View related analysis:

- USD/CHF Hurled Overboard, Swiss Franc, Gold Remain Supreme

- AUD/USD weekly outlook: The Battler Stages a V-Bottom Recover

- AUD/USD, Nasdaq Soar as Trump Blinks First, Sparking Epic Market U-Turn

- AUD/USD Analysis: Eyes on China and the yuan Amid Trump’s 104% Tariff

Market positioning from the COT report – 8 April 2025:

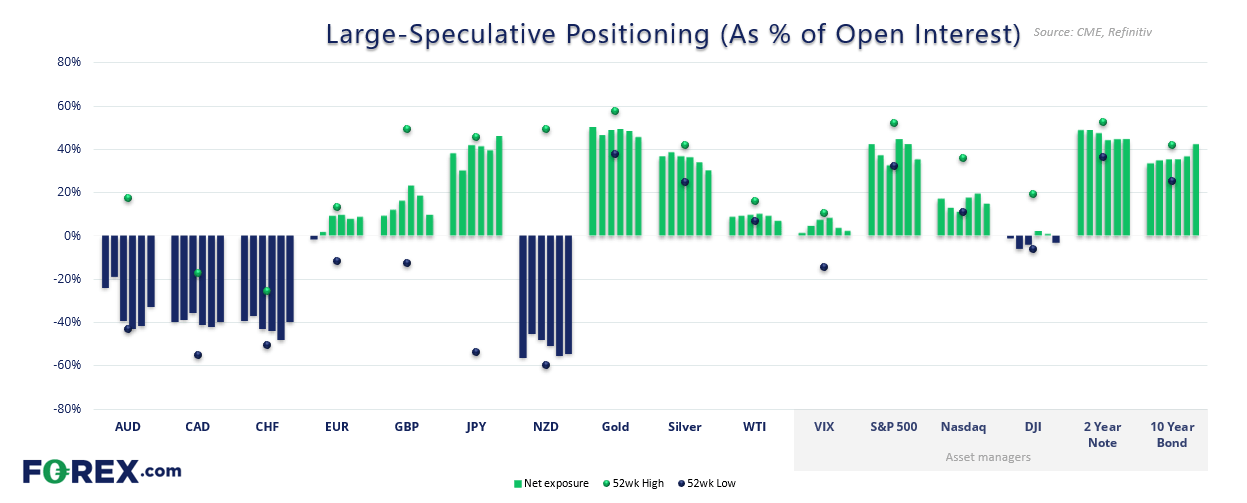

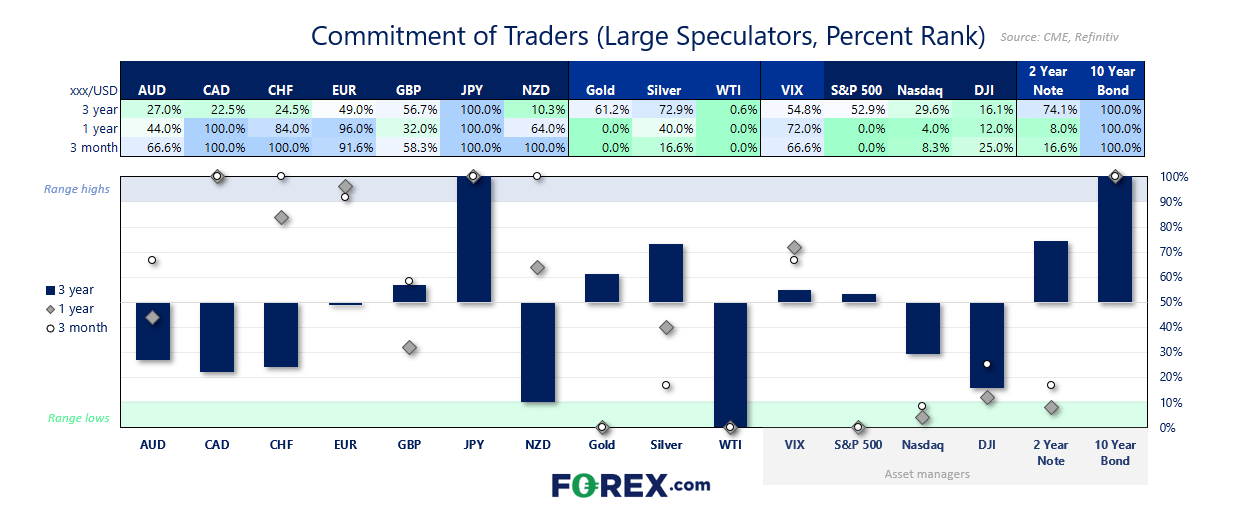

- Large speculators reduced gross-short exposure to Australian dollar futures (AUD) futures by -10% (-10.2k contracts) and increased longs by 9% (2.2k contracts), reducing net-short exposure by -12.5k contracts

