DAX rises ahead of the ECB rate decision

- ECB is expected to cut rates by 25 bps

- Tone surrounding trade tariff impact on growth and inflation in focus

- EUR/USD consolidating around 1.1350

The DAX, along with its European peers, is holding mostly steady on Thursday, the last day before the long weekend and before the ECB rate decision later today.

At 13:15 BST central bank is widely expected to cut rates by 25 basis points, marking the 7th rate cut from the central bank since it started its easing cycle, taking the rate to 2.25%.

The ECB meeting comes as inflation in the region has cooled to 2.2% in March and amid a weak growth outlook owing to Trump’s trade tariffs. The focus of the meeting will be on tone around tariffs and the expected impact that the trade war could have on both inflation and growth.

Trade talks between the US and the EU have reportedly not progressed as well as hoped, and the EU warned that it feared full tariffs would be applied.

Meanwhile, Trump has said that he is considering a pause on auto tariffs, which would be very beneficial to German car makers.

Any trade tariff commentary will continue to drive sentiment across global stock markets.

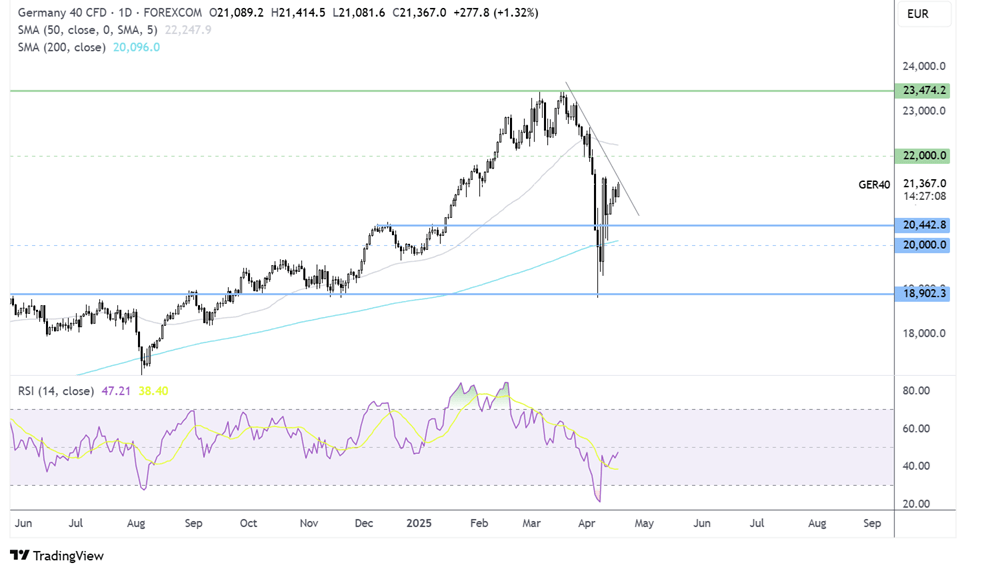

DAX forecast – technical analysis

The DAX extended its recovery from the 18,809 low, running into resistance at 21,500 before correcting lower. The price is testing the falling trendline resistance at 21,380, with a rise above here and 21,500 needed to negate the downtrend and expose 22,000, the round number.

Failure to rise above the falling trendline could see the price retest 20,450, the December high. Below, the 200 SMA at 20,100 comes into focus.

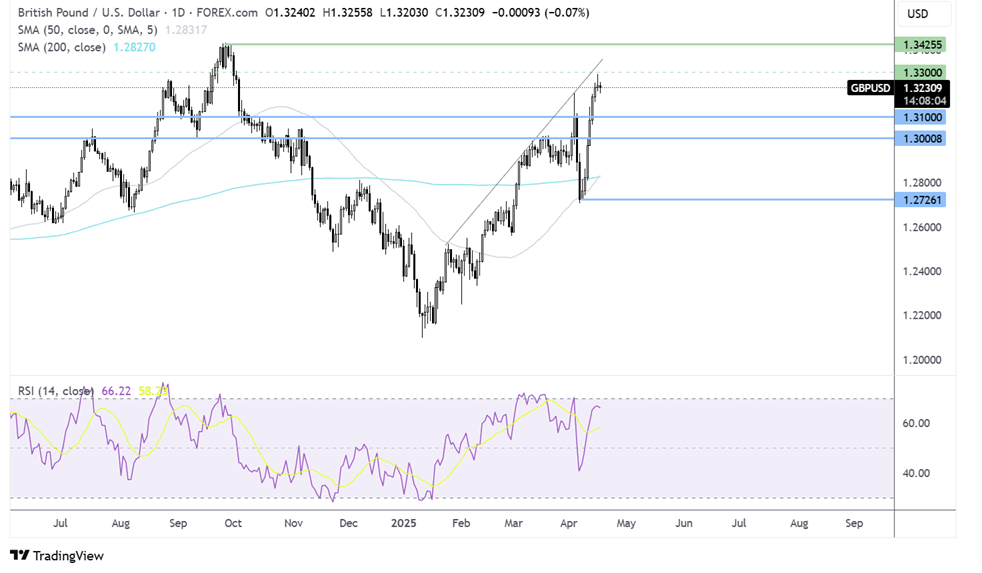

GBP/USD eases back from a 6-month high as USD rises

- USD rises from 3-year low

- UK CPI eases to 2.6% from 2.8% & service sector inflation cooled

- GBP/USD eased back from 1.3290, chart remains constructive

GBP/USD has eased back from a six-month high of 1.3292 reached on Wednesday and currently trades around 1.3230 heading into the European session ahead of U.S. data releases later in the day, including jobless claims, housing starts, and the Philly Fed manufacturing index.

The U.S. dollar index is rising from a 3-year low towards 99.6, following stronger-than-expected US retail sales in March and after Federal Reserve chair Jerome Powell's speech yesterday, in which he warned about the stagflationary impact of U.S. trade tariffs. He reiterated the Fed would keep rates on hold to assess the impact of tariffs.

Over recent weeks, the pound has benefited from the weaker USD, helping sterling reach a 6-month high. Data showed that UK headline inflation cooled by more than expected to 2.6% YoY in March down from February's 2.8%, and core inflation, which escalates food and energy, rose 3.4%, down slightly from 3.5%. Service sector inflation, which is watched closely by the Bank of England, eased more than expected to 4.7% from 5%, supporting the view that the Bank of England could cut interest rates at the May meeting.

Cooling inflation, in addition to deteriorating UK labour market, owing to the recent increase in employers' National Insurance contributions, could push the central bank towards further monetary policy easing. This could limit the upside in GBP. However, USD weakness has been the bigger driving force

GBP/USD forecast – technical analysis

GBP/USD recovered from its 1.27 April low rising above its 200 SMA to a peak of 1.3290. The price has eased back modestly to 1.3220 at the time of writing, and the constructive stance remains.

Buyers will need to rise above the 1.3290 level to create a higher high to bring 1.3330 the rising trendline and 1.3425 into play, the September 2024 high.

Support can be seen at 1.31 round number and 1.30. A break below here negates the near term uptrend.