WTI crude has recovered by nearly 4% over the past three trading sessions, approaching the $64 per barrel level. The short-term bullish bias has remained firm despite recent OPEC+ production announcements, suggesting that ongoing concerns about the escalation of the war in Ukraine continue to support higher oil prices.

What Is OPEC+ Planning?

In recent days, OPEC+ announced a production increase of 411,000 barrels per day starting in July, marking the third consecutive month of planned output hikes. The goal is to bring back a total of 2.2 million barrels per day to the market, compensating for the production cuts that had been in place for previous years.

However, this latest increase has been interpreted as less aggressive than expected, since the organization indicated that future increases would be approached more cautiously, with a focus on stabilizing prices in the short term. This tone has acted as a key catalyst, as markets were expecting more substantial hikes. The recent comments highlighted OPEC+’s intention to maintain stability, which has helped support the current upward momentum.

In this context, if OPEC+ refrains from more aggressive production increases, it could indicate that the group is not aiming to push prices down, but rather to stabilize the market, as long as demand remains steady and is not impacted by trade tensions. This could allow buying pressure to remain constant in the short term.

Is the Ukraine Conflict Still Impacting the Market?

Despite ongoing efforts to negotiate peace, with the U.S. playing a key role, fighting between Russia and Ukraine continues. A new round of negotiations has begun in Istanbul, but there remains significant uncertainty around a timely resolution.

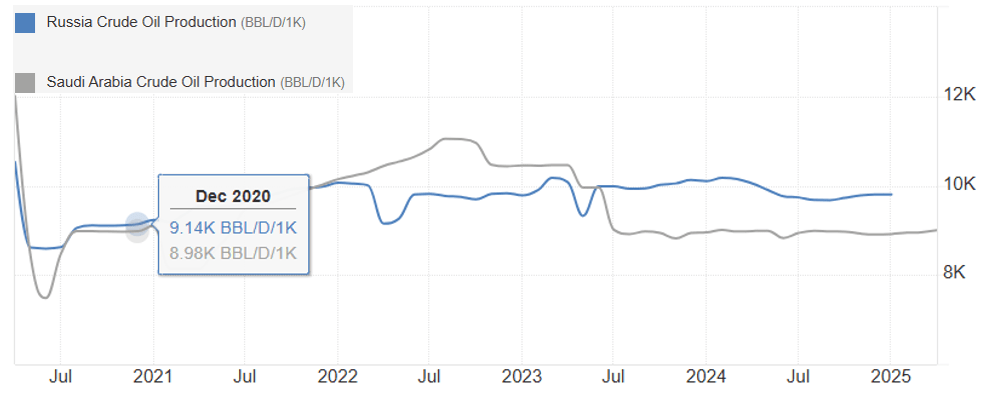

This uncertainty is fueling concerns over Russian output, as the country faces threats of additional economic and trade sanctions while the conflict continues. Russia produces approximately 9.8 million barrels per day, surpassing Saudi Arabia’s output of around 9.01 million barrels per day, with both countries being key OPEC+ members.

Source: TradingEconomics

Sanctions on Russia have already significantly reduced global oil supply. If the war persists and further sanctions are implemented, the supply of available barrels could decrease even further, supporting sustained upward pressure on oil prices.

