WTI crude oil has shown a relatively steady variation of around 3% over the past few trading sessions, without establishing a clear direction, as the price oscillates around the $60 mark in the short term. Uncertainty over the near-term outlook for WTI has grown following recent production announcements by OPEC+, whose impact on the oil market remains unclear.

OPEC+ Takes the Stage

In a recent virtual meeting, OPEC+—the group that brings together the world's largest oil-producing countries—agreed to increase joint production by 411,000 barrels per day starting in June. This increase is part of a plan to gradually reverse the cuts implemented in previous years, based on the argument that global demand projections remain positive.

However, this new policy has reignited concerns about a potential short-term oversupply. WTI prices had already been under pressure due to demand concerns linked to trade tensions, and now, with expanding supply, the risk of an imbalance between supply and demand could lead to significant downside pressure.

Additionally, strong restrictions remain in place on Russian oil exports due to geopolitical conflict. If U.S. diplomatic efforts succeed in easing those sanctions, the resulting increase in global supply could be even more pronounced. It’s worth noting that Russian output accounts for approximately 8% of global oil demand, so any return of Russian supply to the market could amplify the bearish impact, especially if demand fails to recover strongly.

In this context, production-related factors could create a sustained imbalance, reinforcing continued downward pressure on WTI prices in the short term.

What’s Happening with Oil Market Confidence?

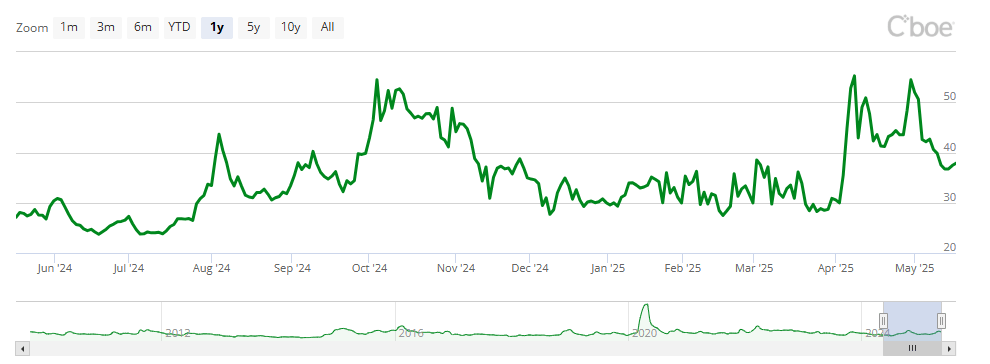

Currently, the Cboe Crude Oil ETF Volatility Index is showing rising oscillations, approaching the 40-point level. It’s important to note that values between 25 and 40 reflect moderate expected volatility, while readings above 40 begin to signal high uncertainty or fear in the market.

Source: Cboe

While the index appeared to be moving away from this critical zone, it is now approaching a potential inflection point again. If indecision continues and the index climbs above 40, it could further erode confidence in crude oil, reinforcing a persistent bearish bias in upcoming sessions.

