Key Events to Watch:

- U.S. Trade Court blocks Trump-era tariffs, boosting dollar strength against currencies and precious metals

- Trade optimism may overshadow today’s U.S. GDP second estimate and Core PCE as markets take a forward-looking stance

- NVIDIA beats earnings again, pushing the Nasdaq toward 21,700

- Silver holds key support amid renewed tech optimism

Following the latest FOMC projection highlighting inflation persistence alongside weak growth and employment figures, the Trade Court’s decision to block Trump’s tariffs offered markets a dose of optimism. While Trump has yet to respond, the ruling challenges a key pillar of his trade strategy.

In the meantime, the U.S. Dollar Index climbed back above 100, dragging EUR/USD and silver toward critical support zones. Notably, silver rebounded above 33, supported by its dual role as both a safe haven and a key industrial metal—particularly in technology, where momentum is building following NVIDIA’s strong earnings beat.

EUR/USD Outlook: Daily Time Frame – Log Scale

Source: Trading view

Despite the dollar’s sharp rebound, EUR/USD is still holding above the critical 1.1270 support and the broader uptrend channel stretching across 2025. If this trend holds, and with daily RSI retesting the 50 neutral zone from above, the pair could recover toward 1.1380 and 1.1430.

A sustained close above 1.1430 would likely open the door to retest 2025 highs near 1.1480 and 1.1570. From the downside, a decisive close below 1.1270–1.12 would signal a trend break, exposing the pair to further downside toward 1.1140 and 1.1070—levels that align with the upper boundary of a long-term descending trendline connecting lower highs since 2008.

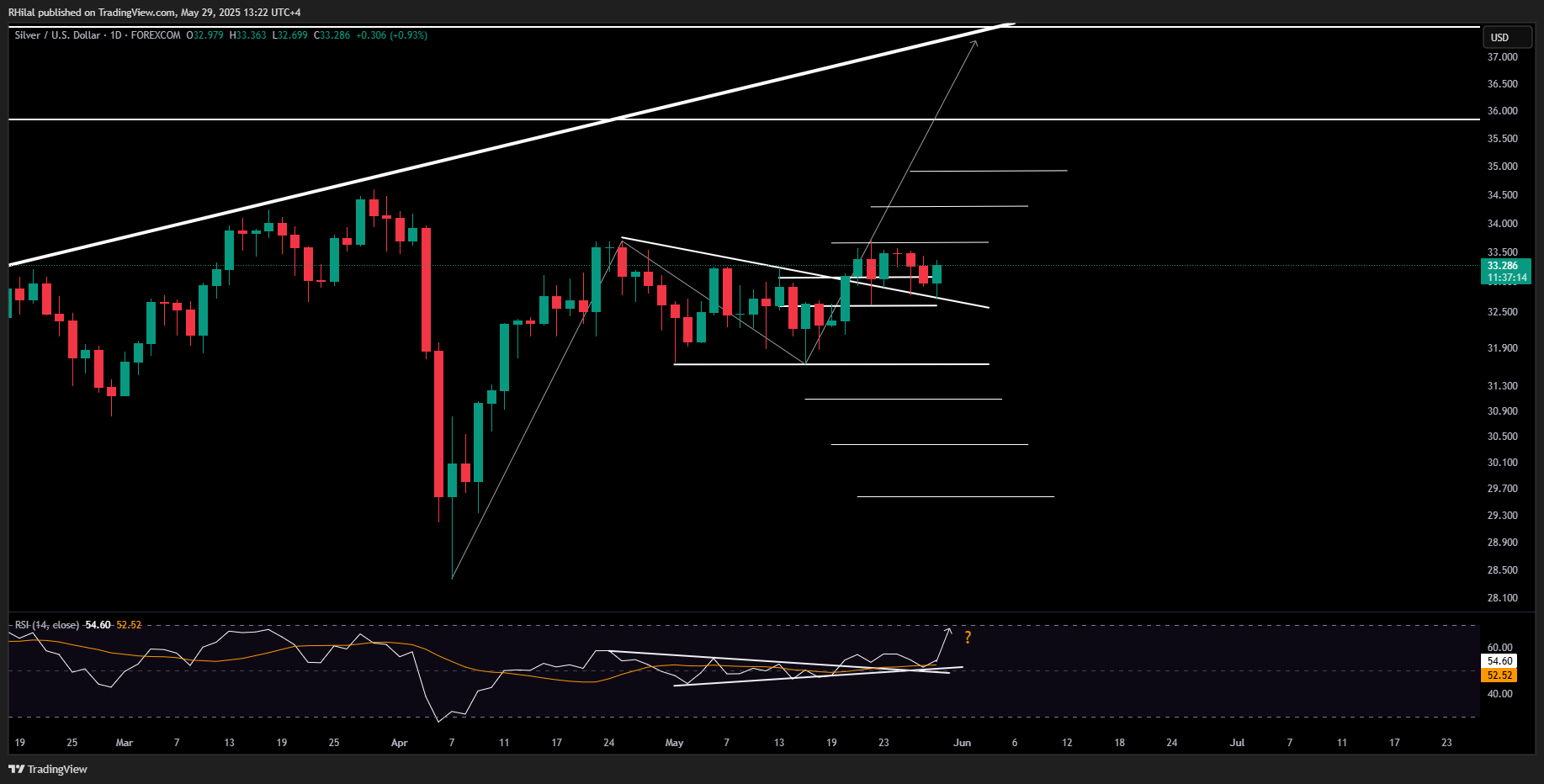

Silver Outlook: Daily Outlook – Log Scale

Source: Tradingview

While the dollar’s recovery has pressured precious metals, silver continues to hold a bullish structure above the key 32.60 support. This aligns with RSI’s hold above the 50 level and a developing triangle formation. A clean close above 33.60 would confirm momentum and set the stage for further gains toward 34.40, 34.90, and 35.80.

However, if silver fails to hold 32.60 and re-enters its consolidation zone, the bullish setup may be invalidated. In that case, downside levels include 31.60, 31.00, 30.30, and 29.60.

Historically, silver’s price action tends to consolidate for extended periods before breaking out within a short time period, which may prolong the current setup’s validity despite broader market volatility.

Written by Razan Hilal, CMT

Follow on X: Rh_waves