Disney Q2 earnings preview

Disney will report Q2 earnings on Wednesday ahead of the open. Revenue is expected to have risen from a year ago, but profits are expected to have declined. Disney is expected to post revenue of 23.17 billion, up 5% year over year, but adjusted EPS is expected to decline to 1.20.

In the previous quarter, Disney's revenue and profits beat estimates. It reported a slight drop in Disney+ subscribers to 124.6 million and said it expects another modest decline in this quarter. This is in sharp contrast to Netflix, which continues to outpace Disney.

Disney's earnings figures come after President Trump announced his intention to implement a 100% tariff on movies produced outside of the US. Towns of the tariffs are not yet clear and make little sense given that it implies that the US film is meant to be shot in the US. If it did go ahead, it could decimate the industry.

The most important segment, the Parks, which contributes around half of operating profits, is expected to post modest growth. Guidance will be key

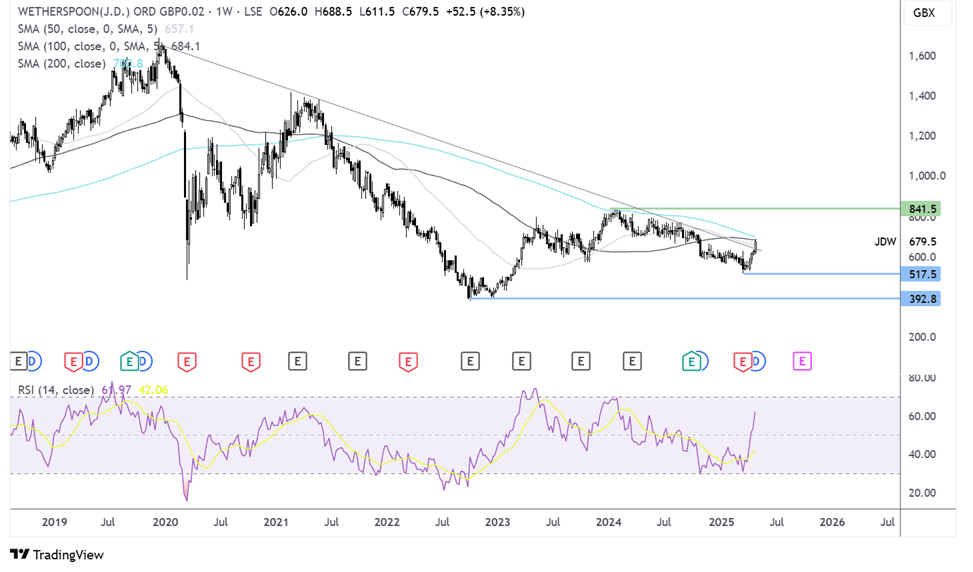

How to trade DIS earnings?

Disney continues to trade within a familiar holding pattern, capped by 122 on the topside and 80 on the lower side. The price has recently recovered from 80 and trades at 92 at the time of writing. The RSI remains below 50. Sellers will look to break below 80 to create a lower low and levels not seen since 2014.

Any recovery would need to retake the 100 SMA at 96 and above here, 110 comes into play, the 200 SMA.

Novo Nordisk earnings preview

NovoNordisk is set to release Q1 earnings on May 7th before the open. The results come after rival Eli Lilly topped expectations with its results on Thursday, with upbeat numbers following its phase three trial of a weight loss pill.

Last week, Novo Nordisk also announced it was expanding patient access to its weight loss jab through tie-ups with multiple telehealth organisations in the US. CVS also selected Wegovy, Novo Nordisk’s weight loss jab, as its preferred weight loss jab.

Novo guided to sales growth of 16% to 24% this year a much slower pace than in recent years but this could be optimistic after weekly US Wegovy prescriptions has plateaued since mid-February. Competition is heating up with differentiated products being brought to market. With that in mind, investors will be looking for any updates regarding Nova's research pipeline. Any news surrounding oral formulation or additional approvals for therapies could help boost the share price, which has come under pressure.

Meanwhile, Novo also risks being caught up in Trump’s trade war if tariffs are applied to pharmaceuticals.

