Key Events to Watch

- US-Middle East trade deals and sanction reliefs

- PBOC rate cut expected Tuesday, China data in focus

- Flash PMIs (US, UK, Eurozone) to reveal tariff impact

- OPEC lowers 2025 non-OPEC+ supply growth forecast

- Summer oil demand season approaching

Recent developments impacting oil prices revolve around renewed optimism over US-Middle East trade negotiations, OPEC’s downward revision in supply growth projections, and sanction reliefs in key regions such as Iran and Syria. In addition, unwinding of previous OPEC+ supply cuts continues amid global trade frictions.

The prospect of a positive trade deal between the US and China adds to market optimism, with risk assets, including oil, maintaining bullish momentum. Equity indices have reclaimed levels above their Liberation Day highs, reinforcing the long-term bullish case for crude, despite soft economic data and the near-term effects of tariff-related headwinds.

Looking ahead, the People’s Bank of China is expected to implement a 10-bps rate cut this week. This move could stimulate economic activity and subsequently boost oil demand. Meanwhile, upcoming flash PMI figures from the Eurozone, UK, and US will provide further insight into the impact of tariffs, although market sentiment may remain more heavily influenced by trade deal progress and seasonal demand.

With summer on the horizon, demand expectations remain supportive of oil prices. Risks of a pullback below $60 and $58 may resurface if trade tensions escalate or oversupply returns—though such scenarios don't appear imminent for now.

Technical Analysis:

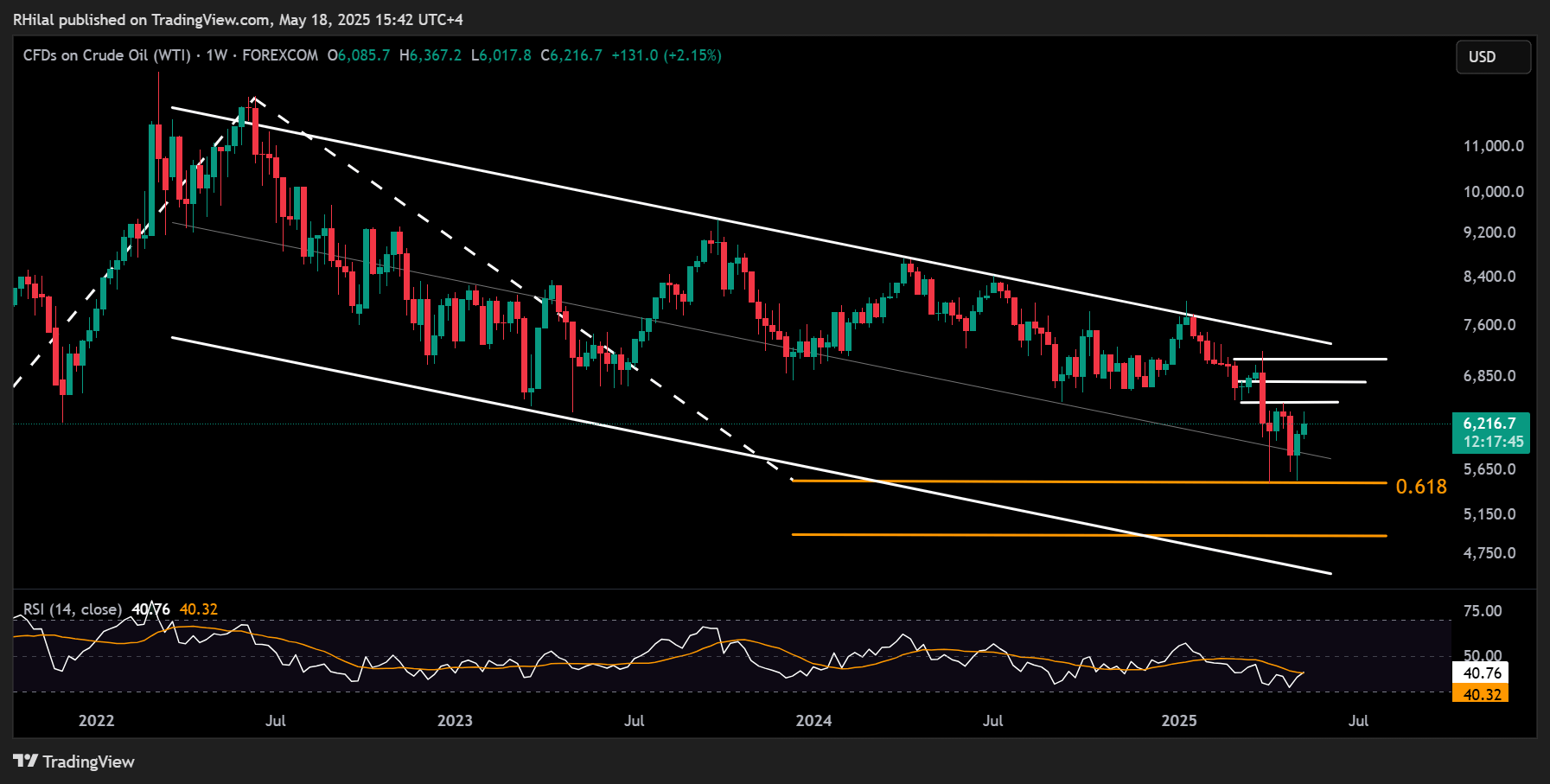

Crude Oil Weekly Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

Crude oil prices as still holding above the key 55 support and above the 60 psychological-barrier, challenging the 65-resistance zone to extend another leg higher in the direction of the 70-mark. Should a clean close occur above the 65-mark, the next key levels to watch are 67.70 and 71.

From the downside, support levels 58 and 55 are expected to remain solid for support. A breach below 55 may open the way for another critical low and support at 49$ per barrel.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves