The first half of Friday’s session has been a positive one for risk, with Chinese equities leading a global stock market rebound overnight. In Europe, the DAX was up a good 2% on the session, with solid gains seen elsewhere in the region. Across the pond, US futures were up by 0.5 to 1.0 percent, led by the Nasdaq 100. Gold hit the $3,000 mark for the first time ever, boosted on increased haven demand amid trade war risks and recent stock market volatility. The positive tone from the equity markets was evidenced in the FX space, with the risk-sensitive commodity dollars bouncing back, the euro rising to $1.09 and US dollar falling against most other currencies except the pound (thanks to weak UK data) and the yen, with the latter being the weakest ahead of next week’s Bank of Japan rate decision. The US dollar forecast remains modestly bearish following last week’s big drop, driven largely by the rallying EUR/USD pair on the back of the Germany’s big spending plans. Chancellor-in-waiting Friedrich Merz is racing against time to convince the parliament to approve a €500 billion fund for infrastructure, alongside major reforms to borrowing rules, in a bid to stimulate growth and boost military expenditure in Europe's largest economy. Market remains largely convinced that the deal will be sealed and for that reason both the euro and European stock markets remain on the front foot.

Weak inflation data keeps dollar bulls at bay

Thursday’s weaker-than-expected PPI confirms that inflation is easing. This is precisely the kind of news the stock market needed as tariff concerns escalate and is part of the reason why index futures have rebounded today. The PPI came following Wednesday’s softer CPI release. Still, while CPI inflation showed some moderation, it fell short of the game-changing shift some had hoped for. The cooling was largely concentrated in services, meaning it may not directly translate into a lower PCE Price Index. Furthermore, February’s data does not fully account for the knock-on effects of Trump’s aggressive tariff measures. The Fed is unlikely to rush into rate cuts, instead opting for a steady approach until sustained improvements become evident. But on balance, there is a real possibility now that the Fed could consider cutting interest rates sooner than anticipated, potentially as early as this summer. It must be noted however that inflation is not the only concern for markets—it is also about growth, or rather the lack of it, coupled with uncertainty over tariffs.

Coming up: UoM consumer sentiment and inflation expectations

Now that the inflation data have been absorbed, the focus today is on University of Michigan consumer sentiment surveys later today. A sharp decline in last month’s reading heightened concerns over the impact of Trump’s trade policies on economic confidence. This closely watched survey, which polls around 420 respondents on current and future economic conditions, should provide further insight into sentiment trends. Inflation expectations—having spiked last month to 4.3% from 3.3%—will be closely examined for signs of persistent price pressures. The implications for monetary policy, the US dollar forecast, and broader market direction could be significant.

Big central bank meetings could further impact dollar forecast

The Bank of Japan will kick off the big central bank rate decisions next week, although it remains to be seen whether there will be any major policy changes. If any of these central banks turn out to be more hawkish than expected, this could weigh on the dollar.

Bank of Japan: Wednesday, March 19

Speculation has been rife about further tightening of policy in Japan, owing to strong wage growth and inflation. It will all be about guidance on future policy at this meeting. A recent Bloomberg survey of 52 economists suggested the next rate increase is coming between June and September. But 13% of surveyed economists now think the next increase is on May 1, up from 4% in the last survey.

US Federal Reserve: Wednesday, March 19

No one is expecting the Fed to cut rates at this meeting, but any signs of them doing so sooner than expected could hit the dollar. The Fed will have to take into account the impact of tariffs on inflation and the uncertainty they bring, plus the recent soft patch in US data. So, pay close attention to the policy statement, the economic projections and Powell’s press conference.

Bank of England: Thursday, March 20

With inflation concerns growing, the Bank of England is set to hold rates at 4.5% at its 20 March meeting. However, expectations for cuts in 2025 have risen. Markets see a 95% chance of a hold this month but a 77% likelihood of a cut in May and 55% in August— a sharp shift from January’s outlook. Yet, with UK inflation rising to 3.0% in January from 2.5% in December, these projections may prove optimistic.

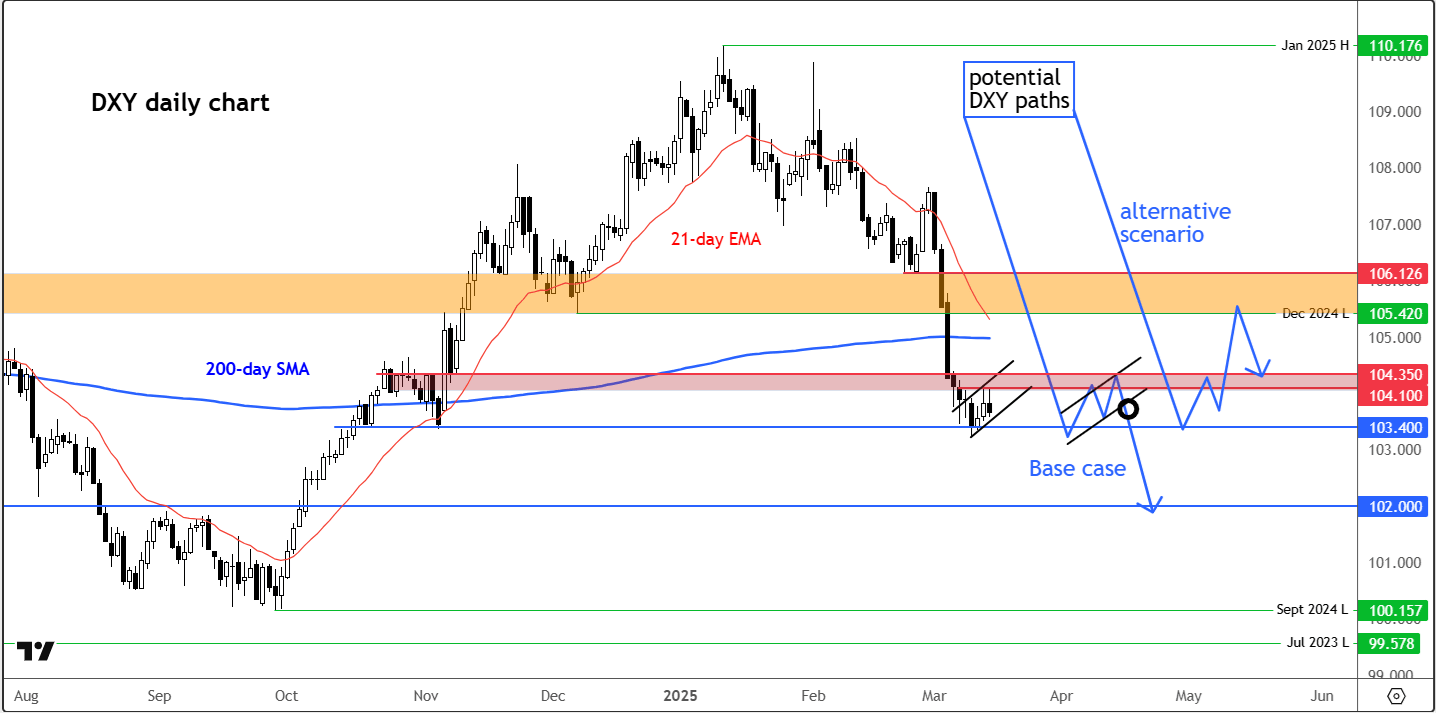

Technical US dollar forecast: Dollar Index (DXY) key levels to watch

Source: TradingView.com

Following last week’s big 3.4% drop, the Dollar Index has been stuck in a holding pattern for much of this week. It is potentially consolidating inside a bear flag continuation pattern. As the name suggests, this pattern is often found in downward trending markets, where fast moves pause for a while before resuming lower. A potential breach of the pattern’s support trend could potentially pave the way for a clean breakdown of support around the 103.30-103.40 area. Below that zone, there are not many obvious support levels until around – or just below – the 102.00 handle. Thereafter, the September low and the psychological 100.00 level will come into focus next. Resistance, meanwhile, is seen between 104.10 to 104.35 area. A clean break above this zone would invalidate this short-term bearish US dollar forecast.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R