Key Events:

- China’s new loans jumped from ¥1,010B to ¥3,640B, signaling resilience despite tariff risks

- OPEC downgraded 2025 global growth to ~3% on continued tariff concerns

- World oil demand was revised down to 1.3 mb/d for both 2025 and 2026

- Nasdaq and Crude Oil hold rebounds—Nasdaq below 19,200, Crude near $60.

- Netflix and TSMC to report earnings on Wednesday

Ongoing US-China trade probes and tariff talks—especially around electronics, chips, and autos—keep markets on edge. OPEC's revised forecasts signal caution: growth estimates for 2025 and 2026 were lowered to 3% and 3.1%, respectively. Meanwhile, U.S. indices hover below key resistance zones: Nasdaq under 19,200, Dow below 41,000, and S&P below 5,500, while crude oil stabilizes near $60. U.S.-Iran nuclear tensions are also resurfacing.

Former President Trump recently reaffirmed his willingness to strike Iran’s nuclear sites if negotiations fail, stoking volatility across gold and oil markets. China's economic resilience is under the spotlight. Sunday’s sharp rise in new loans suggests strong internal support. Investors await GDP, industrial production, and retail sales data on Tuesday—key indicators for oil demand and global growth.

With the U.S. focused on containing China’s economic momentum, markets remain cautious. Gains are being held just below resistance levels, while tech earnings—especially from Nvidia and TSMC on Thursday—may inject fresh volatility into equities.

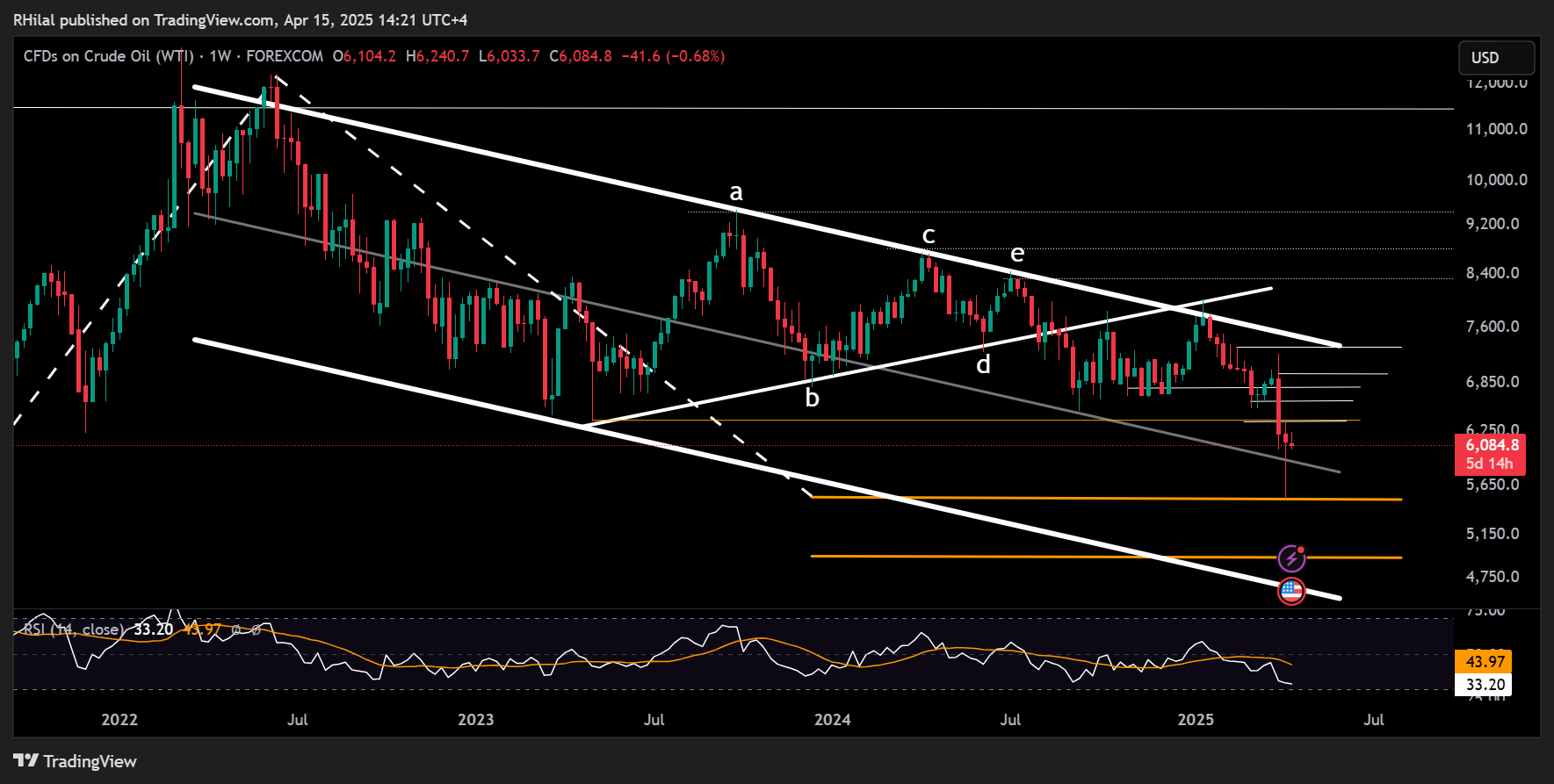

Crude Oil Forecast: Weekly Time Frame – Log Scale

Source: Tradingview

OPEC’s demand downgrade echoes fear of a global economic slowdown. Still, oil prices continue to consolidate above the $60 mark.