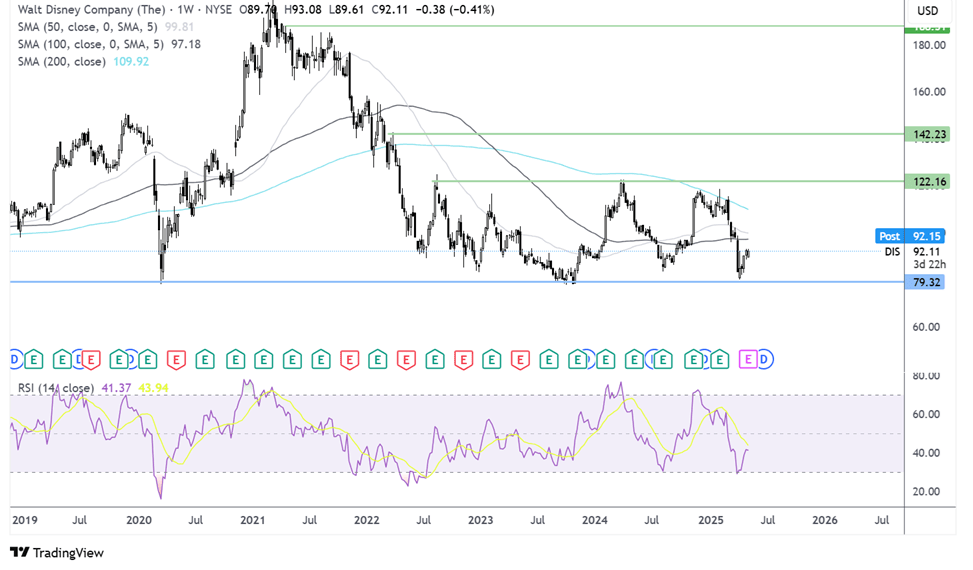

How to trade NOVO earnings?

NOVO trades in a falling channel dating back to June last year, dropping to a low of 380, a level that was last seen in 2022. The price has corrected lower from 380 and is testing resistance at the mid-point of the falling channel.

Buyers supported by the RSI above 50 will look to rise above the mid-point and the 50 SMA to 550 horizontal resistance.

Failure to rise above the mid-point could see sellers target 380, with a break below here extending the bearish trend and opening the door to 350

JD Wetherspoon results

In the March half-year results, JD Wetherspoons posted a dip in profits, lowering the share price. Profit before tax and separately disclosed items came in at £32.9 million, down from £36 million in 2024. However, the pub chain posted a 3.9% increase in total sales in H 1 2025, or £1.03 billion.

JD Chairman Tim Martin has warned over the impact of higher costs from increases to employer National Insurance contributions and the minimum wage, which were announced in the autumn budget. He said that this could result in an increase of cost by £60 million a year, which would amount to around £1500 a week per pub. The combination of higher rates for pubs and supermarkets and higher labour costs will likely weigh heavily on the pub industry. Wetherspoons could struggle to offset those higher costs.

The pub’s value credentials could put it in good standing if the economy deteriorates.

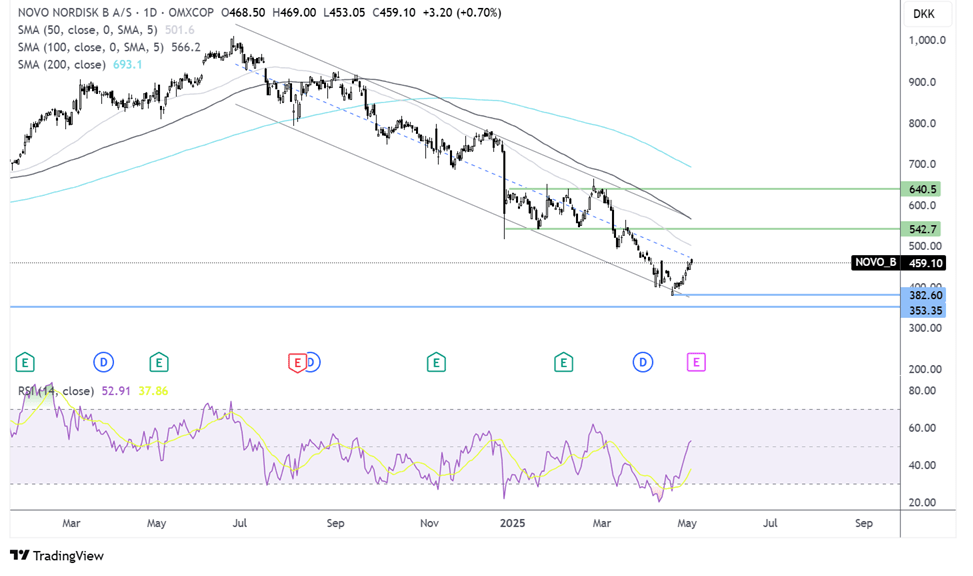

How to trade JDW earnings?

On the weekly chart, JDW fell to a low of 515 before recovering higher, rising above the multi-year falling trendline and the 50 SMA.

Buyers supported by the RSI above 50 will look to rise above the 200 SMA at 700 to extend gains towards 840.

Failure to retake the 700 level could see the price fall back towards the trendline support at 615 and 515p below there.