-

Net-short exposure to Canadian dollar futures (CAD) fell to a 6-month low

-

Large speculators derisked against the New Zealand dollar (NZD) by shedding gross-longs by 29% (-3.3k contracts) and gross-shorts by -16% (-9.1k contracts)

-

Gross-short exposure to Swiss France (CHF) futures plunged by -26% (-12.2k contracts), as traders questioned whether being short the ‘go to’ safe haven currency was a good idea

-

They also culled gross-short exposure to Japanese yen futures (JPY) by -26% (-10.3k contracts)

-

Traders bet again energy by increasing gross-short exposure to WTI crude oil by 12% (18.5k contracts) and trimming shorts by -3% (-9.4k contracts)

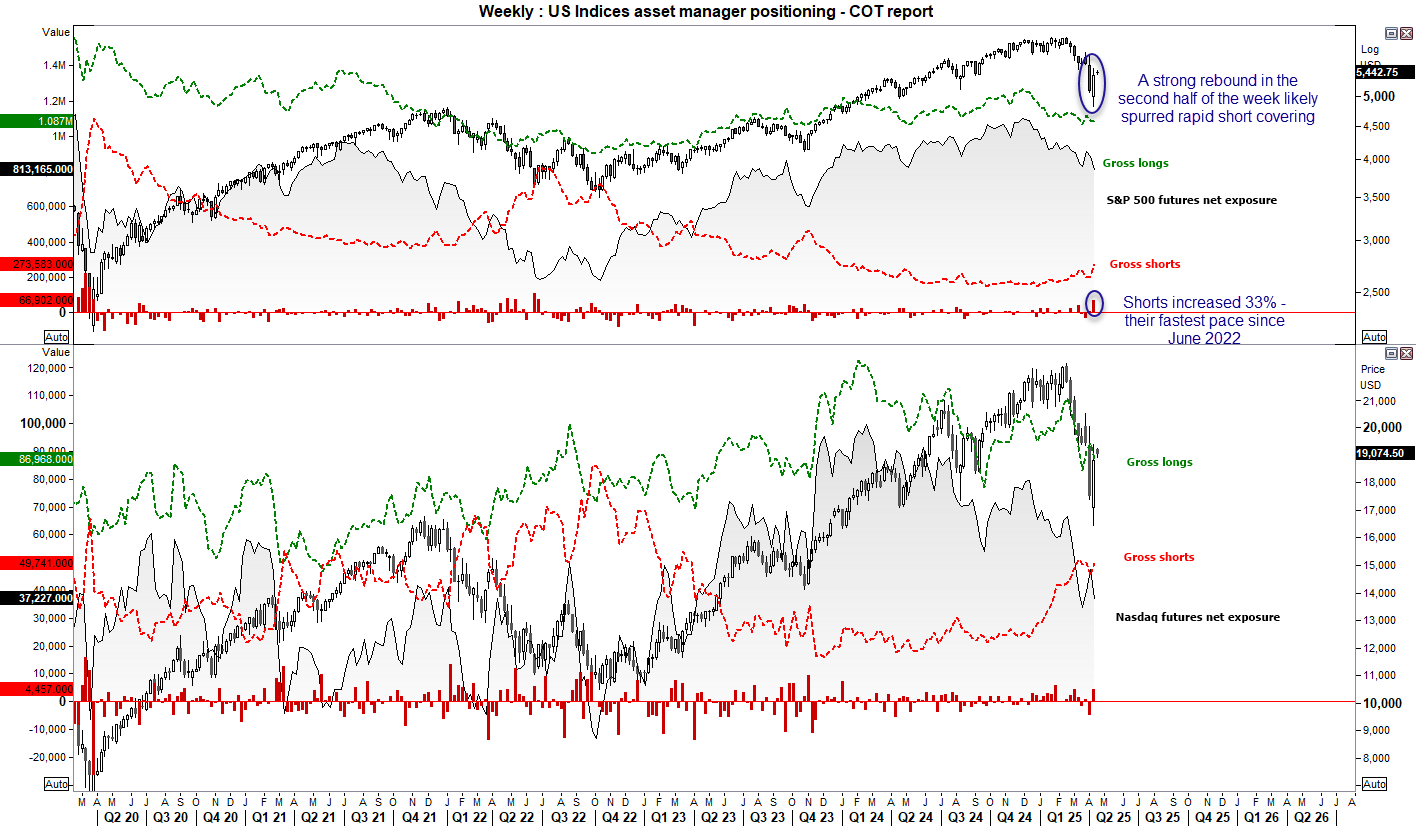

- Asset managers went all in on shorting S&P 500 contracts by increasing gross-short exposure by 32% (66.9k contracts). Flipped to net-short Dow Jones (DJI) futures and reduced net-long exposure to Nasdaq (NQ) futures by -10.2k contracts

