After the big drop at the start of the month, including that brutal three-day selloff that started on Thursday 3rd April — which marked the start of the DAX’s worst performance since 2020 — global equities have shown clear improvement in the last few days, even as the trade war uncertainty has not been completely removed. Traders are continuing to unwind some of their bearish bets following Trump’s decisions to ease the growth-chocking and inflation-stocking tariffs, and this is helping to push risk assets higher. The DAX forecast has improved but further upside progress may be slow to come by until such a time that trade deals are struck.

Trade war latest: EU-US trade talks make little progress

We’ve certainly seen calmer tone across the financial landscape ever since Trump delayed the reciprocal tariffs by 90 days and then followed it up by suspending of tariffs on consumer tech items – phones, computers, and the like – between the US and China. Global shares have enjoyed a bit of breathing space, even if there was little headway made in narrowing the transatlantic trade divide, as European Union and US negotiators failed to find common ground, according to Bloomberg. Officials from President Donald Trump’s administration signalled that the lion’s share of American tariffs levied on the bloc are here to stay, dampening hopes of a swift resolution. But this setback comes against a backdrop of a wider easing of tariffs, which explains why markets have been able to shrug it off. Still, with the threat of further tariffs around, we could well see markets struggle to make clear headway in the coming days, and instead chop around in consolidation – especially with this being a holiday-shortened week. According to the Bloomberg report, the US is refusing to outright remove the 20% “reciprocal” tariffs, which have been reduced to 10% for 90 days, as well as other tariffs targeting sectors including cars and metals.

Stimulus hopes keeps long-term DAX forecast positive

Markets love a bit of stimulus, and if we focus away from the trade skirmishes, it’s not all doom and gloom on the Continent. Should the fog of trade uncertainty eventually clear, attention is likely to shift back to European equities, which have enjoyed a recent tailwind thanks to fiscal commitments — chief among them Germany’s hefty €500 billion stimulus unveiled last month. That injection of confidence gave both the euro and equity markets a noticeable boost, before stocks plunged on trade war concerns. The question now is whether Europe can reclaim its place at the front of the pack once the trade dust settles.

Technical DAX forecast: Key levels to watch

Source: TradingView.com

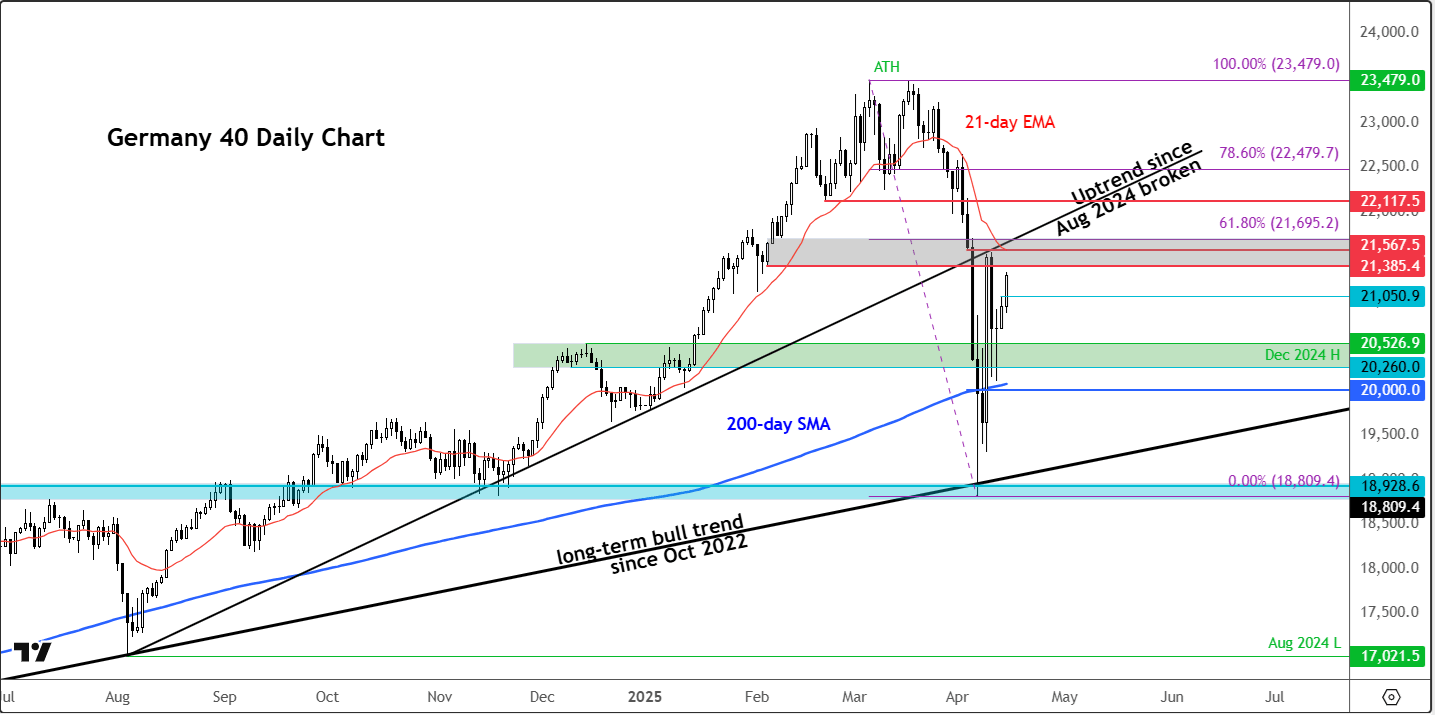

The big rally from last Monday’s crash has brightened the technical DAX forecast, especially as several levels have now been reclaimed. That sharp sell-off last Monday appears to have been little more than a buying opportunity, as strong dip demand emerged around the 18,800 to 18,900 zone — a key region of former resistance now acting as solid support. That level also coincides neatly with a long-term trend line dating back to the October 2022 low.

With the index now reclaiming ground above its 200-day moving average and comfortably clearing the psychological 20,000 level and now 21,000 mark, the bulls have regained significant control once again.

That said, the index is now not too far off the next band of resistance, coming in around 21,385 to 21695. This area is shaded in grey on the chart. As well as prior support and resistance, the underside of the broken short-term trend line also comes into play here, as too does the 61.8% Fibonacci retracement level.

On the downside, yesterday’s high at 21,050 is now the first line of defence for the bulls, followed by the area marked in green on the chart.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R