Key Events to Watch This Week

- US Offers to ease sanctions off Russia with Ukraine peace deal proposal, set to take effect on Thursday with the Minerals Deal

- IMF Spring Meetings – potential policy signals amid global tariff negotiations

- China Loan Prime Rate Decision – Monday amid US-China and US-Global Trade Talks

- FOMC Member Remarks – relevant given the weak dollar narrative

- Middle East Sanction Risks & Supply Disruptions

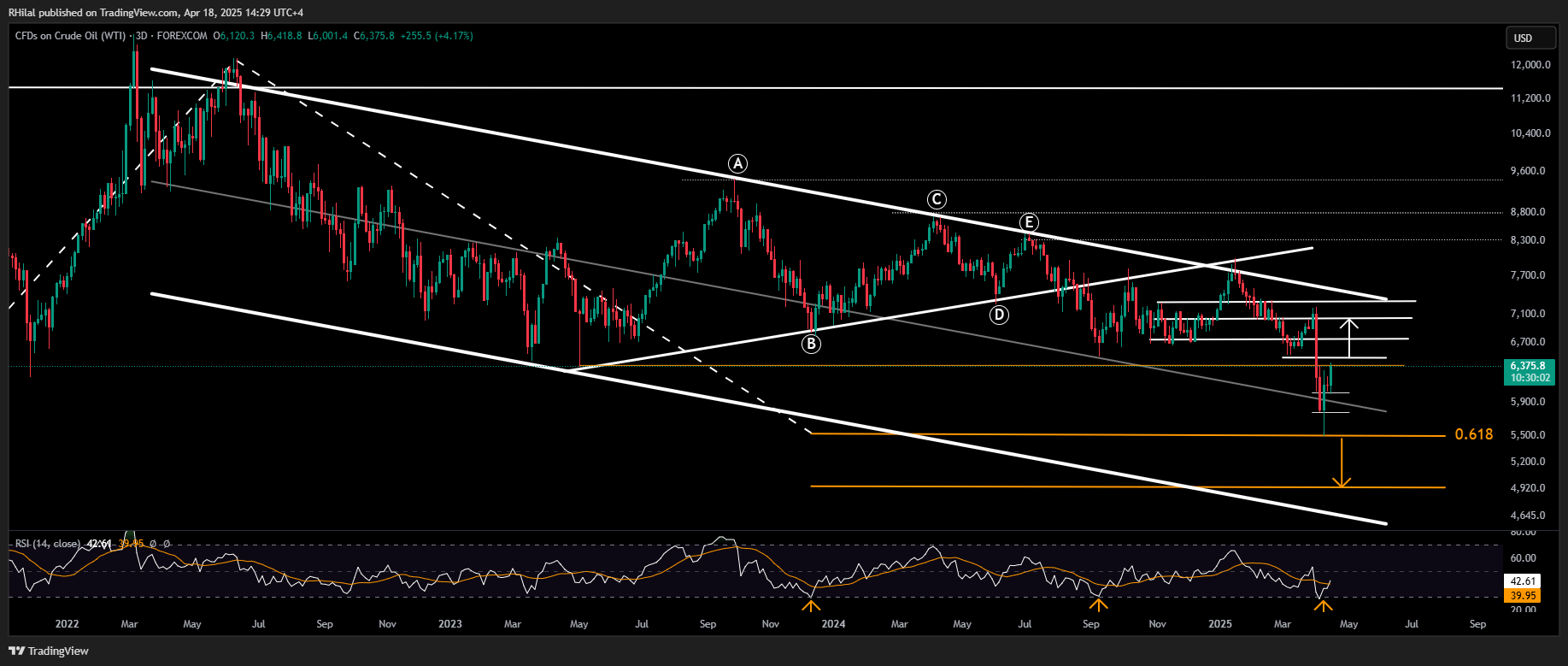

Sentiment & Market Structure: VIX, SPX500, US30, Nasdaq, and OIL 3-Day Time Frame

Source: Tradingview

Since the height of the trade war sell-off, I’ve been tracking the correlation between oil, U.S. indices, and the VIX. These markets reversed together following the announcement of a 90-day tariff delay—bouncing from oversold conditions last seen in 2020.

As of last Monday, the VIX rebounded from levels reminiscent of both 2020 and 2008, a signal often associated with major sentiment shifts.

Oil is currently advancing more decisively, supported by escalating geopolitical risks—particularly rising U.S.-Yemen tensions following the latest U.S. strike on the Ras Isa oil port in western Yemen, along with sanctions on Iranian and Russian oil—pushing prices toward $64 per barrel.

Looking ahead, developments surrounding the IMF meetings, U.S.-China negotiations, and potential resource deals involving Ukraine and Russia will be key drivers. Oil-exporting countries remain supportive of higher prices as they seek to stabilize and enhance revenue amid prolonged price pressure.

China's Data Surprise and Underlying Risks

China posted stronger-than-expected GDP, industrial production, and retail sales last week, offering a short-term boost to sentiment. However, the outlook remains fragile as U.S.-China trade tensions continue to escalate, creating uncertainty around the sustainability of the recovery.

Macro Sentiment: Caution Signals Flashing

From a sentiment perspective, extreme positioning is becoming more apparent:

- VIX has rebounded from highs last seen in 2008 and 2020

- USD/CHF is trading near 10-year lows, suggesting heavy pressure on the dollar

- Gold has reached record highs near $3360, with momentum indicators now matching those during previous crises (2020 pandemic, 2008 recession)

These elements raise the risk of sharp reversals. Should any positive geopolitical developments or peace agreements surface, markets could shift direction swiftly—especially with sentiment currently stretched.

Technical Analysis: Quantifying Uncertainties

Crude Oil Week Ahead: Weekly Time Frame – Log Scale

Source: Tradingview

Following a sharp rebound from the $55 low—mirroring broader market strength and gains in U.S. indices—oil is now hovering near a key resistance level at $64. Meanwhile, major U.S. indices remain below their respective resistance zones, awaiting confirmation of further uptrends.

A sustained break and hold above $64 could open the door for additional upside toward $66 and $70. On the downside, if gains fail to hold and prices slip back below $64, support levels to watch are $60, $58, and $55.

A decisive break below $55 may trigger a steeper decline, potentially driving oil prices back toward the $49 per barrel region.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves