US futures

Dow futures 0.1% at 42,250

S&P futures 0.18% at 5992

Nasdaq futures 0.25% at 21776

In Europe

FTSE 0.12% at 8845

DAX -0.56% at 23323

- US stocks muted ahead of the Fed

- US stocks are unchanged, with eyes on the Middle East

- Trump evaluates his options, including direct involvement

- Fed is expected to leave rates unchanged, all eyes are on the dot plot

- Oil steadies after a 4% jump yesterday

U.S. stocks are set to open broadly unchanged amid rising tensions in the Middle East and ahead of the Federal Reserve's interest rate decision later today.

The Israel-Iran conflict looms large over investors, particularly after Iran's supreme leader rejected U.S. President Donald Trump's demand for unconditional surrender in a statement on Wednesday. This was his first public comment since Friday. It comes as President Trump and his team evaluate several options, including potentially joining direct strikes against Iranian nuclear facilities.

Headlines will continue to drive market sentiment and market moves. Any fresh developments will overshadow the Federal Reserve's interest rate decision later today.

The Federal Reserve is expected to leave interest rates unchanged at 4.25% to 4.5% as policymakers consider the impact of Trump's tariffs on inflation and the economy. Policymakers are likely to maintain a wait-and-see approach. Given recent weak data, the Fed could leave the door open to a summer cut.

With a rate cut expected, our attention will be on growth and inflation forecasts, along with the dot plot, which maps out official projections for the trajectory of rates. The last Fed dot plot pointed to 225 basis point rate cuts by the end of this year, which is in line with what the market is pricing in. The market sees a 56% chance now of the Fed cutting rates in September.

Corporate news

The banking sector will be in focus after reports that US bank regulators intend to reduce a key capital buffer for the country's biggest lenders. Big names such as JP Morgan, Goldman Sachs, and Morgan Stanley could be impacted.

Circle, the company behind stablecoin USDC is rising 3% after the US Senate passed the Genius bill the legislation which establishes federal guidelines for digital dollars which are paid to the greenback.

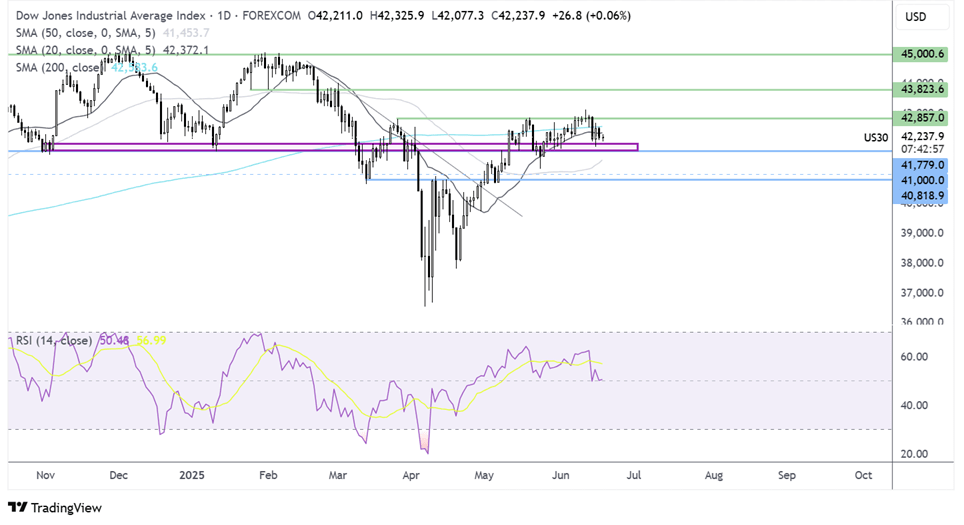

Dow Jones forecast – technical analysis.

The Dow Jones recovery from 36,550 ran into resistance around 42,800 and has been trading in a holding pattern, limited on the upside by 42,800 and 42,000 on the downside. The price has fallen below the 200 SMA, and the RSI is neutral. Sellers will need to break below the 42k support zone to extend losses towards 41,000 and 40,800. Meanwhile, buyers would need to rise above the 200 SMA at 42,500 to extend gains towards 42.8k zone.

FX markets – USD falls, EUR/USD rises

The USD is falling as safe-haven flows ease and as attention turns to the Fed rate decision later today. A more dovish-sounding Fed could pull USD lower.

The EUR/USD is rising capitalising on the weaker USD and the slightly improved market mood. Eurozone CPI confirmed that inflation eased to 1.9% YoY. Attention will be on a swathe of ECB officials due to speak later today.

GBP/USD is rising after UK inflation cooled by less than expected. UK CPI is 2/3 point 4% down from 3.5% but still up from the 3.3% expected. Service sector inflation cooled by more than expected 4.7%, a metric the Bank of England watches closely. However, food and non alcoholic drink prices jumped by 4.4%, considerably more than expected. The data is unlikely to move the needle for the Bank of England, which is expected to leave interest rates unchanged on Thursday.

Oil rises as the Middle East conflict continues, IEA oil report

After jumping over 4% in the previous session, oil prices are modestly lower today as they remain focused on the Middle East and turn to the Federal Reserve interest rate decision later today.

The oil market jumped 4% yesterday as it considered the possibility of direct US involvement. A direct threat from the US could broaden the confrontation further and put energy infrastructure in the region at higher risk of attack.

The Strait of Hormuz remains a key focus given its role as a major waterway for around 20% of global seaborne oil. A disruption to these flows could push oil towards $100 a barrel.

The Fed's rate decision will also be in focus, although no change to the benchmark interest rate is expected. Should the Fed adopt a more dovish tone in light of recent weak data and the conflict in the Middle East, oil prices could rise.