The weekly chart shows signs of reversal, with an oversold RSI and a long wick closing above $60.

Bullish Scenario: A close above $64 opens the door to $66, $68, $69.60, and eventually $73.

Bearish Risks: A break below $58 brings $55 back into focus. A drop beneath $55 could extend losses toward $49, aligning with the long-term uptrend base from my Q2 Outlook.

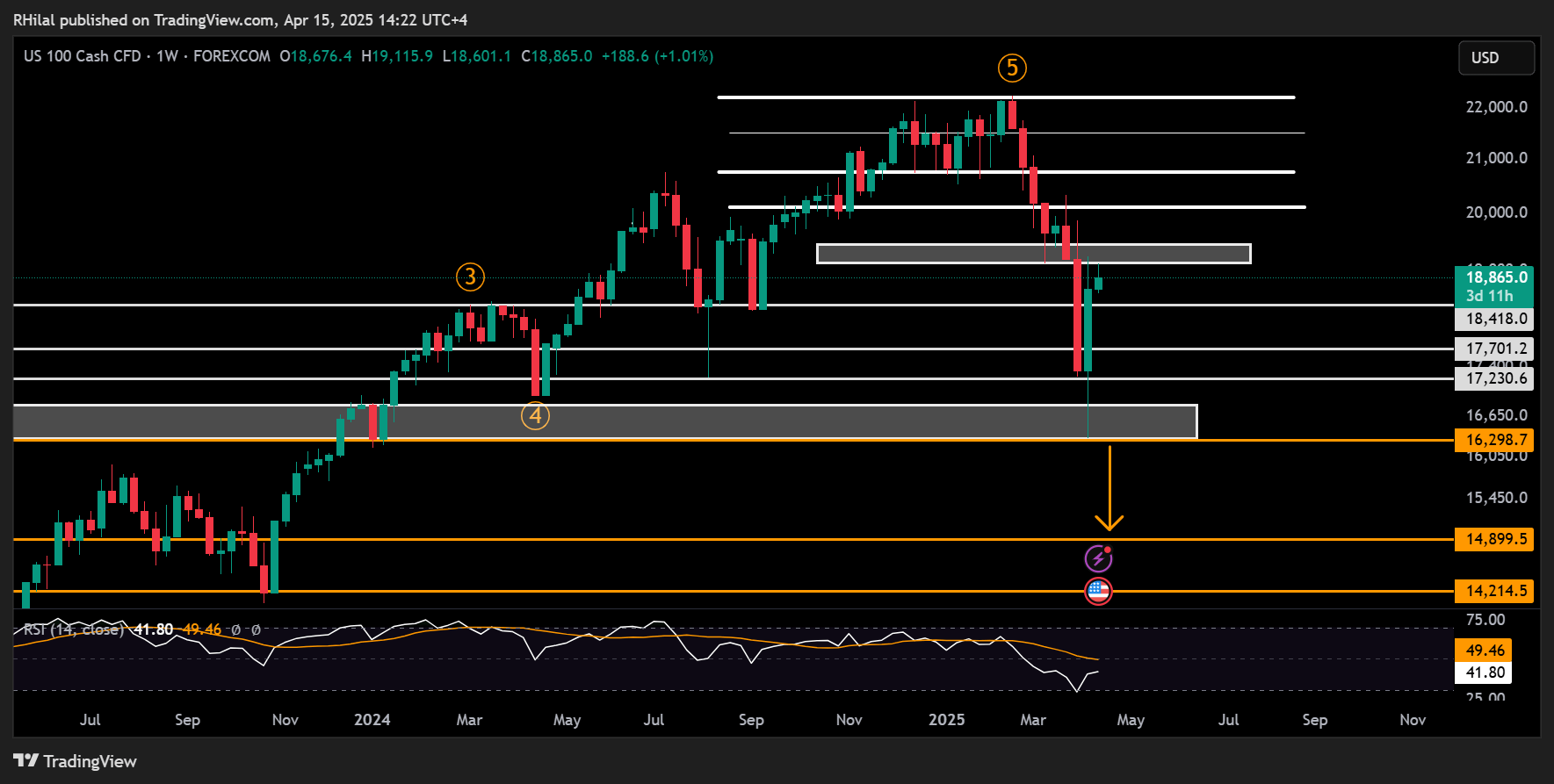

Nasdaq Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

The Nasdaq’s bounce from the 16,300 area mirrors prior multi-year RSI rebounds (2020, 2022). The index now tests major resistance between 19,100–19,400.

- A weekly close above could unlock moves toward 20,000, 20,800, 21,500, and 22,000.

- Support levels: 18,400, 17,700, 17,100, 16,600, and 16,300

- Below 16,300, downside risks may extend to 14,900

Written by Razan Hilal, CMT

Follow on X: @Rh_waves