WTI Technical Outlook

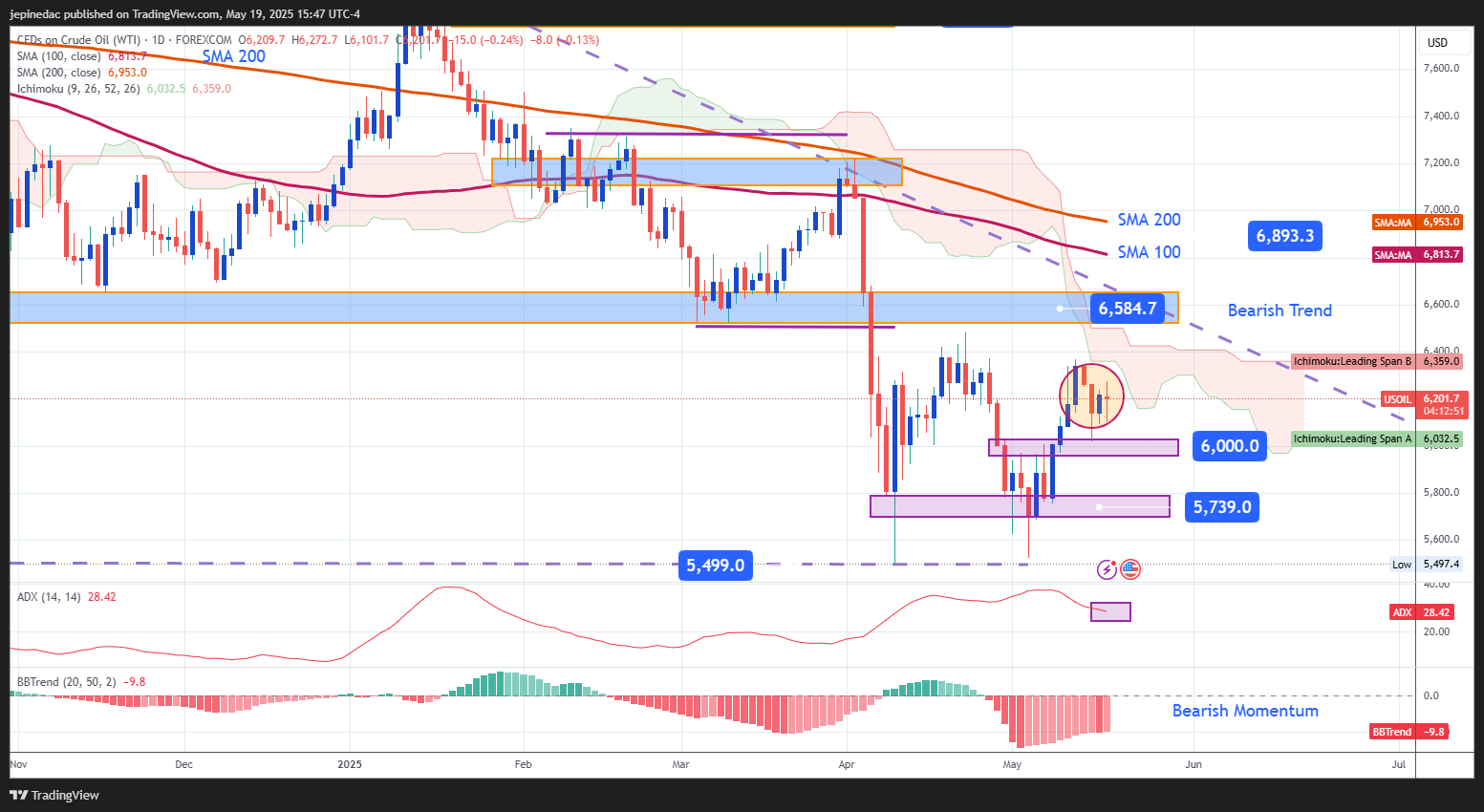

Source: StoneX, Tradingview

- Bearish Trend Still in Place: Since January 15, WTI has been in a sustained downtrend. Recent upward movements have failed to break resistance at $65 per barrel, reinforcing selling pressure and confirming that the bearish structure remains dominant in the short term.

- ADX: The ADX line remains above the 20 level, but its slope has flattened, indicating declining volatility. If the ADX doesn’t show any significant increases, prices are likely to enter a prolonged phase of neutrality.

- Bollinger Bands (BB Trend): The Bollinger Bands trend indicator continues to show strong selling momentum. When comparing time frames, the bands lean toward bearish movements in the short term. As long as the histogram remains negative, selling pressure will remain in control, outweighing any recovery attempts within the context of the long-term downtrend.

Key Levels:

- $60 – Crucial Support: A key psychological level that acts as an immediate barrier amid rising uncertainty. It may contain downward corrections if the market doesn’t find a new catalyst.

- $65 – Nearby Resistance: Aligns with a former consolidation zone and the top of the current downtrend. A sustained breakout above this level could revive bullish sentiment and challenge the ongoing bearish structure.

- $57 – Key Support: The lowest recent neutral level for WTI. A sustained break below this point could open the door to new lows and extend the prevailing downtrend.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25