US futures

Dow futures 0.13% at 42,100

S&P futures 0.31% at 5890

Nasdaq futures 0.3% at 21289

In Europe

FTSE 0.53% at 8769

DAX 0.64% at 24120

- US futures fall after Trump comments against China

- Core PCE eased in line with expectations to 2.5%

- Personal spending falls to a 2-year low

- Oil falls ahead of the OPEC+ meeting

Stocks fall as US- China trade war worries return

U.S. stocks are set to open lower after data show that US inflation cooled in April and as trade tariff worries hit confidence.

Core PCE, the Federal Reserve's preferred gauge for inflation, eased to 2.5% YoY in April, down from 2.7% in March, which is in line with forecasts and the lowest level in four years. Meanwhile, personal spending fell to 0.2% down from 0.2% as consumers hit the brakes amid anxiety among consumers over the outlook for the US economy amid Trump’s erratic trade policies.

While higher tariff prices have yet to be reflected in inflation, American consumers are showing signs of anxiety.

Separately, U.S. President Trump accused China of violating an agreement with the US to ease tariffs, ramping up tensions once again between the world's two largest economies. Trump failed to specify exactly how China had violated the agreement negotiated earlier in the month, which saw both countries scaled back tit for tat tariffs.

Corporate news

Gap is falling 14% after the close retailer posted strong quarterly earnings but said tariffs could cost the company between $100 million and $150 million.

Ultra Beauty, the cosmetic company, rose 9.3% after raising its full-year outlook and beating Q1 expectations.

Dell Technologies rose 0.8% after the tech giant boosted full-year earnings guidance despite a mixed Q1 report. Earnings missed estimates due to tariff-related hits to demand.

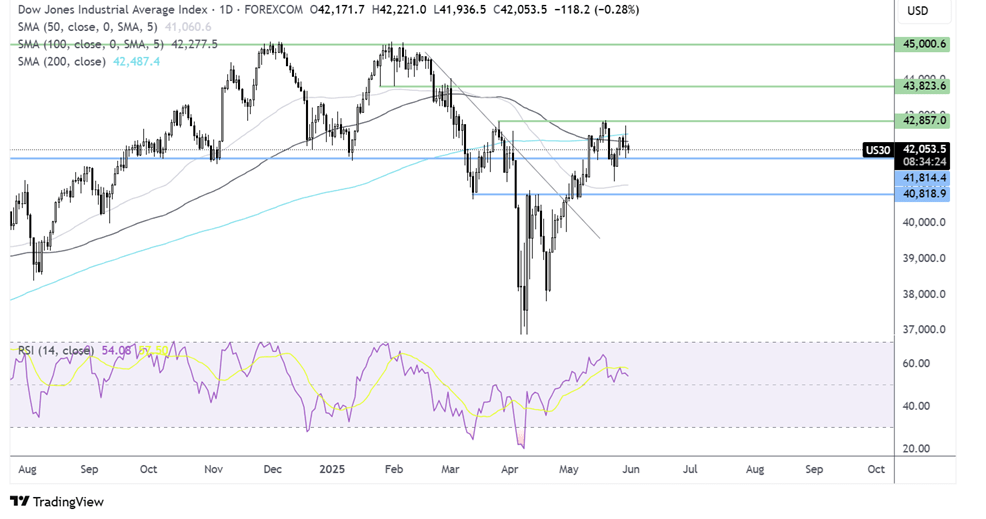

Dow Jones forecast – technical analysis.

The Dow Jones is trading in a holding pattern below the 200 SMA, capped on the upside by the 42,850 and on the downside by 41,775. Buyers need to rise above the 200 SMA at 42,500 and the 42,850 level to extend gains towards 43,800. Should sellers take out support at 41,775, the price could head towards 41,160, last week’s low.

FX markets – USD rises, EUR/USD falls

The USD is rising modestly after US core PCE data and amid ongoing uncertainties surrounding Trump's trade war, following his comments regarding China, and as the appeals court removes the block on his tariffs.

The EUR/USD is falling ahead of next week’s ECB rate decision, when the central bank is widely expected to cut rates by 25 bps further. German inflation data came in line with expectations at 2.1% year on year.

GBP/USD is slightly lower and is set to fall across the week after briefly spiking to a 3-year high close to 1.36 at the start of the week. GBP remains supported by sticky inflation and expectations the BoE will cut rates cautiously.

Oil falls ahead of OPEC+ meeting

Oil prices are modestly lower and are set to fall across the week as the market looks forward to the upcoming OPEC meeting this Saturday, where the oil cartel is expected to increase voluntary outputs further.

Expectations of a 411,000 barrel per day hike in output are high. However, these expectations are likely already priced in, so the actual decision may have limited impact.

The potential hike comes as the global surplus widens to 2.2 million barrels per day.

Demand outlook remains weak due to the uncertainty surrounding Trump's trade tariffs and their impact on global growth.