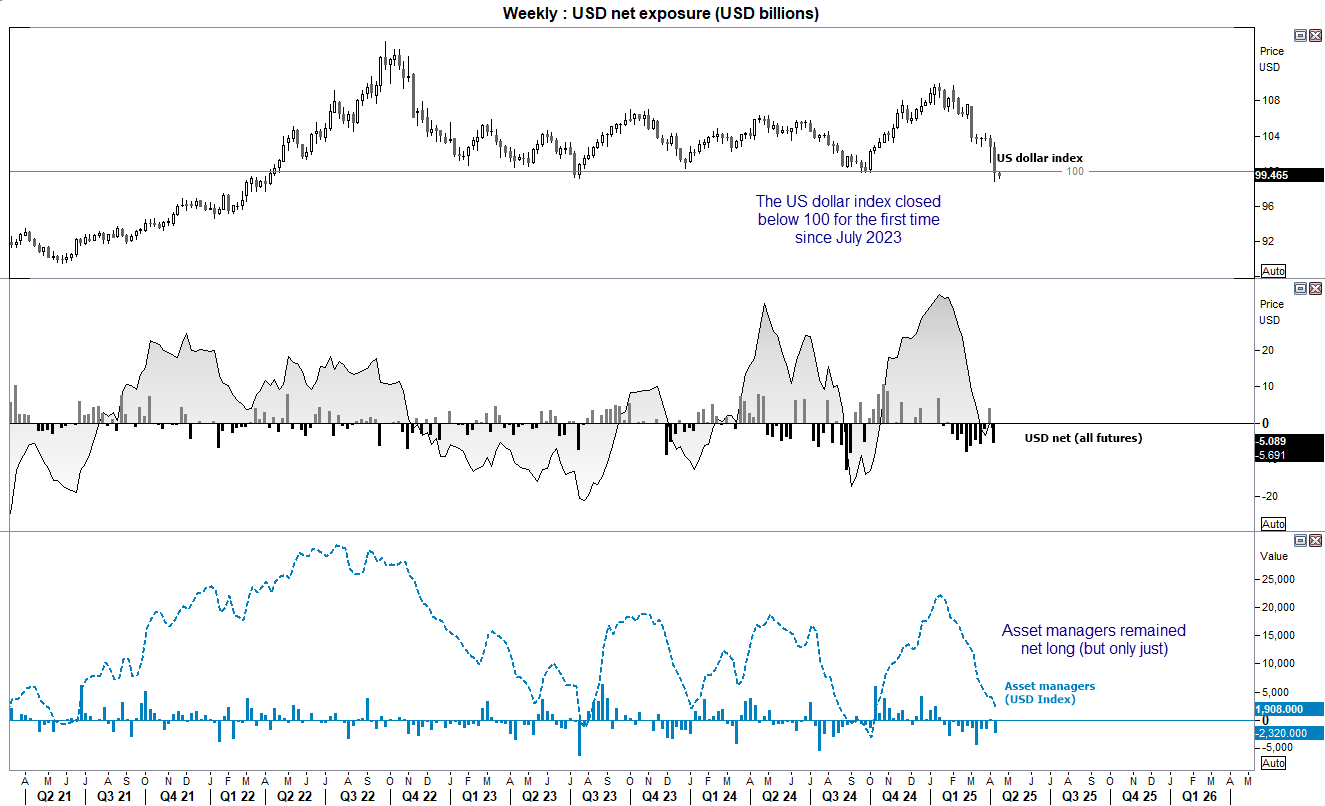

US dollar positioning (IMM data) – COT report:

The US dollar index finally closed below 100 last week, to mark its first weekly close below the milestone level since July 2023. And that also suggests that asset managers may have already flipped to net-short exposure to the dollar index, as they were only net-long by around 2l contracts by Tuesday’s close.

Still, futures traders remain effectively net-short the US dollar by -$5 billion according to the IMM (International Money Market).

How the US dollar index trades around 100 is key going forward, given the level has held as support since April 2022.

