- Crude oil forecast uncertain amid supply-heavy landscape

- WTI claws back some ground, but not out of the woods yet

- Demand outlook hinges on global tariff negotiations

It’s been a quiet few weeks in the oil markets, with WTI crude prices more or less treading water. Investors seem reluctant to commit either way, pondering whether the recent deluge of bearish headlines has already been priced in. The recent easing in global trade tensions after Trump’s decision to pause tariff hikes, has taken some of the edge off demand concerns. As a result, oil prices may be bracing for a short-term rebound. But let’s not get ahead of ourselves — the broader crude oil forecast remains riddled with uncertainty, especially as the supply side of the equation continues to cast a long shadow.

Supply Glut Casts a Long Shadow Over Oil

The recent weakness in crude has been, unsurprisingly, fuelled by supply-side anxieties. The OPEC+ is inching production higher — an additional 411,000 barrels per day set to flow starting June, as per the agreement at the group’s last meeting. The cartel is fast-tracking its rollback of earlier cuts, which had once helped prop up prices. Meanwhile, across the pond, American producers are churning out more oil with leaner operations — fewer rigs, but higher output.

The broader crude oil forecast doesn’t benefit from this picture of ever-expanding production. Forecasters are now pencilling in more output not just from OPEC+, but also from the wider oil-producing world. Even if a fair chunk of this is already baked into current pricing, it’s difficult to turn decidedly bullish with confidence while barrels keep piling up, and uncertainty over demand growth lingers…

Trade Talks Soothe Demand Jitters – For Now

On the demand side, things are marginally rosier. Trump’s backtracking on tariff hikes — pausing those on the EU and trimming some on China — has injected a bit of optimism into the global economic outlook. A 50% tariff threat sent risk assets reeling last Friday, but weekend talks led to a cooling of heads and a month-long extension for negotiations with the EU. That followed a prior softening of tariffs on European goods to 10%.

Markets took the news well, with equities bouncing nicely to send the German DAX index to a new record high today, more than recovering the 850+ points it dropped at one point on Friday. Oil, however, has remained somewhat aloof. This may be down to the inelastic nature of demand — even if economies perk up a bit, the sheer weight of supply seems to be dampening any enthusiasm for a full-blown rally. In other words, crude is behaving more like a supply story than a demand one — a key nuance in today’s crude oil forecast.

WTI Chart: Signs of Life, But Not Yet Out of the Woods

Source: TradingView.com

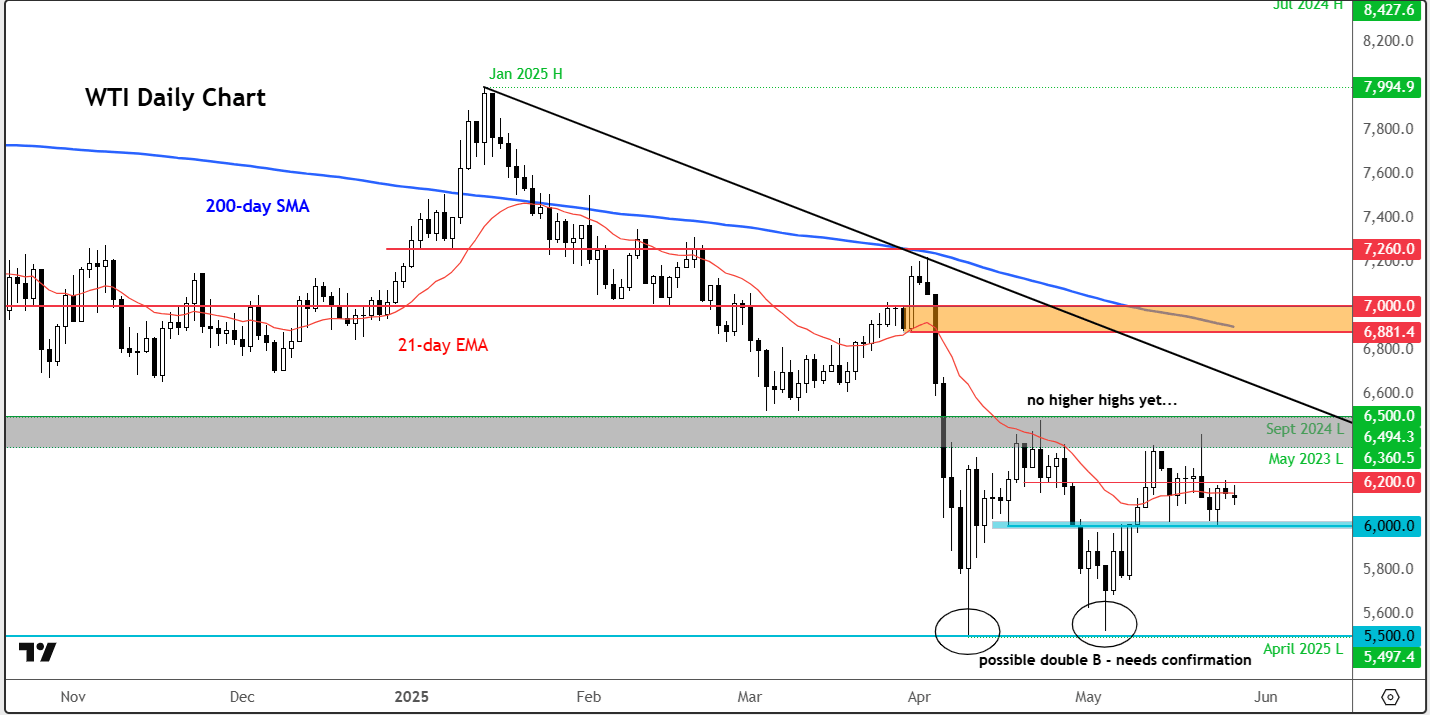

From a technical perspective, WTI no longer looks quite as frail as it did just weeks ago. After plumbing the depths at just below the $55 handle in April, prices revisited this territory in early May again — only to bounce back a good $8 or so, before easing off again. While that bounce is not yet enough to confirm a classic double bottom, May’s price action has tilted slightly bullish.

Still, the bulls will want to see more convincing evidence. Key resistance lies between $63.60 and $65.00 — a zone that served as a solid floor in May 2023 and again in September 2024, but has since flipped into overhead resistance after the breakdown in April. A clean break above this band would mark the first credible sign of a broader reversal.

Until that happens, any upside move must be treated as a counter-trend rally — promising, but not yet persuasive.

Support, meanwhile, is holding firm around the $60.00 zone, where prices found a footing late last week. Should that floor give way, eyes will turn to $58.00 and then the more familiar lows near $55.00.

In summary, the crude oil forecast remains delicately poised. The bulls are sniffing for opportunity, but the fundamentals — particularly on the supply side — continue to keep enthusiasm in check. For now, caution remains the order of the day.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R