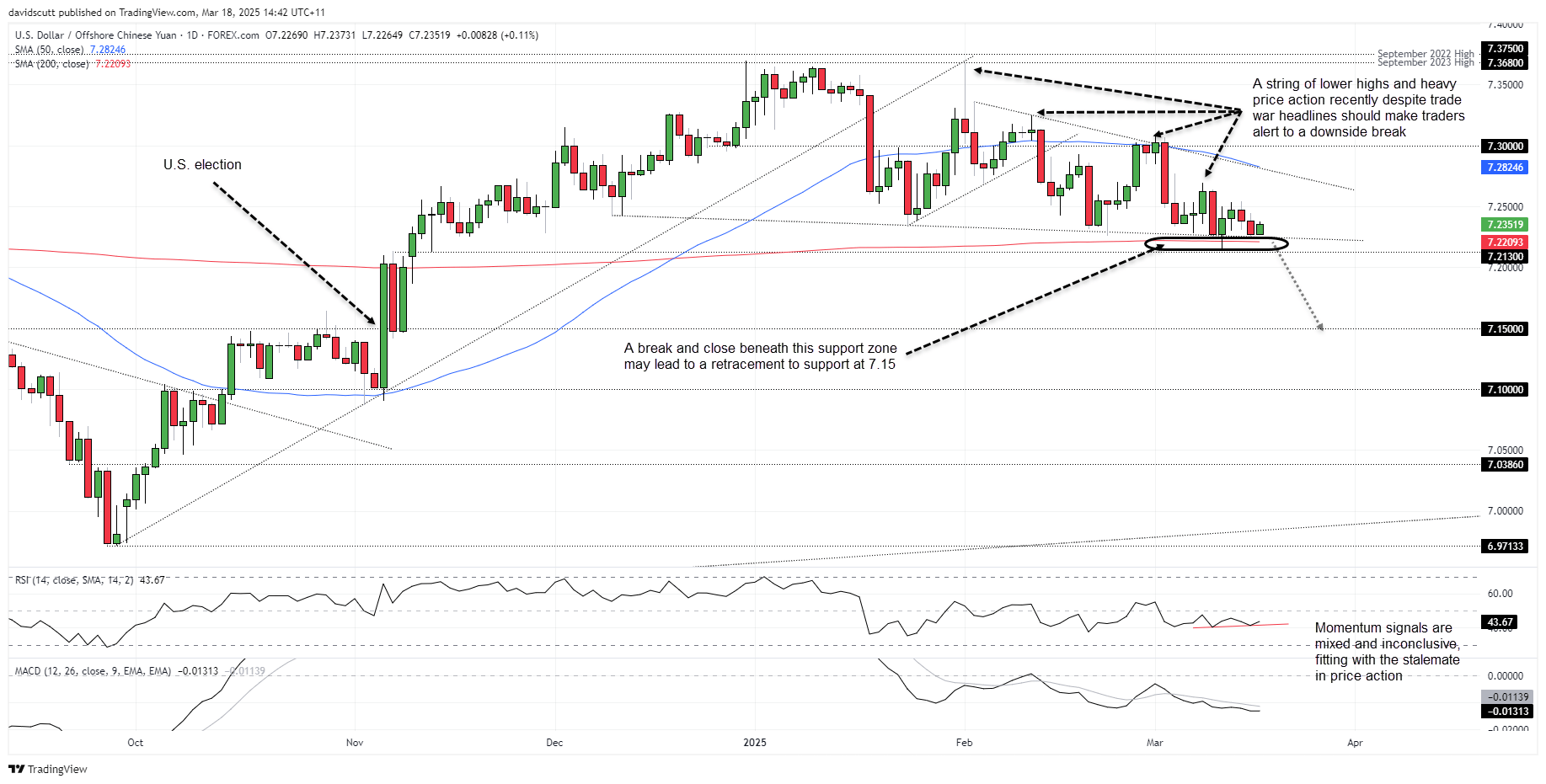

Despite volatility and uncertainty generated by the trade war, USD/CNH has been grinding lower in early 2025, coiling within a gradual falling wedge. More recently, it has struggled to bounce from a key zone consisting of wedge support, the 200DMA, and 7.2130—a minor level that acted as support and resistance after the U.S. election in November 2024.

This zone is crucial for assessing directional risks in AUD/USD and NZD/USD. A clean break and close beneath it could open the door for a move towards 7.1500, where USD/CNH was repeatedly capped before the election.

Despite broad USD weakness against other majors, that hasn’t translated into meaningful downside in USD/CNH. The only bearish probe into the zone on March 12 was quickly reversed. Momentum indicators remain mixed—RSI (14) has marginally diverged from price in recent weeks, countering the bearish signal from MACD.

It’s a real stalemate, likely limiting upside in AUD and NZD against the USD and other majors. But when the deadlock eventually breaks—whether through a break of support or another push higher towards strong resistance above 7.3680—AUD/USD and NZD/USD are likely to move in the opposite direction.

-- Written by David Scutt

Follow David on Twitter @scutty