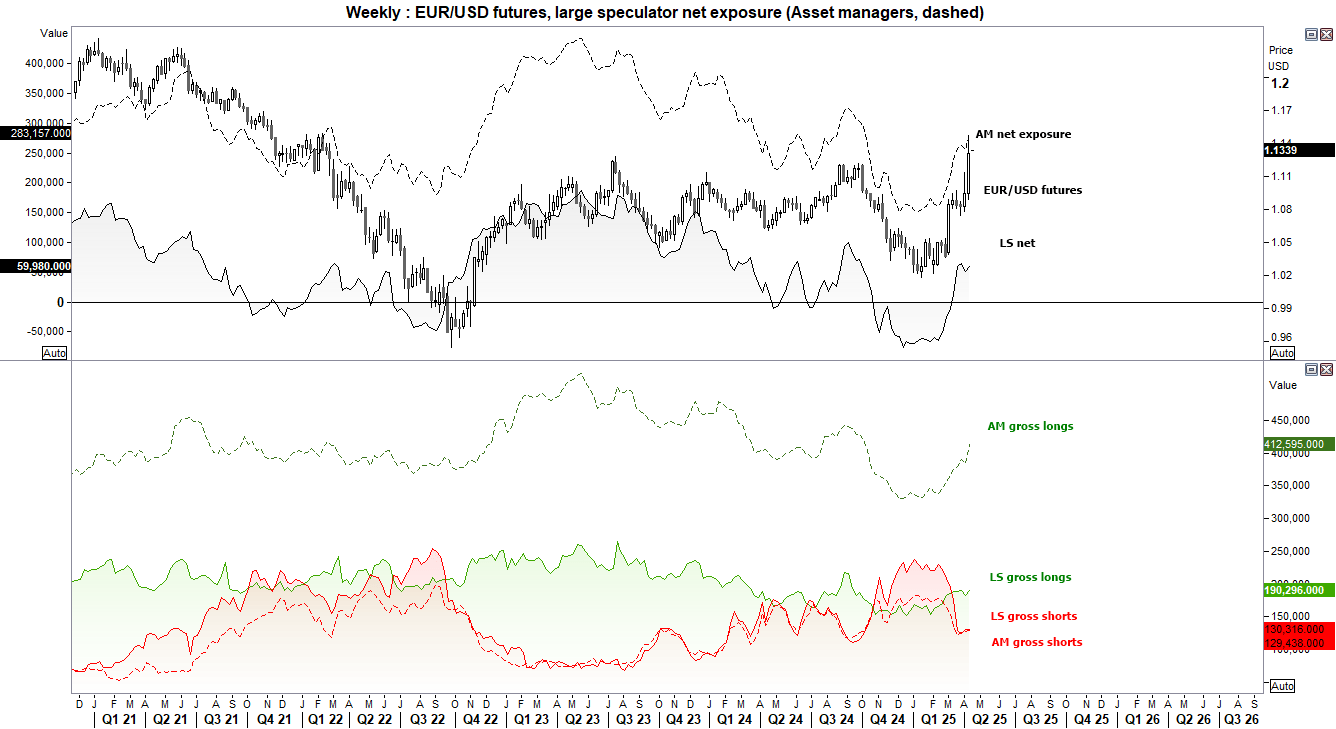

EUR/USD (Euro dollar futures) positioning – COT report:

Asset managers piled into bullish EUR/USD bets last week, increasing gross longs by 28.5k contracts (7.4%), sending their net-long exposure to a 6-month high. Large speculators also increased their net-long exposure by 8.2k contracts to mark their fourth week of net-long exposure.

