- Dow Jones forecast clouded by weak US consumer sentiment and inflation expectations

- Sentiment survey reflects pre-truce fears, with inflation jitters leading the drop

- Equity rebound and easing China-US tensions may lift final May numbers

The US stock markets struggled to get going after the latest consumer survey data from the University of Michigan raised stagflation alarm bells. However, while the data did look a bit alarming, it is worth noting the small sample size, and the fact they were collected before news broke of the China-US trade truce. Without a new bearish catalyst, ongoing trade optimism may keep the stock markets supported for a while yet. Our Dow Jones forecast remains mildly positive for now.

Dow Jones forecast unlikely to be tilted by souring consumer mood

The University of Michigan’s preliminary May sentiment survey landed with a thud — and the timing had everything to do with it. Most responses were collected before news broke of the China-US trade truce, which helps explain why inflation fears surged and optimism faded fast. In short, the mood was already fragile, and markets hadn’t yet offered their rebound balm. Another reason why you should take the data with a pinch of salt: UoM only asks around 420 consumers where they expect prices to be 12 months in the future for this survey. Anyway, and understandably consumers were clearly rattled.

According to the UoM data, one-year inflation expectations jumped to 7.3%, the highest since the pandemic chaos, while the 5-to-10-year view rose to 4.6%. Those are eye-watering numbers that suggest people are bracing for persistent price pressure — and it’s weighing on confidence.

Meanwhile, the headline sentiment score fell to 50.8, well below the 53.1 expected. Both the current conditions and expectations indices were dragged lower by concerns over rising costs, a jittery job market, and no doubt the early April stock market drop. While some would argue that this signals caution for the Dow Jones forecast, since spending risks are tilting to the downside, others would say the data is not a true reflection of the situation right now, and that in any event monetary support is warranted from the Fed – and weakness in data will bring about interest rate cuts.

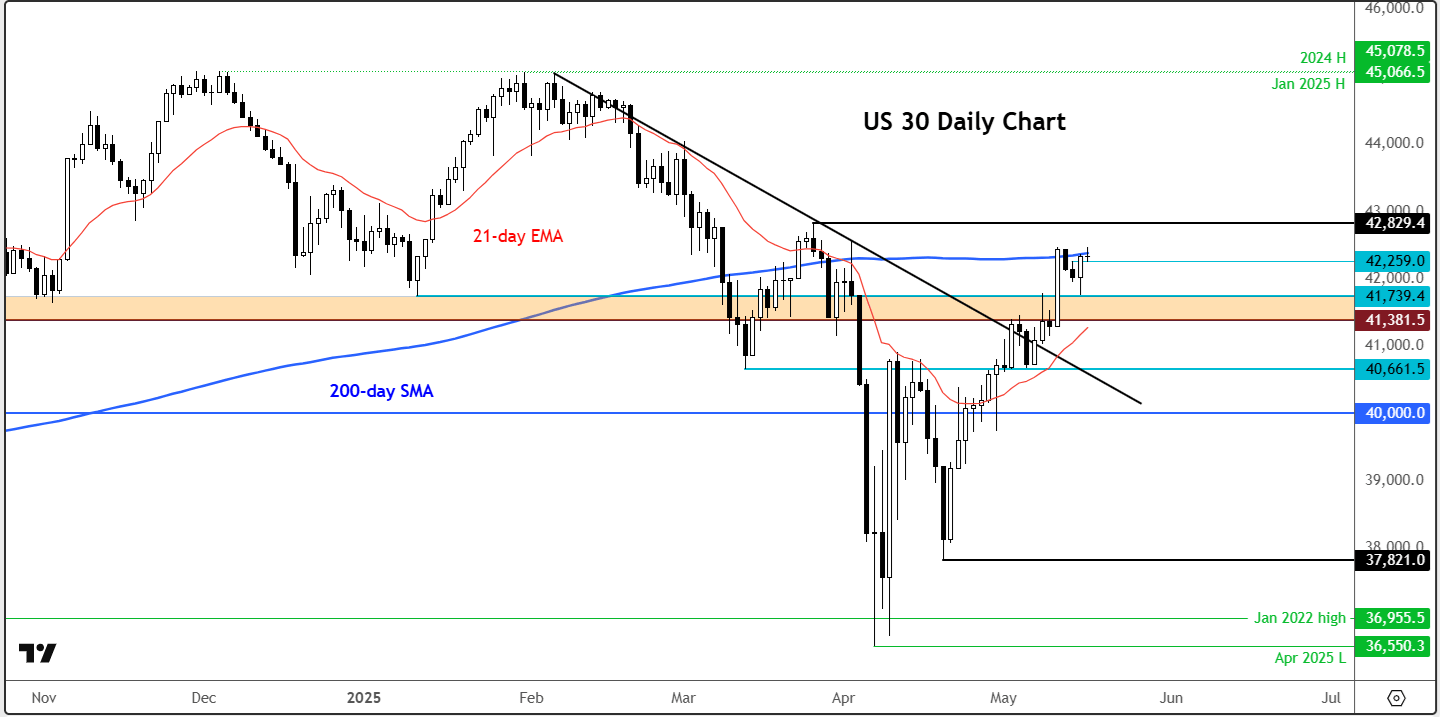

Before looking at the key events for the week ahead let’s have a quick look at the Dow chart…

Technical Dow Jones forecast: Bulls remains in control

Source: TradingView.com

The Dow Jones chart has been consolidating just below its 200-day moving average over the past few sessions, even as the tech-heavy Nasdaq 100 pushed to new highs for the week. However, support at 41,750 held firm yesterday, triggering a sharp rebound. This move formed a bullish hammer candle on the daily chart — a classic signal of potential upward momentum. With this fresh sign of strength, the question now is whether the Dow can finally break above its 200-day MA and sustain a move higher. The broader trend is starting to tilt more bullish.

Week ahead: RBA, UK CPI and Global PMIs

There are not many major US data releases in the week ahead to significantly impact the Dow Jones forecast, but we will have key PMI data on Thursday that will need to be watched closely.

Here are the week’s top 3 macro events:

1. RBA rate decision

Tuesday, May 20

All eyes will be on the Reserve Bank of Australia ahead of its rate decision. Strong Aussie April job data added complexity to the policy outlook with the economy adding 89,000 jobs—well above forecasts—while the unemployment rate held at 4.1%. Despite this, analysts still anticipate another rate cut, following February’s 25 basis point reduction. With inflation stuck at 2.4%, just above the RBA’s 2% target, the bank faces a tricky balancing act.

2. UK CPI

Wednesday, May 21

The recent rate cut by the Bank of England was a hawkish one as a couple of the MPC members voted to keep rates unchanged amid worries about the persistence of inflation in the services sector. All eyes will therefore by on the CPI release to see whether the UK will follow the global trend of disinflation. However, for April, CPI is expected to have jumped to 3.3% from 2.6% y/y last month. Any reading above this could send the pound higher.

3. Global PMIs

Thursday, May 22

The negative impact of the trade war has so far been only visible in certain survey-based indicators, as was again the case with the release of the UoM data earlier today. But the PMI data is key. The PMIs provide a leading indicator of economic health as businesses react quickly to market conditions, and their purchasing managers hold one of the most current and relevant insights. Any surprise readings could move the needle.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R