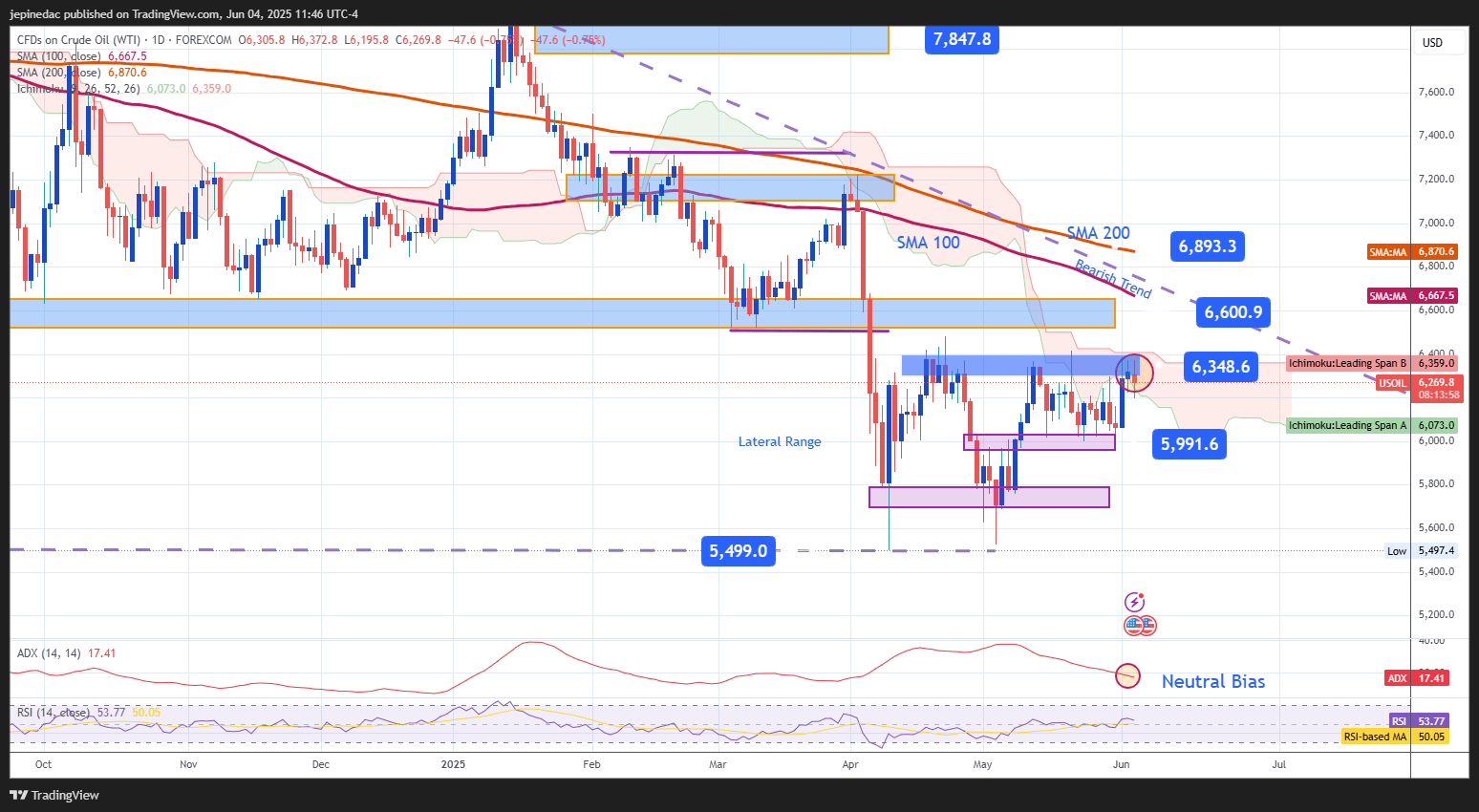

WTI Technical Outlook

Source: StoneX, Tradingview

- Bearish Trend Remains Intact: Since January 15, WTI has maintained a steady downward trend. Recent bullish movements have failed to break through resistance at $66 per barrel, confirming that the dominant bias remains bearish. In the short term, a sideways channel has formed between resistance at $64 and support near $60. A breakout to the upside could lead to a more extended bullish move, although it would not yet threaten the long-term bearish trend.

- ADX: The ADX line remains below the 20 level, indicating that the average volatility over the past 14 sessions remains low, which could support continued sideways movement in upcoming sessions.

- RSI: The RSI has followed a similar pattern, remaining above the neutral 50 level, but showing signs of flattening, which suggests waning bullish momentum and a potential shift toward greater neutrality in the near term.

Key Levels:

- $64 – Current Barrier: Marks the upper boundary of the short-term sideways channel and may act as resistance to continued upward movement.

- $60 – Key Support: A critical psychological level. A drop below this area could reactivate the bearish trend and break the current neutral setup.

- $66 – Final Resistance: Aligned with the 10-period moving average. A sustained move above this level could challenge the longer-term bearish trend.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25