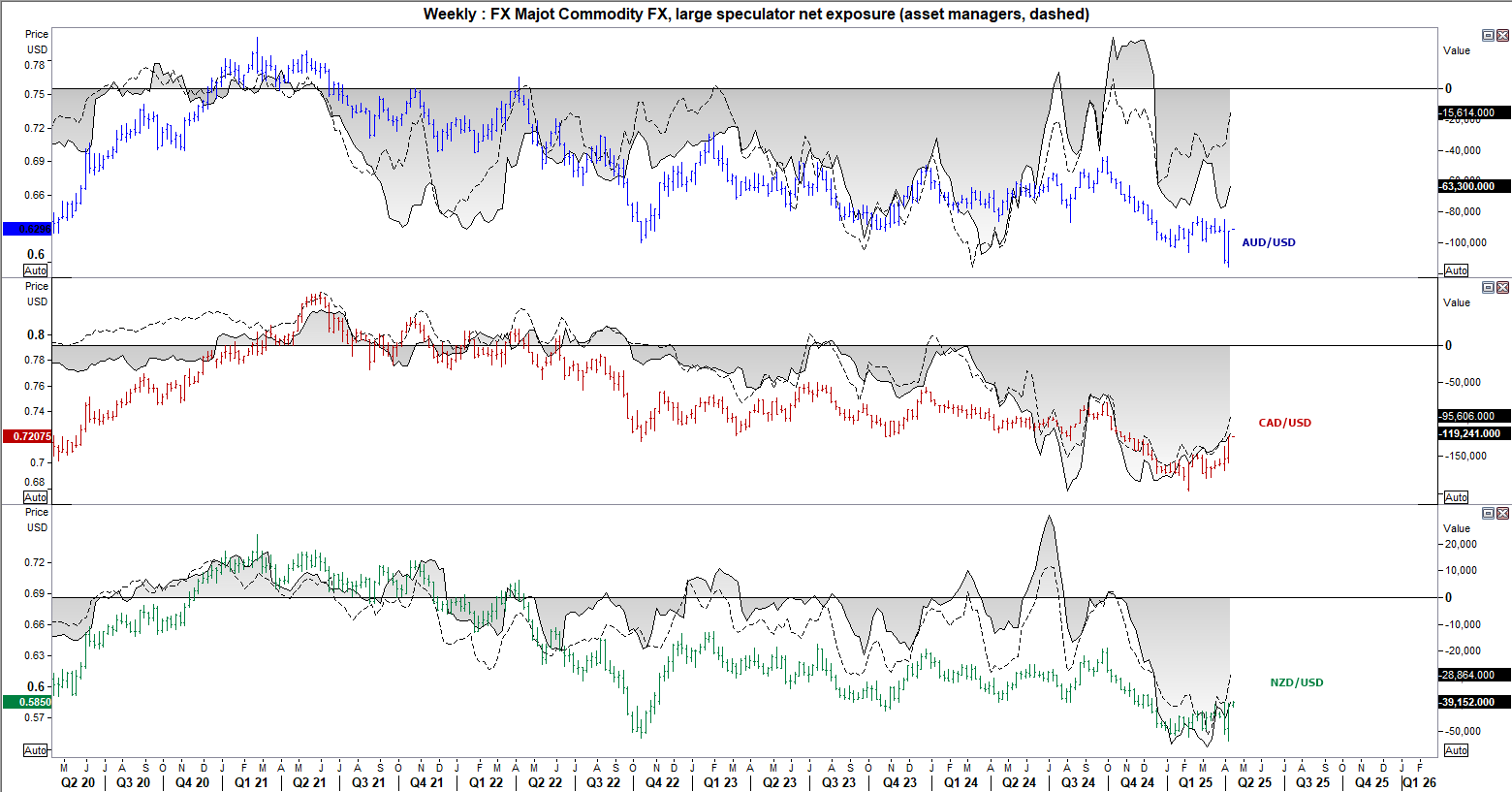

Commodity FX (AUD, CAD, NZD) futures – COT report:

Australian dollar (AUD) futures

AUD/USD formed a solid recovery from the 59c handle last week, and erased all of the prior week’s gains. Large speculators and shed gross shorts by -10.2k contracts to mark the fastest pace of short covering since June, and asset managers closed -11.7k contracts (fastest pace of short covering since May). However, asset managers also increased longs by 8k contracts – and that was before AUD/USD began its strong rebound from Wednesday’s low.

Canadian dollar (CAD) futures

Net-short exposure has been flagging a potential bullish reversal for the Canadian dollar for several months. So it is good to finally see the Canadian dollar strengthen, while USD/CAD collapses. Net-short exposure has fallen to a 6-month low among large speculators, and shows the potential to fall further given the strong bullish move seen on the Canadian dollar in the second half of last week.

New Zealand dollar (NZD) futures

Asset managers and large speculators also reduced their net-short exposure to New Zealand dollar futures. However, they appear to be derisking away from the Kiwi dollar, given both longs and shorts were trimmed. Still, like the Australian and Canadian dollar, NZD/USD performed a strong recovery in the second half of the week which was presumably a combination of fresh longs and further short covering. Overall, it appears we have seen the cycle lows for commodity FX.

S&P 500 (ES), Nasdaq 100 (NQ) futures positioning – COT report:

Bears did not shy away from shorting US indices at the beginning of last week, with asset managers increasing their gross-short exposure to S&P 500 futures by 33% (67k contracts). This marked the fastest rise of shorts since December 2022 and pulled their net-long exposure to the least bullish level since December 2023.

However, given the strong rebound in the second half of the week, I suspect many if not all of these shorts have capitulated.

It is also worth noting that asset managers have been betting against the Nasdaq for a much longer period of time.