US futures

Dow futures -0.2% at 39500

S&P futures 0.08% at 5375

Nasdaq futures 0.24% at 18730

In Europe

FTSE -0.23% at 8377

DAX -0.0% at 21913

- Stocks struggle as China denies trade talks are taking place

- US- China trade war de-escalation optimism fades

- Alphabet falls ahead of earnings

- Oil rises after 3% losses yesterday

Stocks struggle as trade worries return

U.S. stock prices are mixed as China dashed any optimism over potential progress in trade relations and a de-escalation of the U.S.-China trade war, saying no talks with Washington are taking place.

Today's move lower comes after strong gains yesterday, which saw US indices close over 2% higher but off their session peaks. The markets had rallied on hopes that the US-China trade dynamic might improve after Trump signalled a softer stance. Check T Scott Bessent also struck an optimistic tone, but optimism faded after the Chinese Ministry of Commerce denied any ongoing economic or trade discussions and called for the removal of unique natural tariffs.

Despite the dip in futures today, U.S. stocks are still on track to book a weekly gain.

On the data front, US jobless claims were in line with expectations, at 222,000, up from 216,000 the previous week. The four-week moving average came in at 220,250, slightly below the previous reading of 221000. The data suggests that labour market conditions have been relatively stable this month, even as business and investor confidence deteriorate.

Corporate news

Alphabet is edging lower. The technology giant is due to release its latest quarterly results after the market close, which could set the tone for mega-cap earnings. Expectations are for the Google parent to report net earnings growth of 6.2% with revenue growth of almost 12%. The market will look for any concerns regarding tariff exposure and recessionary impacts on e-commerce advertising and cloud spending.

IBM is falling 6.7% after posting stronger-than-expected earnings and revenue for Q1, but it maintained its full-year guidance.

Hasbro is rising over 7% after the toymaker posted Q1 revenue that was ahead of forecasts, helped by strengthen in its digital gaming segment.

Southwest Airlines fell 4% as the airline carrier plans to cut its schedule in Q2 and pulled guidance for earnings before interest and taxes this year and next.

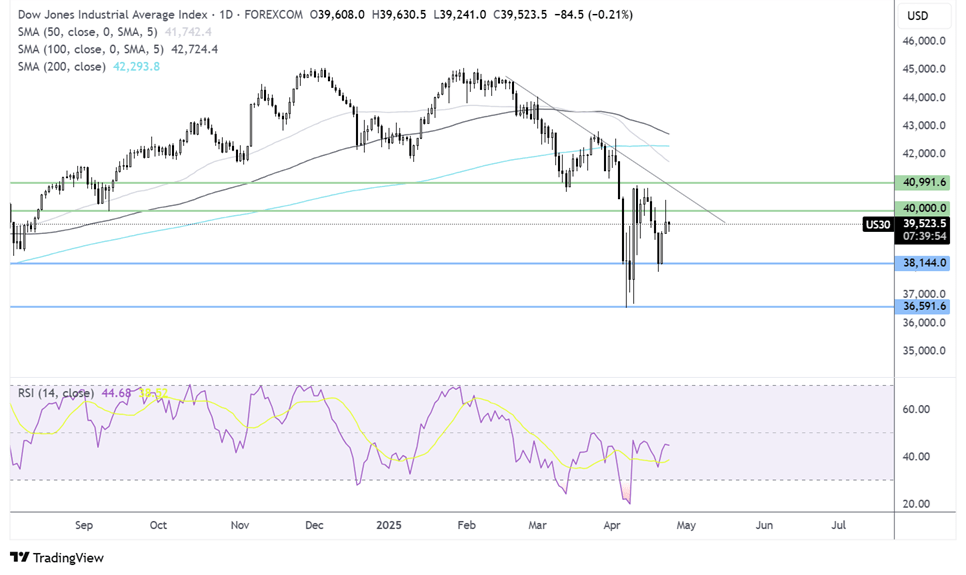

Dow Jones forecast – technical analysis

.

The Dow Jones continues to trade below its falling trendline, forming a series of lower highs and lower lows. The recent recovery from 37,800 failed to hold above 40k, which, combined with the RSI below 50 keeps sellers hopeful of further declines. Buyers would need to rise above 40k and 41k to create a higher high. Support is seen at 38,200 with a break below here creating a lower low.

FX markets – USD falls, EUR/USD falls

The USD is falling, giving back recent gains amid renewed worries over the US-China trade war and the impact on the US economy. The DXY remains capped below the 100.00 level.

The EUR/USD is rising after stronger-than-forecast German business morale. The IFO business climate unexpectedly improved to 86.9 in April from 86.7 in March. This comes after German PMI data yesterday showed that business activity slipped into contraction.

GBP/USD is rising to 1.33 after two days of losses. The pound benefits from a weaker USD, although gains would be capped after the BoE Governor warned over the growth impact of Trump’s trade tariffs. The BoE is expected to cut rates by 25 bps in May.

Oil rises after steep losses yesterday

Oil prices are rising as investors weigh up an OPEC+ output increase against conflicting trade tariff signals and US-Iran nuclear talks.

Oil prices fell 3% yesterday after Reuters reported several OPEC+ members were keen to accelerate oil output increases for a second month in June. Kazakhstan, which produces around 2% of global oil, has repeatedly exceeded its quota over the past year, saying it would prioritise national interests over OPEC+ production levels.

Further disagreements between OPEC+ members could potentially lead to a price war, although they are not there yet.

Meanwhile, investors continue to eye the US-China trade war development, amid a lack of clarity.

Separately, the US applied fresh sanctions on Iran's energy sector on Tuesday.